QE 4EVA

For the first time in almost two decades, Petrodollar recycling countries are net sellers of USD denominated assets. To arrest the fall of the RMB, China has begun selling US Treasuries to support their currency. Other Emerging Markets countries faced with plunging currencies now must sell USD assets to intervene as well. If that’s not bad enough, the Fed just might raise interest rates for the first time in 6 years.

Up until now the Fed has strongly telegraphed its intentions to begin raising rates this fall. Liftoff looks more and more unlikely given the global macro landscape. An even stronger USD exacerbates the above issues. EM currencies and RMB will get weaker and cause more selling of USD assets for their defense. Standing still is not an option for the Fed. To get out in front of potentially catastrophically high interest rates, another round of money printing is in the cards.

If the world financial markets continue free falling even after another hit of the free money heroin, investors will seek safety in other risk assets. Bitcoin having bottomed at $162 (down over 80% from the ATH) looks very attractive on a longer term horizon. BitMEX recently listed March 2016 Bitcoin futures contracts, XBTH16. The pernicious effects of a global central bank printing orgy will be unmistakable by March. Consider buying XBTH16 to express a 6 month bullish view.

First They Laugh… Then They Buy

Earlier this year I proclaimed that 2015 would be the year Bitcoin was co-opted by legacy financial institutions. It started with investments in high profile Bitcoin firms (Coinbase, Circle etc.). Now the first bank has publicly admitted to buying Bitcoin, and is now rolling out a program that allows their clients to donate Bitcoin to charities. It only applies to charities, but this is a step in the direction of a full scale trading and storage operation.

The Wall Street moment that Bitcoiners have been dreaming about is here. Nothing happens in a vacuum. Now that Barclays has backed Bitcoin and the blockchain publically, banks will come out of woodwork announcing how they to are innovating by buying and accepting Bitcoin for certain purposes. The bear winter is nearing an end.

The zeitgeist is changing and profits are in order for savvy traders. The grand finale of summer is upon us. VC’s are all busy taking drugs in the desert, and the east coast Brahmans are finishing out the summer in the Hamptons, the Cape, or Nantucket. Come September 8th, a full on barrage of positive acceptance news will change the tide of sentiment.

Barclays to become first UK high street bank to accept bitcoin

XBT Term Structure

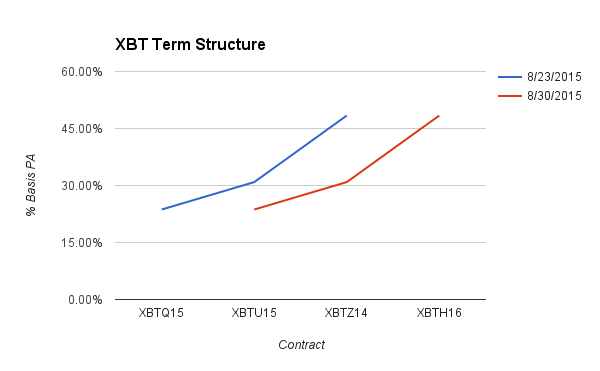

XBTQ15 expired and XBTH16 was listed in the past week. The downdraft to $200 compressed basis as well. The steepest fall was for XBTZ15, which fell almost 18% points. A break out in either direction should see the curve shift upwards. On a down move, bottom feeders bid up the basis to get long exposure for the rebound. On an up move, Fomo buyers bid up basis to ride the upward momentum. Volatility is cheap at these levels especially for longer dated futures. If 30 day volatility normalises to 75%-100%, the basis will rise significantly especially for XBTH16.

Trade Recommendation:

Buy XBTH16 and sell XBTU15 to take advantage of a rise in longer dated basis.

XBT Spot: Margin Call

The final weeks of summer are not going quietly. Tuesday’s flash crash took Bitcoin below $200 on Bitfinex. The $162 print I will call the double bottom. While we might drift lower towards $200, I find it very unlikely it is breached again.

Cash buyers will emerge and will pick at the carcasses of leveraged longs. The $220 level was breached again, and now we hover between $215-$220. Expect another down draft to $200-$210. At these levels consider increasing leveraged long exposure to overweight and prepare for a V-shaped rally.

Trade Recommendation:

Buy XBTU15 with spot at $210-$220 with an upside target price of $240.