Greece To Sell Islands To Fund Its Banks

The people of Greece have been betrayed. Prime Minister Alexis Tsipras called a referendum on the conditions of the controversial EU bailout package. The people voted not to accept the terms. Now he has “signed” a new program that cedes all control of Greece to Brussels. The most galling part of the new plan is that proceeds from a 50 billion Euro privatisation fund (read: selling Greek islands and public utilities to the highest bidder) will be used to recapitalise the failing banks. The EU has robbed Peter to pay Paul. In the end they have provided no real assistance to their European brother.

Greece has until Wednesday to pass the agreement in parliament. The Greek people need to make themselves heard. They must put the fear of God into any MP who dares to ignore the landslide No vote in the referendum. If this agreement passes, violence will reign in Greece. If the banks somehow manage to reopen, they will be emptied of Euros within days.

As this agreement hit the newswires, Bitcoin began nosediving. The price touched a low of $281. Once more information about the deal trickles out, traders will focus their sights on Wednesday and the political fight to pass the agreement. $300 Bitcoin may return in a few days time.

Bitcoin is one of the only ways that European people can secure assets outside of the EU banking systems. Germany is hell-bent on demonstrating to Spain, Italy, Portugal, and France what happens when they are disobeyed. Citizens of these countries must read the writing on the wall. It is not enough to hold cash under the mattress, or spirit capital to Switzerland. Every EU citizen will now wonder: is our country next? Will we be made to beg for scraps from unelected bureaucrats? Redenomination risk is real, and the contagion will spread across Europe. Bitcoin will continue to be bought on these fears regardless of whether the Greeks receive another bailout.

China: The Wests Portrait Of Dorian Gray

The financial services industry employs many intelligent people. But in the end there are only two actions, Buy or Sell. China is seeking to remove the sell button permanently in an attempt to prop up its market. Authorities have even threatened jail time for those who sell their holdings. 50% of the market is shut, and you can now pledge your house as collateral for a loan to buy stocks.

Many western commentators have chastised China for not living up to the free market principles they were supposedly striving to implement. China is not doing anything that western governments (US and Europe) haven’t tried before. The Chinese style is just a tad more in your face. Franklin D. Roosevelt in 1933 banned the private holding of gold by US citizens. Those who refused to sell their barbaric relic to the government at a below market rate faced federal prison. China is the US and Europe’s portrait of Dorian Gray.

If China’s brash way of dealing with falling asset markets proves successful, similar measures will be introduced when the contagion spreads to western capital markets. People invest in paper assets (stocks, bonds, etc.) to store and grow wealth. If there is no exit, these assets are worth zero. You can’t eat stock. You can’t eat Bitcoin either, but at least there are free markets for the exchange of Bitcoin.

Santa Baby

Santa baby, just slip a Bitcoin under the tree for me;

Been an awful good girl, Santa baby,

So hurry down the blockchain tonight

The low volatility phase that began in mid-April is over. 30-day realised Bitcoin volatility has risen to 50.96%. As the volatility mean reverts, the current market structure will change dramatically. With the backdrop of Grexit and turmoil in financial markets globally, the more likely scenario is for Bitcoin to continue its upward ascent with increased vigor. While short dated futures’ basis on BitMEX and our competitors has risen sharply, December futures’ basis (XBUZ15) on BitMEX has barely budged.

As volatility increases, the Bitcoin call option becomes more valuable. Given an unlimited upside, longs will be willing to pay increasing rates to borrow USD and buy Bitcoin. XBUZ15 has the most remaining time value, and the rate rise will impact this contract’s basis the most.

There are two ways to profit. If you would like to retain upside exposure to Bitcoin and rates, buy XBUZ15. If you would just like to profit off of rising rates, then buy XBUZ15 and sell XBUU15. This will cost you around $2-$4, as XBUZ15 is more expensive by that amount than XBUU15. The $2-$4 is your entry fee and maximum loss. Effectively, you are borrowing money between September and December for 5% per annum. Given the explosive nature of Bitcoin, that is very cheap. Compare to Bitfinex, where you can borrow USD at 27% per annum.

Trade Recommendation:

Buy XBUZ15 outright, or buy XBUZ15 and hedge your delta by selling XBUU15.

