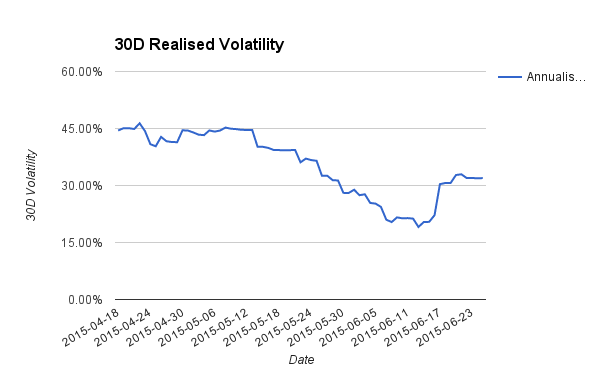

In the June 15th Crypto Trader Digest, I presented a time series analysis of 30 day realised Bitcoin volatility since 2010. I defined a low volatility phase, as a period of time when the 30 day volatility was below 45% annualised. 2015’s low volatility phase began in the middle of April, and reached it’s nadir June 13th at 19.08%. Current 30 day volatility stands at 31.95%, a 67% increase. September is only 2 months away. Using past trading behaviour as a guide, price action will increase to take us out of the low volatility phase by early fall.

Since the $150-$170 crash in January, Bitcoin has local bottomed in the $210-$220 range on 4 separate occasions. Sub $200 Bitcoin while anticipated by many bears, might just never come to pass again. After 18 months of winter, a volatility median reversion to 74% is more likely to lead to substantially higher prices. The $300 upside resistance level, could fall quicker than many expect and unleash a wave of FOMO buying across the crypto-currency complex.