Abstract: In this third piece on crypto mining incentives, we look at the different time periods miners may choose to maximise profits: in the short term or long term. We draw analogies with related concepts in traditional mining, such as high-grading. In corporate finance circles, there are rumours of potential IPOs for crypto miners, which could mean management focus shifts to the short term, as these groups may unfortunately need to justify quarterly earnings to investment analysts. We then look at the implications of this on potential network issues, such as replace by fee (RBF), AsicBoost, and the blocksize limit. Whether one likes it or not, we think full RBF is coming.

Bitmain crypto-mining farm in Inner Mongolia: photograph (above) and satellite image (below). Bitcoin mining is no longer for only for hobbyists. (Source: Google Maps satellite image)

Please click here to download the pdf version of this report

Overview

In September 2017, we wrote two pieces on mining incentives. Part 1 focused on the mining cost curve and compared it to the dynamics of the cost curve in traditional mining while part 2 looked at circumstances in the energy industry that could result in attractive opportunities for crypto miners, concluding that failed or otherwise uneconomic energy projects may be best suited for Bitcoin mining. In November 2017, we wrote about miners chasing short-term profits in the Litecoin vs. Dogecoin hashrate wars of 2014 and how this was repeated again with Bitcoin Cash, as the hashrate oscillated between coins due to miners attempting to maximise short-term profits rather than make decisions based on ideological support for their favoured coins.

This piece looks at the possibility that miners will focus on short-term profit maximisation (perhaps even next-block profit maximisation) or on promoting the long-term viability of the system by enacting policies designed to improve the end-user experience, thereby potentially increasing long-term profits. The level of competition in the industry, as well as the level of profitability, can alter decisions to pursue short-term and long-term profit maximisation. Higher levels of competition and lower profit margins may result in a more short-term outlook. Each strategy could have implications for Bitcoin, replace-by-fee transactions, AsicBoost, or the blocksize-limit policy.

Mining is becoming less ideological and more commercial. At the same time, the intensity of competition may increase in the coming months and years. We predict full RBF will become prevalent in Bitcoin mining, as miners seek to maximise short-term profits.

Long term vs. short run

Most businesses want to maximise profits and Bitcoin mining is likely to be no exception. In the past, perhaps, some miners were hobbyists or idealists, but this era appears to have ended — profits are now seen as a main driver as the industry grows and becomes more commercial. However, profit maximisation can be more complex than one may think. Strictly speaking, investors should select projects which maximise discounted returns, and evaluating the difference between profits today and profits tomorrow — the discount rate — is often a challenge.

Analogy with traditional mining: High-grading

In traditional mining, high-grading is the practice of harvesting a higher grade of ore in a way that wastes or destroys lower grade ore, reducing the overall return of the mine. This destructive process reduces the total value of the ore body by making some ore inaccessible or literally destroying it in favour of access to higher grade ore. Mining management teams may engage in this process due to short-term pressure — for example, to boost short-term profit margins to satisfy shareholders, to generate cash flow to satisfy debt holders, or to achieve their own performance-linked bonuses. Management teams might conceal this conduct from the public or from investors.

High-grading often occurs during prolonged periods of price weakness of the relevant commodity, when profit margins are low, debt levels are high, and there is considerable pressure on management teams. Randgold CEO Mark Bristow has said:

The question is, are the companies going to re-cut their business long-term at a lower gold price, or are they going to re-cut their short-term business hoping they’ll be rescued in the long term by the gold price? That second one is called high-grading and it’s a disaster.

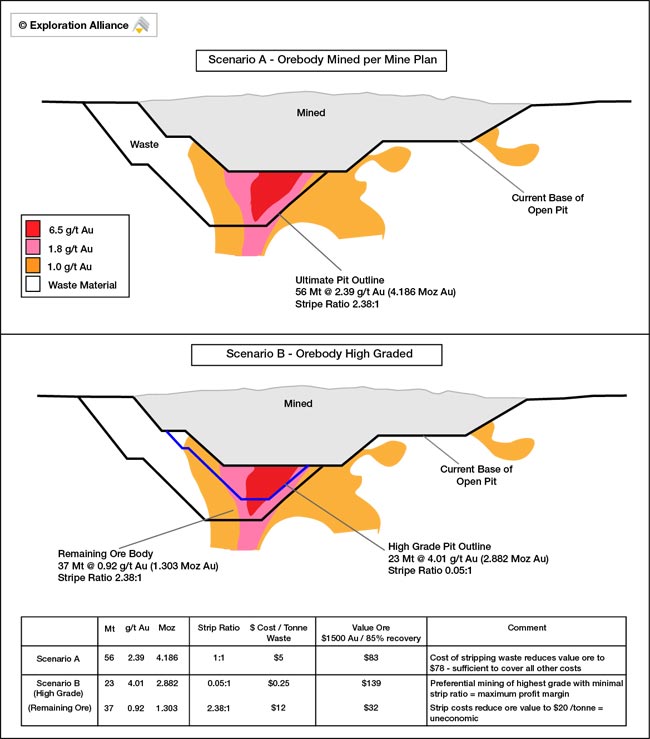

The diagram below depicts the plan for a high-grading open-pit mine. An initial plan for a larger mine (scenario A) captures more of the total ore but the alternative plan (scenario B) increases the grade of the ore mined, while permanently destroying or removing access to some high-grade ore, which is potentially detrimental to the long-term interest of mine owners.

