(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The Hokkaido ski season ended for me in mid-March this year. However, lessons from the mountain can still be applied to President Trump’s Tariff Tantrum. Every day is different, and there are so many variables that interact – one never knows which snowflake or turn of the skis will trigger an avalanche. The best we can do is approximate the probability of triggering one. One technique that is used to more definitively assess the instability of a slope is ski cutting.

Before dropping, one skier from the group traverses the start zone and hops up and down, attempting to trigger an avalanche. If successful, how the instability propagates across the face determines whether the guide deems the slope safe to ski. Even if an avalanche is triggered, we may still ski the slope, but choose which aspects carefully to avoid triggering anything larger than a loose, powdery slide-off. If we see shooting cracks or a mega slab cracking loose, we get the fuck out of there.

The point is to attempt to quantify the worst-case scenario based on the current conditions and act accordingly. Trump’s self-proclaimed “Liberation Day” on April 2nd was a ski cut of a steep and perilous face that is the global financial market. Team Trump borrowed their tariff policy from an economics book on trade entitled “Balanced Trade: Ending the Unbearable Costs of America’s Trade Deficits,” and adopted a maximalist position. The tariff rates announced were worse than the worst-case estimates of mainstream economists and financial analysts. In snow theory terms, Trump triggered a persistent weak layer avalanche that threatened to take down the entire fugazi fractional reserve filthy fiat financial system.

The initial tariff policy represented the worst-case outcome because the US and China both took maximalist positions in opposition to each other. While the financial asset market pukefest was intense, resulting in trillions of dollars of losses worldwide, the real problem was the rise of US bond market volatility measured using the MOVE Index. The index moved to almost an all-time-intraday-high of 172, and then Team Trump bolted from the danger zone. Within a week of announcing the tariffs, Trump moderated his plans by pausing implementation on every nation except for China for 90 days. Then, Boston Fed Governor Susan Collins wrote in the Financial Times that the Fed stood ready to do whatever it took to ensure well-functioning markets, a few days later, when volatility refused to fall substantially. Finally, the BBC, US Treasury Secretary Scott Bessent, gave a Bloomberg interview and told the world his member was gargantuan, especially because his department could dramatically upsize the pace and amount of treasury debt buybacks. I characterize this chain of events as a policymaker pivot from “everything is fine” to “everything is fucked, we must do something”, markets surged, and most importantly, Bitcoin bottomed. Yes motherfuckers, I’m calling the local bottom at $74,500.

Regardless of whether you characterize Trump’s change in policy as a retreat or a savvy negotiating tactic, the result is that the administration deliberately caused a financial market avalanche, and it was so severe that they adjusted their policies a week later. Now, as the market, we know a few things. We understand what happens to bond market volatility in the worst–case scenario, we recognize the levels of volatility that trigger a change in behavior, and we are aware of the monetary levers that will be pulled to mitigate the situation. Using this information, we as Bitcoin hodlers and crypto degen investors know that the bottom is in because the next time Trump ramps up the Tariff rhetoric or refuses to reduce tariffs on China, Bitcoin will rally in anticipation of the monetary mandarins running the money printing press at max Brrrrr levels to ensure bond market volatility remains muted.

This essay will examine why a maximalist position on tariffs leads to bond market dysfunction as measured by the MOVE Index. Then I will discuss how Bessent’s solution, treasury buybacks, will add a large amount of dollar liquidity to the system, even though technically buying old bonds by issuing new ones in and of itself adds no dollar liquidity to the system. Finally, I will discuss why this Bitcoin and macro setup is similar to 3Q2022 when Bessent’s predecessor, Bad Gurl Yellen, raised the treasury bill issuance amounts to drain the Reverse Repo Program (RRP). Bitcoin hit a local low post-FTX in 3Q2022, and now Bitcoin has hit this bull cycle’s local low in 2Q2025 after Bessent brought out his “not QE,” QE bazooka.

Max Pain

I shall reiterate that Trump’s goal is to collapse the US current account deficit to zero. To do this quickly requires a painful adjustment, and tariffs are his administration’s preferred cudgel. I don’t give a fuck whether you think it’s good or bad. Or whether Americans are ready to work 8-hour plus shifts in an iPhone factory. Trump got elected partly on the belief of his base that they got fucked by globalization. And his team is hell-bent on fulfilling the campaign promise to elevate the concerns of, in their parlance, “Main Street” over “Wall Street.” This all assumes those around Trump can get re-elected traversing down this path, which is not a given.

