Hedging a quanto perpetual swap is not straightforward. The added component of correlation risk between two crypto assets complicates things. I will take things from first principles, then provide a more general formula.

Assumptions:

Symbol: ETHUSD

Multiplier: 0.000001 XBT

ETHUSD Price: $500

.BETH (ETH/USD Spot Index): $500

.BXBT (XBT/USD Spot Index): $10,000

Scenario 1 – Short ETHUSD and Hedge

You are lifted for 100,000 contracts of ETHUSD.

First let’s compute your currency exposures:

XBT Value = $500 * 0.000001 XBT * -100,000 = -50 XBT

ETH Value = XBT Value / [ .BETH / .BXBT ] = -1,000 ETH

Next you hedge your ETH/USD exposure by purchasing 1,000 ETH at the spot price. Assume you can match the current .BETH Index price on your purchase.

You have hedged your underlying currency exposure. At this point your exposure is perfectly hedged. However, as the price of ETHUSD changes, your PNL on ETHUSD will be in XBT, while the PNL on your ETH hedge will be in USD.

Let’s look at two extreme examples.

Example 1: .BETH Rises and .BXBT Falls

.BETH and ETHUSD rises to $750

.BXBT falls to $5,000

ETHUSD PNL = (ETHUSD Exit Price - ETHUSD Entry Price) * Multiplier * # Contracts = -25 XBT, USD Value -$125,000

ETH Spot USD PNL = (.BETH Exit Price - .BETH Entry Price) * # ETH = $250,000

Net USD PNL = ETHUSD XBT PNL in USD + ETH Spot USD PNL = +$125,000

In this example the correlation between the USD value of XBT and ETH is -1. They moved in a perfectly negatively correlated fashion, and you made money.

Example 2: .BETH Rises and .BXBT Rises

.BETH and ETHUSD rises to $750

.BXBT rises to $15,000

ETHUSD PNL = -25 XBT, USD Value -$375,000

ETH Spot USD PNL = $250,000

Net USD PNL = -$125,000

In this example the correlation between the USD value of XBT and ETH is +1. They moved in a perfectly positively correlated fashion, and you lost money.

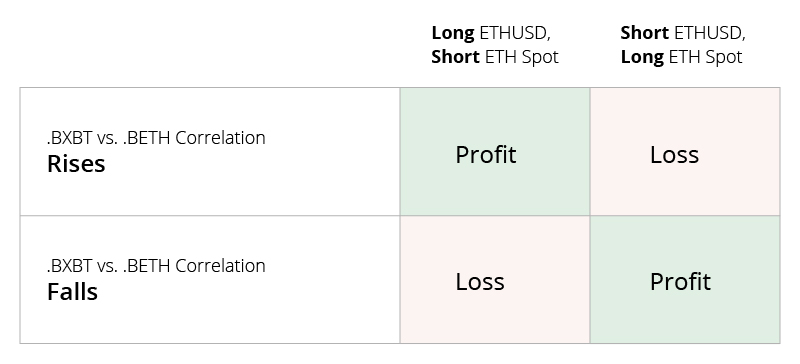

The short ETHUSD position + Hedge profited when correlation fell, and lost when the correlation rose. Due to the flat ETHUSD vs. .BETH basis, the entry price assumed a correlation of zero between the two cryptos.

Scenario 2: Long ETHUSD and Hedge

You are hit for 100,000 contracts ofETHUSD.

First let’s compute your currency exposures:

XBT Value = $500 * 0.000001 XBT * 100,000 = 50 XBT

ETH Value = XBT Value / [ .BETH / .BXBT ] = 1,000 ETH

Next you hedge your ETH/USD exposure by shorting 1,000 ETH at the spot price. Assume you can match the current .BETH Index price on your purchase, and there is no cost to borrow ETH for this short sell.

You have hedged your underlying currency exposure. At this point your exposure is perfectly hedged. However, as the price of ETHUSD changes, your PNL on ETHUSD will be in XBT, while the PNL on your ETH hedge will be in USD.

Let’s look at two extreme examples.

Example 1: .BETH Rises and .BXBT Falls

.BETH and ETHUSD rises to $750

.BXBT falls to $5,000

ETHUSD PNL = 25 XBT, USD Value $125,000

ETH Spot USD PNL = -$250,000

Net USD PNL = -$125,000

In this example the correlation between the USD value of XBT and ETH is -1. They moved in a perfectly negatively correlated fashion, and you lost money.

Example 2: .BETH Rises and .BXBT Rises

.BETH and ETHUSD rises to $750

.BXBT rises to $15,000

ETHUSD PNL = 25 XBT, USD Value $375,000

ETH Spot USD PNL = -$250,000

Net USD PNL = $125,000

In this example the correlation between the USD value of XBT and ETH is +1. They moved in a perfectly positively correlated fashion, and you made money.

The short ETHUSD position + Hedge profited when correlation rose, and lost when the correlation fell. Due to the flat ETHUSD vs. .BETH basis, the entry price assumed a correlation of zero between the two cryptos.

The below table summaries the two scenarios:

Time Horizon

The correlation between XBT and ETH is not static. The longer you hold a hedged swap position, the more chance that the correlation regime you expect based on the recent past, will change.

Unlike a futures contract, the ETHUSD swap has no expiration date. Therefore your quanto risk is specific to your time horizon. For market makers who are in and out quickly, the quanto effect is negligible. For cash and carry market makers who hold a position for an extended period of time to capture funding, the quanto effect can destroy one’s PNL.

Covariance

Many market makers will not be satisfied leaving their correlation risk unhedged. They will constantly hedge their PNL on the BitMEX and spot leg of their portfolio. Depending on the XBT and ETH volatility, and their correlation, the covariance will determine whether the hedging of PNL positively or negatively impacts your overall profits. If both assets are highly volatile and the correlation is moving in or out of your favour, your gains or losses from hedging the PNL are amplified.

We are in uncharted territory. In a few month’s time, I will observe the past data and attempt to calculate what portion of the funding is attributed to market makers pricing in a quanto risk, and what portion is due to the interest rate differentials between ETH and USD.