(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Winter is over in North Asia. The warm weather, sunshine, and early blooming of the sakura announced the presence of Spring. After decamping from the beautiful mountains of Hokkaido, I spent my last weekend in Tokyo.

One afternoon, after finishing a sumptuous lunch, I asked one of the very experienced staff members about a particular aspect of Japanese cuisine that had always puzzled me. My question: what is the difference between omakase and kaiseki? In both circumstances, the chef chooses the menu based on the tastiest seasonal food items. The staff member explained that the entire purpose of a kaiseki is to prepare you for the matcha tea ceremony. The chef is supposed to create a meal that prepares your body to receive the tea.

When you sit down for a kaiseki meal, the destination is known, but the path is not. This brought to mind the current situation vis-à-vis the world’s major central banks, and in particular, the Federal Reserve (Fed). Ever since the Fed started raising rates in March 2022, I have been arguing that the end result was always going to be a significant financial disturbance, followed by a resumption of money printing. It’s important to remember that it is in the best interest of the Fed and all other major central banks to perpetuate the continuation of our current financial system – which gives them their power – so actually cleansing the system of the egregious amount of debt and leverage built up since WW2 is out of the question. Therefore, we can predict with near certainty that they will respond to any substantive banking or financial crisis by printing money and encouraging another round of the very same behaviour that put us in that perilous position in the first place.

I and many other analysts have stood on our virtual soap boxes and predicted that the Fed would continue hiking until they broke something. No one knew exactly what would break first, but we were all certain that it would happen. And not to get too far ahead of myself, but some (including me) have maintained that a disruption in some part of the US financial system in 2023 was going to force the Fed to reverse the tightening cycle we’ve been in for the past year – and it would appear that we’re right on track.

Subsequent to my return to the jungle, I sat down for a deliciously spicy Sichuan meal with my favourite hedge fund manager. We caught up on personal matters, and then spent the majority of the dinner talking about the implications of the Fed’s new Bank Term Funding Program (BTFP). BTFP also stands for Buy The Fucking Pivot! I thought I understood the magnitude of what the Fed just did, but I did not fully appreciate just how impactful this policy will truly be. I will go into detail about what I learned a bit later in the essay – but suffice it to say, BTFP is Yield Curve Control (YCC) repackaged in a new, shiny, more palatable format. It is a very clever way to accomplish unlimited buying of government bonds, without actually having to buy them.

To fully understand why this BTFP program is so groundbreaking and ultimately destructive to savers, let’s go through how we got here. We must first understand why these banks have gone bust, and why the BTFP is a very elegant response to this crisis.

The Ides of March

The beginning of the end started in March 2020, when the Fed pledged to do whatever it took to arrest the financial stress brought about by COVID-19.

In the West (and in particular, the US), COVID was some China / Asia thingymajig with a little street-fried bat thrown in. The elites proclaimed that nothing was wrong. And then, all of the sudden, folks started getting sick. The spectre of lockdowns in America began to rise, and the US markets started tanking. The corporate bond markets followed, freezing up shortly thereafter. Dysfunction spread quickly, creeping into the US Treasury market next. Backed into a pretty significant corner, the Fed moved quickly to nationalise the US corporate credit markets and flood the system with liquidity.

The US Federal Government responded by running up the largest fiscal deficit since WW2 in order to drop money directly into people’s bank accounts (in the form of stimulus checks – or, as I like to refer to them, “stimmies”). The Fed essentially cashed the checks of the government. The government had to issue a significant amount of new treasuries to fund the borrowing, which the Fed dutifully bought in order to keep interest rates near zero. This was a highly inflationary practice, but at the time, it didn’t matter because we were muddling through a once-in-a-generation global pandemic.

Right on cue, a financial boom of epic proportions began. Everyone had stimmy checks to spend, rich and poor alike. And at the same time, the cost of funds for asset speculators dropped to zero, encouraging insane risk taking. Everyone was rich, and everything became an exercise in Number Go Up!

The Bull Market

Because the public had all this new money, the banks were flooded with deposits. Remember that when we purchase goods, services, or financial assets, the money doesn’t leave the banking system – it just moves from one bank to another. So, the majority of the newly-printed money ended up as deposits on some bank’s balance sheet.

For large, systemically important, Too Big to Fail (TBTF) banks like JP Morgan, Citibank, Bank of America etc., the percentage rise in deposits was noticeable, but nothing ridiculous. But for small to midsize banks, it was enormous.

The runts of the US banking establishment (sometimes called Regional Banks) had never been so deposit rich. And when banks take deposits, they use them to make loans. These banks needed to find somewhere to put all this new money in order to earn a spread, also called Net Interest Margin (NIM). Given that yields were either zero or barely above zero, depositing the money with the Fed and earning interest on their excess reserves would not cover their operating costs – so banks had to increase their earnings by taking on some level of credit and/or duration risk.

The risk of a borrower not repaying the loan is called credit risk. The highest-rated credit you can invest in (i.e., the credit with the lowest credit risk) is the debt of the USG – also known as treasuries – since the government can legally print money to pay back its debt. The worst credit you can invest in would be the debt of a company like FTX. The more credit risk a lender is willing to take, the higher the interest rate that lender will demand from the borrower. If the market believes the risk of companies not paying their bills is increasing, credit risk increases. This causes the price of bonds to fall.

By and large, most banks are quite credit risk averse (i.e., they don’t want to lend their money to companies or individuals they think are likely to default). But, in a market where the most obvious and safest alternative – investing in short-term USG debt – carried yields near 0%, they needed to find some way to turn a profit. So, many banks started to juice yields by taking duration risk.

Duration risk is the risk that a rise in interest rates will cause the price of a given bond to fall. I won’t belabour you with the maths for calculating the duration of a bond, but you can think of duration as the sensitivity of a bond’s price to a change in interest rates. The longer the time to maturity of a given bond, the more interest rate or duration risk that bond has. Duration risk also changes based on the level of interest rates, which means the relationship between duration risk and a given level of interest rates is not constant. This means that a bond is more sensitive to interest rates when rates rise from 0% to 1% than from 1% to 2%. This is called convexity, or gamma.

By and large, most banks limited credit risk by lending money to various arms of the USG (rather than risky companies), but increased their interest income by buying longer-dated bonds (which carry more duration risk). This meant that as interest rates rose, they stood to lose a lot of money very quickly as bond prices fell. Of course the banks could have hedged their interest rate exposure by trading interest rate swaps. Some did, many did not. You can read about some truly stupid decisions made by SVB’s management with regards to their hedging of the massive interest rate risk embedded in their government bond portfolio.

Let’s play this out. If a bank took in $100 of deposits, then they would have purchased $100 of USG debt such as US Treasuries (UST) or Mortgage Backed Securities (MBS). Nothing wrong with this asset liability management strategy so far. In practice, the ratio of deposits to loans should be less than 1:1 in order to have a safe margin for loan losses.

