(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram and X

Access the Korean language version here: Naver

I spent the first two weeks of October skiing on the South Island of New Zealand. My guide, whom I spent all of last season in Hokkaido, assured me that New Zealand was one of the world’s most badass places to backcountry ski. I took his word and spent two weeks with him, travelling out of Wānaka chasing powder and big lines. The weather played ball, and I was able to ski some spectacular peaks and traverse immense glaciers. As an added bonus, I also upgraded my alpine mountaineering knowledge.

Storms in the South Island are vicious. When there is “weather,” you sit at home or in the mountain hut. To pass the time, one afternoon, my guide led an avalanche science course to pass the time. I have done avi training many times since I first went into the British Columbia backcountry as a teenager, but I have yet to take a proper certified course.

The information is fascinating and sobering because the more you learn, the more you understand that you are always chancing it when you ski in avalanche terrain. Therefore, the aim is to reduce risk to an acceptable level.

The course teaches you about different types of snowpacks and how they can lead to an avalanche. One of the scariest conditions is a persistent weak layer (PWL), which could trigger a persistent slab avalanche when stressed.

In avalanche science, a PWL refers to a specific layer of snow within a snowpack that remains structurally weak for an extended period, significantly increasing the risk of avalanches. These layers are particularly dangerous because they can be buried deep within the snowpack, lying dormant and unstable over weeks or even months until they’re eventually triggered by added stress, like a skier or more snowfall. Understanding the presence of PWLs is crucial for avalanche forecasting, as these layers are often responsible for large, deep, and deadly avalanches.

The post-WW2 geopolitical situation in the Middle East is a PWL on top of which our modern global order rests. The trigger usually has something to do with Israel. The avalanche that we care about from a financial markets’ perspective is how energy prices will respond, how global supply chains will be impacted, and whether there will be a nuclear weapons exchange if there is an escalation of hostilities between Israel and another Middle Eastern nation, most specifically Iran or their proxies.

As investors and traders, we are on a precarious yet exhilarating slope. On the one hand, now that China has kickstarted a money printing reflationary exercise in earnest, every major country or economic bloc is lowering the price and increasing the quantity of money. This is the time to go with the maximum long-term risk, and obviously, I mean crypto. Buuuttttt, if the Israel / Iran escalation continues and results in the destruction of oil fields in the Persian Gulf, a closure of the straits of Hormuz, and or a nuclear bomb or device being set off, crypto markets could take a massive dump. War is uninvestable, as they say.

I face a choice: do I continue selling fiat to buy crypto or reduce my crypto exposure and sit in cash or US Treasury bonds? I don’t want to be underallocated if this truly is the start of the next leg higher in the crypto bull market. Still, I also don’t want to incinerate capital if Bitcoin drops 50% in a day because Israel / Iran triggered a persistent slab financial markets’ avalanche. Forget about Bitcoin; it always bounces back; I’m more worried about some of the utter dogshit I have in my portfolio … meme coins.

I want to walk readers through the simple scenario analysis I’m employing as I consider how to portion Maelstrom’s portfolio.

The Scenarios

Scenario One: The Israel / Iran conflict fizzles into small tit-for-tat military actions. Israel continues assassinating folks and decapitating dicks, and the Iranian response is telegraphed, non-threatening missile strikes. No critical infrastructure is destroyed, and neither are there any nuclear strikes.

Scenario Two: The Israel / Iran conflict escalates and culminates in the destruction of some or all Middle Eastern oil infrastructure, a closure of the straits of Hormuz, and or a nuclear attack.

The persistent weak layer holds in Scenario One but fails in Scenario Two, causing an avalanche in the financial markets. Let’s focus on the second outcome, which imperils my portfolio.

I will evaluate the effects of the second scenario as it impacts crypto markets specifically, but mostly on Bitcoin. Bitcoin is the crypto reserve asset, and the entire crypto capital market will follow its lead.

I am even more concerned that Israel will up the ante now that the US has committed to deploying THAAD missile defence systems in Israel. Israel must be planning a large strike, which they anticipate a strong Iranian response. Therefore, they called Daddy, US President Slow Joe Biden, to send reinforcements. Also, the more that Israel publicly professes it will not hit Iranian oil or nuclear sites, the more I believe that is precisely what they plan to do.

On Sunday, The United States said it will send U.S. troops to Israel along with an advanced U.S. anti-missile system in a highly unusual deployment meant to bolster the country’s air defences following missile attacks by Iran.

