Abstract: Due to numerous requests, we provide a follow up to our February 2019 piece, “Anatomy Of The Next Global Financial Crisis”. We update our thinking following the pandemic driven crash and liquidity driven recovery in financial markets. We no longer think long dated volatility related bets are an effective way to protect portfolios because they are now too expensive. We believe that inflation linked government bonds could be the main pillar going forwards as part of one’s protection strategies, as more of a tactical position. While gold, Bitcoin and to a lesser extent the yen, could be the other main pillars.

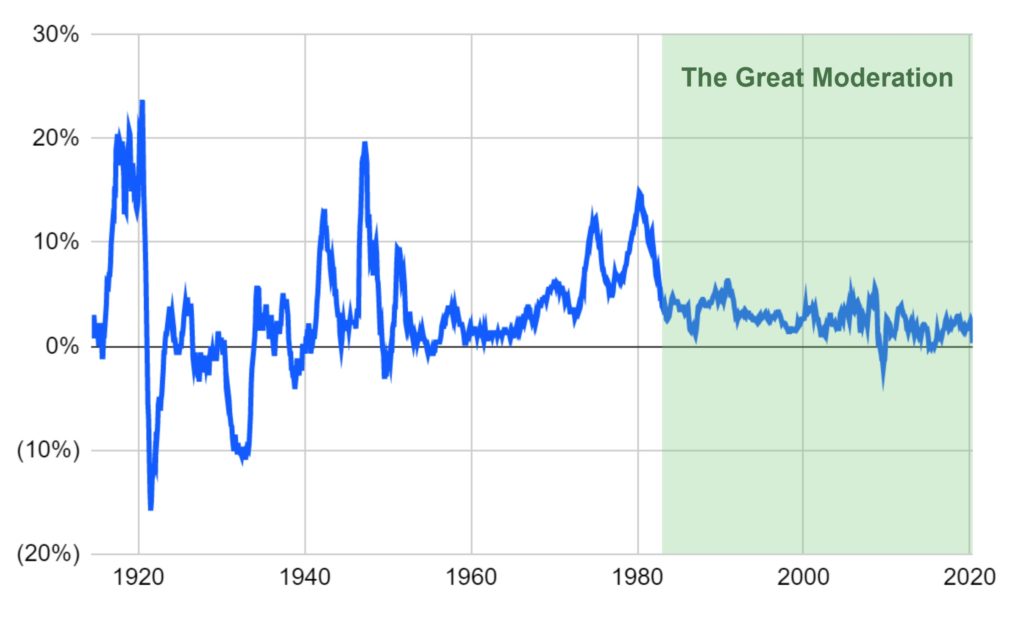

Figure 1 – US consumer price index since 1914

Overview

As we predicted back in 2019, a financial crisis was approaching and now one is undoubtedly here. We were wrong in our list of potential catalysts, carelessly overlooking a virus as a potential instigator. As we explained back then, we think such crises are inevitable due to the structure of the financial system. In our view, the pandemic should be thought of as an aggravating factor or accelerant for our coming economic woes, not a fundamental cause. Although of course the virus is very serious and is having a significant impact on society and the economy, we think the longer term economic damage that will be caused by the extent of deleveraging that may follow, is somewhat inevitable and cannot really be blamed on the virus. If it wasn’t for COVID-19 something else may have come along.

After an initial financial panic in the wake of the economic shutdown due to COVID-19, financial markets have had a strong recovery. At the time of writing the S&P 500 Index is down only 7.9% YTD, having rallied 35.9% from the March lows. While the Nasdaq is in positive territory YTD. Remarkably April 2020 witnessed the largest monthly rise in the stock market since 1987, all while millions of Americans lost their jobs at the same time. What this indicates is that liquidity considerations, driven by Fed policy, are outweighing weak economic fundamentals.

As for the mechanics of the financial crisis, market disorder failed to emerge to the extent that we predicted:

Fixed income markets become volatile, illiquid and dysfunctional, as investors rush for the exit. Securitised bond-based assets, such as CLOs and Bond ETFs, trade at a significant discount to their net asset values. The contagion spreads across other liquid asset classes, such as equities.

