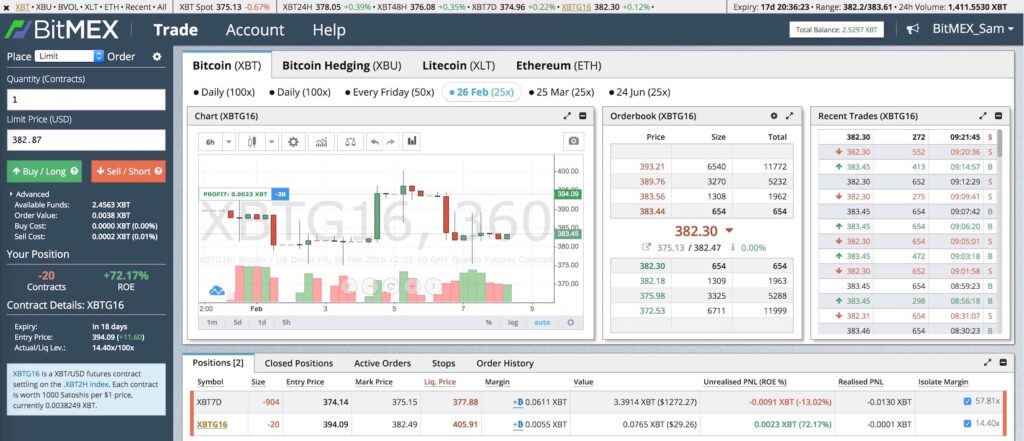

BitMEX’s New Look

We have been hard at work making changes to the BitMEX UI/UX. A major facelift will be released at the end of this week. You can get a sneak peek on BitMEX Testnet. We also welcome your feedback. This is only the beginning; we intend to go through every widget individually to simplify and improve usability.

In addition to a new look, we will also be greatly expanding the number of order types available. We expect to launch Market, & Stop Market types, Post-only (Maker) orders, and hidden orders in the near future. Many more are coming.

In other news: China, China, China. The long awaited BitMEX China A50 Index Futures Contract is nearing completion. You can view the A50 Contract Details, and a Trading Guide on BitMEX Testnet as well. We aim to list this contract by the end of the month. Keep an eye on the BitMEX Blog and your inbox for further details.

Classic vs. Core Roshambo

Bitcoin Classic has now been released and the race is on to reach 75% consensus. The showdown between Classic and Core is nearing the final stretch. If the Chinese miners are serious about increasing the block size to 2 MB, expect them to begin running Classic shortly after they return from holiday next week. If not, like Punxsutawney Phil… expect more Winter.

Once 75% consensus is reached, then the 28 day grace period begins. During this period, those not running Classic should upgrade their Bitcoin software before Classic goes live. Then the moment of truth will arrive. Will the fork in Bitcoin lead to a price crash or pump?

Every trader has a different opinion on whether a Bitcoin fork will be positive or negative for the price. The one thing we can be sure of is intense price volatility after the 75% consensus is reached. Now is a perfect time to purchase your volatility lottery tickets by trading March (XBTH16) and June (XBTM16) futures contracts.

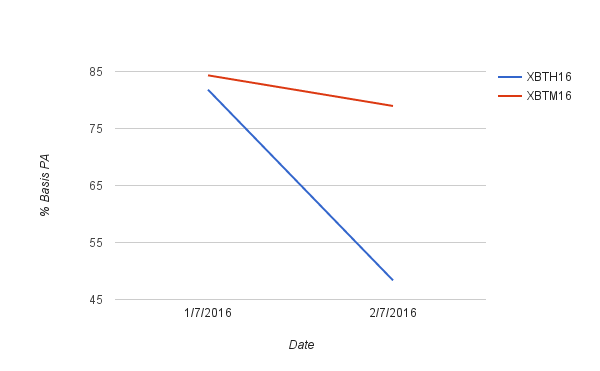

The above graph shows the % Basis PA (per annum) of each futures contract over the past month. XBTH16’s % Basis PA has gotten smacked hard, while XBTM16 has held up well. Buying XBTH16 vs. selling XBTM16 is the appropriate strategy. The trade has positive carry or theta because the premium earned by selling XBTM16 is higher than what is paid by buying XBTH16. The expectation is that during the period of high volatility XBTH16 will rise faster than XBTM16 due to the depressed % Basis PA level.

If the price crashes, expect the basis to trade lower then snap sharply higher as bottom feeders buy longer dated futures contracts aggressively. Given XBTH16 trades cheaper than XBTM16, expect speculators to focus their buying power on XBTH16. If the price spikes once Classic reaches 75% consensus, again speculators will focus their buying power on the cheaper contract, XBTH16.

If you intend the hold the spread trade until XBTH16 expiry, XBTM16’s % Basis PA would have to be above 94.75% for the trade to start losing money.

Getting paid to wait for the inevitable Classic vs. Core fireworks is a great strategy for those who don’t have a strong bullish or bearish view.

View how many nodes are running Bitcoin Classic at Coin Dance.

Arbitrage During Lunar New Year

Happy Lunar New Year! During Lunar New Year, Asia is closed for business. The most liquid Bitcoin exchanges are all based in Asia. Deposit and Withdrawals of fiat currency will be processed slower, or not at all. Onshore bank CNY transfers are still open during this week, but the major XBTCNY exchanges will have slower processing times. OKCoin USD and Bitfinex both will not be processing USD deposits or withdrawals until February 15th.

Arbitrage opportunities will present themselves for traders who happen to have CNY, USD, and Bitcoin deposited on certain exchanges. The China Bitcoin premium can expand to much higher levels this week as traders will be unable to deposit USD and take advantage of lower prices outside of China. Price differences between OKCoin USD and Bitfinex could persist all week. Do not read too much into large price discrepancies as they are not driven by actual demand, but by closures of the on- and off-ramps.