Abstract: BitMEX Research examines the market dynamics of Lightning network routing fees and the financial incentives for Lightning node operators to provide liquidity. We identify the interrelationship and balance between Lightning routing fees and investment returns for channel liquidity providers, as a major challenge for the network, rather than the computer science aspects of the routing problem. We conclude that if the Lightning network scales, at least in theory, conditions in wider financial markets, such as changing interest rates and investor sentiment may impact the market for Lightning network fees. However, regardless of the prevailing economic conditions, we are of the view that in the long term, competition will be the key driver of prices. Low barriers to entry into the market could mean the balance favours users and low fees, rather than investment returns for liquidity providers.

Please click here to download a PDF version of this report

Overview

We first wrote about the Lightning network back in January 2018, when it was mostly theoretical. Today, as the Lightning network transitions from abstract to experimental, we felt it was time to take another look. The primary focus of this report is to analyse the Lightning network from a financial and investment perspective, notably with respect to fees and the incentives for Lightning network providers. We will not examine other aspects of the technology.

The routing problem

Critics of the Lightning network often point to routing as a major problem, typically making claims like its “an unsolved problem in computer science”. In general, we do not really agree with this characterization of the routing problem and do not see the computer science of routing to be a major challenge, finding paths between channels to make payments may be relatively straightforward and similar to other P2P networks, such as Bitcoin.

However, what we do think its a major challenge is the interaction or balance between the financial and economic aspects of liquidity provision and payment routing. Lightning network node operators need to be incentivised by routing fees to provide sufficient liquidity, such that payments can be made smoothly. Liquidity needs to be allocated specifically to the channels where there is demand and identifying these channels may be challenging, especially when new merchants enter the network. This balance between ensuring the network has low fees for users, while also ensuring fees are high enough to incentivise liquidity providers, is likely to be a significant issue. As we explain further in this article, the magnitude of this problem and the fee rates at which the market clears, may depend on economic conditions.

Lightning fee market dynamics

For onchain Bitcoin transactions, users (or their wallets) specify the fee for each transaction when making a payment and then miners attempt to produce blocks by selecting higher fee transactions per unit block weight, in order to maximise fee revenue. In contrast, Lightning currently appears to work the other way around, routing node operators set the fee and then users select a path for their payment, selecting channels in order to minimise fees. With Lightning, suppliers initially set fees rather than users. Lightning may therefore offer a superior fee architecture, as suppliers are providing a specialised service and it is more suitable that suppliers compete with each other over fee rates, rather than ordinary users, where the priority should be on simplicity.

In Lightning there are two types of routing fees node operators must specify, a base fee and a fee rate.

Two types of Lightning network fees

| Fee type | Description | Convention |

| Base fee | A fixed fee charged each time a payment is routed through the channel | This is expressed in thousandths of a Satoshi. For example a base fee of 1,000 is 1 satoshi per transaction. |

| Fee rate | A percentage fee charged on the value of the payment | This is expressed in millionths of a Satoshi transferred. For example a fee rate of 1,000 is, 1,000/1,000,000, which is 0.1% of the value transferred through the channel. Equivalent to 10bps. |

Investment capital

In order to provide liquidity for routing payments and to earn fee income, Lightning node operators need to lock up capital (Bitcoin) inside payment channels.

Two types of channel capacity

| Description | Creation | |

| Inbound capacity | Inbound liquidity, are funds inside the node’s payment channels which can be used to receive incoming payments. These funds are owned by other participants in the Lightning network. If the payment channels are closed, these funds will not return to the node operator. |

An inbound balance is created in one of two ways: * When another network participant opens a payment channel with the node * When the node operator makes a payment via an existing channel |

| Outbound capacity | Outbound liquidity, are funds inside the node’s payment channels which can be used to make outbound payments. These funds are owned by the node operator and part of their investment capital. The node operator may consider the opportunity costs of other investments, while considering the total outbound balance. If the payment channels are closed, these funds will return to the node operator. | An outbound balance is created in one of three ways: * When the node operator opens a payment channel with another network node * When the node operator receives a payment via an existing channel * When payments are routed through the node and fees are received |

Graphical illustration of a channel’s inbound and outbound capacity

(Source: Bitcoin Lightning Wallet)

(Note: The orange balance is the inbound capacity, while the blue balance is the outbound capacity)

The operation of the Lightning fee market

Becoming a successful routing node is harder than one may think. At the time of writing, according to 1ml.com, there are 7,615 public Lightning nodes. However, it is likely that only a few hundred of these nodes are doing a good job providing liquidity, by managing the node, rebalancing channels and setting fees in an appropriate manner.

