Abstract: In September 2017, we wrote a piece on the SegWit capacity increase. Here, we provide an update on SegWit adoption with six more months of transaction data. We also compare the transaction throughput to that of Bitcoin Cash, an alternative capacity-increase mechanism.

Please click here to download the pdf version of this report

SegWit vs. Bitcoin Cash

The SegWit upgrade to the Bitcoin protocol occurred in August 2017. After this, users had the option of upgrading their wallets and using SegWit, which provides the benefits of about 41% more scale (assuming no other users also upgrade).

Around the same time, Bitcoin Cash provided an alternative mechanism for increasing capacity, in which one also needs to upgrade to a new wallet and adopt a new transaction format to get the benefit of more transaction throughput, although a main difference between this and SegWit’s approach is that Bitcoin Cash resulted in a new coin.

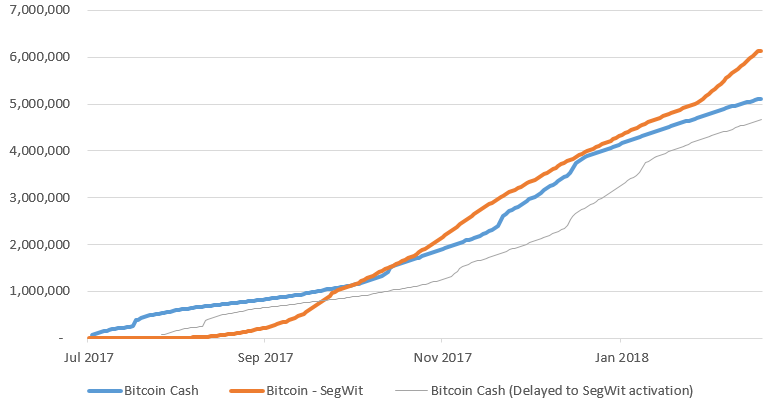

The transaction volumes of Bitcoin Cash and the new SegWit Bitcoin transaction format have been reasonably similar. Since the launch of Bitcoin Cash, 6.1 million SegWit transactions have taken place, only 20.1% more than the cumulative number of Bitcoin Cash transactions. These figures are remarkably close — although supporters of the SegWit capacity-increase methodology could claim that Bitcoin Cash had a one-month head start and that the Bitcoin Cash chain has lower transaction fees so that a comparison is not appropriate. Adjusting for the one-month head start, SegWit has 31.5% more cumulative transaction volume than Bitcoin Cash, larger than 20.1% but still reasonably close. Of course, its possible that at some point either or both of these figures could be manipulated.

Although the data suggests that SegWit transaction have been adopted slightly faster than Bitcoin Cash, resulting in more transaction volume, Bitcoin Cash advocates could argue that the Bitcoin Cash token is more about a philosophy of larger capacity in the long term, rather than the speed of the actual increase in transaction volume in the short term. Therefore Bitcoin Cash supporters can still claim that Bitcoin Cash will eventually have more transaction volume than Bitcoin, once adoption of the coin increases.

Cumulative transaction volume since the launch of Bitcoin Cash. (Source: BitMEX Research, Bitcoin blockchain, Blockchair for Bitcoin Cash data)

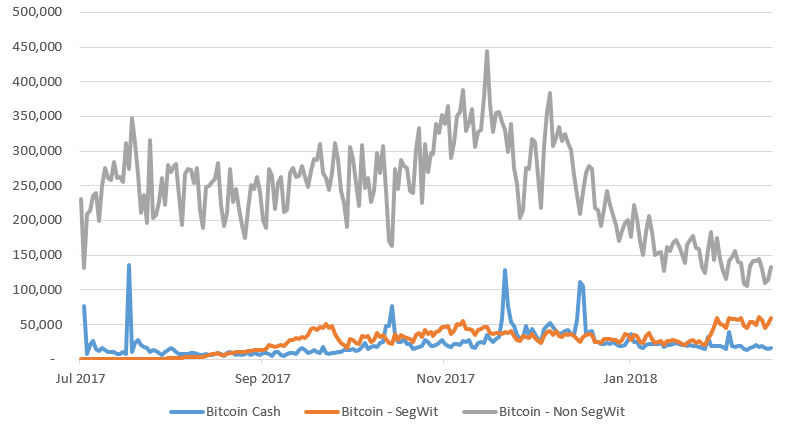

As these charts indicate, there was a sharp spike in Bitcoin Cash transaction volume when it launched; in contrast the SegWit upgrade was more gradually adopted. This is likely to be related to the investment flows and excitement of the new Bitcoin Cash coin, which may have driven short term adoption, as some of the spikes in the chart illustrate. Three months after the launch of Bitcoin Cash, on 31 October 2017, SegWit transaction volume overtook Bitcoin Cash and has remained in the lead ever since.

Daily transaction volume. (Source: BitMEX Research, Bitcoin blockchain, Blockchair)

The chart below shows that the adoption of SegWit has continued to grow since August 2017, perhaps increasing in steps as large corporate entities switch to SegWit. Adoption currently hovers around 30% as a proportion of the number of transactions, although the adoption rate only measures around 22% as a proportion of block space, which is possibly a more important metric.

Percentage of transactions that use SegWit. (Source: BitMEX Research, Bitcoin blockchain, Blockchair)

SegWit has begun to meaningfully impact system-wide capacity, potentially reducing fees and benefitting even users who choose not to upgrade to the new transaction format. However, the transaction fee market is still immature and, in our view, transaction prices are likely to remain volatile going forward.

Conclusion

Adoption of both the new transaction format for SegWit and Bitcoin Cash has been reasonably slow. At the same time, as our earlier piece shows, adoption of new consensus rules can also be gradual. This illustrates why it may be important to construct network upgrades in the least disruptive way possible, perhaps an upgrade mechanism which is safe even if users and miners do not upgrade at all.

Disclaimer

Whilst many claims made in this note are cited, we do not guarantee accuracy. We welcome corrections.