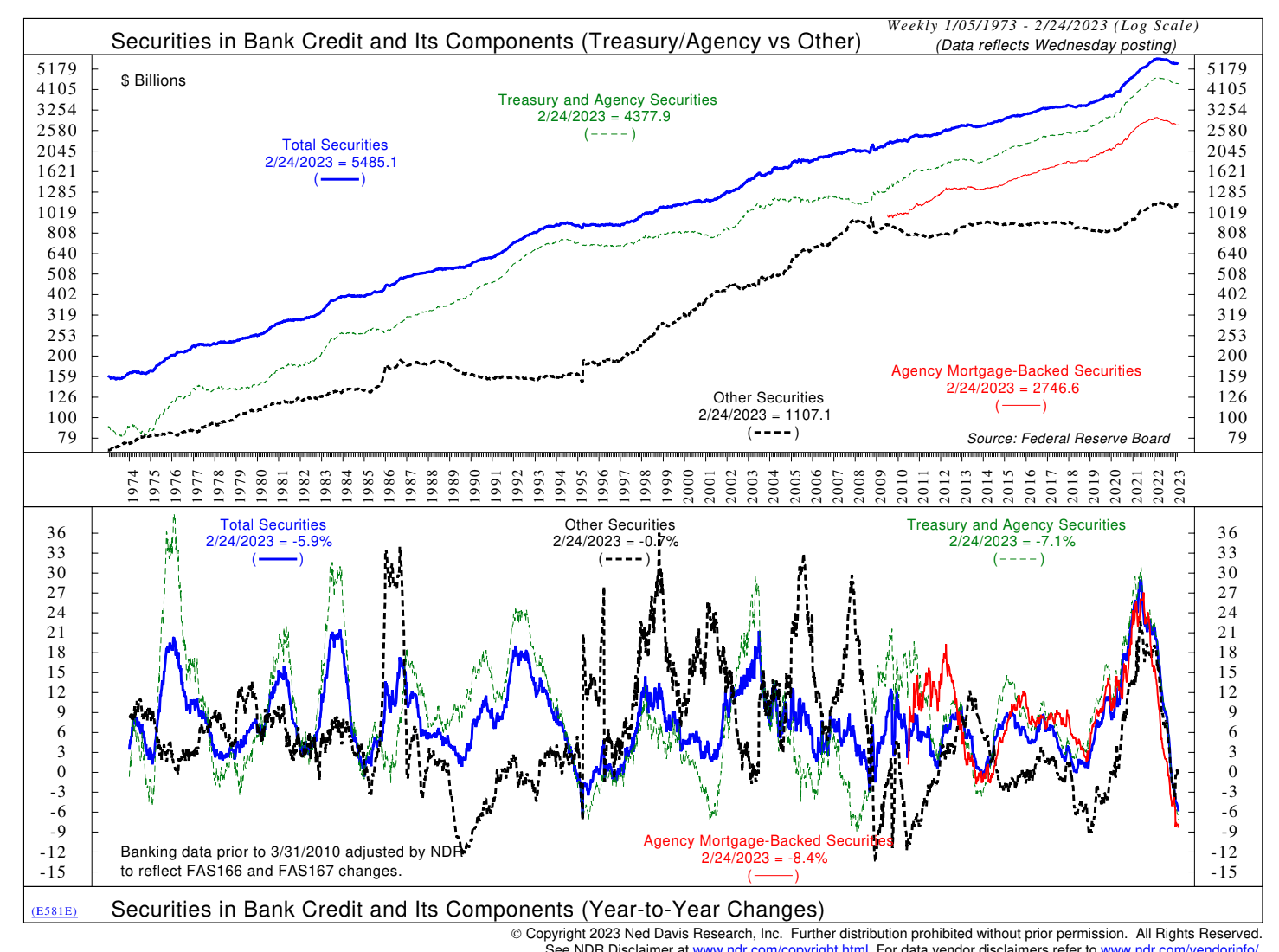

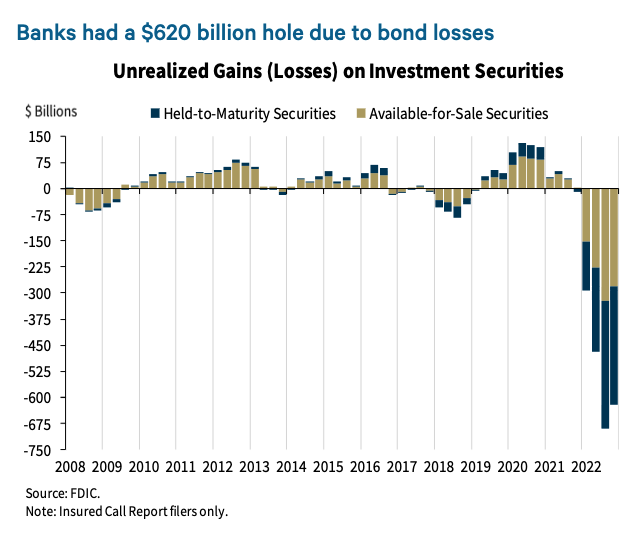

As the above chart depicts, US banks bought a fuck-ton of UST in 2020 and 2021. This was great for the USG, which needed to fund those stimmy checks. This was not so great for the banks, as interest rates were at 5,000-year lows. Any small increase in the general level of interest rates would lead to massive mark-to-market losses on banks’ bond portfolios. The FDIC estimates that US commercial banks are carrying an unrealised $620 billion in total losses on their balance sheets due to their government bond portfolios losing value as interest rates rose.

How did banks hide these massive unrealised losses from their depositors and shareholders? Banks hide losses by playing many legal accounting tricks. Banks who have lent out money don’t want their earnings oscillating with the mark-to-market of their tradable bond portfolio. Then the whole world would catch on to the charade they are playing. That could dampen their stock price, and/or force their regulators to close them down for breaching capital adequacy ratios. Therefore, banks are allowed to mark a bond as “held to maturity” if they plan not to sell it before it matures. That means they mark a bond at its purchase price until it matures. Thereafter, regardless of what the bond trades at in the open market, the bank can ignore unrealised losses.

Things are going well for the small banks. Their NIM is increasing because they are paying 0% interest on their customers’ deposits while lending those deposits out to the USG in SIZE at 1% to 2% (UST), and to American home buyers at 3% to 4% (MBS). It may not seem like much, but on hundreds of billions of dollars’ worth of loans, that is meaningful income. And because of these “great” earnings, bank stocks are soaring.

KRE US – SPDR S&P Regional Banking ETF

The ETF pumped over 150% off of the COVID March 2020 lows through the end of 2021.

But then, INFLATION shows up.

He Ain’t No Arthur Burns, He Be Paul Motherfucking Volker

A quick history lesson on past Fed governors. Arthur Burns was the Fed chairperson from 1970 to 1978. Contemporary monetary historians do not look kindly on Mr. Burns. His claim to fame is that he was the Fed governor who refused to nip inflation in the bud early on in the 1970’s.

