XBTUSD is a leveraged trading product that allows traders to speculate on the Bitcoin / USD exchange rate with up to 100x leverage. Many BitMEX traders are familiar with spot, margin, and futures trading. This post will explain why XBTUSD is a superior trading product.

The below is a comparison matrix between XBTUSD, spot, margin, and futures trading.

| Type | Leverage | Maturity | Physical Settlement |

| XBTUSD | High | Never Expires | No |

| Spot Trading | None | Never Expires | Yes |

| Margin Trading | Low | Never Expires | Yes |

| Futures Trading | High | Expires | No |

XBTUSD vs. Spot Trading

Trading Bitcoin on a spot basis is the gateway drug of digital currency trading. If you want to buy Bitcoin, you must pay the full USD value. If you want to sell Bitcoin, you must possess the total amount of Bitcoin you wish to sell.

Because Bitcoin and USD are physically settled by both counterparties, there cannot be any leverage or shorting. XBTUSD is a P2P product; long vs. short. There is no physical settlement of Bitcoin or USD; therefore leveraged trading and shorting are allowed.

Imagine you want to buy 100 Bitcoin at $500. If you were trading on a spot basis, you must have $50,000. With XBTUSD, you only need to post 1 Bitcoin as margin for the long position.

Imagine you want to sell 100 Bitcoin. If you trade on a spot basis, you must have 100 Bitcoin. With XBTUSD, you only need to post 1 Bitcoin as margin for the short position.

XBTUSD vs. Margin Trading

Margin trading or trading spot with leverage is a popular way to trade Bitcoin. You still trade on the spot order book, but you borrow USD or Bitcoin to go long or short.

Again because Bitcoin and USD are still physically settled on the spot order book, the leverage offered cannot be very high. The most popular Bitcoin / USD margin trading platform, Bitfinex, offers maximum leverage of only 3.33x.

Because XBTUSD is long vs. short and no USD or Bitcoin change hands, the effective leverage can be much higher. XBTUSD’s maximum leverage is 100x.

XBTUSD vs. Futures Trading

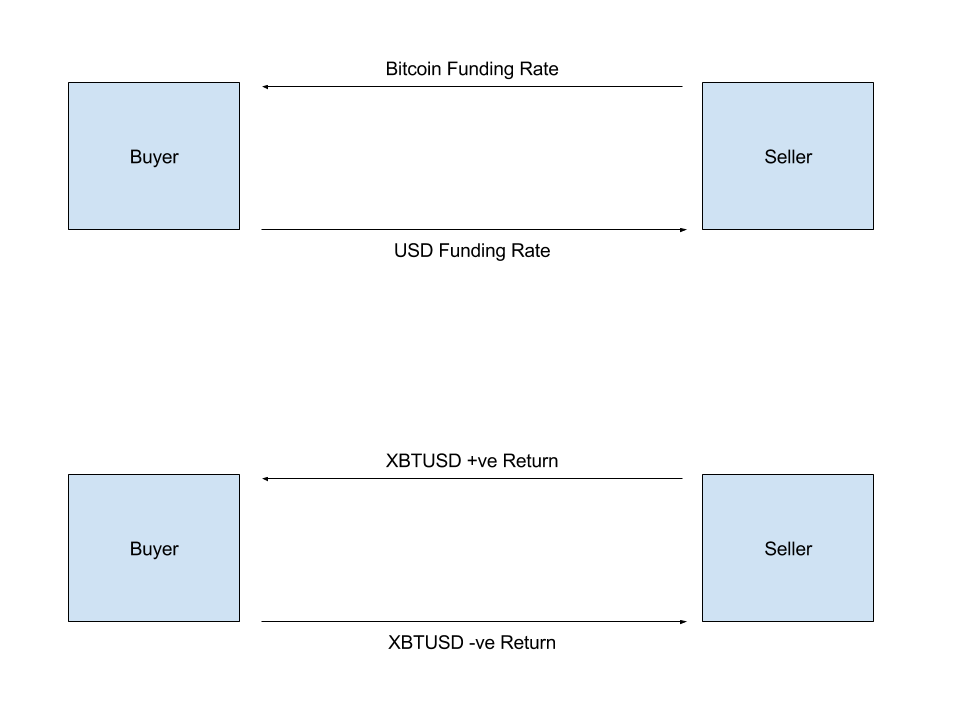

Technically XBTUSD is a swap. Buyers and sellers exchange USD and Bitcoin interest payments for price performance. The below diagram is a representation of the swap structure. Please read Swaps 101 for a more in-depth discussion.

Both XBTUSD and futures trading are not physically settled. As a result, both feature high leverage.

The one drawback of futures contracts is that they have an expiry date. Many Bitcoin traders crave the high leverage, but don’t want their position to expire at an arbitrary date. Additionally to accommodate traders with various time preferences, exchanges list futures contracts with various maturities. This fragments liquidity.

Due to the swap structure, XBTUSD does not have an expiry date. An XBTUSD position stays open until it is closed or it is liquidated due to adverse price movements. Long term and short term traders all trade the same product, which increases liquidity.

Conclusion

If you wish to speculate on the future value of Bitcoin, the BitMEX XBTUSD product is the ideal choice. It has high leverage and no expiry date.