The reason financial markets dumped on Liberation Day is that if foreign exporters earn less or no dollars, they can’t buy as much or any US stocks and bonds. Furthermore, if exporters have to change their supply chains or even rebuild one within America, they must fund part of the rebuild by selling the liquid assets they have, such as US bonds and stocks. That is why the US markets and any market overly exposed to American export earnings collapsed.

The silver lining, at least initially, was that scarred traders and investors piled into treasury bonds. Their prices rose and yields fell. The 10-yr yield dropped dramatically, which is great for the BBC because it helps him stuff more bonds down the market’s throat. But the dramatic moves in bond and equity prices elevated volatility, which is the death knell for certain types of hedge funds.

Hedge funds, hedge … sometimes, but always using a fuck ton of leverage. Relative Value (RV) traders typically identify a relationship or spread between two assets, and if that spread widens, they utilize leverage to buy one asset and sell the other, anticipating a mean reversion. As a general rule, most hedge fund strategies are implicitly or explicitly short market volatility in a macro sense. When volatility falls, mean reversion occurs. When volatility rises, shit goes all over the place, and stable “relationships” between assets break down. This is why risk managers at banks or exchanges that explicitly or implicitly extend leverage to hedge funds raise margin requirements when market volatility rises. When hedge funds receive a margin call, they must unwind their positions immediately lest they get liquidated. Some investment banks delight in deading their clients with margin calls during extremely volatile periods, assuming the positions of their bankrupted clients, then profiting when the policymakers invariably print money to squash volatility.

The relationship we are really concerned with is between stocks and bonds. Due to their role as the risk-free asset in nominal terms and the global reserve asset, U.S. Treasury bond prices rise when global investors flee stocks. It makes sense because fiat must be placed somewhere to earn a yield, and the US government, owing to its ability to operate the printing press at no cost, can never voluntarily go bankrupt in dollar terms. The real value energy value of a treasury can and does fall, but policy makers aren’t concerned about the real value of any of the dogshit fiat assets flooding the globe.

During the initial few trading days post-Liberation Day, stocks fell and bond prices rose / yields fell. Then, something happened, and bond prices fell in tandem with stocks. The 10-yr yield round-tripped to a degree that hasn’t been seen since the early 1980s. The question is, why? The answer, or at least what policymakers believe the answer to be, is extremely important. Is there something structurally broken in the markets that must be fixed with some form of money printing by the Fed and/or Treasury?

