“Nothing happens. Nobody comes, nobody goes. It’s awful.”

― Samuel Beckett, Waiting for Godot

The crypto community has been waiting for a variety of Godots since its inception. For traders, our Godot is the mythical Institutional Investor. When they get involved in a big way, our bags will transform into Lambos, and we will live happily ever after. When they get involved, liquidity will magically improve and the market will “behave” as it is supposed to.

Many crypto commentators including myself, proclaimed 2018 as the year institutional investors get involved in a big way. This flood of new money would help support a Bitcoin price above $10,000; and take us to Valhalla in short order.

With northern hemispheric summer approaching, are institutional investors actually flocking to our new space? News of a Goldman and JP Morgan crypto trading desk aside, what is the best proxy for insto interest in crypto?

The CME and CBOE Bitcoin futures contracts trading volumes are the best proxy. Both of these contracts are USD margined and settled. Anyone who trades these contracts obtains Bitcoin price exposure without ever touching Bitcoin. At BitMEX, our contracts are margined and settled in Bitcoin. That means to trade, you must own Bitcoin. Most instos love the idea of Bitcoin, but are terrified of actually buying, storing, and transferring it.

The Numbers

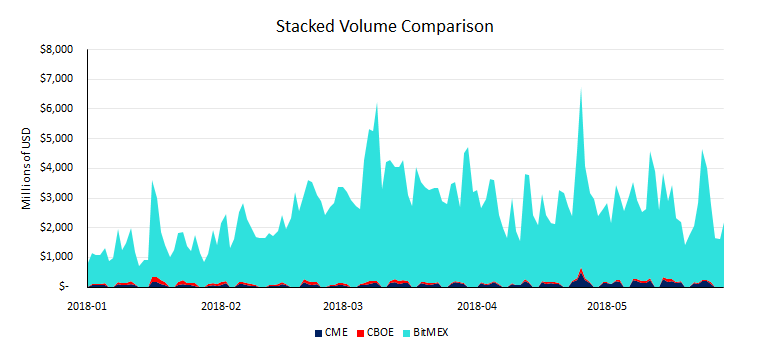

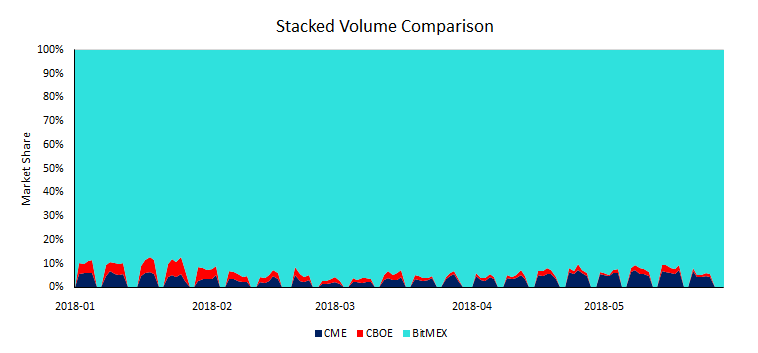

The above graphs show the USD trading volumes of the CME, CBOE, and BitMEX Bitcoin / USD contracts YTD.

The first takeaway is that BitMEX dominates. BitMEX’s retail client base, trades multiples of the insto client base of the CME and CBOE. BitMEX retail traders for the most part would find it very difficult to open an account with a broker that offers connectivity to the CME and CBOE. These brokers will require relatively high account minimums. The lower leverage offered and higher contract notionals at the CME and CBOE mean that even if a typical BitMEX client had connectivity, they would not be able to afford to trade even one contract.

It is clear from this data that retail traders still dominate the flows. Anecdotally, if you hang out long enough in Telegram, WeChat, Reddit etc. you will hear traders talk about spot movements triggered by quirks of a particular derivatives market. Friday settlement for OKex quarts on many occasions has completely whipsawed the market. Trading behaviour is also affected by an upcoming large funding payment on the BitMEX XBTUSD swap. What there is scant mention of, are market changes in response to the CME or CBOE expiry.

Tomorrow Is Another Day

The CME and CBOE volumes point to tepid involvement by instos. The Jan to May MoM CAGR is 3.94%. However, that will change. As banks gin up their trading activities over the next 6 to 12 months, they will begin hand-holding their clients in their crypto baptism. If a bank is going to take the reputational risk by publicly announcing the creation of a trading desk, they will do whatever they can to generate business to justify the risk. The easiest product to trade is the one that doesn’t require anyone to actually touch the underlying asset.

An easy win for a newly minted trading desk is to provide risk pricing on CME and CBOE listed futures. A client wants to trade a chunky block immediately; the sell-side desk will quote a two-way and clear their risk on-exchange over the trading day. The client gets instant liquidity in excess of the screen, and the bank can take healthy bid-ask margins on meaningful flow.

As volumes and open interest grows, the interplay between the USD settled and Bitcoin settled derivatives markets will lead to profitable distortions in the market. Before that happens, interested traders should read the BitMEX vs. CME Futures Guide. The non-linear components of the BitMEX products complicates things, but ultimately means there will be profitable arbitrage and spread trades between the two universes.