*Note: This article explains the 2015 and 2016 futures products. Please go to our product page for the most up-to-date details.

Lesson 1 explained the time value of money and how to calculate the annualised basis of a futures contract. Lesson 2 will focus on the basis term structure and different ways to profit from curve shifts.

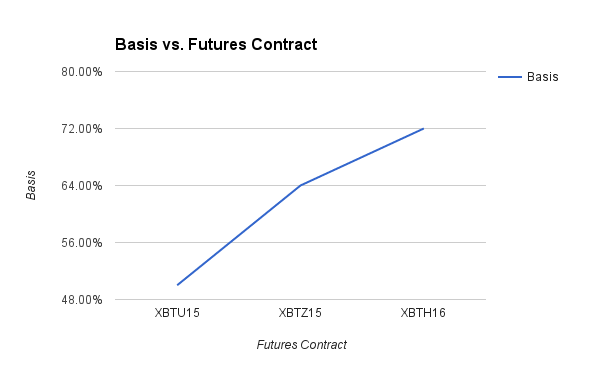

The basis term structure is a graphical representation of the annualised percentage basis for different maturity futures contracts.

Contango Term Structure

For a Bitcoin/USD future, being in contango means that the USD interest rate is higher than Bitcoin’s. Or put another way, traders believe that Bitcoin will appreciate in the future vs. the USD.

Assume there are three futures contracts:

Spot = $250

XBTU15 (September 2015): $260, t = 0.08 (days until expiry, Days/360)

XBTZ15 (December 2015): $290, t = 0.25

XBTH16 (March 2016): $340, t = 0.5

Below is a graphical representation of the upward sloping term structure.

The best trading strategy for playing an upward sloping yield curve is a carry trade. Selling the longer dated XBTH16 and buying the shorter dated XBTU15 allows traders to capture the interest rate differential. When XBTU15 expires, the trader will purchase the XBTZ15; after XBTZ15 expires, the trader purchases XBTH16 to close the position.

Numerical Example:

T+0 days:

Buy 1,000 contracts XBTU15 @ $260

Sell 1,000 contracts XBTH16 @ $340

T+12 days:

XBTU15 expires at the spot price of $250

XBTZ15 = $258

XBTU15 Realised PNL = ($250 - $260) * 1,000 * 0.00001 BTC = -0.1 BTC

Buy 1,000 XBTZ15 contracts @ $258 (this replaces the long XBTU15 position)

T+30 days:

XBTZ15 expires at the spot price of $250

XBTH16 = $310

XBTZ15 Realised PNL = ($250 - $258) * 1,000 * 0.00001 BTC = -0.08 BTC

Buy 1,000 XBTH16 contracts @ $310 (this closes out the XBTH16 position)

XBTH16 Realised PNL = ($310 - $340) * -1,000 * 0.00001 BTC = 0.3 BTC

Total PNL:

-0.1 BTC from XBTU15

-0.08 BTC from XBTZ15

+0.3 BTC from XBTH16

Total Profit = 0.12 BTC

As time elapsed the trader gained profited more from the fall in XBTH16’s price, than the loss experienced when XBTU15 & XBTZ15 expired. This is called positive carry, or positive Theta. The risk to this strategy is that the interest rate differential between XBTU15 & XBTZ15 or XBTZ15 & XBTH16 increases dramatically when the trader short rolls the position. The trader is short rolling, because he is short the near month contract and must buy it back, and then short the farther month contract to stay hedged against his long XBTH16.

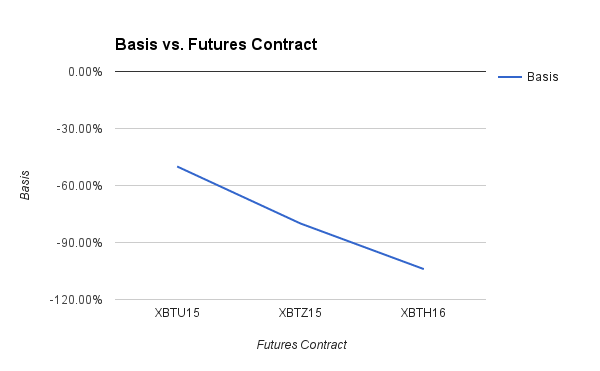

Backwardation Term Structure

For a Bitcoin/USD future, being in backwardation means that the USD interest rate is lower than Bitcoin’s. Or put another way, traders believe that Bitcoin will depreciate in the future vs. the USD.

Assume there are three futures contracts:

Spot = $250

XBTU15 (September 2015): $240, t = 0.08

XBTZ15 (December 2015): $200, t = 0.25

XBTH16 (March 2016): $120, t = 0.5

Below is a graphical representation of the downward sloping term structure:

The best trading strategy for playing a downward sloping yield curve is a carry trade. Buying the longer dated XBTH16 and selling the shorter dated XBTU15 allows traders to capture the interest rate differential. When XBTU15 expires, the trader will sell the XBTZ15; after XBTZ15 expires, the trader sells XBTH16 to close the position.

Numerical Example:

T0 days:

Sell 1,000 contracts XBTU15 @ $240

Buy 1,000 contracts XBTH16 @ $120

T12 days:

XBTU15 expires at the spot price of $250

XBTZ15 = $240

XBTU15 Realised PNL = ($250 - $240) * -1,000 * 0.00001 BTC = -0.1 BTC

Sell 1,000 XBTZ15 contracts @ $240 (this replaces the short XBTU15 position)

T30 days:

XBTZ15 expires at the spot price of $250

XBTH16 = $163.33

XBTZ15 Realised PNL = ($250 - $240) * -1,000 * 0.00001 BTC = -0.1 BTC

Sell 1,000 XBTH16 contracts @ $163.33 (this closes out the XBTH16 position)

XBTH16 Realised PNL = ($163.33 - $120) * 1,000 * 0.00001 BTC = 0.43 BTC

Total PNL:

-0.1 BTC from XBTU15

-0.1 BTC from XBTZ15

+0.43 BTC from XBTH16

Total Profit = 0.23 BTC

As time elapsed the trader gained profited more from the rise in XBTH16’s price, than the loss experienced when XBTU15 & XBTZ15 expired. This is another example of positive carry or Theta. The risk to this strategy is that the interest rate differential between XBTU15 & XBTZ15 or XBTZ15 & XBTH16 decreases dramatically when the trader long rolls the position. The trader is long rolling, because he is long the near month contract and must sell it, and then buy the farther month contract to stay hedged against his short XBTH16 position.

In Lesson 3, I will explain some basics about risk management. The terms Delta, Dollar Value of 1% (DV01), and Theta (time value) will be introduced.