Paul Volker was the Fed chairperson from 1979 to 1987. Contemporary monetary historians laud Mr. Volker’s commitment to slaying the inflationary beast his predecessor simped for. Mr. Volker is presented as bold and courageous, and Mr. Burns is presented as weak and feeble.

You know what’s sad? If you put a gun to my head, I could probably list every single chairperson the Federal Reserve has had since its inception in 1913. I couldn’t do that for other significant world figures. Kabloom!

Sir Powell wants to be more like Volker and less like Burns. He is very concerned about his legacy. Powell isn’t doing this job to get paid – he is most likely a centa-millionaire. It’s all about cementing his place in history as a monetary force for good. That is why when inflation shot up to 40-year highs following the pandemic, he put on his best Volker costume and marched into the Mariner Eccles building ready to fuck shit up.

In late 2021, the Fed signalled that inflation was a concern. Specifically, the Fed said that it would start raising interest rates above 0% and reducing the size of its balance sheet. From November 2021 to early January 2022, risky asset prices peaked. The pain train was ready to leave the station.

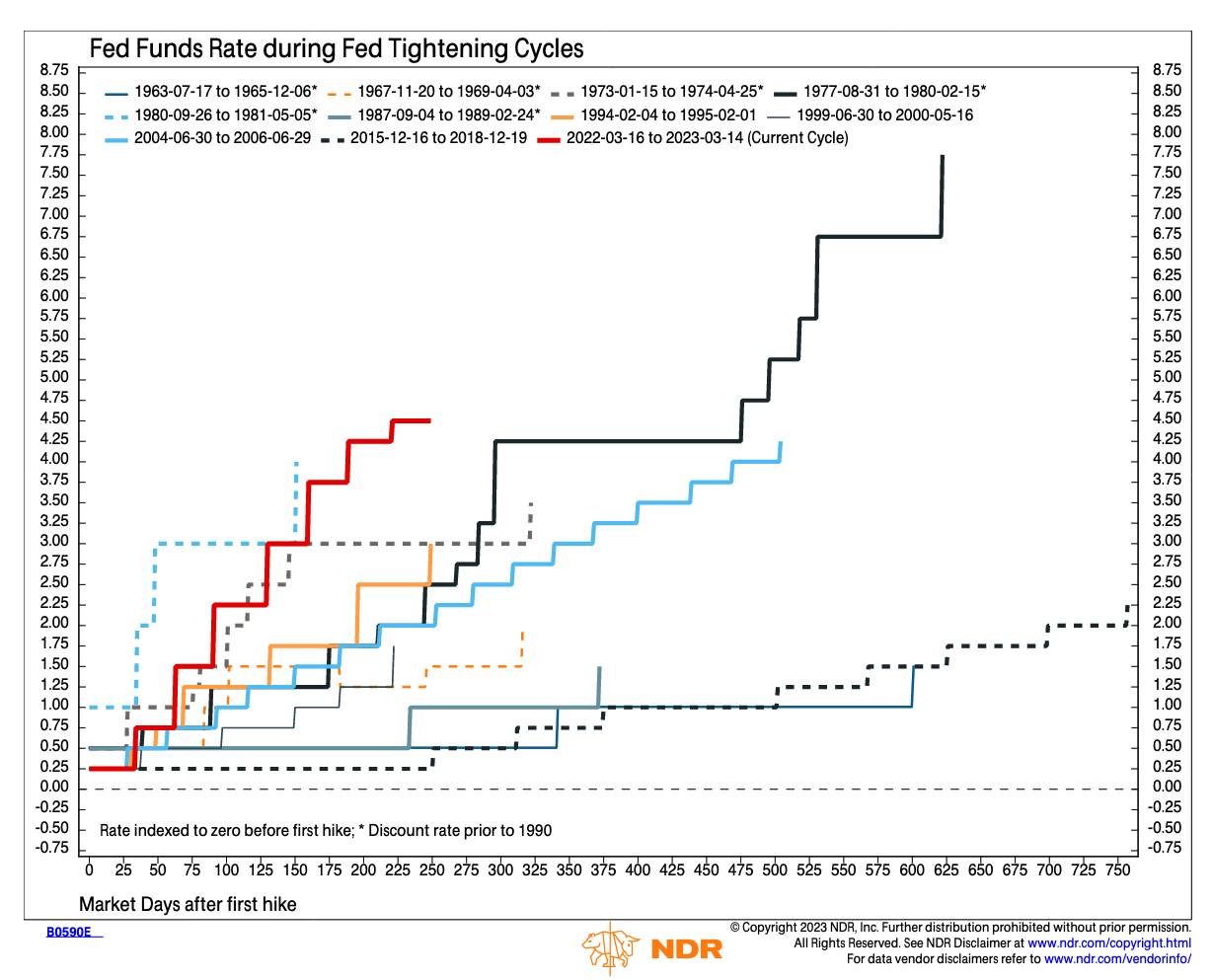

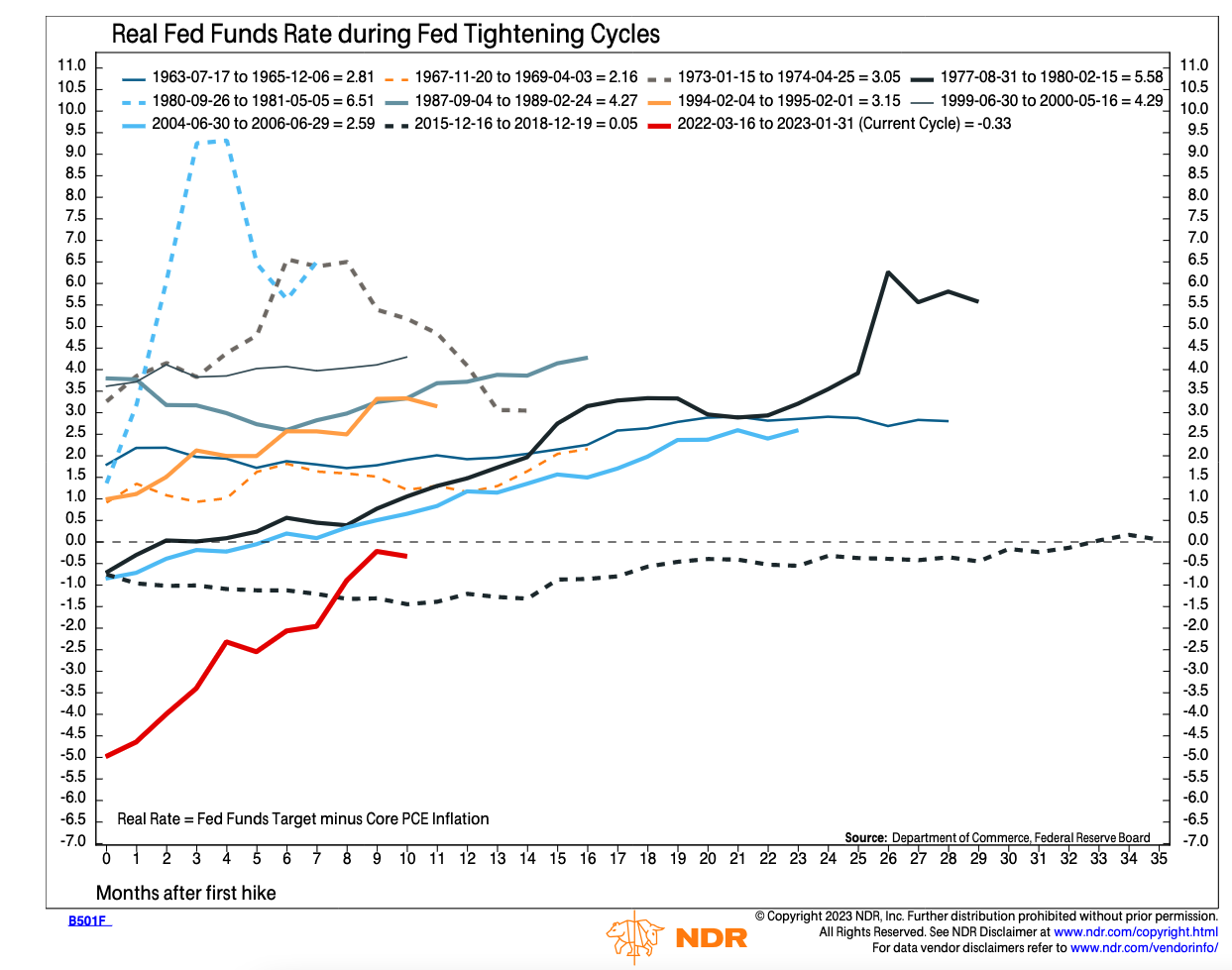

This current Fed tightening cycle is the fastest on record (i.e., the Fed raised interest rates by greater amounts more quickly than ever before). As a result, 2022 was the worst year for bond holders in a few hundred years.