(Source: Exploration Alliance)

Revising a mining plan due to changes in discount rates, costs, or commodity prices can of course be entirely legitimate in some circumstances, but high-grading has negative connotations and is normally associated with reducing the value of assets in an inappropriate manner.

Although there is no direct link between high-grading and crypto mining, the concept demonstrates that when mining teams are under pressure, they can make short-term decisions that destroy long-term shareholder value. This is particularly relevant in the listed space, where shareholders may have less control, less information, or more of a short-term focus.

Mining profitability

Whether miners make these destructive short-term-focused decisions or not often depends on the level of profitability, which can be determined by the price of the underlying commodity. If the price of the commodity or crypto asset falls, a miner who is no longer profitable may be faced with three options:

- Operate at a loss — This could make a contribution to fixed costs.

- Suspend operations — In traditional mining, this could reduce the supply of the commodity and thus increase its price. In crypto mining, on the other hand, this could lower the difficulty, increasing profit margins for the remaining miners.

- Modify mining policies — In traditional mining, this could be a modification to the mining plan such as, for example, a switch to high-grading. In the case of crypto, it could be engaging in full RBF, overt AsicBoost, or, in the event of an unlimited blocksize limit, clearing the memory pool to scoop up all the fees, despite the negative impact this could have on pricing in the transaction fee market, destroying industry prospects.

In general, lower profitability can increase the pressure on management teams and lead them to make more short-term decisions — for example, to pay down debt if they are under pressure from banks or to return to profitability if they are under pressure from shareholders. Higher-margin companies may have more freedom to focus on the long term and may be able to invest for the future.

Industry concentration

In addition to profitability, another factor to consider in crypto mining is the level of concentration in the industry.

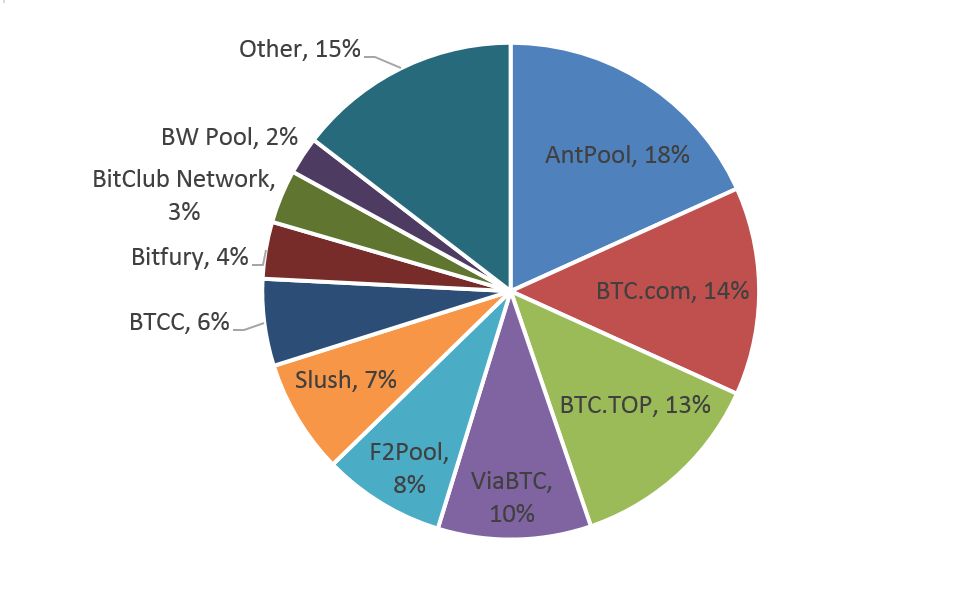

Mining pool concentration over the last six months. (Source: BitMEX Research, Blockchain.info)

The above chart illustrates the level of concentration among mining pools, but one could also analyse the level of concentration in the industry by looking at chip production or the control of mining farms. With respect to chip production, we estimate that Bitmain may have a 75% market share in Bitcoin.

The policies of a miner with a large market share may have a significant impact on Bitcoin, which could impact the value of the entire system. In contrast, the policies of each small miner with a low market share may not have much impact on the system as a whole. Among the small miners, this threatens to become a tragedy of the commons if policies that are best for the system as a whole are not those that are most beneficial for each small individual miner. For instance, a small miner with a 1% market share can opt to engage in action that increases profits but damage the prospects of the whole system if all miners were to engage in the same action. Why would the small miner choose not to conduct the activity, since that miner’s 1% market share will not make much difference on its own.

In addition, the level of competitive intensity may also matter. If miners are ruthlessly competing for market share, they may be more focused on doing whatever it takes to improve profit margins to win business.

Replace by fee

Replace by fee (RBF) is a system that enables the replacement of a transaction in a miner’s memory pool with a different transaction that spends some or all of the same inputs, due to higher transaction fees. A variant of this feature was first added by Satoshi, who later removed it. Bitcoin Core then added in an opt-in version of the technology, where users must specify that the transaction can be replaced when making the transaction.

RBF has always been controversial, both the full version and the opt-in version, with detractors claiming that it reduces the usability of Bitcoin by undermining zero-confirmation transactions. Supporters of RBF claim, among other things, that miners will eventually adopt full RBF anyway, as it boosts short-term profits by selecting transactions with larger fees, even though it may harm long-term profitability by reducing the utility of the system, which could lower the Bitcoin price. Again, it’s sometimes seen as a “tragedy of the commons” problem. Opponents of RBF may counter this by saying miners have more of a long-term focus, and therefore RBF advocates are solving a theoretical game-theory problem that may not apply.

Certain industry characteristics encourage short-term profit-driven motives and therefore full RBF:

| Short-term profit: Full RBF more likely | Long-term profit: Full RBF less likely |

| A period of falling Bitcoin prices | A period of rising Bitcoin prices |

| Lower profit margins | Higher profit margins |

| Lower levels of industry concentration | Higher levels of industry concentration |

| More intense competition and rivalry among miners | A less intense competitive environment and collaboration among miners |

| Publicly owned mining companies | Privately owned mining companies |

| Profit-driven miners | Ideologically driven miners |

Unlimited blocksize limit

As anyone following Bitcoin knows, the blocksize debate is a complex issue. One angle is the interrelationship between the fee market and mining incentivisation. Supporters of larger blocks sometimes argue that a fee market would still work with an unlimited blocksize, while “smaller-blockers” often dispute this point.

An element of this argument is related to whether miners focus on the long term or the short term, just like for RBF. Supporters of an economically relevant blocksize limit claim that without a limit, miners may focus on maximising short-term profits and scoop up all the fees, resulting in low fees and insufficient mining incentives. “Larger-blockers” retort that miners will have more of a long-term focus and would not take such action, as it would damage the long-term viability of the system, and therefore their businesses.

History of the “death spiral” argument

In some ways, this short-term versus long-term incentive discussion, or the “death spiral” argument, goes right to the genesis of the blocksize debate, back in in April 2011, which is when Mike Hearn wrote this at Bitcointalk:

The death spiral argument assumes that I would include all transactions no matter how low their fee/priority, because it costs me nothing to do so and why would I not take the free money? Yet real life is full of companies that could do this but don’t, because they understand it would undermine their own business.

One day earlier, Hearn had written that “the death spiral failure mode seems plausible” but he apparently changed his mind after thinking about the issue further.

Some larger-blockers have somewhat shifted views in recent years to a pro-mining philosophy of chasing short-term profits, perhaps because a large miner, Bitmain, ironically has been one of the most prominent advocates of larger blocks. Most larger-blockers appear have shifted the narrative to other valid points, although, as explained above, this “short term versus long term” line of thought can be considered the genesis of the blocksize debate and part of the reason for the initial division in the community.

There is no right or wrong answer to these questions. Whether miners have a short-term focus or long-term focus depends on many factors, including profitability and market share. The industry may go through cycles of shifts between long-term and short-term focus depending on conditions in the industry. This phenomenon is visible in traditional mining, driven by commodity price cycles that impact industry conditions.

Changing times: Short-term profit focus will be king

The Bitcoin community is rapidly transforming from a cohesive group of people with a shared vision working together to build a revolutionary technology to a larger community of competing profit-driven factions, and the change is almost complete. It may have seemed unrealistic a few years ago to assume that miners would be primarily driven by short-term profit maximisation, but this has increasingly become accepted as the norm, certainly after the hashrate swings caused by Bitcoin Cash’s EDA.

Mining is a business: TSMC has reported that one crypto-mining business may be spending US$1.5 billion per annum on chips, and growing. In some corporate-finance circles, rumours are circulating that large mining pools or chip producers could shortly conduct an IPO, something almost unimaginable a few years ago. This could put management of the mining pool in the unfortunate position of needing to justify operating profit margins to investment analysts and shareholders each quarter. At the same time, many expect the mining industry to become more competitive this year, with new companies launching competitive products.

In this new world, RBF behaviour and the fee market “death spiral” failure mode seem more and more inevitable. Perhaps early fee market and RBF advocates were too obsessed with unrealistic and complex game theory, and maybe were too early, when a better tactical decision could have been to focus on the user experience before adopting RBF and full blocks. Bitcoin has changed, and short-term profit maximisation is the new mantra.

We predict that many miners will engage in full RBF and even overt AsicBoost (which can also boost profits) in the coming years as they do all they can to maximise short-term profits. Whether one likes it or not, it’s coming….