(Source: BitMEX Research February 2019)

Figure 2 – iShares Investment Grade Corporate Bond ETF (LQD US) Premium/(Discount) to NAV

Bond ETFs did trade at a discount to NAVs for a few days in March 2020, for instance the Blackrock ETF LQD traded at around a 6% discount. However, the Federal Reserve intervened faster and more aggressively than we thought. The Fed even appointed the largest ETF issuer itself, Blackrock, to oversee the bond buying program, which includes its own ETF products, that we recommended buying put options on.

How to protect your capital now?

As we explained back in 2019, there were six pillars to the strategy for building a portfolio for a financial market crash:

- VIX calls

- Corporate bond ETF puts

- Index linked government bonds

- Hedge funds focused on volatility

- Gold, and

- Bitcoin

As for when such a crisis will occur, we obviously do not know. In our view, the charts in this report identify a problem, but they do not seem to suggest that we are necessarily right on the precipice of a major crisis; it could be several years away. As for how to profit from such events, this is perhaps even more challenging than predicting their timing. Maybe one could construct a portfolio of VIX calls, long dated corporate bond ETF puts, index-linked government bonds, hedge funds specializing in volatility, gold and maybe to a lesser extent, even Bitcoin.

(Source: BitMEX Research February 2019)

Due to queries from some of our readers, we will try to provide an update to our thinking. The first thing to note is that the price of the volatility elements of the doomsday portfolio have significantly increased. As Figure 3 and Figure 4 below illustrate, even though the underlying (the VIX and the LQD ETF) have almost returned to the pre-crisis February 2020 levels, the cost of the options are significantly more expensive.

Figure 3 – VIX Call Premium vs VIX Index

(Source: Bloomberg)

(Note: The chart somewhat understates the increase in premium as the time value of the option is decaying)

Figure 4 – iShares Investment Grade Corporate Bond ETF (LQD US) Put Premium vs LQD

(Source: Bloomberg)

(Note: The chart somewhat understates the increase in premium as the time value of the option is decaying)

In our view VIX calls and corporate bond ETF puts are now too expensive to offer reasonable protection. From our original list, it leaves just four remaining:

- Index linked government bonds

- Hedge funds focused on volatility

- Gold, and

- Bitcoin

Inflation is Coming

As we mentioned in our March 2020 piece, we think inflation is eventually likely to arise out of this crisis as the one clear winner. At the time, Bitcoin analyst and commentator Eric Wall questioned us, asking why inflation linked bond prices do not indicate rising inflationary expectations:

Indeed inflation is not here now. It could essentially emerge in two phases:

- Phase 1: not at all, and,

- Phase 2: all of a sudden.

In the current economic shock and uncertainty, demand is significantly impaired, which increases deflationary pressure. We have already seen the CPI in the US decline to 0.3% YoY in April 2020 (compared to 1.5% in March). In the UK the CPI fell to 0.8% YoY in April 2020 (compared to 1.5% in March).

Inflation may even go negative. Real bond yields may therefore be positive just when central banks would like to keep them as low as possible. This is one of the scenarios policymakers may fear the most and this could stimulate an even more aggressive policy response, pushing bond yields even lower and into negative territory. At some point we will reach an inflection point, where the policy response to this results in inflation. Even the FT’s chief economic commentator, Martin Wolf, acknowledged that inflation may follow COVID-19, in his May 2020 piece “Why inflation might follow the pandemic”.

Inflation linked bonds

We have been doing a lot of thinking and we have decided that inflation linked government bonds could be the main pillar in our portfolio. If we are wrong with our inflation thesis, Bitcoin and gold could decline in value. However, in a deflationary environment, bond yields may decline and go negative and therefore the yield component of the linkers may offer a degree of protection.

The inflation linked bonds should be thought of as more of a tactical investment than gold or Bitcoin. One could invest in them now and then patiently wait. It could be a few months or a few years and then there could be an unexpected spark in inflationary expectations. In that initial period, where inflationary expectations could be extremely volatile, the bonds could rally. At this point it may be a good idea to tactically divest.