Source: Reuters

Risk One: Physical Destruction of Bitcoin Mining Rigs

War is physically destructive. Bitcoin mining rigs are the most valuable and important physical manifestations of crypto. What would happen to them?

The major assumption in this analysis is to which part of the world a kinetic conflict would spread. While the Israel / Iran war is merely a proxy war between the US / EU and China / Russia, I assume that neither side wants to attack the other directly. It’s much better to localise the kinetic conflict to the shithole countries of the Middle East. Also, the ultimate belligerents are all nuclear powers. The US is the most aggressive militaristic global power and has, knock on digital wood, never directly attacked another nuclear power. That’s saying something as the US is the only nation to deploy a nuclear weapon; when to close out WW2, they terrorised Japan into surrendering by nuking two cities. Therefore, it is reasonable to assume the physical conflict stays confined to the Middle East.

The next question is, are there any Middle Eastern states where there is a significant amount of Bitcoin mining activity? According to some media outlets, Iran is the only country where Bitcoin mining has flourished. Iranian Bitcoin miners account for up to 7% of the global hash rate, depending on the source. What would happen if, due to internal energy shortages or missile strikes on facilities, the Iranian hash rate dropped to 0%? Nothing.

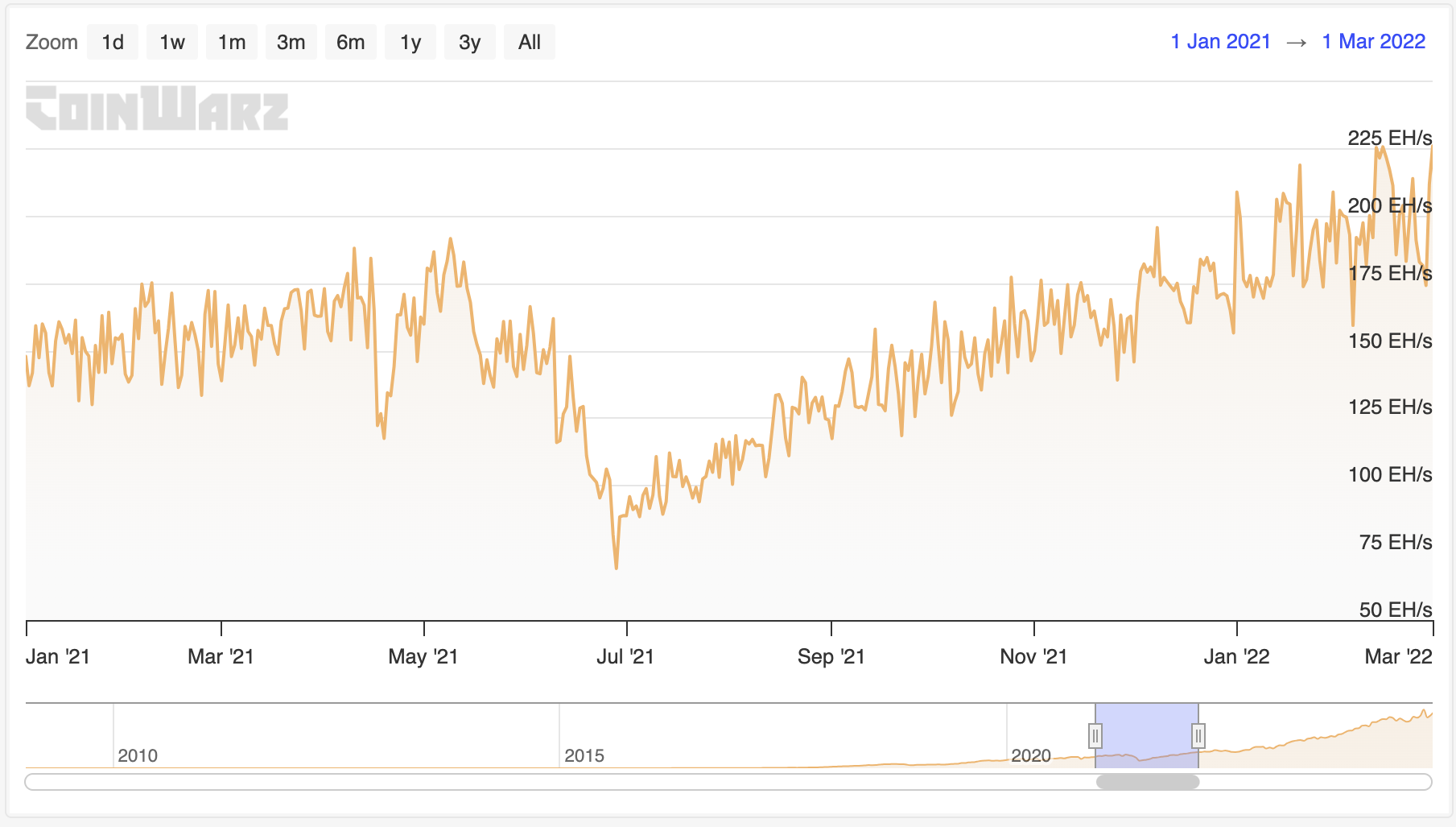

This is a Bitcoin network hash rate chart from January 2021 until March 2022.

Remember when China kind of banned Bitcoin mining in mid-2021, and the hash rate quickly dropped 63%?