When trading crypto derivatives, choosing the right order type can change the execution of your strategy and overall risk management. On BitMEX, the wide variety of order types gives you precise control over your trades, from instant execution to strategic positioning.

This guide will walk you through the order types available on BitMEX, so that you can execute your trading strategy as precisely as possible and make informed trading decisions.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000+ worth of trading credits to new users – you can register here.

Before Getting Started

- Fund your Account

BitMEX offers maximum flexibility through Multi-Asset Margining, which allows you to use any of the following supported crypto assets as collateral for your derivative trades: USDT, RLUSD, XRP, SOL, XBT (BTC), ETH, and USDC.

To learn how to deposit funds on BitMEX, please read our dedicated guide here.

- Define an Order

An order is an instruction from a trader to buy or sell an asset on a trading platform like BitMEX. It specifies the quantity, price, and type of execution desired. Head over to the Key Order Types Every Trader Should Know section below to learn about the most common to advanced order types available on BitMEX.

- Understand the Order Controls Panel

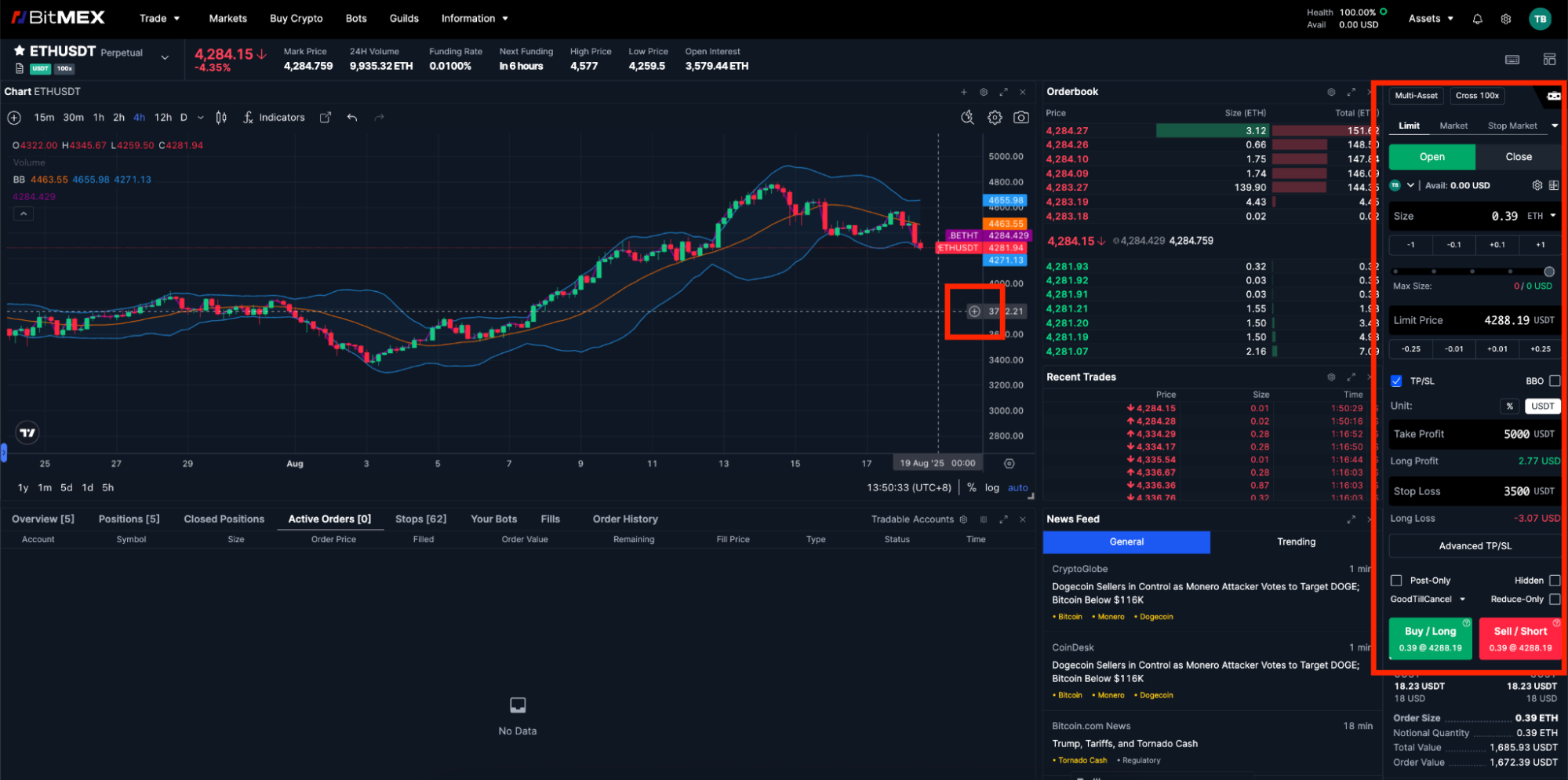

Before placing an order, it’s vital to familiarise yourself with the order controls located on the right side of the trading interface.

- Notional Value: You can choose to define your order size in either Tether (USDT) or Bitcoin (BTC). Most traders find it easier to think in a USD-equivalent, so setting the notional value to USDT is a common practice.

- Buy/Long vs. Sell/Short: This is your fundamental decision. Going long means you believe the price of the asset will increase, while going short means you expect it to decrease. A price increase benefits a long position, and a price decrease benefits a short position.

Learn more about how to place a trade on BitMEX here.

Key Order Types Every Trader Should Know

Key Order Types Every Trader Should Know

While BitMEX offers several advanced order types, mastering the basics is the first step. The two most common order types are the Market Order and the Limit Order.

|

Term |

Definition |

How It Works |

|

Market Order |

An order to buy or sell an asset immediately at the best available price in the order book. |

Your order is executed instantly, consuming liquidity. This guarantees execution but not a specific price, making it susceptible to slippage in volatile markets. |

|

Limit Order |