In this environment of increasing financial repression, it is becoming more and more challenging to project one’s wealth. In order to succeed, investors may need to invest in areas they are not normally accustomed to and be more nimble and flexible. We doubt many of our readers normally invest in treasuries. US 10 year inflation linked treasuries currently yield around minus 0.46%. On the face of it the investment sounds somewhat stupid, however we think it has some merit.

Figure 5 – US 10 year breakeven

(Source: Bloomberg)

The yen

Investors could also consider adding Japanese yen to their protective arsenal. The last time gold was up this high in the mid $1,700s, back in 2012, the yen was much stronger trading at around ¥78 per US$, compared to ¥108 today. Of course much has changed in Japan since then, with 8 years of Abenomics and unprecedented BoJ balance sheet expansion. However, many of the economic characteristics of Japan that made the currency more gold-like than any over in the last 20 years or so remain. Japanese investors have a huge amount of money overseas and in times of crisis this is often repatriated driving up the value of the yen.

As Figure 6 shows, the strong relationship between the yen and gold appears to have broken down to some extent in 2019. If investors want to hold a fiat currency, the yen could be the best choice. Therefore we would also add the yen to our list of potential protections.

Figure 6 – Gold vs Japanese Yen since 2000

(Source: Bloomberg)

Paul Tudor Jones

As many in the Bitcoin space have commented, in his May 2020 investor letter, hedge fund manager Paul Tudor Jones set out an investment case for Bitcoin. He compared Bitcoin to financial assets, cash and gold, and concluded that although Bitcoin had inferior store of value properties to these alternatives, it was far cheaper, making it the best investment. Perhaps the most intriguing thing in the letter, other than the fact that Bitcoin made his list at all, was his comparison to the 1970s:

Many of you know my fondness for analogues. Bitcoin reminds me of gold when I first got in the business in 1976. Gold had just been productized as a futures instrument (like Bitcoin recently) and had enjoyed a heck of a bull market, almost tripling in price. It then corrected almost 50% in nearly two years similar to Bitcoin’s 28-month 80% correction! But in the case of gold, it was a tremendous buying opportunity as gold went on to more than quadruple past the prior highs. The red line in the chart below is where we might be in Bitcoin today

(Source: Paul Tudor Jones and Lorenzo Giogianni market outlook letter – May 2020)

As Figure 1 above illustrates, we have had a very benign inflationary environment since around 1980, prior to that the chart looks relatively eccentric. Almost nobody is around in today’s financial markets with a memory of the 1970s, including policymakers. This is why we think that when volatile inflationary expectations return, they will hit the market with a high degree of consternation.

Conclusion & the end game

In many ways COVID-19 appears to be accelerating many trends that were already occurring in the economy. Increased adoption of digital technology and the internet. This may benefit a small number of increasingly powerful technology giants. On the other hand the bulk of economic activity, conducted by small and medium sized businesses, may bear the brunt of the impact of COVID-19. These businesses may struggle to meet their financial obligations and interest payments. If there is one lesson they learn from COVID-19, it may be the need to repair their balance sheets and prepare for the next rainy day (or rainy decade). This deleveraging may result in deflationary pressure and could persist for years.

We could shortly be heading towards a strange scenario where both unemployment and the stock market are at all time record highs. This is a potentially pernicious combination. If this persists, governments may eventually yield to political pressure and adjust monetary policy such that it is more accommodative to workers, rather than investors. In that scenario, as we have said before, we think there will only be one clear winner: inflation.

As for the other long outcomes, there is a lot more uncertainty. In the wake of higher consumer prices, it may lead to more government intervention in the economy, a greater degree of government control over the means of production in order to reduce prices and increased levels of financial repression. As hedge fund manager Crispin Odey recently put it:

It is no surprise that people are buying gold. But the authorities may attempt at some point to de-monetise gold, making it illegal to own as a private individual

(Source: Crispin Odey April 2020 investor letter)

In this extremely repressive environment the mantra that you have heard again and again from gold bugs and Bitcoin maximalists respectively, could finally become essential: “take physical delivery of your gold” and “not your keys not your Bitcoin”.