I Want A Ferrari

I like cars. I would really like to experience the thrill of driving a Ferrari, but I really don’t want to own a car. People who own a Ferrari but don’t drive it often might want to earn some income by loaning out their car.

I would be willing to pay a rate of interest, to drive a stranger’s Ferrari for a short period of time. I am willing to swap an interest payment, for the use of a Ferrari.

Altcoins Are Like Ferraris

Traders love altcoins because they have extreme volatility on the up and downside. Savvy traders can earn substantial sums trading altcoins in a short period of time. However, most traders have no interest in holding or storing altcoins. They just want to participate in the price performance of the coin.

As a result, most altcoin traders prefer to trade on margin. To go long they pledge Bitcoin as collateral, borrow additional Bitcoin and buy the altcoin of their choice. To go short, they pledge Bitcoin as collateral, and borrow the altcoin to short it. In both cases, the traders must pay interest to the lender of Bitcoin or the altcoin.

Just like the Ferrari example above, traders swap interest payments for the performance of the altcoin. Traders have no interest in owning the coin, but they obtain the same economics through a swap.

BitMEX Swap Basics

BitMEX swaps mimic the exchange of cash flows and price performance inherent in trading any currency pair. Every currency pair consists of a base and quote currency. The base currency comes first then the quote currency in any currency pair code. For ETHXBT, ETH is the base currency and XBT is the quote currency.

Imagine you want to buy ETH. You first need to borrow XBT to exchange it for ETH. The person lending you XBT will charge you a rate. Once you have purchased ETH, you can lend it out to someone else.

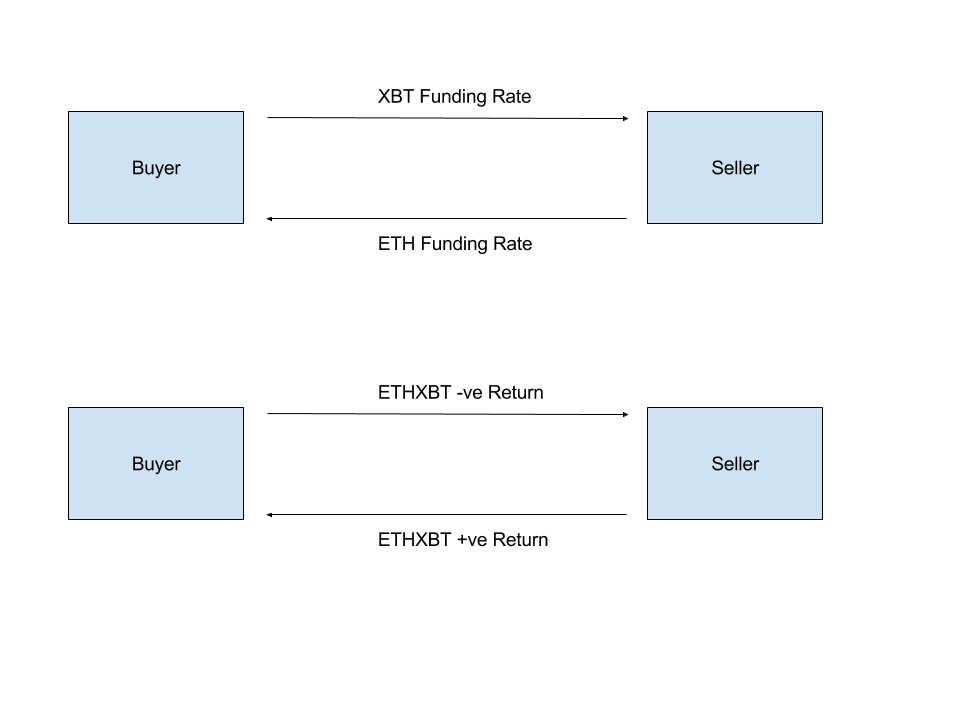

In this example, as a buyer of ETHXBT, you pay the XBT (quote currency) rate and receive the ETH (base currency) rate. The opposite is true if you wished to sell ETHXBT.

To perfectly replicate the action of borrowing and lending the base and quote currency, buyers of BitMEX swaps must pay the quote currency rate and receive the base currency rate. Sellers of swaps must pay the base currency rate, and receive the quote currency rate.

BitMEX does not operate a lending market for either the base or quote currency, so the rates reference an external third party market.

Buyers and sellers swap interest rate payments for exposure to the underlying asset. Buyers of ETHXBT are long and profit from a rise in price; sellers of ETHXBT are short and profit from a decline in price.

The net of the base and quote interest rates is the Funding Rate. The Funding Rate is charged each day at the Funding Timestamp based on the value of the position. It’s just like a bond. If you hold the bond on the coupon date, you get a payment. If you do not, you get nothing. If you buy ETHXBT and sell it before the Funding Timestamp, you are not eligible to pay or receive the Funding Rate.

Swap Boxes And Arrows

The diagram above shows the interest payments and performance obligations for buyers and sellers of ETHXBT.

How Are Swaps Valued?

BitMEX intends for swaps to mimic margin trading. Swaps are valued at the prevailing spot price of the underlying asset. For ETHXBT, that is the ETH/XBT exchange rate on Poloniex.

To ensure that the swap’s price does not deviate greatly from spot, each week unrealised profit will become realised at the prevailing spot price. That allows profitable traders to either withdraw their winnings, or either re-leverage them on additional contracts.

Is There Leverage?

Of course, this is BitMEX. Because no physical asset changes hands, BitMEX is able to offer very high leverage on swaps. If two traders wish to trade an ETHXBT swap worth 100 XBT, each side must post at least 4 XBT of margin. If the price declines or rises by more than 2%, the long or short trader will be liquidated. For more information, please refer to the Liquidation document.

How Long Do Swaps Last?

The beauty of BitMEX swap contracts is that there is no settlement date. As long as you can afford to pay the daily funding rate, and the spot price does not touch your liquidation price, you can keep your swap. If you wish to close your swap, trade out of your position in the open market. Buyers close their swaps by sell; sellers close their swaps by buying.

Let’s Trade

ETHXBT is BitMEX’s first swap product. It allows traders to trade the ETH/XBT exchange rate with up to 33x leverage. Traders do not need to own or borrow ETH to trade ETHXBT. Margin, profit and loss are all denominated in Bitcoin.