(Any views expressed in the below should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

A new breed of crypto derivative – the ETH staking yield swap (ETHYLD) – has arrived at BitMEX. It’s an addition that means, from today at 04:00 UTC, users can trade and speculate on daily ETH staking rates, with up to 2x leverage.

The introduction of ETHYLD unlocks new trading and hedging opportunities for our users – including the ability to take positions on the value of ETH staking (and validator rewards). More derivative listings are on their way, so stay tuned.

Start trading ETHYLD here, or read on for a deep dive into ETH staking yield swaps.

If you haven’t yet signed up for a BitMEX account, you can do so here.

ETH Staking Yield Swaps, Explained

A new type of crypto derivative invented by BitMEX, the ETHYLD swap allows traders to “swap” the variable yield that emanates from staking ETH on Lido (i.e. floating rate) for a fixed interest rate (i.e. fixed rate) – and vice versa.

The Two Sides to an ETHYLD Swap

During the life of an ETHYLD contract, there are two interest rates being “swapped” each day:

- The floating rate will be based on the variable yield that emanates from the Lido Finance validator pool. For each ETH staked, Lido users are issued a stETH token. Every day at 12:00 UTC, a rebase happens – where staking rewards are accrued to the balance of stETH held in a wallet.

- The fixed rate represents a trader’s best guess of the average daily ETH staking yield – from the inception of the contract until maturity. It’s the rate that traders speculate on, and will be an annualised rate.

Like all crypto derivative contracts on BitMEX, it is possible for ETHYLD traders to take a leveraged position (i.e. trade ETHYLD with up to 2x leverage). In addition, traders can also hold a position as long as they allocate enough margin to satisfy the maintenance margin requirement – once this is not the case, the trader will get liquidated.

However, there are also several key differences between our ETH staking yield swap vs. other crypto derivatives listings that users should be aware of – which are detailed in this blog. One main difference is that traders Pay or Receive the fixed rate on an ETHYLD contract, rather than Buy or Sell:

- The Payer pays the fixed rate and receives the floating rate. In other words, the trader has entered a long position.

- The Receiver will receive the fixed rate and pay the floating rate. In other words, the trader has entered a short position.

