Daily 50x Leveraged Bitcoin / USD Futures Contracts

Last Friday we launched a daily 50x leveraged Bitcoin / USD futures contract with the symbol XBT24H. Due to the low volatility of Bitcoin, scalping or range trading is the preferred strategy of many day traders. With 50x leverage, traders can double their initial investment with only a 2% move in the spot price. XBT24H has quickly become our most popular contract, and we have added additional market makers to help improve liquidity.

Is Bitcoin A Safe Haven Asset?

Don’t fight the Fed was the investing mantra over the past 6 years. Indeed fund managers who did not heed that advice were eviscerated. The Fed did a beautiful job of constructing the narrative of central banking omnipotence. There was no economic problem that couldn’t be solved with lower interest rates, money printing, and equity market bubbles.

Nothing lasts forever and investors confidence in central bankers ability to engineer higher asset prices has come undone. It began in China where the PBOC lost the plot and has not been able to convince the hoard of ordinary punters to return to the tables. Next up was Grandma Yellen. Her concern over the weak world economy and markets was heard loud and clear except this time traders actually sold assets. The bribe of more free money didn’t turn the tide, and now the S&P 500 has given up all QE3 gains.

Where can investors hide? After falling almost 50% from the its high of $1,900 per ounce, gold was one of the best performing assets over the last few weeks. The question for Bitcoiners is whether Bitcoin will be viewed as a safe haven asset in the times of market turmoil to come. Market turmoil tends to benefit Bitcoin. The Grexit summer scare was negative for the broader financial markets, but Bitcoin performed beautifully in the risk-off environment. It traded up to $320. As soon as the Greeks folded to ze Germans, risk-on was back and Bitcoin fell back into low $200’s.

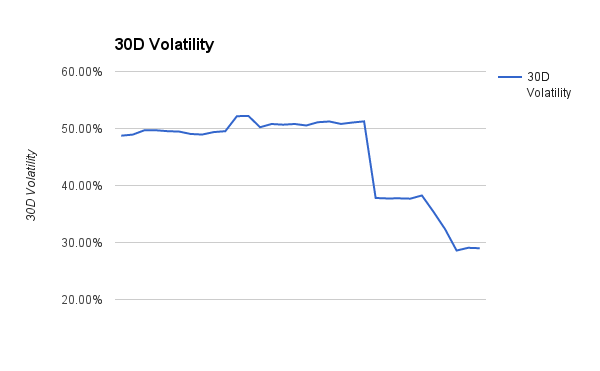

The above graph shows the 30 day realised volatility over the past month. Volatility fallen by almost half in that time period. This is quite surprising when compared with a backdrop of a deteriorating global financial system. Once the world’s most volatile asset, Bitcoin has put many traders to sleep. As turmoil increases in the financial markets, Bitcoin is poised for a breakout in price and volatility.

The market neutral strategy is to buy October 2015 (XBTV15) 25x leveraged Bitcoin / USD futures contracts and short sell spot. An uptick in volatility on a breakout move will result in the XBTV15 premium rising. At that point sell XBV15 and buy back the shorted Bitcoin.

If you believe Bitcoin will begin behaving more akin to gold, go long December 2015 (XBTZ15) 25x leveraged Bitcoin / USD futures. It is still cheaper in basis terms than March 2016 (XBTH16) futures, but has sufficient time value to experience a nice pop if basis and price began moving upwards.

XBT Futures Term Structure

Volatility continued falling last week. As a result, the term structure barely moved. The XBT term structure is in a healthy contango. The appropriate strategy is to sell XBTH16 and buy XBT7D and short roll. Below are a step by step instructions:

- Sell XBTH16 and buy XBT7D in equal contract amounts.

-

When XBT7D expires, sell the next weekly expiring contract. This is called short rolling. The goal is to remain price neutral.

This trade has positive carry or Theta.

Daily BTC Theta = $Basis / Days Until Expiry * 0.00001 BTC Multiplier * Contracts

Assume that 100,000 contracts per side were traded.

XBTH16 Theta = $56.63 / 180 * 0.00001 BTC * 100,000 = +0.31 BTC

XBT7D Theta = $0.91 / 5 * 0.00001 BTC * 100,000 = -0.18 BTC

Daily BTC Theta = 0.31 BTC - 0.18 BTC = 0.13 BTC

Assume the curve does not shift, a 0.13 BTC profit each day will be earned from this carry trade.

If the short term rates rise significantly, there could be losses incurred when short rolling occurs. The point at which the short XBT7D has a negative daily BTC theta of 0.31 BTC is the break even.

0.31 BTC = $Basis / 5 * 0.00001 BTC * 100,000

$Basis = $1.55

A $1.55 basis equates to a 48.39% annualised percentage basis.

Assuming the rates do not rise on the XBTH16 contract, if the XBT7D annualised % basis rises above 48.39%, it is optimal to let it expire and sell the XBTH16 contracts at the Friday 12:00 GMT settlement.

The above example I walked through is a real world example of the basis trades I wrote about in our recent blog post Bitcoin Basis Futures Trading: Lesson 2. In Lesson 3, I will speak about risk management, and the different variables to monitor.

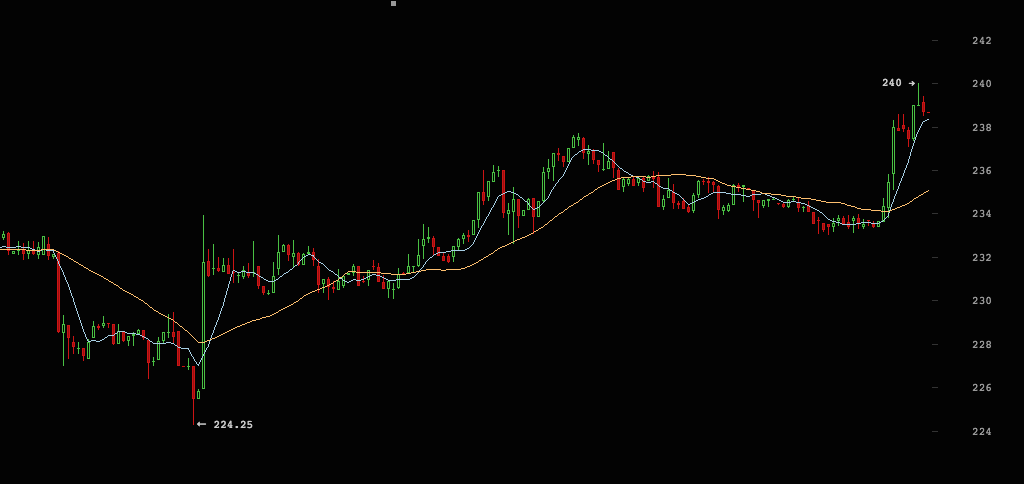

XBT Spot

The near term price target is $250. Bitcoin failed there in the last liftoff attempt. Expect a cooling off period of a few days, and a general fade downwards. The retrace might lead to Bitcoin trading in the mid $230’s for a few trading sessions.

Trade Recommendation:

Buy weekly 25x leveraged Bitcoin/USD futures (XBT7D) while spot is $235-$240. The upside price target is $250.