* The hash rate recovered to its May 2021 high in only eight months. Miners relocated out of China, or other global players were able to boost their hash rate due to more favourable economics. Most importantly, Bitcoin made a new all-time high in November of 2021. The severe drop in network hash rate had no discernible effect on the price. Therefore, even the complete annihilation of Iran at the hands of Israel or the US, knocking out up to 7% of the global hash rate, would have no effect on Bitcoin.

*Note: I say kinda because when observing IP addresses of miners submitting blocks, China still counts as one of the largest places where Bitcoin is mined.

Risk Two: A Dramatic Rise in Energy Prices

The next consideration is what happens if Iran destroys the major oil and natural gas fields in retaliation. The Achilles heel of the over-leveraged Western financial system is a shortage of cheap hydrocarbons. Even if Iran could destroy the Israeli state, it would do nothing to stop the war. Israel is just a useful and expendable vassal of Pax Americana. If Iran wants to strike a blow to the West, it must destroy hydrocarbon production and prevent oil-laden takers from transiting through the straits of Hormuz.

Oil prices would spike, dragging all other energy prices higher as nations short on oil would use other energy substitutes to power their economies. What happens to the fiat price of Bitcoin? It pumps.

Bitcoin is stored energy in digital form. Therefore, if energy prices rise, Bitcoin will be worth more in terms of fiat currency. Bitcoin mining profitability will remain unchanged because all miners face a parallel shift higher in energy prices. It might be more challenging for some large industrial miners to secure energy as utilities at the behest of governments invoke force majeure clauses and cancel contracts. But if the hash rate drops, so does the mining difficulty, which makes it easier for new entrants to mine Bitcoin at higher energy prices profitably. The beauty of our Lord Satoshi’s creation will be on full display.

