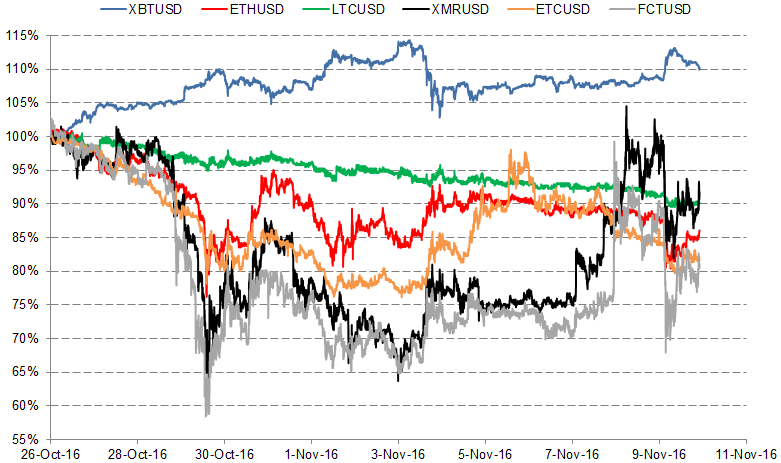

As Bitcoin roars back to life for various reasons, traders are rotating out of altcoins back into the crypto reserve currency. The above chart shows the performance of Bitcoin against that of a number of altcoins over the past two weeks.

What is abundantly clear is Bitcoin up, altcoins down. Furthermore, the performance of Bitcoin and altcoins is negatively correlated (see the table below). Finally, altcoin prices move more violently than Bitcoin.

| Correlations | ETHUSD | LTCUSD | XMRUSD | ETCUSD | FCTUSD |

| XBTUSD | -91% | -65% | -67% | -86% | -77% |

There are a few reasons to explain the above results. China’s devaluation of the CNY, the release of Segwit, and a flight to safety during market volatility that resuscitated Bitcoin.

As traders close their positions in altcoins to ride the Bitcoin wave, altcoins are kicked to the gutter without enough liquidity to cushion the fall.

| Cryptocurrency | Market Cap | % |

| Bitcoin | $11,440,078,705 | – |

| Ethereum | $911,356,507 | 7.97% |

| Litecoin | $185,283,515 | 1.62% |

| Monero | $82,886,148 | 0.72% |

| Ether Classic | $77,732,113 | 0.68% |

| Factom | $20,638,427 | 0.18% |

The above table shows the currency market capitalisations of the above coins. Cryptocurrency traders should keep these numbers in mind when evaluating trading and market impact costs. The market impact or liquidity cost is often ignored by novice traders. When everyone rushes for the exit, the lack of liquidity leads to exaggerated moves and erosion of paper profits.