Node operators may need to:

- Adjust both fee rates and the base fee, monitor the impact of the adjustments and calibrate for the optimal income maximising settings

- Analyse the network and look for poorly connected Lightning nodes with high payment demand, such as a new merchant

- Analyse the fee market, not just for the network as a whole, but the high demand low capacity routes you are targeting

- Constantly monitor and rebalance ones’ channels, to ensure there is sufficient two way liquidity

- Implement a custom backup solution for the latest channel states, to protect funds in the event that the node machine crashes

Currently, there are no automated systems capable of doing the above functions. If this does not change, specialist businesses may need to be setup to provide liquidity for the Lightning network. However, just as with liquidity, the challenges in overcoming these technical issues do not necessarily mean payments will become difficult or expensive. These technical challenges may simply adjust the equilibrium market fee rate. The more difficult these problems are to overcome, the higher the potential investment returns will be to channel operators and the greater the incentive will be to fix the problems. It will be demand that drives Lightning’s success, not the challenges for node operators.

In order for Lightning fee markets to work, node operators may need to adjust fees based on the competitive landscape, this could be based on algorithms or be a manual process, aimed at maximising fee income. In an attempt to emulate what may eventually become standard practise, BitMEX Research experimented with modifying the fee rate on one of our nodes over a three month period, as the below section reveals.

Fee rate experimentation

BitMEX Research decided to conduct a basic experiment to try and evaluate the state of the fee market, even in the Lightning network’s current nascent state. We set up a Lightning node and regularly changed the fee rate to attempt to determine which rates would maximise fee revenue, just as node operators may eventually be expected to do as the network scales.

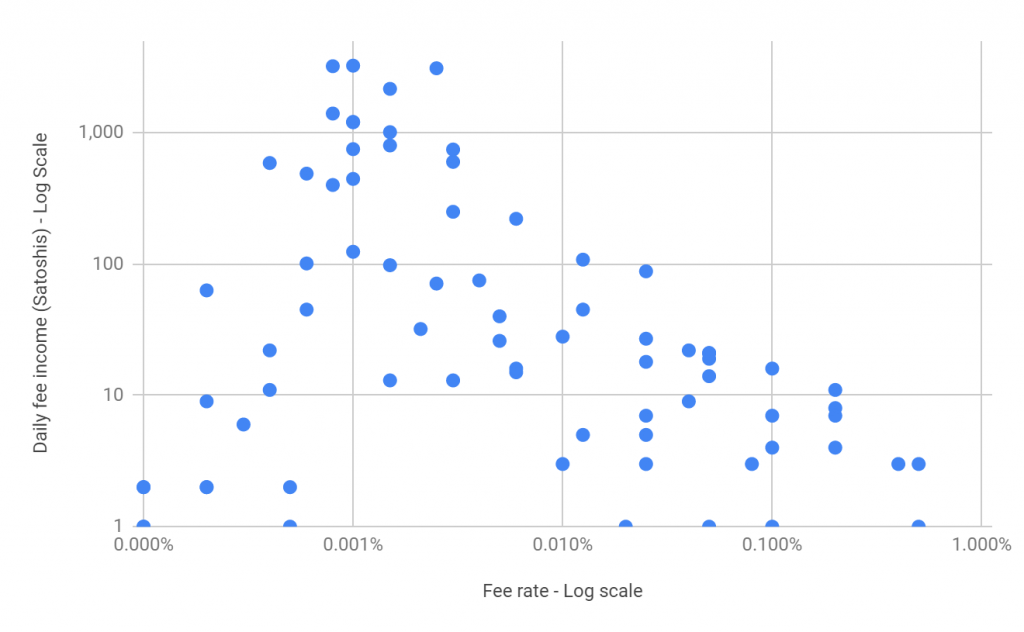

Our basic non-scientific analysis from one node is illustrated in the scatter chart below. It appears to indicate that fee rates do currently have an impact on a lighting node’s fee income. The daily fee income appears to quickly accelerate as one increases the fee rate from 0 till around 0.1 bps. Once the fee is increased above this rate, average daily fee income appears to gradually decline. Therefore, based on this experiment, it appears as if the revenue maximising fee rate is around 0.1 bps, which is certainly very low when compared to other payment systems. However, of course, this is only the fee for one hop, a payment may have multiple hops. At the same time, the current Lightning fee market barely exists, indeed BitMEX Research may be one in only a handful of Lightning nodes that has significantly experimented with economic revenue maximising behaviour by changing fees. Once the network scales and other parties try to maximise revenue, fee market conditions are likely to be very different. This exercise should therefore only be considered as an illustrative experiment, rather than anything particularly revealing about lighting fee markets.