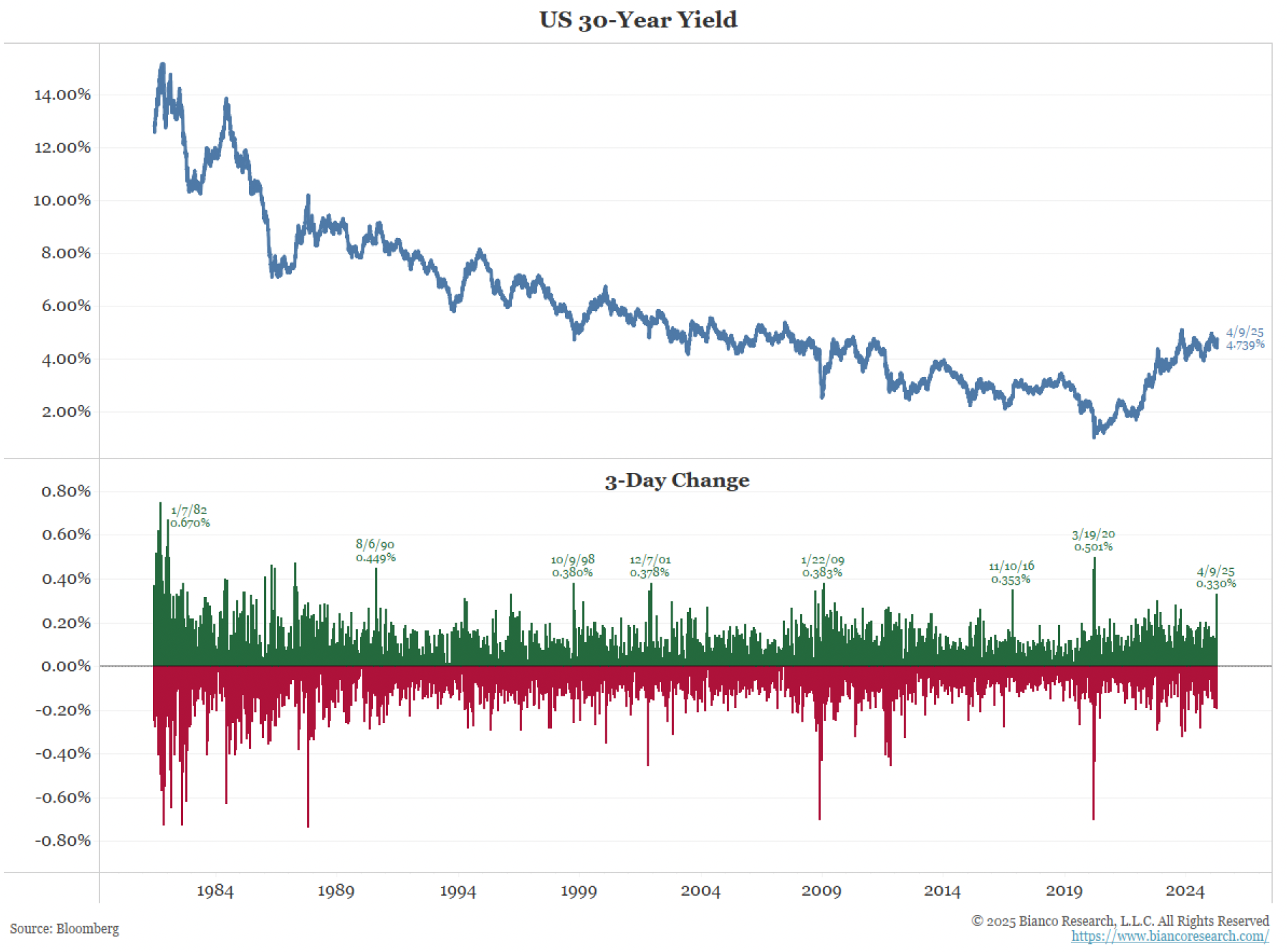

The bottom panel from Bianco Research shows the degree to which the 3-day change in 30-yr bond yields was out of the ordinary. The level of change due to the Tariff Tantrum is on par with market movements experienced during financial crises like COVID in 2020, the 2008 Global Financial Crisis, and the 1998 Asian Financial Crisis. That ain’t good.

The bottom panel from Bianco Research shows the degree to which the 3-day change in 30-yr bond yields was out of the ordinary. The level of change due to the Tariff Tantrum is on par with market movements experienced during financial crises like COVID in 2020, the 2008 Global Financial Crisis, and the 1998 Asian Financial Crisis. That ain’t good.

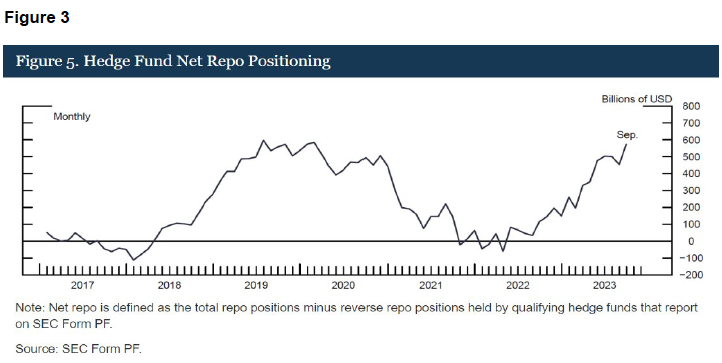

A possible unwind of RV funds’ treasury basis trade positions is such an issue. How large is this trade?

February 2022 was an important month for the treasury market because US President Biden decided to freeze treasury holdings of Russia, the largest commodity producer globally. In effect, it signaled that no matter who you were, property rights were not rights but a privilege. As such, foreign demand continued to wane, but RV funds filled the gap as the marginal buyer of treasuries. The chart above clearly shows the increase in repo positions, which acts as a proxy on the size of the basis trading position within the market.