An order to buy or sell an asset at a specified price or better. |

Your order is placed on the order book and will only execute when the market price reaches your specified limit. This guarantees your price but not immediate execution. |

Maker vs. Taker: A Crucial Distinction

A core concept of crypto exchanges is matching sellers with buyers. This fundamental process relies on two distinct types of traders: market makers and market takers. How are they different?

- A Taker is a trader that removes liquidity from the order book through an immediate order such as using a Market Order. Takers are charged a standard fee.

A Maker is a trader that delivers liquidity and adds depth to the market by placing a limit order. To ensure your limit order is always a maker trade, you can select the “Post-Only” option. This guarantees your order will be cancelled if it would immediately execute against a pre-existing order, saving you from paying taker fees.

Advanced Order Placement & Risk Management Tools

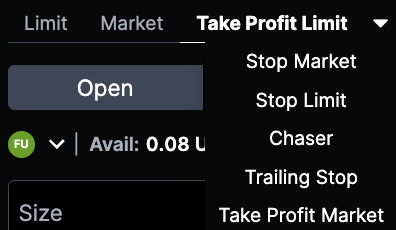

Beyond the basics, BitMEX offers more powerful tools for both order placement and automated risk management. You can find these tools in the drop-down of the Orders Panel to see all available order types, as shown below.

Advanced Order Types

While Market and Limit orders are the foundation of trading, true market proficiency comes from utilising advanced order types. These powerful tools allow you to manage risk, secure profits, and execute complex entry strategies automatically, freeing you from constant screen monitoring.

The following orders combine triggers (like a Stop Limit or Take Profit) with execution types (like Market or Limit) and introduce dynamic orders (Trailing Stop and the sophisticated Chaser order) to give you precise control over your trades in any market condition.

Let’s dive into how each order type operates:

|

Order Type |

What It Does |

Best Use Case |

Example |

|

Stop Market |

Automatically closes your position through a Market Sell Order when the market moves against you, after a predefined price level (the stop price) is reached. |

To protect a position and limit your downside risk without needing to constantly monitor prices. |

Entry: Long BTC at $100,000 Stop Price: $99,000 If the price drops to $99,000, a market order to sell your position will trigger at the best possible price. If the market order was sold at $99,000. Your risk is limited to ~$1,000. |

|

Stop Limit |

Automatically triggers a Limit Sell order to close your position when the market moves against you, after a predefined price level (stop price) is reached. |