The Litecoin Pump and Dump

Until last Friday, Litecoin was up 8x on the month. Since writing Chinese Promoter Pumping Litecoin Via Ponzi Scheme on Friday morning, the price of Litecoin has fallen 45%. The promoter began cashing out his position on Friday afternoon. LTC dumped and Bitcoin pumped on all the Chinese exchanges. Spot Bitcoin on OKCoin.cn hit a high of 2335 CNY or $376; a full retrace happened in minutes and any traders with derivative positions that included China prices got rekt. This happened against a backdrop of a major DDoS attack on many of the leading Chinese exchanges and Bitfinex. There is no definitive evidence of chicanery but where there’s smoke, there’s fire.

Which altcoin will this well-run operation pump next? Be sure to let us know when you do.

Weekly Review: Bitcoin Investment Products

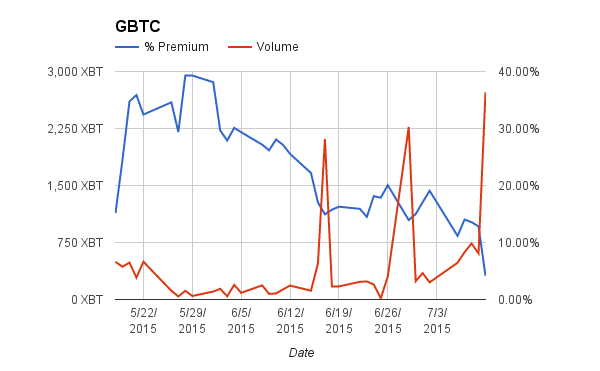

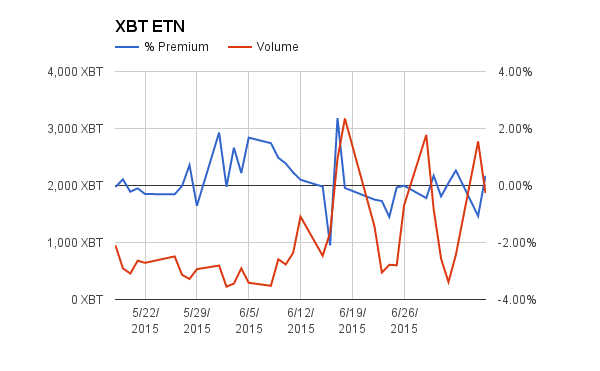

| Week Ending | GBTC Avg Volume | WoW % Chg | % Premium | XBT Avg Volume | WoW % Chg | % Premium |

| 7/3/2015 | 771 XBT | 14.74% | 1,255 XBT | -0.09% | ||

| 7/10/2015 | 1,035 XBT | 34.31% | 8.35% | 2,673 XBT | 112.98% | 0.00% |

The LTC and Bitcoin dump and pump on Friday lit a fire under the trading volumes of GBTC and XBT. Volumes surged on Friday, and XBT traded an all time high 5,170 Bitcoin. With the heightened Greek drama, expect volumes to continue increasing. GBTC’s premium now stands below 10%. As more supply enters the market, it appears the market maker is able to better control the premium.

XBT Spot

The news of a Greek deal slid across the wires. The price slowly faded lower. Within minutes, Bitcoin was in freefall and retested $281. The level held on two attempts, and a consolidation is under way around $285. Intraday volatility has returned. Babysitting your Bitcoin is essential. After a sleepy start to the summer, proper risk management techniques need to be employed or you will find yourself rekt.

The Greece saga is not over. The parliament must approve the deal by Wednesday. Bitcoin will be in a holding pattern until then. The news is likely to be negative (Bitcoin positive) up until the vote. My base case is for the Greece parliament to sell their citizens down the river and vote to approve the deal. The downside target is $260. Medium term I am still bullish Bitcoin as the Greece debacle has laid bare the intentions of the EU overloads. Spanish elections are this fall and the ruling party is in trouble. Expect a flare up of European contagion risk as the markets focus on the next weakest links.

Trade Recommendation:

Sell XBTN15 into the retracement of the $281 fall. The downside target price for spot is $260. If a the EU agreement is voted down, cover quickly.