Abstract: SegWit adoption has grown at a steady pace since activation one month ago and this has surprisingly coincided with a large reduction in transaction fees. Although we think this drop in fees may be a coincidence, as the absolute level of SegWit adoption in the first month is reasonably low

The first month of SegWit data

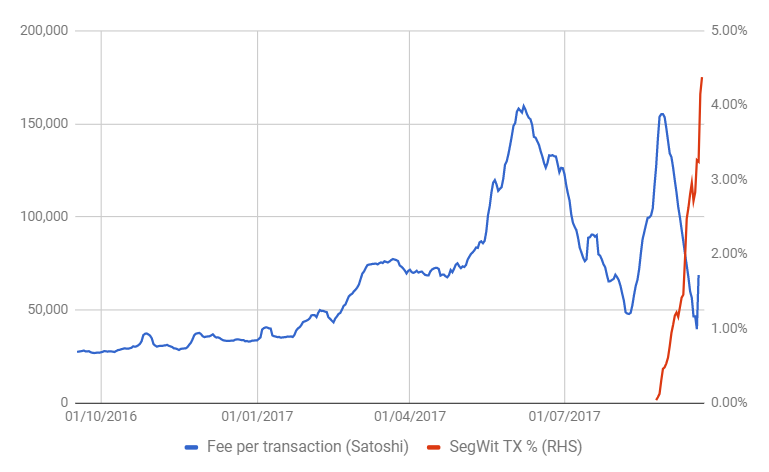

As the chart below (figure 1) shows, in orange, SegWit adoption has increased steadily since activation, in a somewhat linear fashion. Adoption has now reached around 4.5% of transactions. This should represent a small theoretical c1.6% capacity increase for the network, after just one month.

As figure 1 illustrates, the activation of SegWit does appear to have coincided with a sharp reduction in average transaction fees.

Figure 1 – Transaction fees compared to SegWit adoption

Source: BitMEX Research

Note: Data based on daily averages, up to 20th September 2017

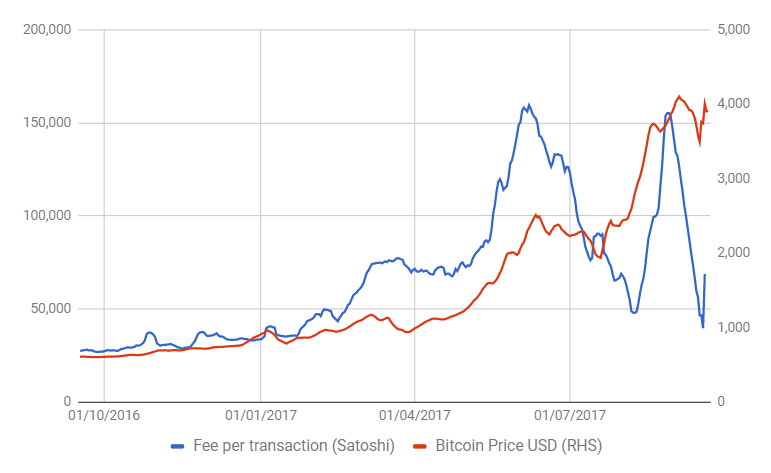

As figure 2 below shows, Bitcoin denominated transaction fees do somewhat correlate with the Bitcoin price and Bitcoin price volatility. This relationship is probably due to higher Bitcoin prices causing increased levels of transaction demand. The first month since SegWit activation was a period of large Bitcoin price increases and high price volatility, which makes the large transaction fee drop appear somewhat unusual. The drop is transaction fees appears to start during the period when the price was still rapidly increasing.

Figure 2 – Transaction fees compared to Bitcoin price

Source: BitMEX Research

Note: Data based on daily averages, up to 20th September 2017

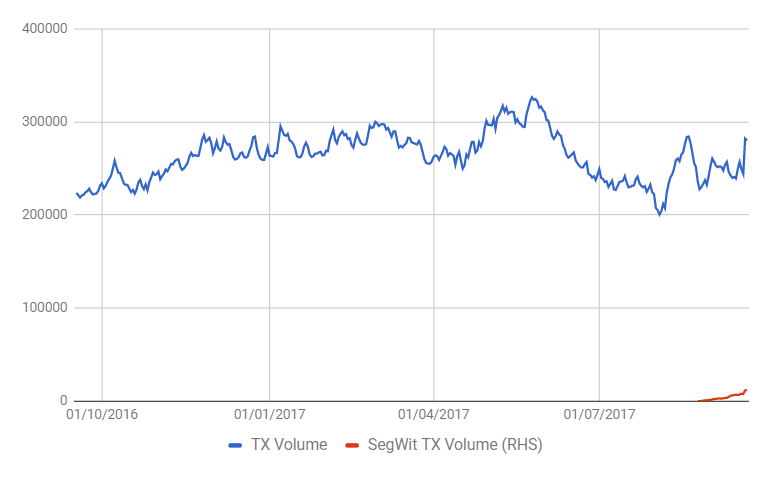

As figure 3 below illustrates, SegWit usage is still low compared to non SegWit usage. Although markets and the price elasticity of demand can be very difficult things to quantify and it is possible that the small 1.6% implied capacity increase caused a reduction in transaction fees, we believe this is unlikely. Therefore the sharp reduction in transaction fees is likely to be an odd coincidence.

It is therefore too early to tell if SegWit was successful in increasing transaction throughput and lowering transaction fees.

Figure 3 – SegWit adoption compared to old format transactions

Source: BitMEX Research

Note: Data based on daily averages, up to 20th September 2017

An alternative explanation for the fee reduction is that not all of the historic demand was “genuine”. A spammer could have been attempting to inflate transaction demand and increase transaction fees. Perhaps the activation of SegWit or launch of Bitcoin Cash meant this spammer now has less reason to continue the expensive attack. Although there is no direct evidence to support this theory.