Entry: Long BTC at $100,000 Stop Price: $99,000 Limit Price: $99,100 If the price drops to $99,000, a Limit Sell Order will be executed at your predefined level ($99,100). Your position will close only if price visits your limit price. |

|

|

Trailing Stop |

A stop order that can be set a predefined price distance from the market price. The stop price automatically adjusts as the market price fluctuates. |

To dynamically secure profits while allowing winning trades to run. |

Entry: Long BTC at $100,000 Trailing Value: $2,000 Price rises to $110,000: The Trailing Stop automatically moves up from $98,000 to $108,000. ($100,000-$2,000) Price peaks at $120,000: The Trailing Stop moves again to a new highest level of $118,000. ($120,000-$118,000) Price reverses and drops: If the price falls to $118,000, your position is sold by a Market Order, automatically locking in a profit of $18,000. Note: The stop price never moves down; it only follows the price up (for a Long position) to secure the maximum possible gain. |

|

Take Profit Market |

Automatically closes your position through a Market Sell Order when the market moves in your favour, after a predefined price level (the take price) is reached. |

To lock in profits without needing to constantly monitor prices. |

Entry: Long BTC at $100,000 Trigger Price: $101,000 If the price surges to $101,000, a market order to sell your position will trigger at the best possible price. If the market order was sold at $101,000. Your gains are limited to ~$1,000. |

|

Take Profit Limit |

Automatically closes your position through a Market Sell Order when the market moves in your favour, after a predefined price level (the take price) is reached. |

Entry: Long BTC at $100,000 Trigger Price: $101,000 Limit Price: $101,500 If the price surges to $101,000, a Limit Sell Order will be executed at your predefined level ($101,500). Your position will close only if price visits your limit price. |

|

|

Chaser Order |

A pegged, passive order that automatically resets on a timer (1-5 seconds) to follow the top-of-book prices to ‘chase’ the best price. |

Entering a fast-moving market without using a market order, aiming to get the best possible price close to the current action without missing the opportunity entirely. |

You want to buy SOL that’s rapidly rising ($180 → $181→ $182). You set a Chaser order that matches the current top-of-book ask price. As the price moves up, your buy order automatically adjusts (e.g., to $50.95, then $51.95), maximising your chance of a quick fill if the price momentarily dips or slows down. |

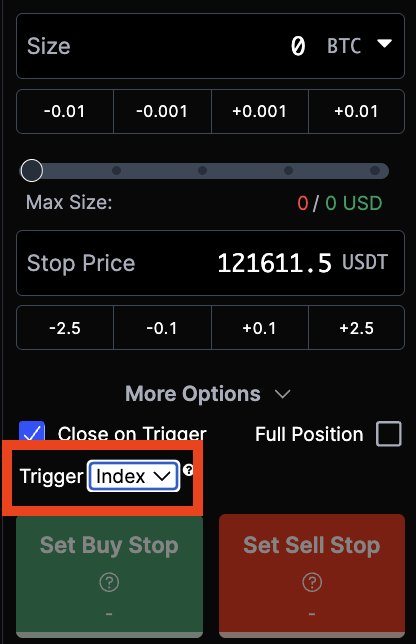

For more precise control, you can choose to trigger these orders based on the Index Price, which is a more stable reference price from a composite of exchanges, rather than the Last Price, which can be more volatile.

How to Conduct On-Chart Trading

BitMEX’s trading interface allows you to place, move, and cancel orders directly on the price chart. This is a very handy feature that provides a clear, visual representation of your trades relative to price action.

Placing an order on BitMEX is an active process that goes beyond simple buying and selling. By understanding the difference between market and limit orders, the concept of makers and takers, and the importance of using Stop Limit and Take Profit orders, you can trade with greater confidence and control. Remember, smart trading is about consistency and discipline, and these order types are your fundamental tools for success.

Placing an order on BitMEX is an active process that goes beyond simple buying and selling. By understanding the difference between market and limit orders, the concept of makers and takers, and the importance of using Stop Limit and Take Profit orders, you can trade with greater confidence and control. Remember, smart trading is about consistency and discipline, and these order types are your fundamental tools for success.

If you haven’t signed up for a BitMEX account yet, we’re currently offering $5,000+ worth of rewards to new users – you can register here.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

In the meantime, if you have any questions please contact Support who are available 24/7.