Powell felt like he was doing what had to be done. Rich people’s financial asset portfolios were taking a backseat to reducing prices on goods and services for the majority of Americans who own zero financial assets. He wasn’t worried about some hedge fund being down massively on the year, or banker bonuses getting slashed. So what … eat the rich, the American economy was strong, and unemployment was low. That meant he could keep raising interest rates and dispel the notion that the Fed only cares about juicing financial asset prices to help rich people. What a fucking hero!!!!

But, trouble was brewing in the banking sector.

Can’t Pay

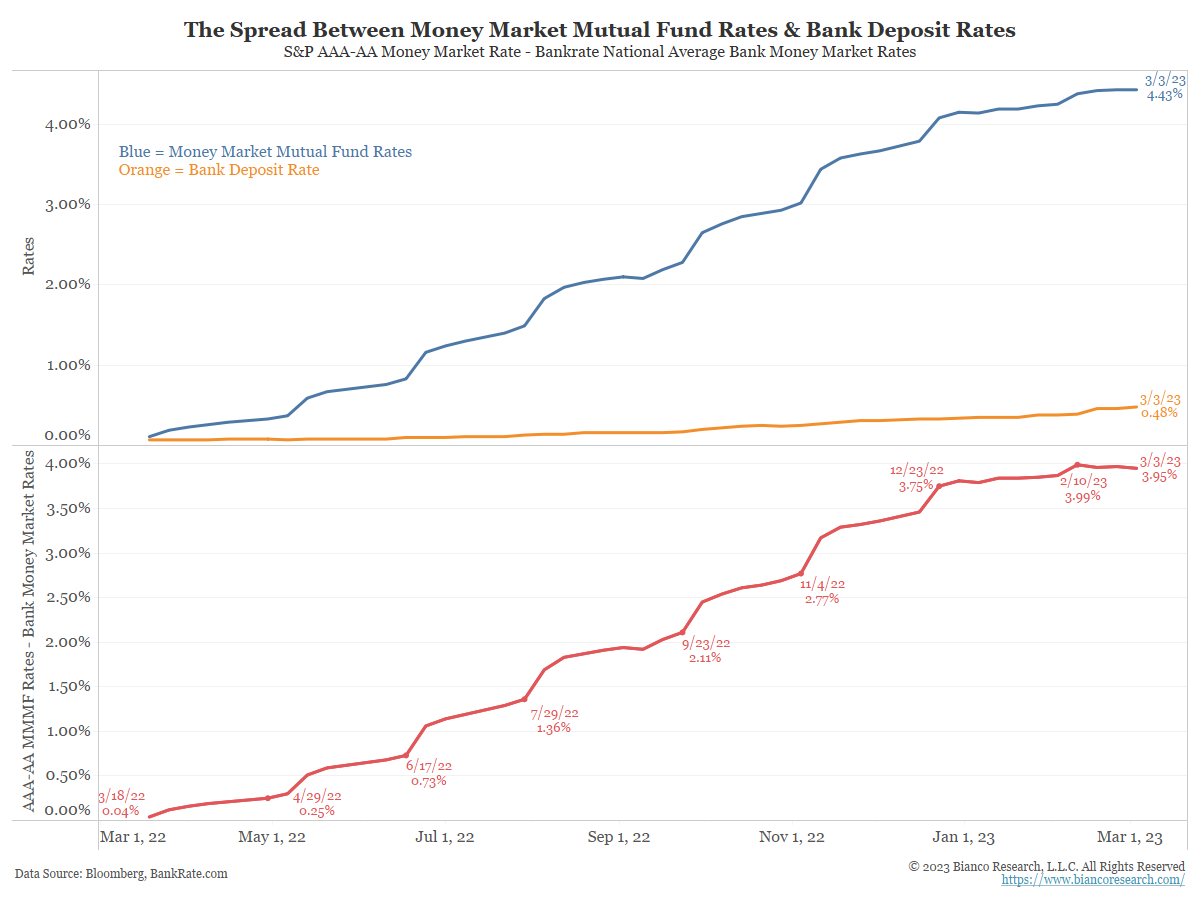

As a bank depositor, you would think that when the Fed raises interest rates, you would receive a higher rate of interest on your deposit. Wrong.com.

The above chart from Bianco Research shows that deposit rates have lagged significantly behind higher money market fund rates, which move in lockstep with the Fed policy rate.

The TBTF banks did not need to raise deposit rates because they didn’t actually need deposits. They have trillions of dollars’ worth of excess reserves at the Fed. Their clients also tend to be larger corporate clients, whose deposits are sticky. The CFO of a Fortune 500 company isn’t going to ditch JP Morgan for some regional bank headquartered in Bumblefuck, America just to earn a few extra basis points. The CFO likes being taken out to Cipriani’s, not Applebee’s. Large corporations also receive other services from the mega banks – like cheap loans – in return for remaining loyal depositors.