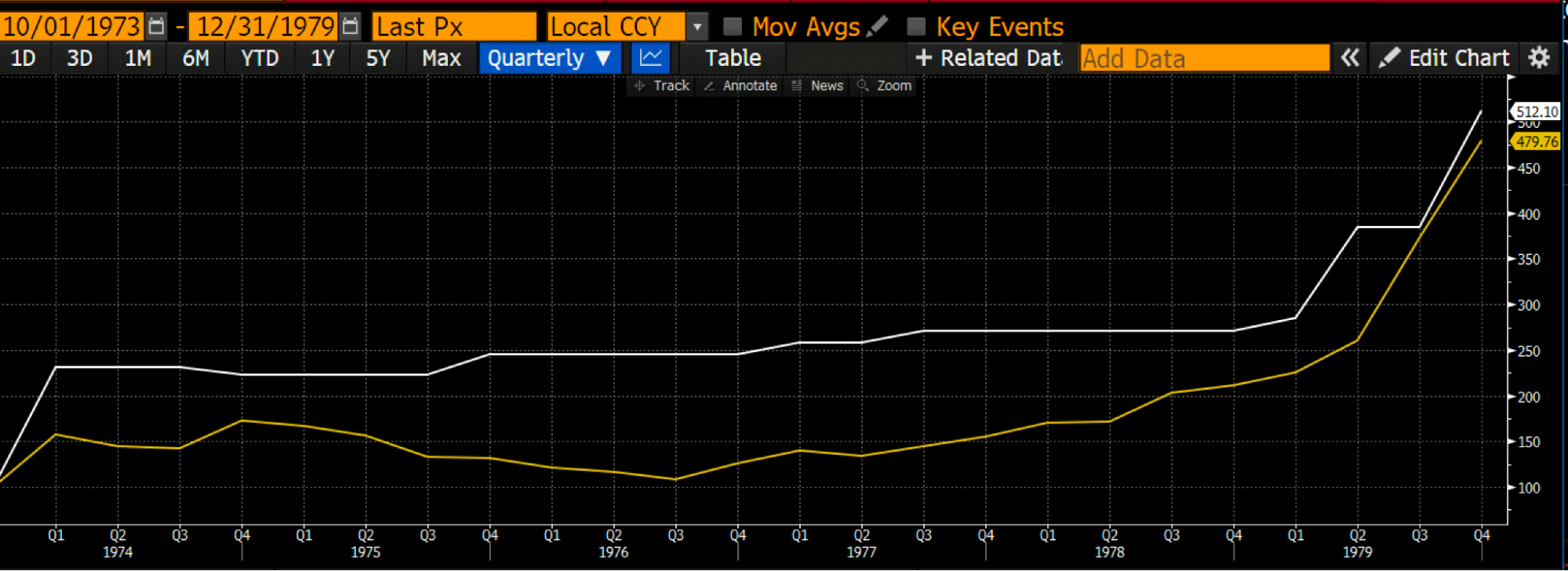

If you want a historical example demonstrating hard money’s resilience to energy shocks, consider how gold traded from 1973 to 1982. In October of 1973, the Arab oil embargo began as a retaliation for the US supporting Israel in the Yom Kippur War. In 1979, Iranian oil supplies were taken out of the global markets as a consequence of the revolution that ousted the Western-backed Shah and installed the current Ayotollah theocratic regime.

The spot oil (white) and gold (yellow) prices vs USD indexed at 100. Oil rose 412%, and gold nearly matched its rise at 380%.

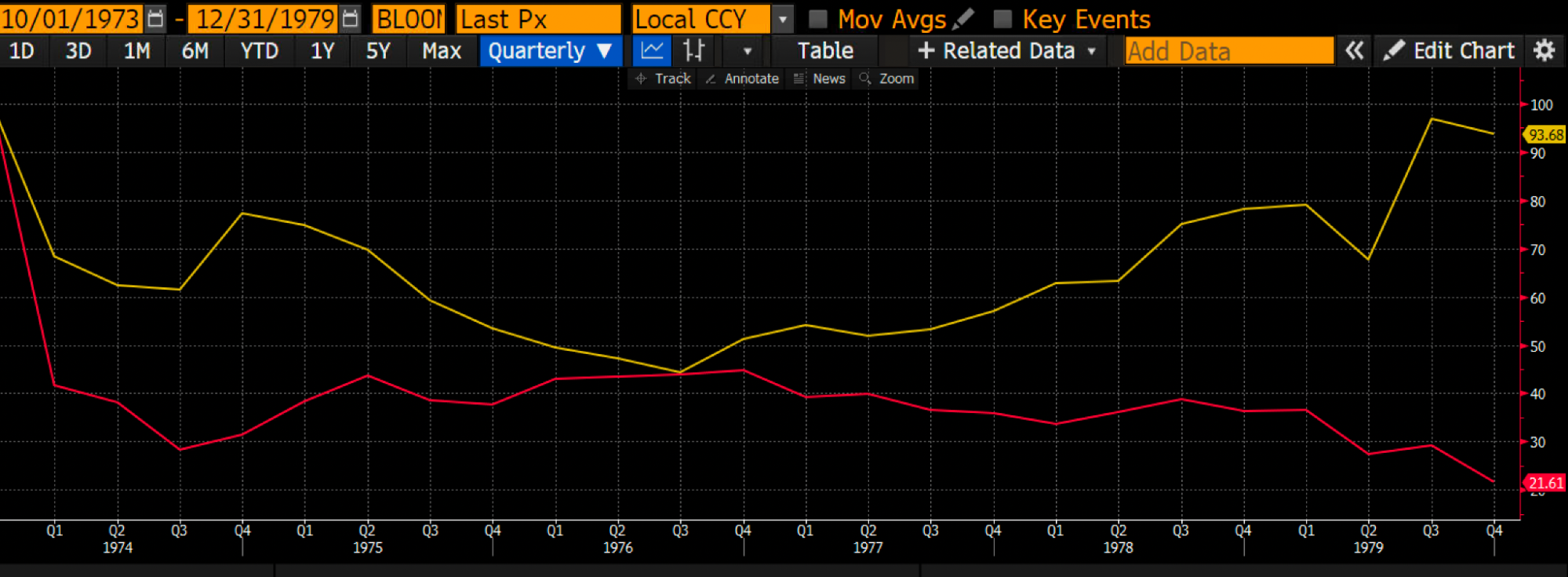

This is the gold price (gold) vs. the S&P 500 Index (red) divided by the oil price and indexed at 100. Gold purchased only 7% less oil, whereas stonks purchased 80% less.