More on the ETHYLD Floating Rate Funding

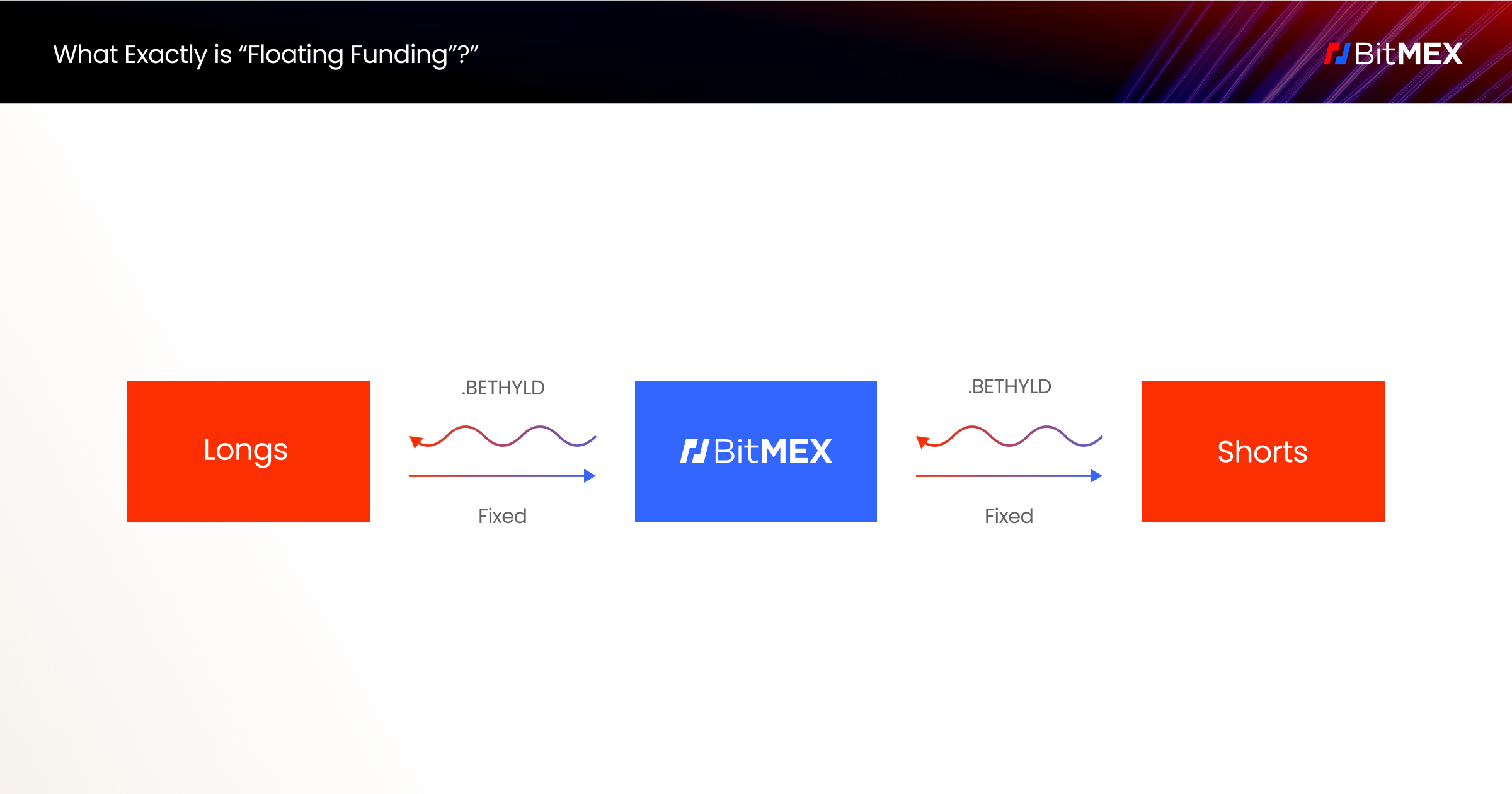

The floating rate (.BETHYLD) is paid to the ‘Payer’ (i.e. long) positions by the ‘Receiver’ (i.e. short) positions each day at 12:00 UTC, in exchange for paying/receiving the fixed rate. This is illustrated below:

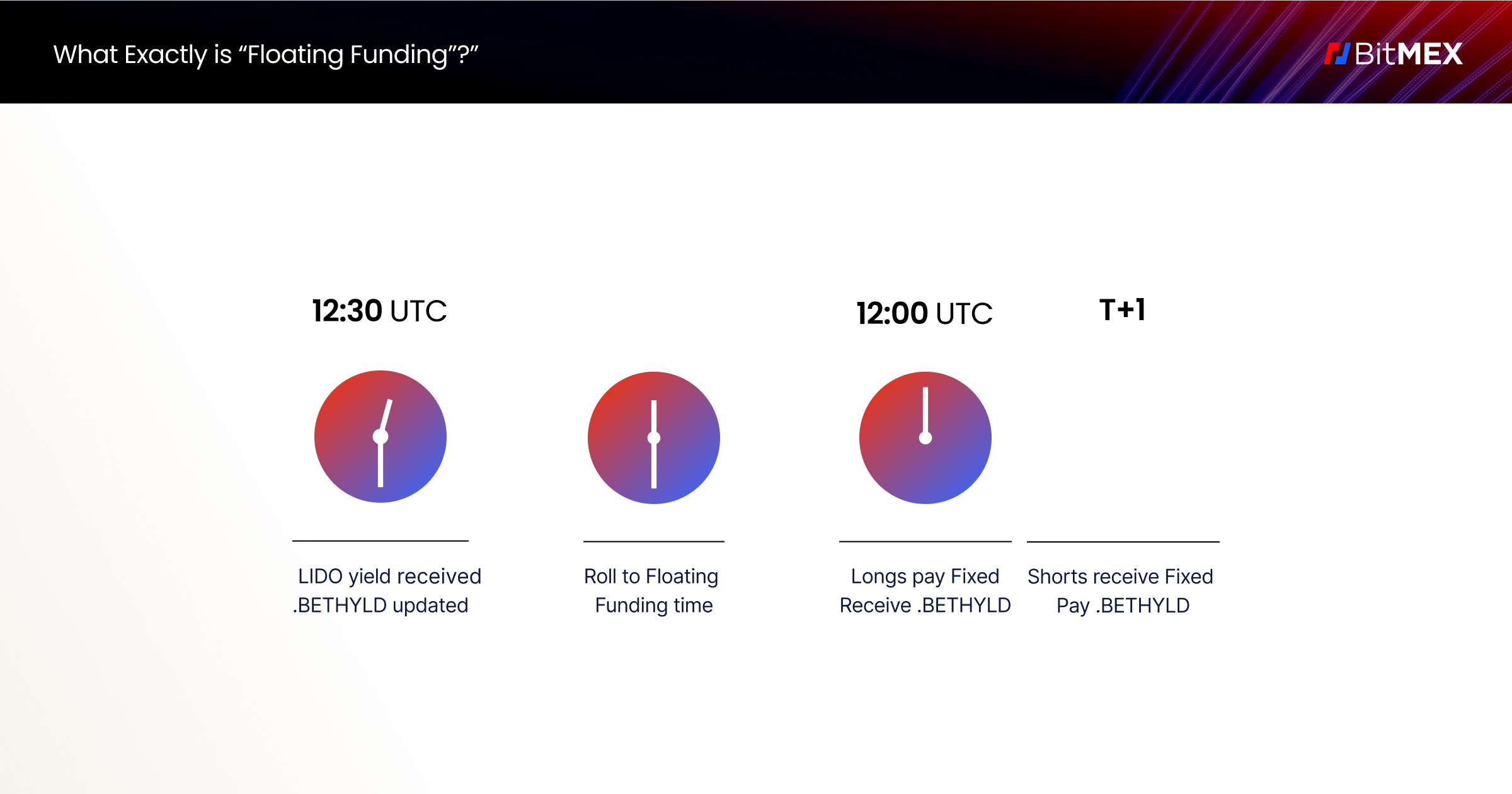

The ETHYLD floating rate is based on our floating index – .BETHYLD – which represents the Lido ETH staking yield. The floating rate will be observed daily by BitMEX when it is available, usually around 12:30 UTC, and cash flow payments (i.e. settlements) between Payers and Receivers will occur at the next 12:00 UTC – as shown below:

The ETHYLD floating rate is based on our floating index – .BETHYLD – which represents the Lido ETH staking yield. The floating rate will be observed daily by BitMEX when it is available, usually around 12:30 UTC, and cash flow payments (i.e. settlements) between Payers and Receivers will occur at the next 12:00 UTC – as shown below:

Who Wants to Pay an ETHYLD Contract?

Who Wants to Pay an ETHYLD Contract?

A Receiver position (receiving fixed, paying floating) may be ideal for traders who:

- Run their own validators and wish to lock in future yields

- Stake ETH on Lido or other venues and wish to lock in future yields

- Think that staking yields will be lower than what’s being implied by the swap price

- Think that the fixed rate is too high

- Wish to earn carry when the daily fixings are lower than the ETH yield swap price

Who Wants to Receive an ETHYLD Contract?

A Payer position (paying fixed, receiving floating) may be ideal for traders who:

- Pay Ethereum chain fees

- Think that staking yields will be higher than what’s being implied by the swap price

- Think that the fixed rate is too low

- Want to earn carry when the daily fixings are higher than the ETHYLD contract price