Basis trade in a nutshell:

The treasury basis trade is when one buys a cash-on-the-run bond and simultaneously sells a bond futures contract. The margin implications on the bank and exchange side are what’s important here. RV funds are constrained in the size of their positions by the amount of cash required for margin. Margin requirements both vary with market volatility and liquidity concerns.

Bank Margin:

To obtain the cash to fund the bond purchase, the fund conducts a repurchase agreement (repo) trade whereby the bank agrees, for a small fee, to front the cash immediately for settlement using the to-be-purchased bond as collateral. The bank will require a certain amount of cash margin against the repo.

The more volatile bond prices are, the more margin the bank will require.

The less liquid a bond is, the more margin the bank will require. Liquidity always concentrates at certain tenors on the yield curve. For global markets, the treasury 10-yr maturity bond is the most important and liquid. When the newest 10-year treasury at the time of issuance is auctioned, it becomes the on-the-run 10-year bond. It is the most liquid. Then, as time progresses, it moves further and further away from the center of liquidity and is considered off-the-run. As on-the-run bonds naturally become off-the-run bonds as time passes, the amount of cash it takes to fund the repo transactions rises while funds wait for the basis to collapse.

In essence, during high-volatility periods, banks are concerned that prices will decline too rapidly if they need to liquidate bonds, and when there is low liquidity to absorb their market sell orders. Therefore, they raise margin limits.

Futures Exchange Margin:

Each bond futures contract has an initial margin level which determines the amount of cash margin required per contract. This initial margin level will fluctuate in response to market volatility.

The exchange is concerned with their ability to liquidate a position before the entirety of the initial margin is spent. The faster price moves, the harder it is to ensure solvency; therefore, margin requirements rise when volatility does.

Unwind Fears:

The outsized influence of the treasury basis trade on the markets and the way in which the main participants fund themselves has been a hot topic within the treasury market. The Treasury Borrowing Advisory Committee (TBAC) has provided the data in past Quarterly Refunding Announcements (QRA) that corroborates the claim that the marginal buyer of US Treasuries from 2022 onwards has been RV hedge funds engaging in this basis trade. Here is a link to a detailed paper submitted to the CFTC, which relied on data provided by the TBAC from April 2024.

The circular reflexive market chain of events that amplifies in horror each cycle is the following:

- If bond market volatility rises, RV hedge funds will be required to post more cash with the bank and exchange.

- At a certain point, the funds cannot afford the additional margin calls and must close positions all at the same time. That means selling cash bonds and buying back bond futures contracts.

- Liquidity falls in the cash market as market makers reduce quoted size at a given spread to protect themselves from toxic one-way flow.

- As liquidity and prices fall together, market volatility increases further.

Traders are well aware of the market phenomenon, and the regulators themselves and their financial journalist hatchet people have been blasting warning signals about this for a while. Therefore, as bond market volatility increases, traders front-run the wall of forced selling, which amplifies volatility on the downside and things unravel faster.

If this is a known market stressor, what policy can The BBC unliterally implement within his department to keep the spice, aka leverage, flowing to these RV funds?

The Treasury Buy Back

Starting a few years ago, the Treasury Department began a buyback program. Many analysts looked into the future and mused how this would aid and abet some money-printing caper. I shall present my theory on the buyback’s money supply impact. But let’s first step through the mechanics of how the program works.

The Treasury will issue a new bond and use the proceeds from that issuance to repurchase illiquid off-the-run bonds. This will cause the value of off-the-run bonds to rise, possibly even over fair value, as the Treasury will be the largest buyer in an illiquid market. The RV funds will see the basis between their off-the-run bond and bond futures contracts narrow.

Basis Trade = Long Cash Bond + Short Bond Futures

Long Cash Bond price rises as off-the-run bonds rise in price due to anticipated Treasury Department buying.

Therefore, the RV fund will lock in a profit by selling their now higher-priced off-the-run bond and close their short bond futures contract. This frees up precious capital at both the bank and exchange ends. As RV funds are in the business of making money, they plow right back into the basis trade at the next treasury auction. As prices and liquidity rise, bond market volatility reduces. This reduces the margin requirements for the funds and allows them to carry larger positions. This is pro-cyclical reflexivity at its finest.

The general market will now relax knowing that the treasury is providing more leverage to the system. Bond prices rise; all is good.