Suppose either party removes Middle Eastern hydrocarbons from the market the Bitcoin blockchain will continue to function, and the price will, at minimum, hold its value vs. energy and definitely rise in fiat currency terms.

I have covered physical and energy risks; let’s move on to the final monetary one.

Risk Three: Monetary

The key question is how the US responds to the conflict. Both political parties are steadfast in their support of Israel. No matter how many innocent men, women, and children the Israeli army exterminates in its quest to destroy Iran and its proxies, the US elite political establishment will continue its support. The US supports Israel by providing weapons. As Israel cannot afford to purchase the weaponry needed to wage a war against Iran and its proxies, the US government borrows money to pay US arms dealers like Lockheed Martin for munitions given to Israel. Since October 7th 2023, Israel has received $17.9 billion in military aid.

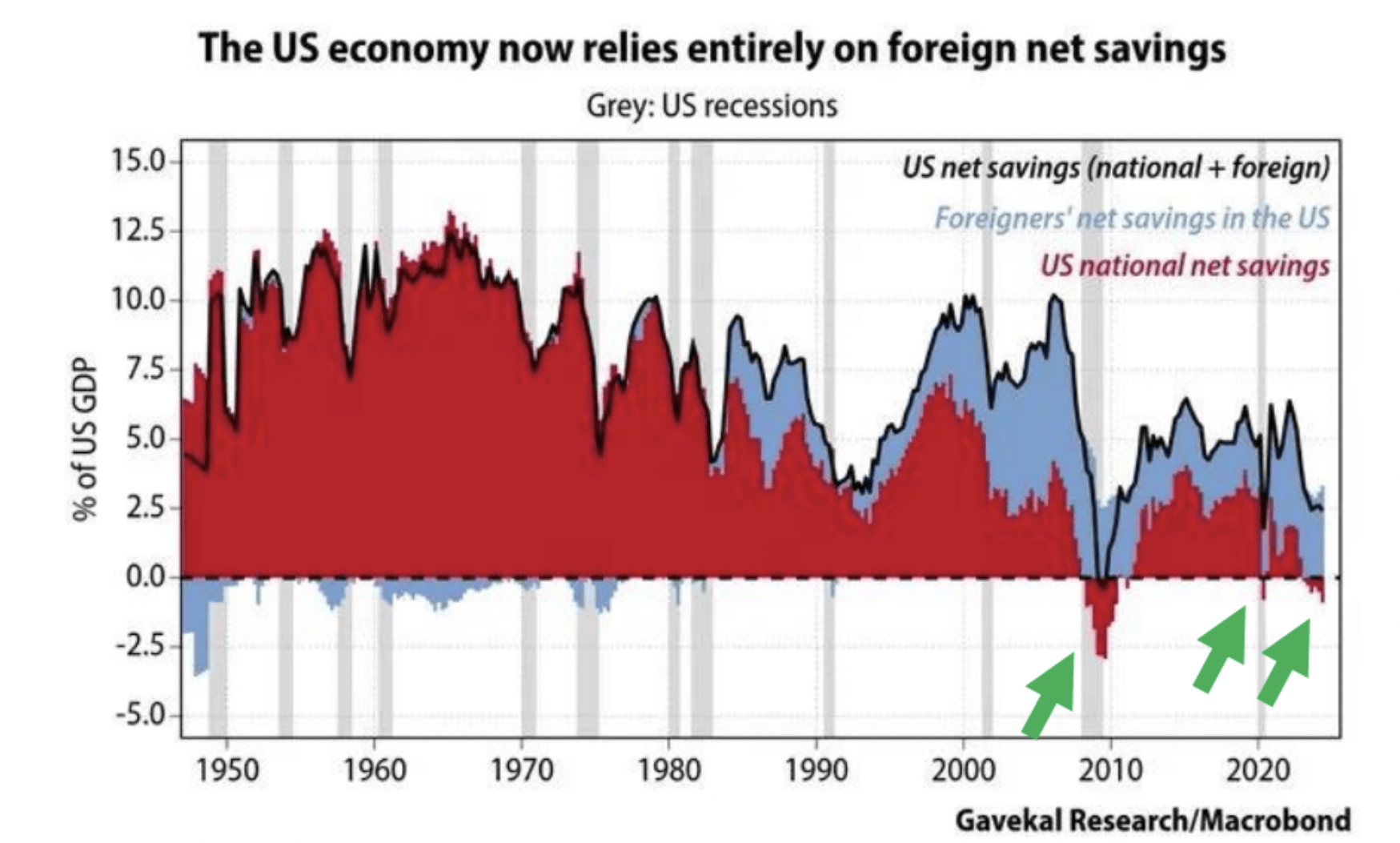

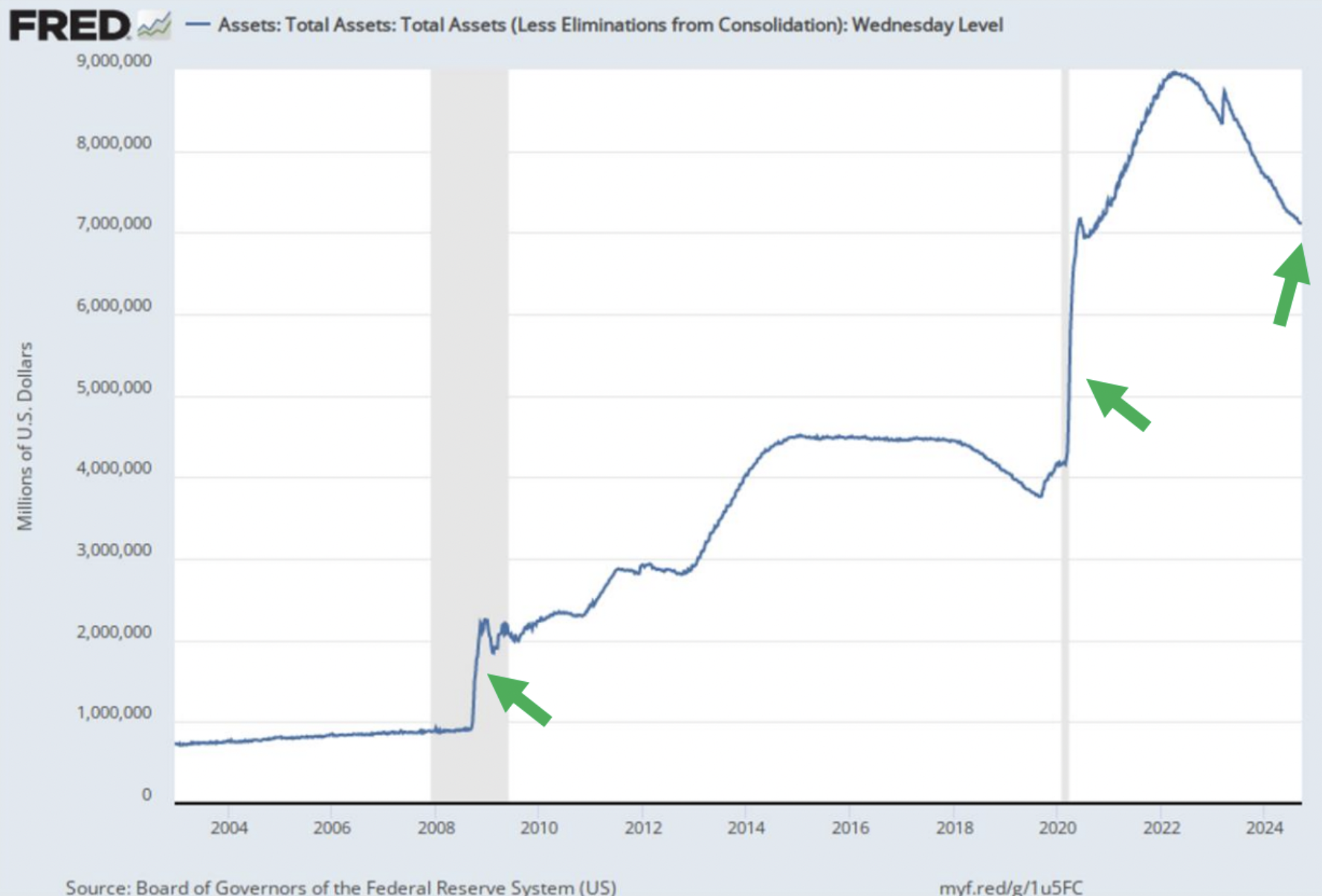

The US government purchases goods on credit and not from savings. That is the message of the chart above. To supply Israel with free weapons requires increased borrowing by the broke US government. The question is, who will buy this debt if national savings are negative? The green arrows denote the instances where US national net savings were negative. Luke Gromen correctly pointed out that those arrows correspond to the following:

The arrows on the chart above correspond to sharp increases in the Fed’s balance sheet size. As the US plays Lord of War by supporting the Israeli military effort, it must borrow more money. Just like after the 2008 Global Financial Crisis (GFC) and the COVID-19 lockdowns, the Fed’s balance sheet or that of the commercial banking system will rise asymptotically to buy this increased debt issuance.

