To Print Money Is Glorious

On his southern tour of China in 1992, Deng Xiaoping was credited with uttering “To Get Rich is Glorious”. His program of Socialism with Chinese Characteristics unleashed one of modern times’ greatest transformations in a country’s wealth. Since the early 1990’s, China transitioned from the century of humiliation, to a century of prosperity and growth.

China’s growth over the past two decades is legendary, but underpinning this growth is one of the largest credit expansions in human history. Socialism with Chinese Characteristics is a euphemism for a red printing press. Printing money is as old as centralised government. China being China just did it larger and more in your face than any government in history. Since the 2008 GFC, China’s total debt to GDP has almost doubled to 180%. The gargantuan issuance of debt underpinned the creation of ghost cities and bridges to nowhere.

The great financialisation that began in 1971 when Nixon took America off the gold standard is reaching its expiry date. World growth is slowing evidenced by an across the board slump in industrial commodities. China is a highly levered to the global manufacturing economy, and the state owned banks (SOE) loan books are stuffed with industrial companies’ debt. This debt must be warehoused and rolled over to keep the many zombie SOE’s alive. As a result, the PBOC continues to aggressively ease monetary conditions.

This past weekend the Reserve Ratio Requirement was cut by 0.50%, and the benchmark lending rate by 0.25%. These desperate moves are meant to help banks deal with their toxic loan books. As deposit rates drop, the rush to sell CNY and convert into a higher yielding asset will intensify. The PBOC is clearly telegraphing that the CNY will depreciate in the near term. Mao’s red army is watching and as the they earn less and less at the bank, they will start to embrace risky assets. Bitcoin serves as a central bank put, an electronic means of wealth preservation, and a vehicle to export domestic capital.

$300 is just the beginning. If the China narrative catches hold again, a truly explosive upward price burst will occur. For the more patient traders, consider buying BitMEX’s 25x leveraged March 2016 Bitocin / USD futures contract, XBTH16.

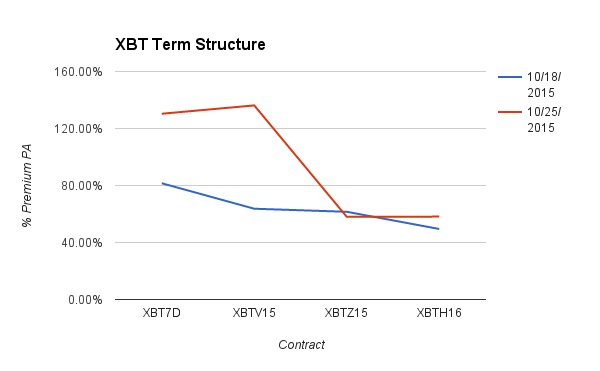

XBT Term Structure

The FOMO was strong this weekend. The amazing China pump to 1950 CNY ignited the inner bull in traders. The short end of the curve shot upwards. The long end barely budged. XBTZ15’s basis was flat, and XBTH16’s basis was up 8% on the week. Traders are still hesitant to believe the rebirth from the $200 to $300 purgatory. That is why the long end has not been bought as aggressively. Many traders expect a $300 breach, and then a quick tumble just like the other two attempts prior.

If the narrative around China grows, the medium term trend for Bitcoin is higher. If $300 can be broken and held for a week, then the FOMO will begin in earnest. Then the long end of the curve will skyrocket. Those patient enough to buy XBTH16 and sell XBTZ15 or spot, will be amply rewarded.

Trade Recommendation:

Buy XBTH16 vs. sell XBTZ15 or spot if you believe $300 can be broken and held for one week.

Dancing With The Daily

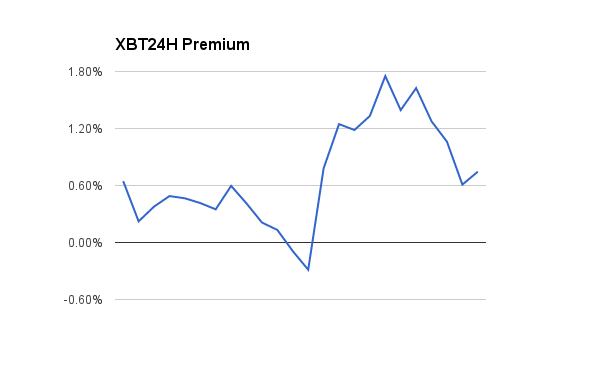

If Bitcoin is fun, Bitcoin with 100x leverage is a hell of a party. BitMEX’s 100x daily expiring Bitcoin / USD futures contract, XBT24H, has quickly become our most popular product. Because of the heightened volatility and price rise, the premium intraday has been massive.

The above chart shows the premium of XBT24H over spot for October 25th from 00:00 GMT to 23:00 GMT. 12:00 GMT is the settlement time, and that is why there is a dip. Starting yesterday night during the pump to 1950 CNY, the premium of XBT24H reached 1.75% outright. For a contract that expires in 24 hours, that is massive. I call that the FOMO premium. In a trending market, traders following the trend and momentum will overpay for exposure. This is a perfect opportunity for spot vs. futures arbitrage.

The trade is to sell XBT24H and buy spot. This is not a perfect arbitrage. At certain prices, the short XBT24H’s negative USD gamma will cause a loss for the portfolio. The PNL function is quadratic so we can solve a priori for the two break even points. For this particular trade, break even is below $259.37 and above $337.71. Given the spot price was $293, it is extremely unlikely that XBT24H will settle outside of that range. This is a no brainer trade for an arbitrageur.

XBT Spot

Bitcoin traders have been praying to the goddess of volatility for the entire summer. She awoke with a vengeance this weekend. The price action in XBTCNY reminded me of 2013. The highs were high, and the retrace was violent and swift. XBTCNY touched 1950 (appx. $306), and then careened lower by 120 CNY to a low of 1830 this morning.

Bitstamp climbed to $296, and during the downdraft briefly touched below $280. The price action will subside this week, and another attempt will be made for $300 on XBTUSD, and 1950 for XBTCNY. Additional easing from the PBOC will lend the China narrative further firepower. Make no mistake, this is a healthy rally. Short at your own peril.

Trade Recommendation:

Buy the weekly 50x leveraged Bitcoin / USD futures contract, XBT7D, while spot is $280 to $285. The upside target price is $300.