The BBC boasted about his new tool in the interview because the Treasury can, in theory, do infinite buybacks. The Treasury cannot just issue bonds without a congressionally approved spending bill behind it. However, a buyback is essentially the Treasury issuing new debt to retire old debt, which it already does to fund principal payments on maturing bonds. The trade is cash flow neutral because the treasury buys and sells a bond in the same notional with one of the primary dealer banks, so it doesn’t require the Fed to lend it money to conduct the buyback. Therefore, if reaching level of buybacks reduces market fears about a collapse in the treasury market, and results in the market accepting a lower yield on debt yet to be issued, then the BBC will go full send with buybacks. Can’t Stop, Won’t Stop.

A Note on Treasury Supply

In the back of his mind, Bessent knows that the debt ceiling will be raised sometime this year, and the government will continue to gorge with increasing ferocity. He also knows that Elon Musk, through his Department of Government Efficiency (DOGE), can’t cut fast enough for a variety of structural and legal reasons. Specifically Elon’s estimate of savings for the year are now down to a paltry (at least given the gargantuan size of the deficit) $150 billion from an estimate of $1 trillion per year. Which leads to the obvious conclusion that the deficit might actually widen, necessitating Bessent to issue more bonds.

As it stands now, the FY25 deficit through the month of March is 22% higher than the FY24 deficit at the same point in the reporting year. To give Elon the benefit of the doubt – I know some of you would rather burn in a Tesla listening to Grimes than do that – he has only been cutting for two months. What is more worrying is that business uncertainty regarding the severity and impact of tariffs, combined with a declining stock market, will result in a significant drop in tax receipts. That would point to a structural reason why the deficit will continue expanding, even if DOGE is successful at cutting more government spending.

In the back of his mind, Bessent is worried that due to these factors, he will have to upsize the borrowing estimates for the rest of the year. As an oncoming deluge of treasury supply approaches, market participants will demand a significantly higher yield. Bessent needs RV funds to step up, using max leverage, and buy the fuck out of the bond market. Therefore, buybacks are necessary.

The positive dollar liquidity impact of buybacks isn’t as straightforward as central bank money printing. Buybacks are budget- and supply-neutral, which is why the treasury can do an infinite amount of them to create large RV fund buying power. Ultimately, this allows the government to fund itself at affordable rates. The more debt issued that is not purchased with private savings but with levered funds created via the banking system, the larger the growth in the quantity of money. And then we know the only asset we want to own when the quantity of fiat rises is Bitcoin. Pump Up The Jam!

Obviously, this isn’t an infinite source of dollar liquidity. There is a finite amount of off-the-run bonds in existence that can be purchased. However, buybacks are a tool that can enable Bessent to mitigate market volatility in the short term and fund the government at affordable levels. This is why the MOVE Index fell. And fears of a general system collapse as the treasury market stabilized.

The Setup

I liken this trade setup to the 3Q2022 setup. In 3Q2022, the right kind of white boy, Sam Bankman-Fried (SBF), busted; the Fed was still hiking interest rates, bond prices were falling, and yields were rising. Bad Gurl Yellen needed a way to juice the markets so she could open the market’s throat wide with a red-bottomed stiletto and defecate bonds without triggering a gag reflex. In short, just like right now – when market volatility is elevated due to a shift in the global monetary system – it was a shitty time to be ramping up the issuance of bonds.

