Brokedown Palace: EM FX

As a Hong Konger with essentially USD (HKD is pegged to the USD), my travels around Asia have gotten much cheaper lately. The Chinese started the party by devaluing the CNY. Subsequently traders took the hammer to emerging market (EM) currencies and many worry a repeat of the 1997 Asian Financial Crisis is upon us.

Talk about volatility, a few weeks back Kazakhstan decided enough was enough and let the Tenge (its currency) fall by 22% in one weekend, annualise that! Meanwhile sleepy Bitcoin has been locked in a tight trading range, and volatility is at historic lows. If Empress Yellen decides to raise rates, the EM FX complex will take another drubbing.

Many EM countries and corporates issue debt in USD not their local currency. Investors understandably don’t want EM FX exposure. Many of these countries are either goods or commodity exporters. The current world economy is characterised by slowing world trade, falling demand for industrial commodities, and a strong dollar. This toxic mix ensures that EM countries and corporates will struggle to pay back USD denominated debt. FX traders see the structural balance of payments problems and continue dumping EM currencies, further exacerbating the problem.

Governments valiantly fight against the global markets by selling down their FX reserves of USD denominated assets. Notable examples are China and Saudi Arabia. At some point smaller nations will have to throw in the towel and allow their currencies to weaken drastically. Regular citizens need not sit back and watch their purchasing power destroyed. Diversifying a portion of their wealth into Bitcoin now, is an intelligent decision. Non-USD Bitcoin exchange rates will begin trading a substantial premiums reflecting the market’s view on the future devaluation that will occur in a particular currency. Get out now while the getting is good.

For readers who are in EM countries and can trade deliverable FX forwards here is a trade idea:

- Buy Bitcoin, sell USD at one of the big global exchanges.

- Sell Bitcoin at a premium, buy your local EM currency. You now have EM currency that you need to convert back into USD.

- Buy a deliverable forward (DF). You will deliver EM currency and receive USD when the DF expires. Now you have USD, wash, rinse, and repeat.

- The premium that Bitcoin trades to your local currency must be greater than the premium on the DF for this trade to work.

Tongzhimen Hao (Greetings Comrades)

The whole world now hums to the tune of Zhongnanhai. Xi Jinping put on a powerful parade last Thursday commemorating their “victory” (read: the US and Russia saving their ass) in WWII. However the markets didn’t care, and the Shanghai Composite closed down over 2% today. In addition they continue to fix the CNY stronger, which necessitates the PBOC to sell even more US Treasuries to support their currency.

Bitcoin traders should be watching the China equity, FX, and rates markets like a hawk. Knowing the change in the daily PBOC fix of USDCNY is a must. Up until now the beauty of day trading Bitcoin was that the fundamentals (if there are any) mattered little. The ability to correctly read a chart and the human emotion it conveyed easily conveyed profits upon the punter. As a global financial catharsis courtesy of China is at hand, clueless traders will be caught out by economic data points. Dust off that textbook and educate yourself before you rek yourself.

They keys data points are:

USDCNY Exchange Rate

Daily change of the Shanghai Composite

The 10yr US Treasury Yield

Dramatic changes in any of these variables will begin to have a noticeable impact on Bitcoin just like they do for gold.

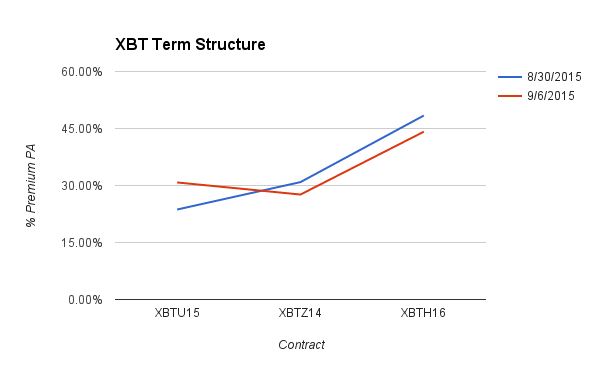

XBT Term Structure

The curve shifted slightly lower in the past week. Given the price rise, this is surprising. The non-linear return in USD for being long the XBT series futures should have lead to an increase in their premium over spot. Long-end futures (Dec15 XBTZ15 and Mar16 XBTH16) look very cheap. If the rally continues and enters the fomo phase, the long end futures will become much more expensive. Traders who wish to profit from a parallel shift upwards due to a rising price should buy XBTZ15 or XBTH16.

XBT Spot: Breakout

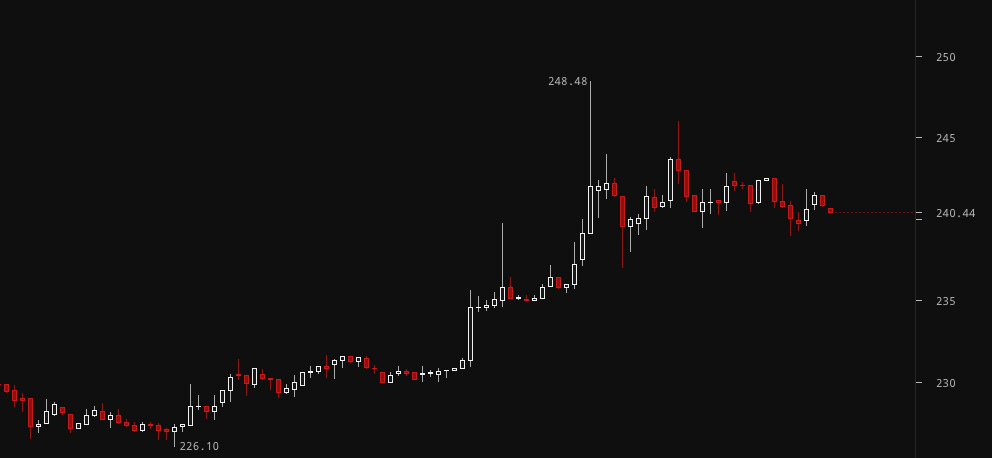

The sleepy 4-day holiday weekend in China culminated with a breakout on Sunday (it was a working day). Bitcoin broke through $230 and traded as high as $248 on Bitfinex. Now the price languishes at $240.

The rally started at $200 and the channel will culminate at $260. $260 is where the previous breakdown in price occurred. Expect price to stall at $240 and trade down into the mid $230’s. If $235 is broken on the downside consider this rally over and ride the rollercoaster back to $220. If $235 can hold, the rally can continue to stair step higher to $250 then $260.

The resistance at $260 will be fierce and in the absence of a new development, the price will not ascend this mountain. China continues puking even after the government has sounded the all clear. Expect more gyrations in the financial markets that could be very positive for Bitcoin if investors view it as a new safe haven.

Trade Recommendation:

Buy XBTU15 (BitMEX weekly Bitcoin/USD futures contract) while spot is $235-$240. The upside target is $255-$260.