Whether you are an experienced trader or new to the crypto space, understanding your platform is key to executing your trades. The difference between a profitable trade and a losing one often depends on whether you’ve executed the trade properly and managed your risk effectively.

At BitMEX, our goal is to provide traders with the most powerful tools available to maximise their trades. This article is a step-by-step guide on placing your first trade on BitMEX and managing your positions.

Before We Start

1. Fund your BitMEX Account

Learn how to make an on-chain deposit here or purchase crypto with your choice of payment, including bank transfer and credit cards.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000+ in rewards to new users – you can register here.

2. Understand Your Margin Mode

Each contract on BitMEX is margined in a specific currency, either Bitcoin (BTC) or Tether (USDT), and can be traded with up to 250x leverage.

To simplify your trading experience, you can enable Multi Asset Margining. This feature allows you to use any asset as collateral for derivatives trades, removing the need for internal conversions. For example, you can trade a BTC-margined contract using USDC as collateral.

1. Where to Place Your Trade

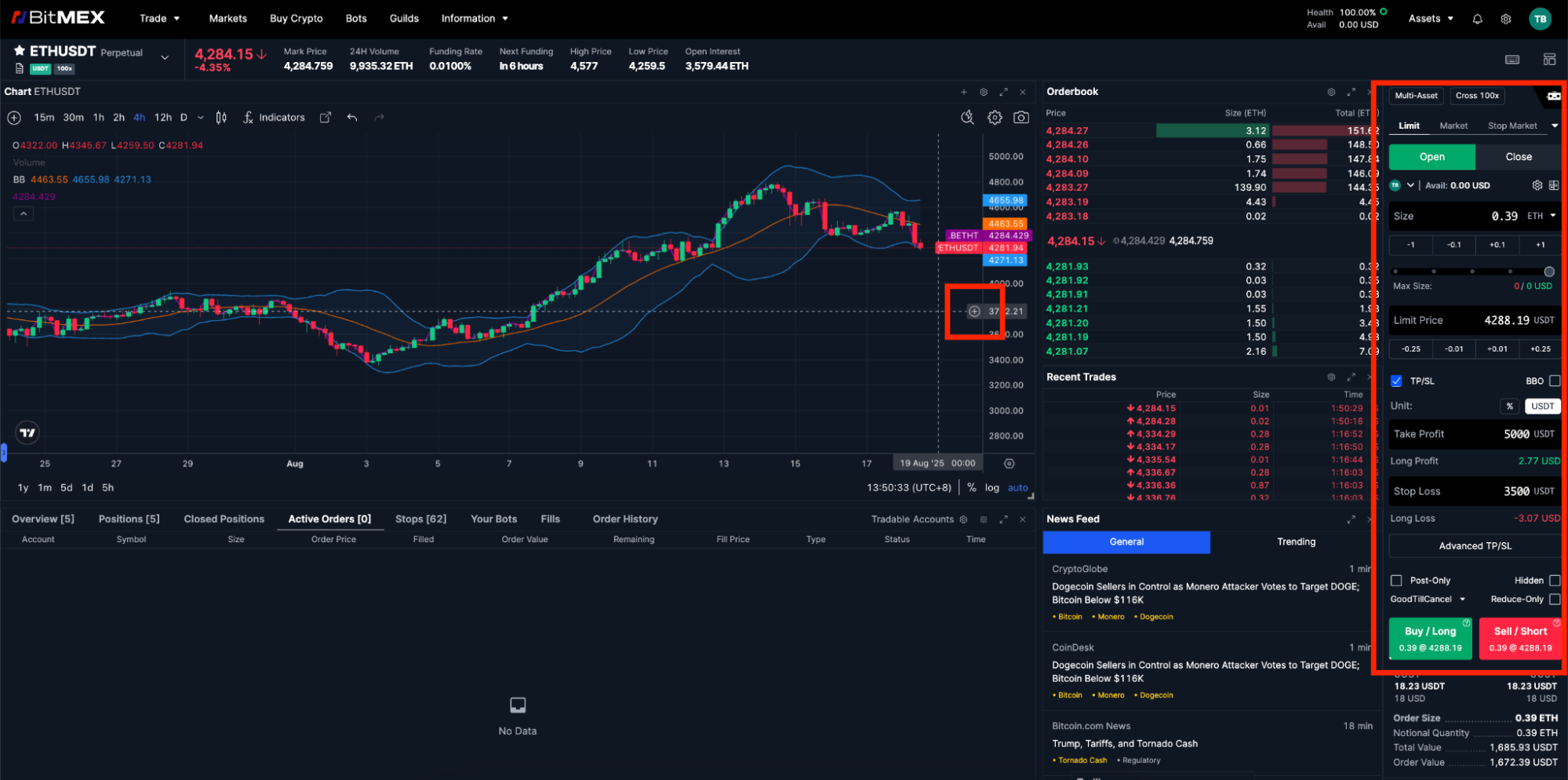

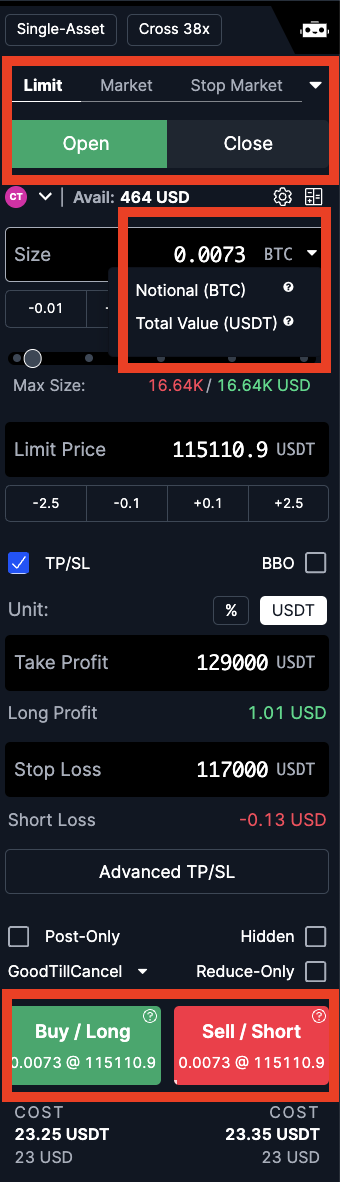

To place a trade, use the Order Controls panel located on the side of your trading interface. On BitMEX, you have several order types available to you. Some of the most popular order types include:

To place a trade, use the Order Controls panel located on the side of your trading interface. On BitMEX, you have several order types available to you. Some of the most popular order types include:

- Limit Order: This order only executes at a specific price you set. However, because it is placed on the order book and waits for that price, there is no guarantee it will be executed.

- Market Order: This order executes instantly at the best available price on the order books. It is used when you need to enter or exit a position quickly. Be aware of slippage in volatile markets.

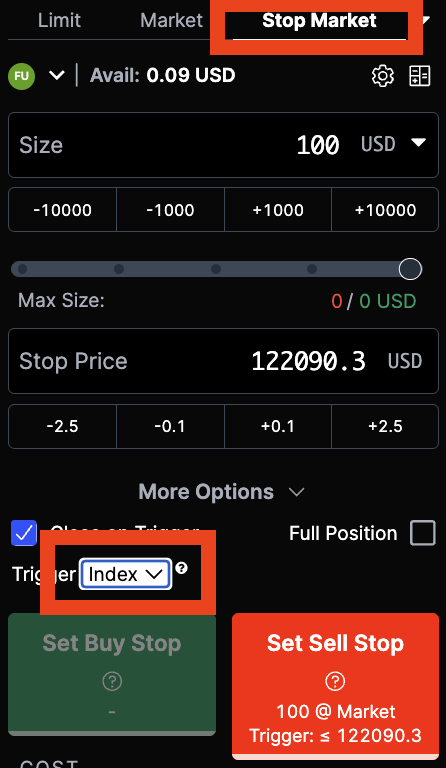

- Stop Market Order: This is a conditional order that becomes a market order when a specified price is reached. It is a critical tool for risk management, like setting a Stop Limit (SL) to prevent further losses.

For more information on order types, refer to this article.

Alternatively, you can also place your order directly on the chart. Learn more about chart trading here.

2. Confirm Your Trade Details

- Select Your Order Type: Choose between a Market, Limit, Stop Market, Stop limit, Chaser, Trialing Stop, Take Profit Limit, and Take Profit Market. Learn more about each order type here.

- Input Your Order Price: If you selected a Limit Order, you must specify the price at which you want your order to be executed.

- Set Order Size & Leverage: Input your order size (in Notional or contracts) and adjust your leverage and margin mode.

- Choose Direction: Decide if you want to go Long (bet on the price rising) or Short (bet on the price falling).

- [Optional but recommended] Set Stop Limit (SL) & Take Profit (TP): Set a price to automatically close your position to either limit a loss or lock in a profit.