The smaller banks could not raise deposit rates because they could not afford to. The interest rates on the UST and MBS bonds held by these banks paid less than the current Fed Funds Rate. That meant that if they were to raise interest rates on their loans to match the Fed, they would have a massive negative NIM. Instead, they just hoped depositors wouldn’t notice that they could get an almost risk-free 5% by pulling their money from the bank and investing in a money market fund. Obviously, that strategy didn’t work.

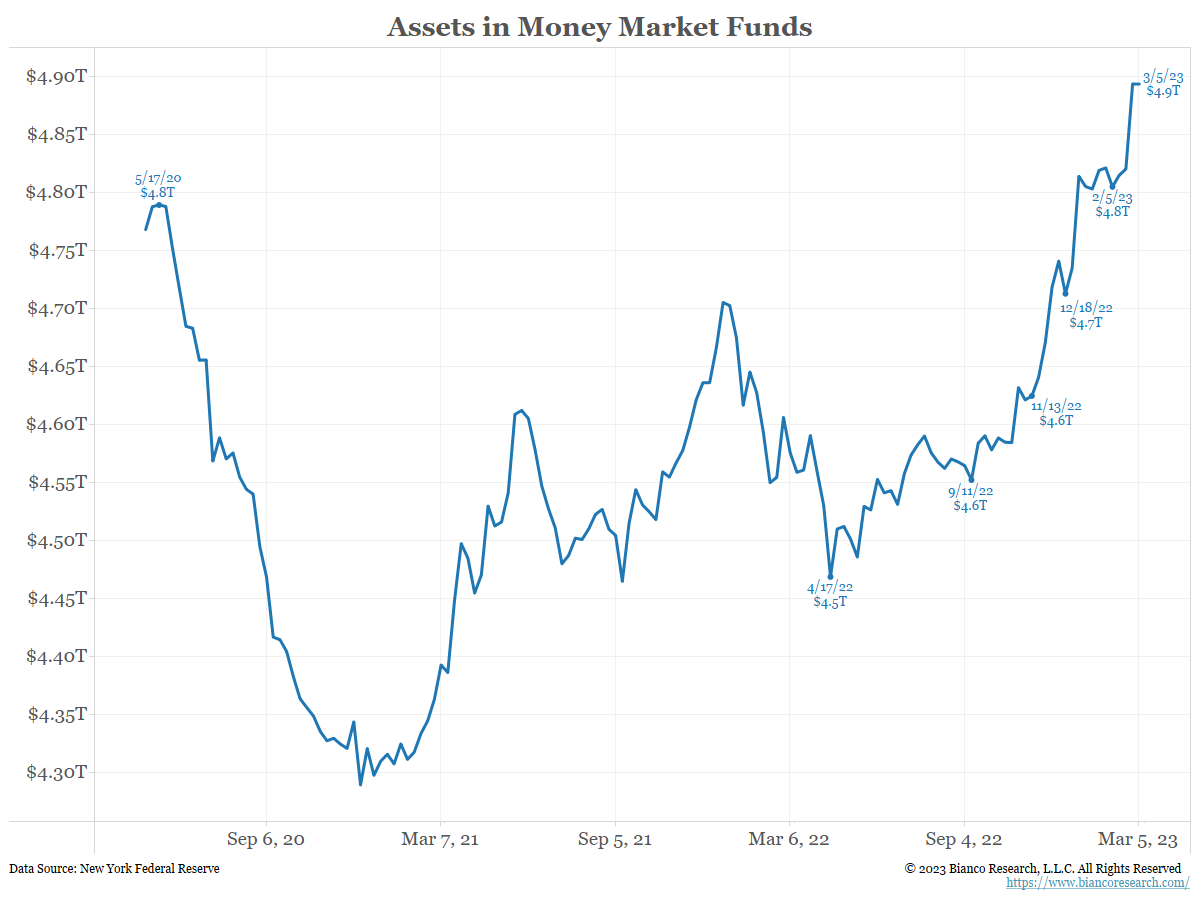

The outcome was that depositors fled the small banks and found a new home in much higher-yielding money market funds.

Source: Bianco Research

As deposits fled the smaller banks, they had to sell the most liquid things on their balance sheet. UST and MBS bonds are super liquid. However, because they were purchased in 2020 and 2021, when marked to market in late 2022 / early 2023, these bonds were worth massively less.

Game Over

The canary in the coal mine was the bankruptcy of Silvergate. Silvergate was a no-name Californian bank before management decided to pave their path to riches by becoming the most crypto-friendly bank in the game. In just a few years, Silvergate became the go-to bank for all the largest exchanges, traders, and holders of crypto who required USD banking services.

Their deposit base ballooned, and they invested their depositors’ money with the USG – which is typically one of the safest investments you can make. It wasn’t like they were dealing with dodgy companies or individuals like Three Arrows Capital; they lent money to the richest and most powerful nation in the world.

Silvergate’s crypto depositors’ decision to flee had nothing to do with a realisation that the bank’s assets – when marked to market – didn’t equal its liabilities. Rather, it was speculation regarding the relationship between Silvergate and FTX. Depositors didn’t want to fuck around and find out whether Silvergate in any way, shape, or form enabled (or even just knew about) the dodgy and potentially illegal activity emanating from FTX. So, they bounced, and the bank had to sell its loans and bonds at a loss to pay out. That is why Silvergate reported staggering losses of $754 million for 2022.

But the outflows didn’t stop. At some point, the market began to worry about whether Silvergate’s assets could be sold at prices high enough to pay back all depositors. The bank run started in earnest, and by the middle of last week, the bank had filed for bankruptcy protection.

Then, shit really hit the fan with the failed SVB rights issue. A rights issue is when, with the help of an investment bank, a company sells shares to large institutional investors at a discount to the current market price. The Financial Times did an excellent walkthrough of the transaction.

The SVB rights issue is interesting because of the sequencing of its execution. Goldman Sachs was the bank used to both bid on the portfolio of underwater SVB bonds, and coordinate the rights issue.

“Goldman Sachs bought more than $21bn worth of securities sold by Silicon Valley Bank last week – a transaction which triggered an ill-fated share sale also managed by the Wall Street investment bank.”

The question is, why did SVB sell the bonds to Goldman first, and conduct the rights issue later? Once SVB sold the bonds, it had to recognise the loss, and it was apparent that the bank was probably in breach of regulatory capital requirements. It also had to disclose all of this to investors (i.e., the folks who might otherwise purchase the stock). Why would you purchase a bank stock if, moments before, it had announced that it had suffered massive losses and might be in breach of capital adequacy ratios? You wouldn’t, obviously, and nobody did. After the rights issue failed spectacularly, luminaries in the tech world instructed their portfolio companies to pull their money from SVB immediately – and a few days later, the bank was bankrupt.