Show Me an Example

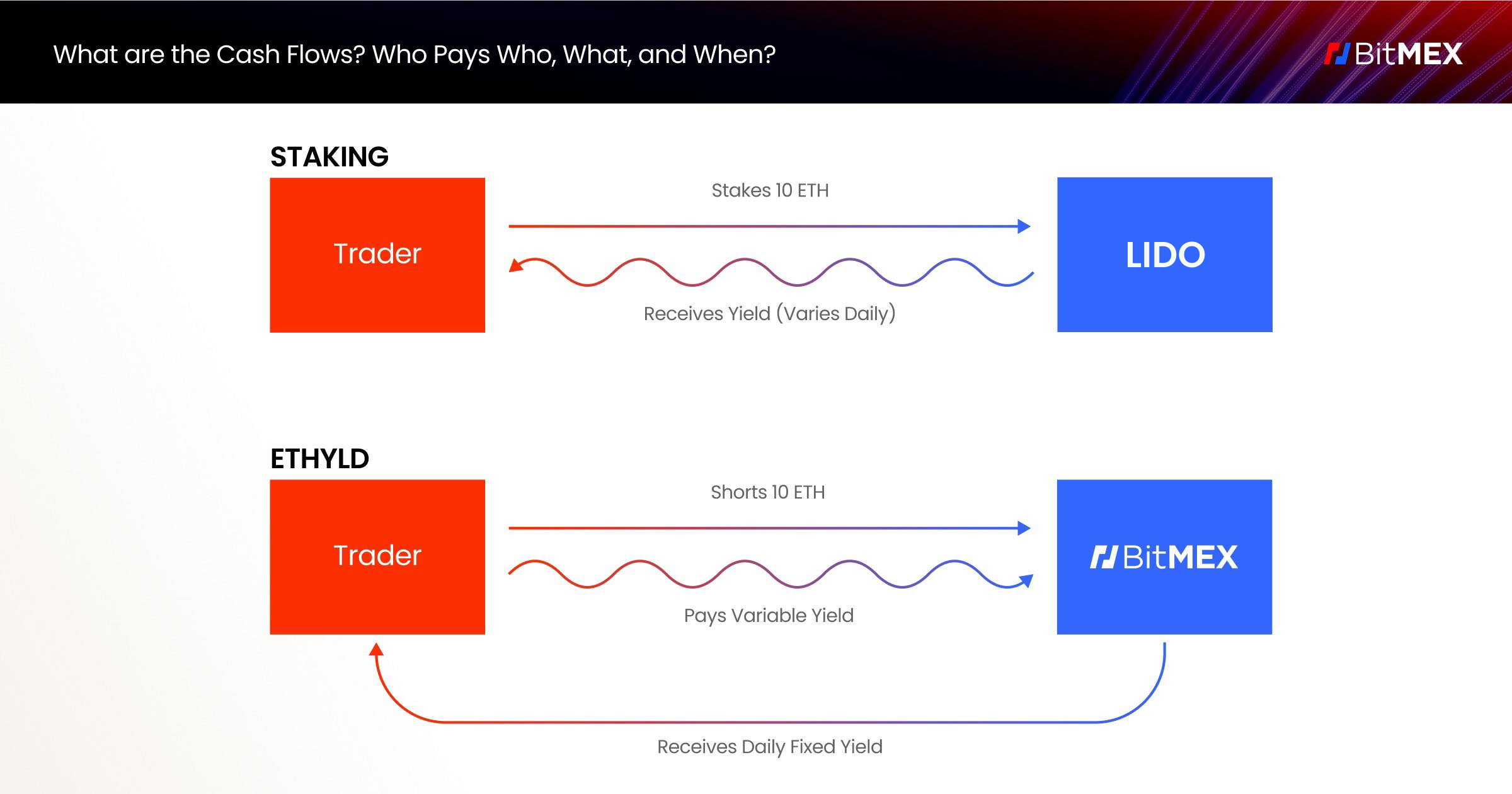

As shown below, a trader who has staked ETH on Lido – and also received fixed on an ETHYLD swap contract – will net receive the fixed rate on their staked ETH (thus converting the uncertain daily variable rate that is derived from staking ETH on Lido into a known fixed rate).

So, say, a trader paid 4% on 1 ETH notional of ETHYLD swap contracts. If the floating rate for a particular day is 4.5%, the net amount received by the trader will be 1 ETH x (4.5% – 4%) x (1 / 365) = 0.00001370 ETH.

Note:

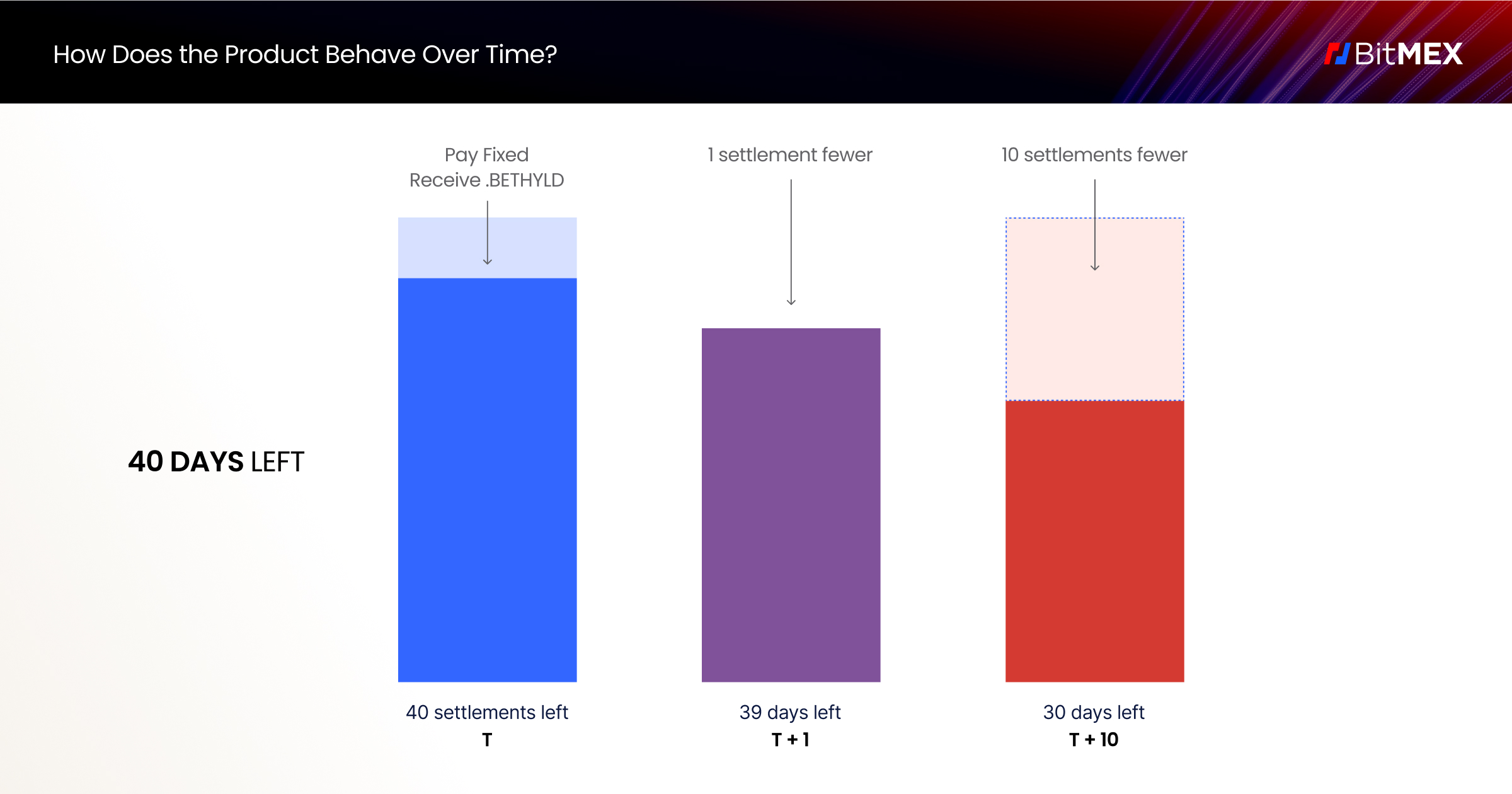

Position Value = Quantity x Average Entry Fixed Rate x (Days Remaining / 365 )

…so the PnL realised when closing out a trade is:

PNL = Quantity x (Exit Fixed Rate – Entry Fixed Rate) x (Days Remaining / 365 ) x if (Pay Fixed, 1, -1)

Swap Maturities

The ETHYLD swap expires quarterly on the last Friday of every calendar month at 12:00 UTC. This timing lines up perfectly with the stETH rebase and our current suite of futures contracts.

For example, if a trader enters a Payer position on our ETHYLDH23 contract on 19 February 2023, they will have 40 days left until the contract expires (on 31 March 2023). This process is further illustrated below:

Note: As we stated above, the Position and Settlement Values of an ETHYLD swap contract both depend upon the number of days remaining on the contract. Example calculations are detailed in this blog.

Note: As we stated above, the Position and Settlement Values of an ETHYLD swap contract both depend upon the number of days remaining on the contract. Example calculations are detailed in this blog.

ETH Staking Yield Contract Specs

- Symbol: ETHYLDZ22

- Expiry date and time: Quarterly on the last Friday of every calendar month at 12:00 UTC

- Margin currency: ETH

- Price quotation: Annualised Yield (as an absolute number on API and as a percentage on the BitMEX trading page – for example, a 4.5% p.a. yield will be displayed as 4.500 on the trading page and will be 0.045 on the API)

- Price limits: Limit Up and Limit Down set hourly at Mark Price +/- 20%

- MarkMethod: LastPriceAdjusted*

- Auto Deleveraging: Enabled

- Contract Size and Minimum Trade Amount: 1 ETH

- ETH Contract Value: ETHYLD Price * Days to Expiry / 365

- Floating Index: .BETHYLD (The Lido ETH staking yield as recorded each day by BitMEX)

- Settlement Index: .BETHYLD

- Max Leverage: 2x

- Maker Fee: -0.01%

- Taker Fee: 0.075%

- Base Initial Margin: 50.00%

- Base Maintenance Margin: 10.00%

- Floating Funding Settlement: Daily at 12:00 UTC

- Floating Funding Fees: Both sides pay 0.0005% daily

*Last Price Adjusted is a marking mode that functions similarly to simple Last Price marking, but with adjustments to allow for Yield Swap Floating Funding payments. Please see here for more details.

The Price is adjusted to take into account the next Floating Funding payment.

For the full contract specs, click here. To start trading ETHYLDZ22, click here.

To be the first to know about our new listings, product launches, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.