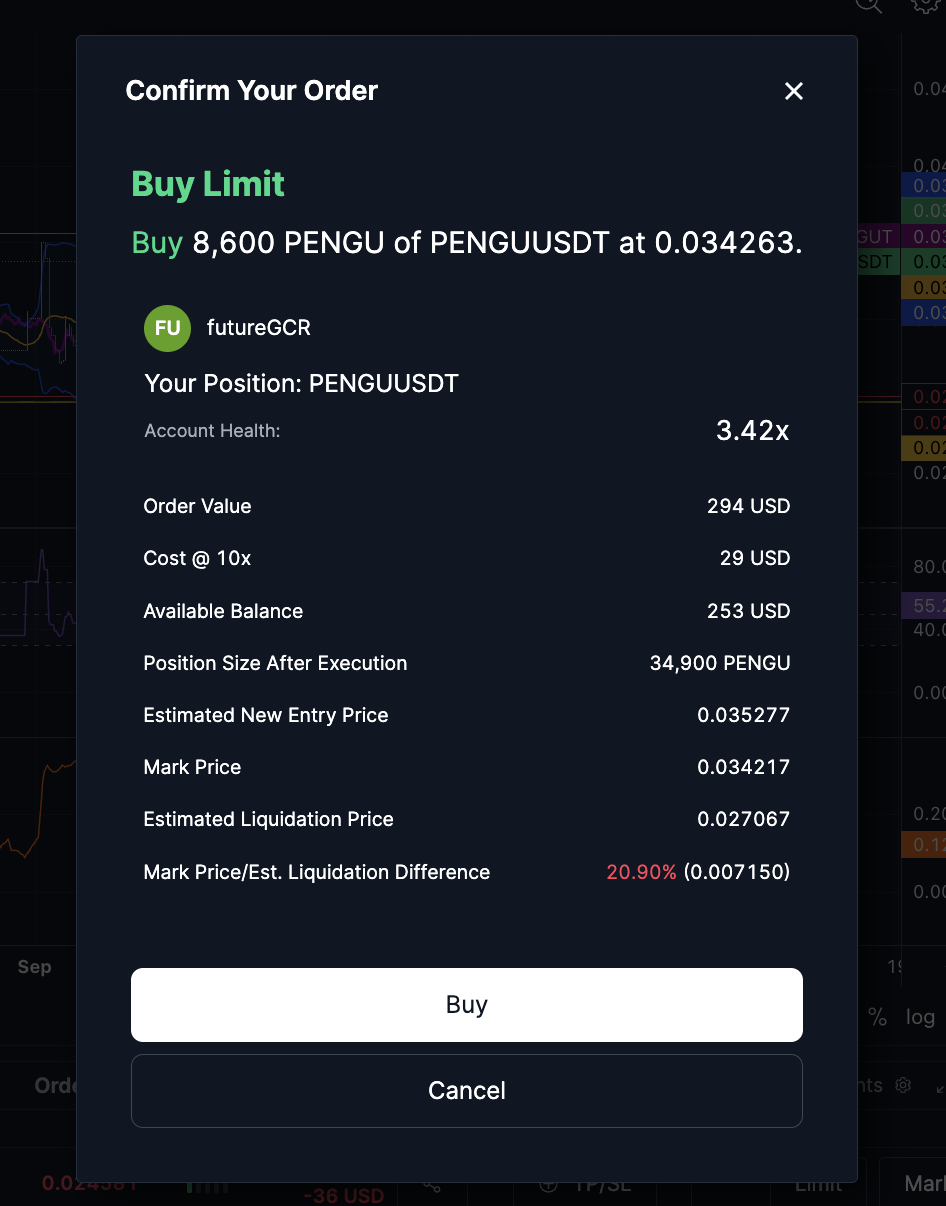

Before you execute your trade, a confirmation window will appear. Take a moment to review all your position details—such as size, leverage, and liquidation—before proceeding.

3. Manage Your Open Positions

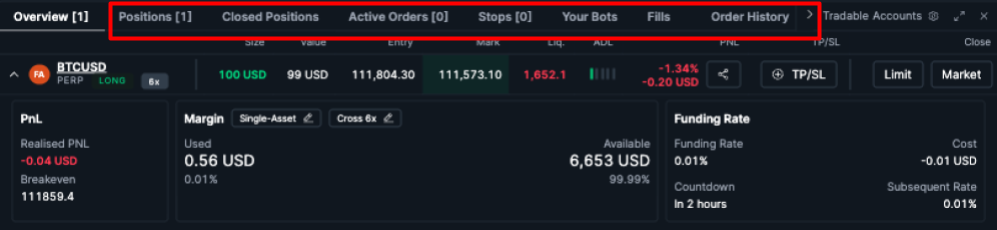

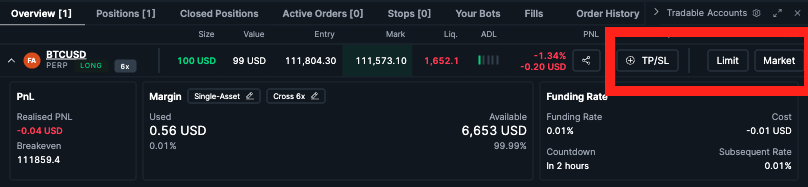

Once your order is filled, your active position will appear in the Overview and Position tabs, where you can view your position details including your breakeven price and margin size. From the same interface, you can easily manage your active orders, stops, and view all historical data by selecting the tabs above.