The moral of this sad story is that the bungling of the SVB rights issue further sharpened the markets focus on the unrealised losses sitting on regional banks’ balance sheets. The market started asking more questions. Who else might be in trouble?

Well, it turns out, the entire US regional banking sector has some variation of the same issue as Silvergate and SVB. To recap why these banks are fucked:

- Their deposit base ballooned, and they lent money during a time when interest rates were at a 5,000-year low.

- As interest rates rose in response to the Fed raising its policy rate, the bond and loan portfolios of these banks nursed large, unrealized losses.

- Depositors wanted to get paid more interest than they were getting from their regional banks, so they started leaving to invest in higher-yielding products like money market funds and short-term US Treasury bills. The banks couldn’t stomach these losses because they couldn’t pay the Fed Funds Rate to depositors, since the interest they were earning on their loan and bond portfolio on a blended basis was far less than that rate.

- The market always knew this was going to become an issue eventually, but it took the failure of Silvergate and then SVB to fully drive home just how severe it was. And as a result, every single regional bank is now assumed to be on borrowed time.

Over the weekend, the whole world watched as crypto and tech bros sang the blues about their deposits in Silvergate and SVB. Circle’s USDC stablecoin depegged and began trading down below $0.90 on fears that it had significant exposure to Silvergate, SVB, and possibly Signature Bank. Many argued that this issue was not about crypto or tech, but that it pointed to a systemic problem that affected all banks not deemed Too Big to Fail.

As a result, everyone knew that, come Monday morning when US equity markets opened, a lot more banks were going to be punished. Specifically, many wondered if a nation-wide bank run would ensue.

Bailout

The Fed and US Treasury did not let a good crisis go to waste. They devised a truly elegant solution to solve a number of systemic issues. And the best part is, they get to blame mismanaged crypto- and tech-focused banks as the reason they had to step in and do something they would’ve had to do anyway.

Now, I will walk through the truly game-changing document that describes the BTFP. (Quotes from the document are in bold and italics, and below each is a breakdown of their practical implications.)

Bank Term Funding Program

Program: To provide liquidity to U.S. depository institutions, each Federal Reserve Bank would make advances to eligible borrowers, taking as collateral certain types of securities.

Borrower Eligibility: Any U.S. federally insured depository institution (including a bank, savings association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

This is pretty self explanatory – you need to be a US bank to partake in the program.

Eligible Collateral: Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), provided that such collateral was owned by the borrower as of March 12, 2023.

This means that the financial instruments eligible for use as collateral under the program are largely limited to US Treasury debt and Mortgage Backed Securities. By setting a cutoff date, the Fed has limited the scope of the program to the total size of UST and MBS held by US banks (approximately $4.4 trillion).

Advance Size: Advances will be limited to the value of eligible collateral pledged by the eligible borrower.

There are no size limitations. If your bank holds $100 billion of UST and MBS, you can submit that total amount to be funded using the BTFP. This means that the Fed could in theory lend against the entire stock of UST and MBS securities held on US banking balance sheets.

The previous two BTFP paragraphs are so important to understand. The Fed just conducted $4.4 trillion of quantitative easing under another guise. Let me explain.

QE is the process whereby the Fed credits banks with reserves, and in return banks sell the Fed their UST and MBS holdings. Under the BTFP, instead of buying the bonds directly from the banks, the Fed will print money and lend it against the banks’ pledges of UST and MBS collateral. If depositors wanted $4.4 trillion in cash, the banks would just pledge their entire UST and MBS portfolio to the Fed in return for cash, which it then passes to depositors. Whether it’s QE or BTFP, the amount of money created by the Fed and put into circulation grows.

Rate: The rate for term advances will be the one-year overnight index swap rate plus 10 basis points; the rate will be fixed for the term of the advance on the day the advance is made.

Collateral Valuation: The collateral valuation will be par value. Margin will be 100% of par value.

The Fed’s money is priced at the 1-year interest rate. Given that short term rates are well above long-term rates, this means banks, for the most part, accrue negative interest over the life of the loan. Even though losses are bad, they get to exchange underwater bonds for 100% of their value, rather than recognising losses and going bankrupt. Err’body keeps their job, except for the poor sods at Silvergate, SVB, and Signature. The first shall be the last …

Advance Term: Advances will be made available to eligible borrowers for a term of up to one year.

Program Duration: Advances can be requested under the Program until at least March 11, 2024.

The program is stated to only last one year …when has a government ever given back the power that the people gave them during a time of crisis? This program will almost certainly be extended preemptively – otherwise, the market will throw a big enough fit to demonstrate it needs its fix of printed money, and the program will be extended regardless.

Implications of BTFP

Bigger than COVID QE

The Fed printed $4.189 trillion in response COVID. Right off the bat, the Fed implicitly printed $4.4 trillion with the implementation of BTFP. During the COVID money printing episode, Bitcoin rallied from $3k to $69k. What will it do this time?

Banks are Shitty Investments

Unlike the 2008 financial crisis, the Fed didn’t bail out banks and allow them to participate in the upside this time. The banks must pay the 1-year interest rate. 1-year rates are considerably higher than 10-year rates (also known as an inverted yield curve). The bank borrows short from depositors, and lends long to the government. When the yield curve is inverted, this trade is guaranteed to lose money. Similarly, any bank that uses the BTFP will need to pay more to the Fed than the interest rate on their deposits.

US Treasury 10-year Yield Minus US Treasury 1-year Yield

Banks will accrue negative earnings until either the yield curve is positively sloped again, or short-term rates drop below the blended rate on their loan and bond portfolios. BTFP doesn’t fix the issue that banks cannot afford to pay the high short-term rates that depositors could get in money market funds or treasuries. Deposits will still flee to those instruments, but the banks can just borrow from the Fed to plug the hole. From an accounting standpoint, the banks and their shareholders will lose money, but banks will not go bankrupt. I expect bank stocks to severely underperform the general market until their balance sheets are repaired.

House Prices Zoom!

30yr Mortgage Rate Minus 1yr Treasury Yield

Purchasing MBS will still be profitable for banks because the spread vs. 1-year rates is positive. MBS rates will converge to the 1-year rate as banks arb the Fed. Imagine a bank took in $100 of deposits and bought $100 of treasuries in 2021. By 2023, the treasuries are worth $60, rendering the bank insolvent. The bank taps the BTFP, gives the Fed its treasuries and gets back $100, but it must pay the Fed 5%. The bank now buys an MBS, which is guaranteed by the government, yielding 6%. The bank pockets a 1% risk-free profit.

Mortgage rates will move in lock-step with the 1-year rate. The Fed has immense control over the short-end of the yield curve. It can essentially set mortgage rates wherever it likes, and it never has to “buy” another single MBS.

As mortgage rates decline, housing sales will pick back up. Real estate in the US, just like in most other countries, is big business. As sales pick up because financing becomes more affordable, it will help increase economic activity. If you thought property would get more affordable, think again. The Fed is back at it, pumping the price of houses once more.

USD Strong to Very Strong!

If you have access to a US bank account and the Fed just guaranteed your deposit, why would you hold money in other banking systems without such a guarantee from the central bank? Money will pour into the US from abroad, which will strengthen the dollar.

As this plays out, every other major developed country’s central bank must follow the Fed and enact a similar guarantee in order to stem the outflow of banking deposits and weaken their currency. The ECB, BOE, BOJ, RBA, BOC, SNB, etc. are probably ecstatic. The Fed just enacted a form of infinite money printing, so now they can too. The issues in the US banking system are the same ones faced by every other banking system. Everyone has the same trade, and now – led by Sir Powell – every central bank can respond with the same medicine and not be accused of causing fiat hyperinflation.

Credit Suisse effectively just failed a few nights ago. The Swiss National Bank had to extend a CHF50 billion covered loan facility to CS to stem the bleeding. Expect a near failure of a large bank in every major, developed Western country – and I suspect that in each case, the response will be a blanket deposit guarantee (similar to what the Fed has done) in order to stave off contagion.

The Path to Infinity

As stated in the BTFP document, the facility only accepts collateral on banks’ balance sheets as of 12 March 2023, and ends one year from now. But as I alluded to above, I don’t believe this program will ever be ended, and I also think the amount of eligible collateral will be loosened to any government bond present on a licensed US banks’ balance sheet. How do we get from finite to infinite support?

Once it becomes clear that there is no shame in tapping the BTFP, the fears of bank runs will evaporate. At that point, depositors will stop stuffing funds in TBTF banks like JPM and start withdrawing funds and buying money market funds (MMF) and US treasuries that mature in 2 years or less. Banks will not be able to lend money to businesses because their deposit base is chilling in the Fed’s reverse repo facility and short-term government bonds. This would be extremely recessionary for the US and every other country that enacts a similar program.

Government bond yields will fall across the board for a few reasons. Firstly, the fear of the entire US banking system having to sell their entire stock of USG debt to pay back depositors goes away. That removes an enormous amount of selling pressure in the bond market. Second, the market will start to price in deflation because the banking system cannot return to profitability (and thus create more loans) until short-term rates decline low enough that they can entice depositors back with rates that compete with the reverse repo facility and short-term treasuries.

I expect that either the Fed will recognise this outcome early and start cutting rates at its upcoming March meeting, or a nasty recession will force them to change tracks a few months from now. The 2-year treasury note’s yield has collapsed by over 100 basis points since the onset of the crisis. The market is screaming banking system-sponsored deflation, and the Fed will listen eventually.

As banks become profitable and can once again compete against the government to attract depositors back, the banks will wind up in the same situation as they did 2021. Namely, that deposits will be growing, and banks will suddenly need to start lending out more money. They will start underwriting loans to businesses and the government at low nominal yields. And once again, they will be thinking that inflation is nowhere to be seen, so they won’t be concerned about rising interest rates in the future. Does this sound familiar?

Then, March 2024 rolls around. The BTFP program is set to expire. But now, the situation is even worse than 2023. The aggregate size of the banks’ portfolio of low-interest rate underwritten loans to business and low-interest rate government bond securities is even larger than it was a year prior. If the Fed doesn’t extend the life of the program and expand the notional of eligible bonds, then the same sort of bank runs we’re seeing now are likely to happen again.

Given the Fed has no stomach for the free market in which banks fail due to poor management decisions, the Fed can never remove their deposit guarantee. Long Live BTFP.

While I’m sure that is abhorrent to all you Ayn Rand wannabes (like Ken Griffin and Bill Ackman), the continuation of BTFP solves a very serious problem for the USG. The US Treasury has a lot of bonds to sell, and less and less people want to own them. I believe that the BTFP will be expanded such that any eligible security, which are mostly treasuries and mortgages, held on a US banks’ balance sheet is eligible to be exchanged for fresh newly printed dollars at the 1-year interest rate. This gives the banks comfort that as their deposit base grows, they can always buy government debt in a risk-free fashion. The banks will never again have to worry about what happens if interest rates rise, their bonds lose value, and their depositors want back their money.

With the newly expanded BTFP, the Treasury can easily fund larger and larger USG deficits because the banks will always buy whatever is for sale. The banks don’t care what the price is because they know the Fed has their back. A price sensitive investor who cared about real returns would scoff at buying more, and more, and more, and trillions of dollars more of USG-issued debt. The Congressional Budget Office estimates the 2023 fiscal deficit will be $1.4 trillion. The US is also fighting wars on multiple fronts: The War on Climate Change, The War Against Russia / China, and The War Against Inflation. Wars are inflationary, so expect the deficits to only go higher from here. But that is not a problem, because banks will buy all the bonds the foreigners (China & Japan, in particular) refuse to.

This allows the USG to run the same growth playbook that worked wonders for China, Japan, Taiwan, and South Korea. The government enacts policies that ensure savers earn less on their money than the nominal rate of GDP growth. The government can then re-industrialise by providing cheap credit to whatever sectors of the economy it wants to promote, and earn a profit. The “profit” helps the USG reduce its debt to GDP from 130% to something much more manageable. While everyone might cheer “Yay growth!”, in reality, the entire public is paying a stealth inflation tax at the rate of [Nominal GDP – Government Bond Yield].

Finally, this solves an optics problem. If the investing public sees the Fed as cashing the checks of the government, they might revolt and dump long-term bonds (>10-year maturity). The Fed would be forced to step in and fix the price of long-term bonds, and that action would signal the beginning of the end of the Western financial system in its current form. The BOJ had this problem and implemented a similar program, whereby the central bank loaned money to the banks to buy government bonds. Under this system, the bonds never show up on the central bank’s balance sheet; only loans appear on the balance sheet, which, in theory, must be repaid by the banks – but in practice, they’ll be rolled over in perpetuity. The market can rejoice that the central bank is not moving towards 100% ownership of the government bond market. Long Live The Free Market!

Front Month WTI Oil Futures

The decline in oil prices and commodities in general tells us that the market believes deflation is coming. Deflation is coming because there will be very little credit extended to businesses. Without credit, economic activity declines, and therefore less energy is needed.

The decline in oil prices and commodities in general tells us that the market believes deflation is coming. Deflation is coming because there will be very little credit extended to businesses. Without credit, economic activity declines, and therefore less energy is needed.

A decline in commodity prices helps the Fed cut rates because inflation will decline. The Fed now has the cover to cut rates.

Get Out

The most frightening outcome for the Fed is if people move their capital out of the system. After guaranteeing deposits, the Fed doesn’t care if you move your money from SVB into a money market fund earning a higher rate. At least your capital is still purchasing government debt. But what if, instead, you bought an asset that is not controlled by the banking system?

Assets like gold, real estate, and (obviously) Bitcoin are not liabilities on someone else’s balance sheet. If the banking system goes bust, those assets still have value. But, those assets must be purchased in physical form.

You are not escaping the insidious wrath of inflation by purchasing an Exchange Traded Fund (ETF) that tracks the price of gold, real estate, or Bitcoin. All you are doing is investing in a liability of some member of the financial system. You own a claim, but if you try to cash in your chips, you will get back fiat toilet paper – and all you have done is pay fees to another fiduciary.

For Western economies that are supposed to practise free market capitalism, it’s very hard to enact wide-ranging capital controls. It’s particularly difficult for the US, since the world uses the USD because it has an open capital account. Any outright ban on various means of exiting the system would be seen as an imposition of capital controls, and then there would be even less desire among sovereign nations to hold and use dollars.

It is better when prisoners don’t recognise they are in a cage. Instead of outright banning certain financial assets, the government will likely encourage things like ETFs. If everyone freaks out about the hyperinflationary impact of BTFP and pours money into GBTC (Grayscale Bitcoin Trust), it would have no impact on the banking system. You must enter and exit the product by using the USD. You can’t escape.

Be careful what you wish for. A true US-listed Bitcoin ETF would be a trojan horse. If such a fund were approved and it sucked in a meaningful supply of Bitcoin, it would actually help maintain the status quo rather than give financial freedom to the people.

Also, watch out for products through which you “purchase” Bitcoin, but cannot withdraw your “Bitcoin” to your own private wallet. If you can only enter and exit the product through the fiat banking system, then you have achieved nothing. You are just a fucking fee donkey.

Bitcoin’s beauty is that it is weightless and invisible. There is no outward manifestation of its existence. You can memorise a Bitcoin private key, and anytime you wish to spend money, you can just use the internet and transact. Owning a lot of gold and real estate is heavy and observable. Why did Gatsby get noticed when Daisy killed that poor person with his sports car? It was because it was an ostentatious vehicle that was instantly recognisable. Something similar could be said for a fuck-off large mansion, or a stash of gold that must be protected 24/7 by armed guards. These savings vehicles and related displays of wealth are an invitation to get robbed by another citizen – or even worse, by your own government.

There is obviously a place for fiat. Use it for what it’s good for. Spend fiat, save crypto.

To Da Moon

As I left dinner with the hedge fund dude, I remarked how much more bullish I was on Bitcoin after speaking with him. The end game is here. Yield Curve Control is here. BTFP ushers in infinite money printing … globally.

The ensuing Bitcoin rally will be one of the most hated ever. How can Bitcoin and the crypto markets in general rally sharply after all the bad things that happened in 2022? Didn’t people learn Bitcoin and those associated with it are scumbags? Aren’t people afraid of the narrative that Bitcoin caused the failure of large banks, and almost consumed the US banking system?

The media is also likely going to push the narrative that this banking crisis happened because banks accepted fiat deposits from crypto folks. That is so farcical that I’m experiencing a deep belly laugh just thinking about it. It is patently absurd to think that it’s somehow the crypto industry’s fault that banks – whose job it is to handle fiat dollars – accepted fiat dollars from a cohort of entities related to crypto, followed (at least to our knowledge) all the banking rules, lent those fiat dollars to the most powerful nation in human history, and subsequently couldn’t pay back depositors because the central bank of the Empire raised interest rates and blew up banks’ bond portfolios.

Instead, what crypto did was once again demonstrate that it is the smoke alarm for the rancid, profligate, fiat-driven Western financial system. On its way up, crypto signalled that the West printed too much money in the name of COVID. On the way down, the crypto free markets quickly exposed a plethora of over-leveraged charlatans. Not even the FTX polycule had enough love to overcome the swift justice of the crypto free market. The stench from these reprehensible individuals (and those they did business with) drove depositors to take their hard-earned money to safer and (supposedly) more reputable institutions. In the process, it exposed for all to see the damage that Fed policy inflicted on the US banking system.

For me and my portfolio, I’m largely done trading stonks. What’s the point? I generally buy and hold and don’t trade around my positions that frequently. If I believe what I wrote, then I am signing myself up for underperformance. If there is a short-term trading opportunity where I think I can earn some quick fiat duckets and then take my profit and buy more Bitcoin, I will do it. Otherwise, I am liquidating most of my stock portfolio and moving it into crypto.

If I own any ETFs that are exposed to precious metals or commodities, I will sell those and buy and store the commodity directly if possible. I know this isn’t practical for most people, but I’m just trying to make clear how deep my conviction is on this.

The one exception to my disdain for stonks are nuclear energy-related companies. The West may pooh-pooh nuclear, but nations on the come-up are looking for cheap, plentiful energy to supply the good life to their citizens. Sooner or later, nuclear power will create the next leg higher in global growth, but it’s impossible for an individual to store uranium – so I therefore will do nothing to my Cameco position.

I must make sure my real estate portfolio is diversified across various jurisdictions. You have to live somewhere, and if you can own your home outright or with as little debt as possible, that is the goal. Again, you don’t want to be attached to the fiat financial system if you don’t have to be.

Crypto is volatile, and most goods and services demand payment in fiat. That’s fine. I’ll hold what I need to in cash. I’ll try to earn the highest short-term yield I can. Right now, that means investing in USD money market funds and owning short-term US treasuries.

My barbell portfolio of crypto + long volatility will remain. Once I have finished shifting things around, I must make sure I am adequately protecting my downside. If I do not have enough exposure to instruments that do well in a situation where governments decide to unwind the leverage embedded in the system (rather than continuing to pile on more), I must increase my investment in my favourite volatility hedge fund. Apart from that, the only major risk to my strategy as a whole is if there is a new source of energy discovered that is dramatically more dense than hydrocarbons. Of course, such a source of energy already exists – it’s called nuclear power. If policy makers were spurred on by their citizens to actually build the necessary infrastructure to support a nuclear-powered economy, then all the debt could be repaid with an amazing burst of economic activity. At that point, I wouldn’t make money on either my crypto or my volatility hedges. But even if there was the political will to build that infrastructure, it would take decades to accomplish. I would have more than enough time to rejig my portfolio for the age of nuclear energy.

Given the already-long length of this essay, I couldn’t go into great detail regarding my predictions for how the BTFP and copycat programs will pervert the global financial system. I hope that my predictions can be judged against reality as it unfolds. This is the most important financial event since COVID. In subsequent essays, I will review how the effects of BTFP are tracking against my predictions. I am cognizant that my incredible conviction in the upward trajectory of Bitcoin may be misplaced – but I must judge events as they actually occur, and if it turns out I am wrong, adjust my positioning.

The end was always known in advance. YCC is dead, long live BTFP! And now I shall let the matcha tea warm my soul, and gaze upon the beauty of the sakura.