How will Bitcoin respond to another sharp rise in the Fed’s balance sheet?

This is the Bitcoin price divided by the Fed’s balance sheet, which is indexed at 100. Since its inception, Bitcoin has outperformed the rise in the Fed’s balance sheet by 25,000%.

We know that war is inflationary. We understand that the US government must borrow money to sell bombs to Israel. We know that the Fed and the US commercial banking system will buy this debt by printing money and growing their balance sheets. Therefore, we know that Bitcoin will rise stupendously in fiat terms as the war intensifies.

What about Iran’s military expenditures? Will China/Russia help Iran’s war effort in some way? China is perfectly willing to buy Iranian hydrocarbons, and China and Russia sell Iran goods; however, none of this trading is done on credit. In a cynical sense, I believe China and Russia will act like the clean-up crew. They will publicly denounce the war but do nothing of note to attempt to prevent Iran’s destruction.

Israel is not interested in nation-building. Instead, they would delight if, as a result of their attacks, the Iranian regime crumbled due to popular unrest. China, in particular, could then roll out its preferred method of diplomacy. Loan a newly formed weak Iranian government funds to rebuild their country using Chinese state-owned firms. That, in essence, is the Belt and Road program Chinese President Xi Jinping has pursued throughout his reign. Then Iran, with its massive deposits of minerals and hydrocarbons, would be fully within the Chinese orbit. China obtains another captive market in the Global South to dump its overproduced, high-quality, and low-priced manufactured goods. In return, Iran sells China cheap energy and industrial commodities.

If you want to call it that, the support from China and Russia will not expand the global fiat money supply. Therefore, it will have no discernable impact on the fiat price of Bitcoin.

