The Wicked Witch Of The West

How should Bitcoin traders approach this event? Binary events of this nature present amazing opportunities to generate massive returns. There are three scenarios.

Fed Tightens:

Commodities, EM currencies, carry trades, and equities will blow up. The PBOC will have even more of a reason to weaken the currency. The CNY has been pegged to the USD over the past few years. Raising rates is negative for EM currencies which is positive for Bitcoin.

Probability ~25%

Fed Does Nothing:

The market will focus on their forward guidance. Under what circumstances would the Fed raise rates or resume QE? EM currencies and commodities are asset classes will telegraph the market’s forward expectations. The pace of CNY depreciation is unlikely to change if the Fed stays put. For the short term, if the Fed does nothing, it is neutral to slightly positive for Bitcoin.

Probability ~50%

Fed Eases:

There are a few more trading days before the Wednesday announcement. If equity markets and EM currencies accelerate their downward spiral, Yellen might be scared into easing. In the September meeting, Yellen stated that they take into consideration the global economy (read equity, FX, and commodity markets). In the face of global armageddon, the Fed might resume QE and or introduce negative interest rates. The largest central bank restarting the money printer is long term positive for Bitcoin, but I believe it is short term negative for Bitcoin. There will be a massive relief rally and many of the global macro problems beginning to surface today will be forgotten for a short while.

Probability ~25%

No one knows for sure what will happen on Wednesday. There are so many factors which could push the decision one way or the other. Prudent traders will flatten their books ahead of the announcement. Expect deathly silence across all assets until the Wicked Witch of The West proclaims her judgment.

Guo With The Wind

Beijing has its own version of the Pop ‘n Lock. Pop the stock market to all time highs, then Lock up many financial participants when the stock market drops. Various CEOs, hedge fund managers, and government officials have been disappeared by the China Securities Regulatory Commission (CSRC) for their alleged role in upsetting the apple cart. This has been dubbed the “kill the chicken to scare the monkey” campaign.

Guo Guangchen, referred to as China’s Warren Buffett, is the CEO of Fosun International Holdings. Fosun is one of the largest private financial services firms in China. Guo was disappeared by the CSRC, and apparently is now assisting in an investigation. No one knows the full truth, as he is still in custody. Guo is both mega wealthy (worth $8 billion), and connected to high ranking government officials. If Guo isn’t safe, no wealthy Chinese person is.

Global Financial Integrity published a report that claims $1.4 trillion has illegally escaped China over the past decade. Now that China’s tycoon’s are scared shitless, they will accelerate the pace of capital flight. Beijing is no fool, the traditional means of capital flight are being shut one by one. Bitcoin stands as a beacon light to those who wish to internationalise their assets, and is completely legal. If even a small percentage of this hot China money discovers Bitcoin, it will re-rate the entire asset class.

China’s Illicit Outflows Estimated at $1.4 Trillion Over Decade

Market Panics As “China’s Warren Buffett” Detained In “Richter Scale 9 Event”

ZAR She Blows

This weekend I found myself watching the movie “BRICS Back Mountain 2001”: a film directed by Jim O’Neill, from SquidWorks Productions. Investors looking for places to deploy excess capital from the developed markets identified the following growth markets: Brazil, Russia, India, China, and South Africa. The search for virgin markets with the capacity to service debt and produce commodities to be consumed by the developed world is not a new phenomenon.

During the late 19th and early 20th Century, Britain and continental Europe exported capital to South America (Argentina & Brazil), Asia (India & Hong Kong), and Africa (Egypt & South Africa). BRICS was a reality long before a Goldman Sachs partner pontificated on the subject. Unfortunately for the BRICS nations: easy come, easy go. Jacob Zuma, in all his wisdom, decided to fire his finance minister. Investors took the stick to the South African Rand (ZAR) and it now is trading at all time lows. The Rand does not suffer alone.

Meanwhile the Brazilian Real, Indian Rupee, Russian Ruble, and Chinese Yuan are all weakening aggressively. Investors do not want local currency exposure. When they lend money to BRICS nations and corporations, they do so in USD. During the commodity super cycle, these nations enjoyed rising local currencies, rising earnings due to rising commodity prices, and easy access to credit because of Fed largesse.

The Wicked Witch of the West, Janet Yellen, has decided to shut off the free money spigot. The surging USD is wreaking havoc upon BRICS nations’ balance of payments. The strong dollar has crushed commodity prices and raised the cost of funds for BRICS nations. Caught in a negative feedback loop of falling earnings and rising debt servicing costs, investors tapped out and took the stick to BRICS currencies.