Lightning node daily fee income versus the feerate

(Source: BitMEX Research)

(Lightning fee income data charts – notes and caveats:

* Daily data from 31st December 2018 to 24th March 2019

* Data from one Lightning node

* The base fee was 0 across the period

* The investment return data excludes onchain Bitcoin transaction fees, when including the impact of fees all but the most optimal fee rate buckets would show a negative investment return

* The data includes both weekdays and weekends, in general Lightning network traffic is significantly lower at weekends

* The fee rate was changed every day at around 21:00 UTC. The fee rate was reduced each day and then jumped up to the top of the fee rate range after several days of declines, to begin the next fee rate downwards cycle. The reason for this was that some wallets (e.g. mobile wallets) did not always query the fee rate each time it attempted to route a payment through the node, therefore when increasing the fee rate, many payments would fail. For example, when opening a channel from a mobile wallet to the Lightning node, then increasing the fee rate and immediately attempting to make a payment, the payment often failed as the wallet attempted to pay with a fee which was too low. In our view, in order to Lightning network fee markets to work, node operators may need to regularly change fees and therefore wallets may need to query fee rates more often

* Channel rebalancing occurred manually, once every two weeks. Approximately 30 minutes was spent on each occasion

* The Lightning node was running LND and the software was updated to the master every two weeks

* Approximately 30% of the channels (by value) were opened using the autopilot, the other 70% were opened manually

* The investment return was calculated by taking the outbound channel capacity of the network each day, annualising the investment return based on the daily fee income and then calculating a simple average based on all the days with a fee rate inside the particular range

* The data is based on one node only and its particular set of channels, the experience for other node operators may be very different

* We tried to use our public node for this experiment, however the fee income was too sporadic, with some network participants regularly paying well above the advertised fee rates by considerable amounts, making the data unreliable

* Unfortunately we needed to use a log scale for both axis. With respect to the fee rate we were unsure of which rates to charge, even which order of magnitude to set, therefore we tried a wide range of fees, from 0.0001% to 0.5% and a log scale was appropriate. At the same time, the daily fee income was highly volatile, ranging from 0 satoshis to over 3,000 satoshis. Therefore a log scale was deemed most appropriate. As the network develops and fee market intelligence improves, a linear scale may be more appropriate)

Fee incomes and investment returns

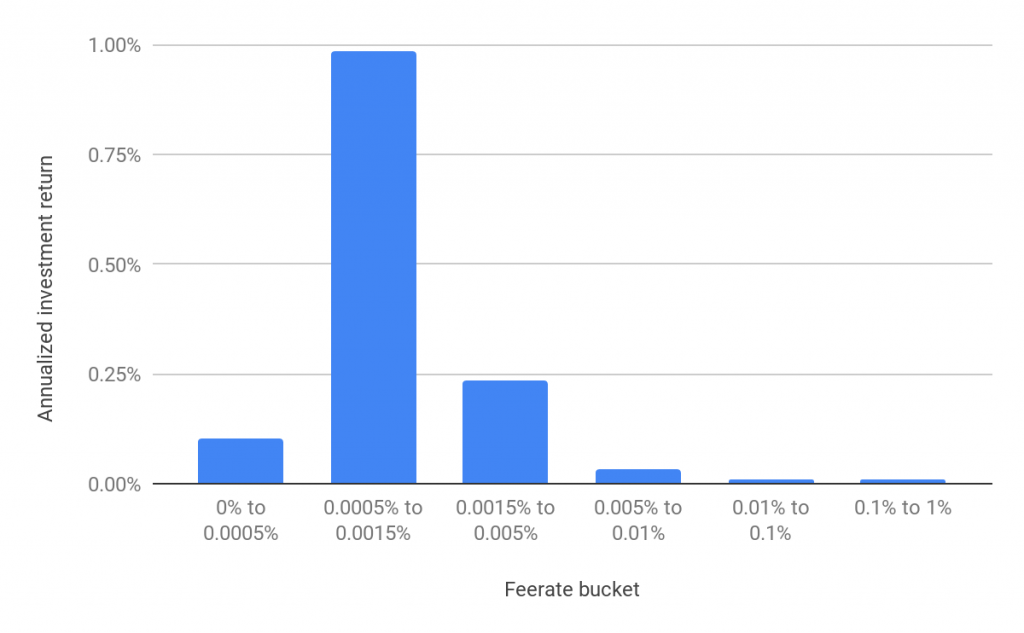

In addition to daily fee income, one can also consider the annualized investment return associated with running a lighting node and the various fee rates. This is calculated by annualising the daily fee income and dividing this number by the daily outbound liquidity.