An intensified Middle Eastern conflict will not destroy any critical physical infrastructure supporting crypto. Bitcoin and crypto will rise as energy prices spike higher. The hundreds of billions or trillions of newly printed dollars will re-energise the Bitcoin bull market.

Trade Carefully

Just because Bitcoin will rise over time doesn’t mean there won’t be intense price volatility, nor does it mean every shitcoin will share in the glory. The name of the game is sizing positions appropriately.

For any position I hold, I am ready for insane mark-to-market drawdowns. As some readers know, I aped into several meme coins. When Iran launched its latest barrage of missiles at Israel, I cut those positions dramatically. My size was too big, given the unpredictability of how crypto assets will react to increased hostilities in the short term. I knew my size was too big because I would have been annoyed if I lost 100% of the money invested in a bunch of joke cryptos. Currently, the only meme coin I own is the Church of Smoking Chicken Fish (symbol: SCF). R’amen.

I have yet to instruct Akshat, the head of investments, to slow down or halt the pace at which we deploy capital into presale token deals. With the idle fiat Maelstrom holds, I will stake it on Ethena and earn some phat yield while I wait for good entry points into various liquid shitcoins.

The worst thing I could do as a trader is trade based on who I think is on the “right” side of this war. That will lead you to ruin as war will be met on either side with financial repression, outright asset confiscation, and destruction. The best thing to do is to get yourself and your family out of harm’s way and then shepherd your capital into a vehicle that outperforms fiat debasement and maintains its energy-purchasing power.

Want More? Follow the Author on Instagram and X

Access the Korean language version here: Naver