4. Close Your Position

You have several options to close your position:

- Limit or Market Close: You can close your position instantly from the Overview or Positions tabs by limit close or market close.

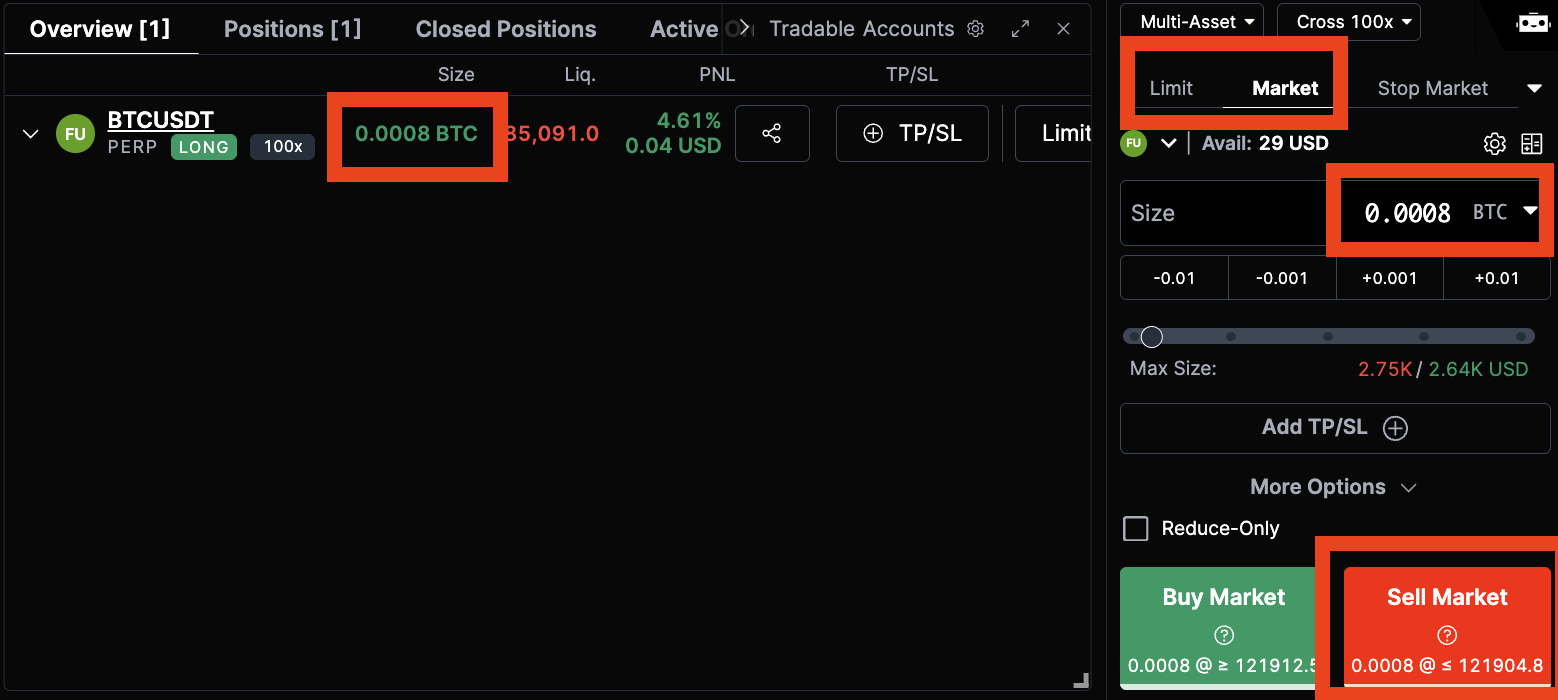

- Order Panel Widget: You can also close your position by placing an opposite order in the order controls. Please ensure the correct contract and positive size matches the position you want to close. Select Buy if you’d like to close a short position, or Sell if you’d like to close a long position.

- Set Stop Orders: You can also set a Stop Market order to set a Stop Limit (SL) or a Take Profit (TP). We recommend using the Index Price for this, as it is a more reliable reference from a basket of exchanges. Learn more about Index Price here.

Speed and precision are the key to executing trades especially in the crypto markets. Remember to start with a plan, manage your risk, and monitor your trades. You can start trading on BitMEX here.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000+ worth of trading credits to new users – you can register here.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.