The highest annualised investment investment return achieved in the experiment was 2.75%, whilst the highest fee bucket investment return was almost 1%. This seems like a reasonably attractive return for what should in theory be a relatively low risk investment, at least once the ability to backup lighting channels in real time becomes implemented. Existing Bitcoin investors could be tempted by these returns and provide liquidity to the Lightning network, or alternatively US dollar based investors could buy Bitcoin, hedge the Bitcoin price exposure using leverage and then attempt to earn Lightning network fee income.

Lightning node annualised investment return by fee bucket

(Source: BitMEX Research)

Of course, liquidity providers in the current Lightning network are not likely to be motivated by investment returns. Current node operators are likely hobbyists, with the overwhelming majority of node operators making losses when considering the onchain fees required to open and rebalance Lightning channels. Although this hobbyist based liquidity probably can sustain the network for a while, in order to meet the ambitious scale many have for the Lightning network, investors will need to be attracted by the potential investment returns.

Lightning network fees and economic conditions

A 1% investment yield may seem attractive in the current low yield environment, however the Lightning network may initially have difficulty attracting the right commercial liquidity providers. Investors in this space are typically looking for a high risk high return investment, which appears to be the opposite end of the spectrum for the relatively low risk low return investment on offer for Lightning liquidity providers. Therefore a new type of investor, one that fits this profile, may be needed.

If the Lightning network reaches a large scale, it is possible that the highly liquid investment product, with stable low risk returns, is sensitive to economic conditions.

Consider the following scenario:

- The federal reserve base rate is 1.0%

- Lightning node operators are typically earning an annualised investment yield of 1.5% on their outbound balance

- Due to robust economic conditions and inflationary pressure, the federal reserve open market committee increase interest rates from 1% to 3%.

- Due to the more attractive investment returns, Lightning network node operators withdraw capital from the Lightning network and purchase government bonds

- Due to the lower levels of liquidity in the Lightning network, users are required to pay higher fees to route payments and the Lightning network becomes more expensive

However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success anyway.

The risk free rate of return

In some ways, if the Lightning network matures, one can even think of the investment returns from running a Lightning node as Bitcoin’s risk free rate of return, or at least a rate of return free from credit risk. In traditional finance this is often the rate investors earn by holding government bonds, where the government has a legal obligation to pay the principal and coupon and a means to create new money to pay the holders of the bonds, such that the risks are near zero. In theory, all other investment projects or loans in the economy should have a higher return than this risk free rate. The same could apply to Bitcoin, with Lightning node liquidity providers return rates being considered as the base rate within the Bitcoin ecosystem.

In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately be determined by:

- Conditions in wider financial markets – higher interest rates could mean a higher Lightning network risk free rate

- The demand for Lighting network transactions – more demand or a higher velocity of money, should increase the Lightning network risk free rate

Conclusion

Whether specialist hedge funds and venture capital investors will have the same enthusiasm about becoming Lightning network liquidity providers, as they did for the “staking as a service” business model for proof of stake based systems in mid 2018 remains to be seen. While the investment returns for Lightning network liquidity providers do not yet look compelling, with the network in its formative stages, we do see potential merit in this business model.

In our view, the Lightning network can easily scale to many multiples of Bitcoin’s current onchain transaction volume without encountering any economic fee market cycles or issues, all based purely on hobbyist liquidity providers. However, if the network is to reach the scale many Lightning advocates hope, it will need to attract liquidity from yield hungry investors seeking to maximise risk adjusted investment returns. Should that occur, unfortunately the network may experience significant changes in fee market conditions as the investment climate changes over time.

However, it is relatively easy to set up a node, provide liquidity and try to earn fee income by undercutting your peers. Where the balance is ultimately struck between the operational channels of running nodes, the extent of liquidity provision and the investment returns, we obviously do not know. However, if we are forced to guess, based on the architecture and design of the Lightning network, we would say the system is somewhat rigged towards users and low fees, rather than liquidity providers.