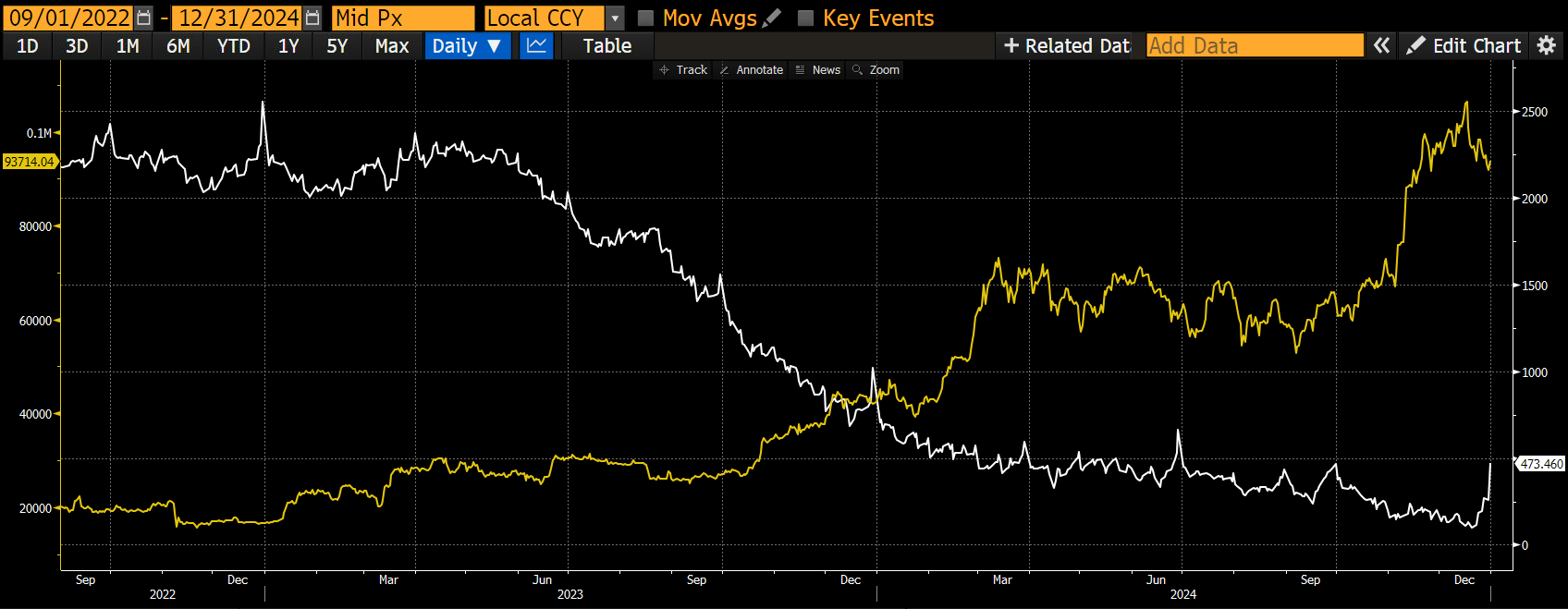

RRP balances (white) vs. Bitcoin (gold).

Just like today, but for a different reason, Yellen couldn’t count on the Fed to ease, as Powell was off on his Paul Volker-inspired vaudevillian temperance tour. Yellen, or some deviously intelligent staffer, rightly deduced that sterile funds held within the RRP by money market funds could be coaxed out into the leveraged financial system by issuing more treasury bills that these funds would be happy to own because of a slight yield pickup over the RRP. This allowed her to add $2.5 trillion of liquidity to markets from 3Q2022 until early 2025. Bitcoin rose almost 6x during that period.

This is quite the bullish setup, but people are scurred. They know high tariffs and a Chi-Merica divorce are bad for stock prices. They believe that Bitcoin is just a high-beta version of the Nasdaq 100. They are bearish and don’t see how an innocuous-sounding buyback program could lead to an increase in future dollar liquidity. They sit on their hands and wait for Powell to ease. He cannot outright ease or provide QE in the same format as previous Fed chairpersons did from 2008 to 2019. Times have changed, and the Treasury does the heavy printing these days. Powell, if he were truly concerned with inflation and the long-term strength of the dollar, would sterilize the effects of the Treasury’s actions under Yellen and now Bessent. But he didn’t then and won’t do so now; he will stew in the cuck chair, and get dominated.

Just like in 3Q2022, folks believed Bitcoin could go below $10,000 due to a confluence of adverse market factors after hitting cycle lows in the $15,000s. Today, some folks believe we are going back through $74,500 to below $60,000, and the bull market is over. Yellen and Bessent ain’t playin’. They will ensure the government is funded at an affordable rate and bond market volatility is quashed. Yellen issued more bills than bonds to inject a finite amount of RRP liquidity in the system; Bessent will buy old bonds by issuing new ones and max out the RV funds’ ability to soak up increased bond supply. Neither is what most investors knew and recognized as QE. Therefore, they slept on it and had to chase the rally higher once it was confirmed as a breakout.

Validation

For buybacks to be net stimulative, the deficit has to continue rising. On May 1st, via the US Treasury’s QRA, we will know the upcoming borrowing schedule and how that compares to previous estimates. If Bessent must borrow more or expects to borrow more, it means that tax receipts are expected to fall; thus, when keeping outlays constant, it produces a wider deficit.