The local populations now face rising costs for all imports. Local currency denominated assets provide no protection from the ravages of inflation. Bitcoin represents one avenue whereby locals can both export capital abroad freely and store wealth. The marginal buying pressure will come from BRICS citizens fleeing their local toilet paper currencies. Speculators also see the writing on the wall and will buy along with them.

Divestment from developing markets by western investors has just begun. The initial effects are only beginning to surface. Long term Bitcoin bulls should take comfort in the strengthening fundamentals for citizens of the world to own electronic gold.

PBOC To Go Nuclear On CNY

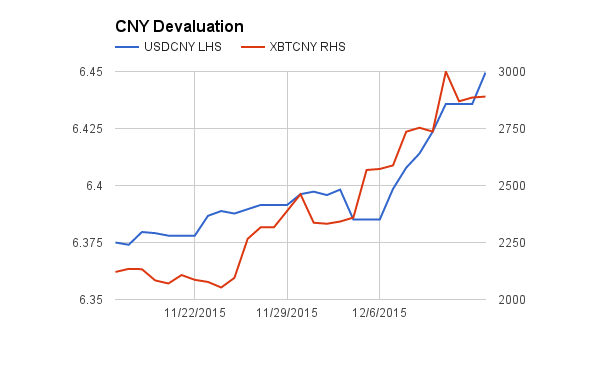

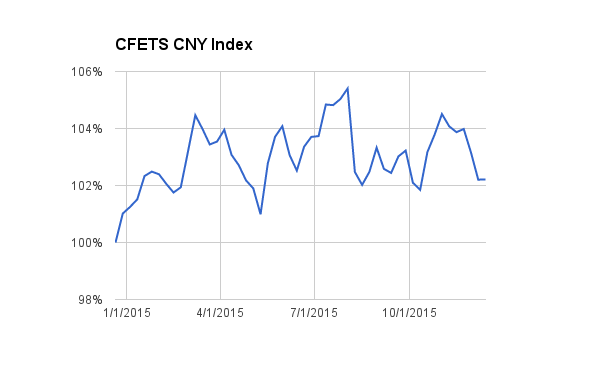

Readers should be quite familiar with the USDCNY vs. XBTCNY chart. The PBOC began devaluing the CNY vs. the USD this August, and stepped up the pace last week. However, the China Foreign Exchange Trade System (CFETS) began publishing a trade weighted CNY index to better reflect actual CNY exchange rate. The CFETS rate is now the all important one. The PBOC devaluation should be judged against this new index.

The CFETS published the weights of the different currencies in the basket. I took the rates and reconstructed the index starting in December 2014. The chart above shows the relative appreciation (>100%) vs. the index value twelve months prior. What stands out is that the CNY has actually appreciated by over 2%. If the PBOC is to obtain parity with the CNY’s value from last year, USDCNY must be devalued by 8.38%. That assumes that the ECB and or BOJ don’t continue printing gobs of money to depreciate the EUR and JPY respectively. The much hailed USDCNY depreciation over the last 6 months hasn’t even regained the CNY’s relative position from last year.

The mandate is clear. The PBOC must accelerate the pace of liberalisation of CNY trading. The PBOC interventions have propped up the CNY. With the buying pressure removed, expect the CNY to fall fast and hard. Bitcoin is priced in CNY, and the price will continue higher. The road to $1,000 will be paved with the face of Mao. Don’t fight the PBOC, BTFD!

The Launch of RMB Index Helps to Guide Public View of RMB Exchange Rate

XBT Spot

The quest for the holy $500 is alive and well. Asisted by the favorable global macro backdrop, Bitcoin continues to climb higher. Make no mistake, the PBOC is weakening the CNY further. Traders who fail to understand the implications and continue shorting into this move will get rekt.

This week’s trading is divided into two periods BY (Before Yellen) and AY (After Yellen). The global markets and other central banks are inflicting max pain in order to scare the Fed off its rate hike course. Tanking global markets and EM currencies are postive for Bitcoin. Depending on what Yellen decides, Bitcoin will continue on its upward trajectory or face a sharp correction. In my opinion, the Fed will not raise and indicate further easing in 2016 causing a massive relief rally and short squeeze. Bitcoin will get stick in the short term, but the uptrend will continue in the medium-term.

Trade Recommendation:

BitMEX 50x Weekly Futures, XBT7D: Buy XBT7D and close the long on Wednesday December 16th. Go short XBT7D into the Fed decision (if you are brave). Otherwise, go long XBT7D if they raise, go short XBT7D if they hold or ease.