The launch of Bitcoin Cash

On 1st August 2017, a new coin was launched, Bitcoin Cash (BCH). This was a chain split from the Bitcoin (BTC) chain. Therefore, every Bitcoin holder at the time of the split, received both Bitcoin Cash and got to keep their original Bitcoin holdings. For example those holding 1 coin prior to the split, then received 1 BTC and 1 BCH after the split.

Bitcoin Cash’s key features

| Feature | Description |

| Blocksize limit increase | Bitcoin Cash increased the blocksize limit, to 8MB from 1MB. This increases the potential transaction throughput of the network, by approximately 4x compared to Bitcoin with SegWit or 8x compared to Bitcoin before SegWit. This higher capacity is a key advantage and should result in lower transaction fees. |

| New transaction digest algorithm |

Bitcoin Cash uses the new transaction digest algorithm for signature verification in BIP143 (part of the SegWit upgrade to Bitcoin, while other parts of the SegWit upgrade were removed). This upgrade fixes the quadratic scaling of sighash operations bug and improves scalability. Using the old hashing digest, each time the transaction size doubles, the number of hashing operations required to verify the transaction increases by a factor of 4 (2 squared), however after this fix, hashing scales linearly with respect to transaction size. The new digest algorithm is compulsory on Bitcoin Cash and is only optional on Bitcoin after SegWit. The new transaction digest algorithm also ensures that Bitcoin Cash transactions are invalid on Bitcoin and Bitcoin transactions are invalid on Bitcoin Cash, such that issues with users accidentally losing funds are mostly avoided. For example, if you send Bitcoin, your Bitcoin Cash remains where it is, and vica versa. |

| New mining difficulty adjustment | Bitcoin Cash has a new downward difficulty adjustment, this made the Bitcoin Cash block header invalid according to Bitcoin’s rules. Many mobile wallets therefore need to upgrade to follow the Bitcoin Cash chain, a key safety mechanism ensuring wallets follow the same chain as the one their transactions occur on. In addition to this, the new difficulty adjustment ensures the block time will not be too long, should only a small number of miners decide to switch to Bitcoin Cash.

The new difficulty adjustment can cause the difficulty to fall too quickly if the gap between blocks is too long. Unfortunately this can incentivize miners to leave the network so that they can return when the difficulty adjusts and profitability improves. The impact of this appears to be that the capacity of the network oscillates in a volatile way and this appears to be a major weakness of the coin. In our view this requires a fix. |

(Source: BitMEX research)

Why Bitcoin Cash was launched

The coin launch was in many respects born out of a political dispute over the best way forward for Bitcoin, with opposing factions strongly disagreeing with each other on the best strategy. Therefore, to some extent, there is an ideological competition between the two coins, with each side hoping their chosen coin will be the most successful. The dispute is difficult to accurately characterize, however the cause of it appears to be that each side looks at the scaling issue with a different key focus. One side appears to prioritise onchain capacity increases, while the other side appears keen to ensure that upgrades occur in a smooth, safe and voluntarist manner. Therefore, although there is not necessarily any direct disagreement between the sides, both groups are determined advocates of their favoured solutions, such that their respective coins have the potential to remain viable in the long run, in our view. It is this determination that can keep coins alive, more than anything else.

There has been some analysis comparing various metrics of the two coins, in particular focusing on mining profitability. Mining profitability is an area of particular interest given the volatile difficulty adjustment on Bitcoin Cash, causing hashrate swings between the two coins. This research note will instead focus on the apparent investor flows between the two coins. Obtaining meaningful data here is more challenging than looking at mining profitability, however the implications of this analysis could prove to be more significant in the long run. The fact that two potentially opposing groups were each given both tokens and can now trade them against each other, to reflect their ideological objectives, makes the trading and financial market dynamics of this situation somewhat unique and interesting, in our view.

Analysis of investment flows

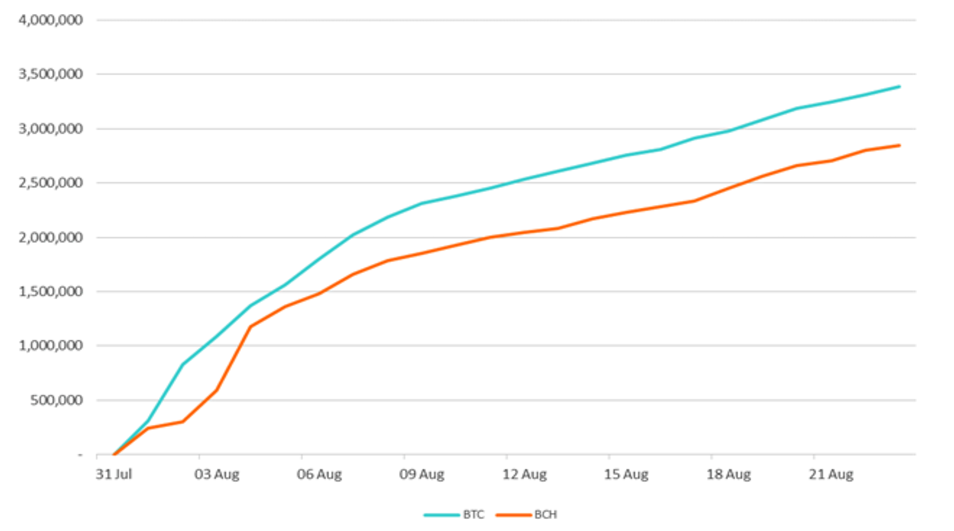

As the following chart shows, since the chain split, as at 23rd August, 2.8 million coins on Bitcoin Cash have been spent at least once. This compares to 3.4 million coins being spent at least once on the Bitcoin chain. We calculated these figures by looking at both blockchains and subtracting the amount of coins which were unspent since the split, from the total coin supply. Bitcoin Cash has c82% of the spend, using this metric, compared to Bitcoin (2.8m/3.4m = c82%). In contrast, according to data from fork.lol, Bitcoin Cash only has c4.9% the transaction volume of Bitcoin. Therefore, since Bitcoin Cash usage is low relative to Bitcoin, it may be somewhat reasonable to assume that most of spend on Bitcoin Cash is “investment flow related”. One may think this low usage (4.9%) is a negative for Bitcoin Cash, however although transaction volume is an important metric, in our view, this has limited implications on financial markets compared to investment flows, which consider value.

Bitcoin (BTC) vs Bitcoin Cash (BCH) – Value of coins spent at least once since the chain split

(Source: BitMEX research, Bitcoin blockchain, Bitcoin Cash blockchain)

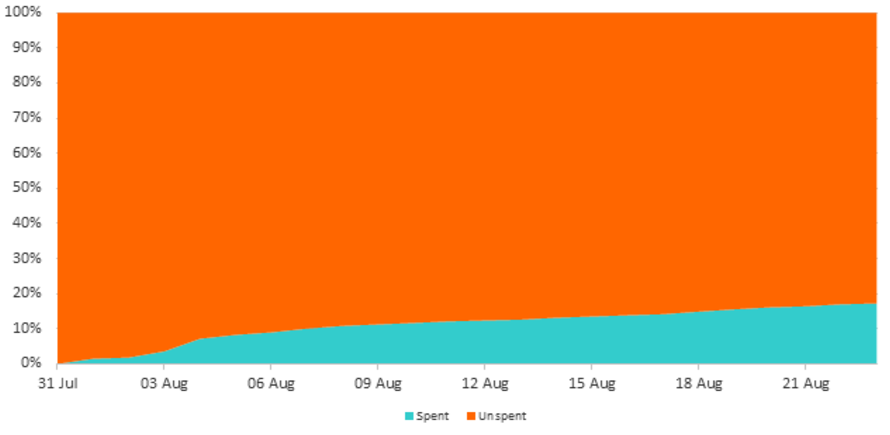

At the time of the split, there were approximately 16.5 million Bitcoins in existence. Therefore, as the chart below shows, 17.2% of these have been spent at least once on Bitcoin Cash, while the remaining 82.8% of coins remain unspent.

Bitcoin Cash (BCH) – Proportion of spent vs unspent coins since the chain split

The above data can in theory be used to estimate the behavior of investors. One could use this information to indirectly estimate the proportion of coin holders that have sold their Bitcoin Cash, which may have implications on the future price. For example:

- If the value of Bitcoin Cash coins spent since the split is large (perhaps 40%), many users may have already sold their Bitcoin Cash and therefore the future price outlook could be positive, as the future supply of Bitcoin Cash coins could be limited.

- If the value of Bitcoin Cash coins spent since the split is low (perhaps 4%), many users may still be yet to sell their Bitcoin Cash and therefore the future price outlook could be negative, as the future supply of Bitcoin Cash could be high.

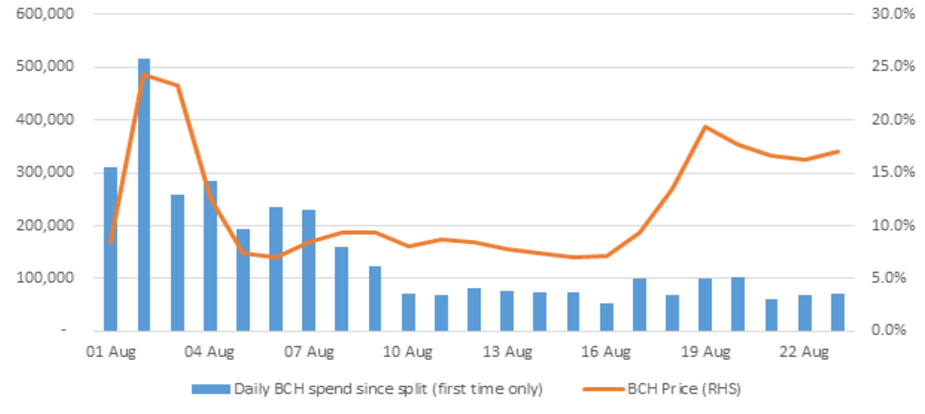

The below chart may illustrate this to some extent. On the 2nd day after the split, there was significant spend on the Bitcoin Cash chain (around 520,000 coins spent for the first time since the split), which may have increased the supply of coins on exchanges and then had a negative impact on the price in the following days. Since around 10th August, the daily spend (for the first time since the split) of Bitcoin Cash has been lower at around the 60,000 level, indicating supply entering the market may be lower. This could be supporting the Bitcoin Cash price to some extent.

Bitcoin Cash price (% vs Bitcoin) compared to daily Bitcoin Cash spend

(Source: BitMEX research, Bitcoin Cash blockchain, Bittrex (for market prices))

In our view, the 17.2% figure could be considered reasonably high, given that perhaps millions of coins may be lost and that the many investors are likely to be lazy and do nothing. The supply of new Bitcoin Cash coins entering the market may therefore continue this gradual decline. Therefore, in our view, this analysis indicates the price outlook for Bitcoin Cash is neutral to positive.

Of course the above analysis is an oversimplification and there are many other factors at play. The 17.2% figure does not imply this value of coins has actually been sold, many investors may have either spent their coins in preparation to sell at a later point or even be splitting coins before doing the opposite trade (Selling Bitcoin and buying Bitcoin Cash). In addition to this, the analysis says little about the demand for Bitcoin Cash and focuses primarily on supply. In order for the price of Bitcoin Cash to increase, strong demand is also required.

There are also many other challenges facing Bitcoin Cash, such as fixing the volatile and unusual difficulty adjustment system and improving the P2P network. Therefore we are not recommending readers invest in Bitcoin Cash, however if you are considering it, we believe this type of analysis may be useful.