Then, in the middle of May, we will get the official April deficit or surplus from the Treasury, which incorporates actual data from the April 15th tax receipts. We can compare the FY25 YTD YoY change and observe whether the deficit is widening. If the deficit is rising, bond issuance will rise, and Bessent must do whatever he can to ensure RV funds can increase their basis trade positions.

Trading Tactics

Trump ski cut the precarious steep pitch and caused an avalanche. We now know the level of pain or volatility (MOVE Index) that the Trump administration can tolerate before moderating the implementation of any policy the market believes negatively impacts the bedrock of the fiat financial system. This elicits a policy response whose impact will increase the supply of fiat dollars that can purchase treasury debt.

If the increasing frequency and size of buybacks are not enough to calm the markets, then the Fed will eventually find a way to ease. They already said they would. Most importantly, they reduced the rate of quantitative tightening (QT) at their most recent March meeting, which is dollar liquidity positive on a forward-looking basis. However, the Fed can still do more beyond just QE. Here is a short list of procedural policies that are not QE but increase the ability for the market to absorb increased treasury debt issuance; one of these could be announced at the May 6-7 Fed meeting:

- Exempt treasury bonds from banks’ supplemental leverage ratio (SLR). This allows banks to buy treasury debt using infinite leverage.

- Conduct a QT Twist whereby cash raised from maturing mortgage-backed securities (MBS) is reinvested into newly issued treasury bonds. The size of the Fed’s balance sheet remains unchanged, but this would add $35 billion per month of marginal buying pressure in the treasury market for many years until the total stock of MBS matures.

The next time Trump presses the tariff button – which he will do, to ensure nations respect his authority – he will be able to ask for additional concessions, and Bitcoin won’t get crushed alongside certain equities. Bitcoin knows that the deflationary policies cannot be sustained for long, given the insane levels of current and future debt the filthy financial system requires to operate.

The ski cut of Mt. Sharpe World, produced a category 2 financial markets’ avalanche that could have quickly escalated to category 5, the highest level. But team Trump reacted, changed course, and put the Empire on a different aspect. The slope’s base was solidified upon using the driest dankest pow pow made of crystalline dollar bills provided by treasury buybacks. It’s time to transition from the slog up the mountain carrying a backpack filled with uncertainty, to jumping off powdery pillows, yelping with delight at how high Bitcoin shall levitate.

As you can tell, I’m very bullish. At Maelstrom, we have maxed out our crypto exposure. Now it’s all about buying and selling different cryptos to stack sats. The coin purchased in the largest quantity was Bitcoin during the dip from $110,000 to $74,500. Bitcoin will continue to lead the way as it is the direct beneficiary of more fiat dollars sloshing about due to future monetary liquidity injections provided to soften the impact of a Chi-Merica divorce. Now that the global community believes Trump is a madman crudely and savagely wielding the tariff weapon, any investor with US stocks and bonds is looking for something whose value is anti-establishment. Physically, that’s gold. Digitally, that’s Bitcoin.

Gold never held the narrative as a high-beta version of US tech stocks; therefore, as the general market collapsed, it performed well as the longest-standing anti-establishment financial hedge. Bitcoin will shed its association with said tech stocks and will rejoin gold in the ‘Up Only’ cuddle puddle.

What about shitcoins?

Once Bitcoin breaches $110,000, the previous all-time high, it will likely surge, further increasing dominance. Maybe it just misses $200,000. Then the rotation begins from Bitcoin into shitcoins. AltSzn: Arise Chikun!

Apart from whatever is the shiny new shittiest of shitcoin token meta, the tokens that will do the best are those connected to projects earning both profit and passing said profit back to staked token holders. There are only a handful of such projects. Maelstrom has been diligently accumulating positions in certain qualifying tokens, and isn’t done yet buying these gems. They are gems because they got slammed just like every other shitcoin during the recent selloffs, but unlike 99% of the dogshit projects out there, these gems actually have paying customers. Due to the sheer volume of tokens out there, convincing the market to give your project another chance after launching your token in Down Only mode on a CEX, ain’t happening. Shitcoin dumpster divers want higher staking APYs where the rewards are generated from actual profits because these cash flow streams are sustainable. To shill our bags, I will pen an entire essay to talk about some of these projects and why we think their cash flow generation will continue and increase in the near future. Until then, back up the truck, and buy everything!

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar