The Perpetual Swap derivative structure is a beautiful thing. Trading is simple, as it mimics the action of margin trading. Most retail traders are familiar with how to trade on margin. Using this wrapper, we can allow anyone to trade exotic derivatives.

“A quanto is a type of derivative in which the underlying is denominated in one currency, but the instrument itself is settled in another currency at some rate. Such products are attractive for speculators and investors who wish to have exposure to a foreign asset, but without the corresponding exchange rate risk.” – Wikipedia

The ETHUSD swap has become the most liquid ETH/USD trading instrument globally. It allows speculators to trade ETH/USD risk, without ever touching Ether or USD. Like all BitMEX contracts, the margin and settlement currency for ETHUSD is Bitcoin. This keeps things simple from a trading perspective.

When the ETHUSD product listed, I walked readers through the mechanics of a quanto derivative. Please read Why Quanto and Hedging a Perpetual Swap for a refresher.

Subsequent to the launch of ETHUSD, the price of Ether took a digger. In such a bear market, many traders expected the funding rate to stay negative. Logically that makes sense.

The market is falling, so the pressure on the margin should be on the sell side. However, the cumulative funding rate from launch till the present is positive. A positive funding rate means longs pay shorts.

My hypothesis was that the positive funding rate represents the quanto risk premium. I then tasked one of the BitMEX Research analysts to conduct a test:

Step 1

Starting on the 9th of August and ending on the 22nd of October, to capture the funding income, you sold ETHUSD (100 XBT notional), and hedged by purchasing Ether with USD.

Step 2

Every hour, you recalculated your net Bitcoin PnL, hedging that exposure into USD.

Step 3

Compute the net returns in USD terms on your portfolio for the period.

Step 4

Add net total funding you received (paid) from being short the ETHUSD swap over the period.

Results

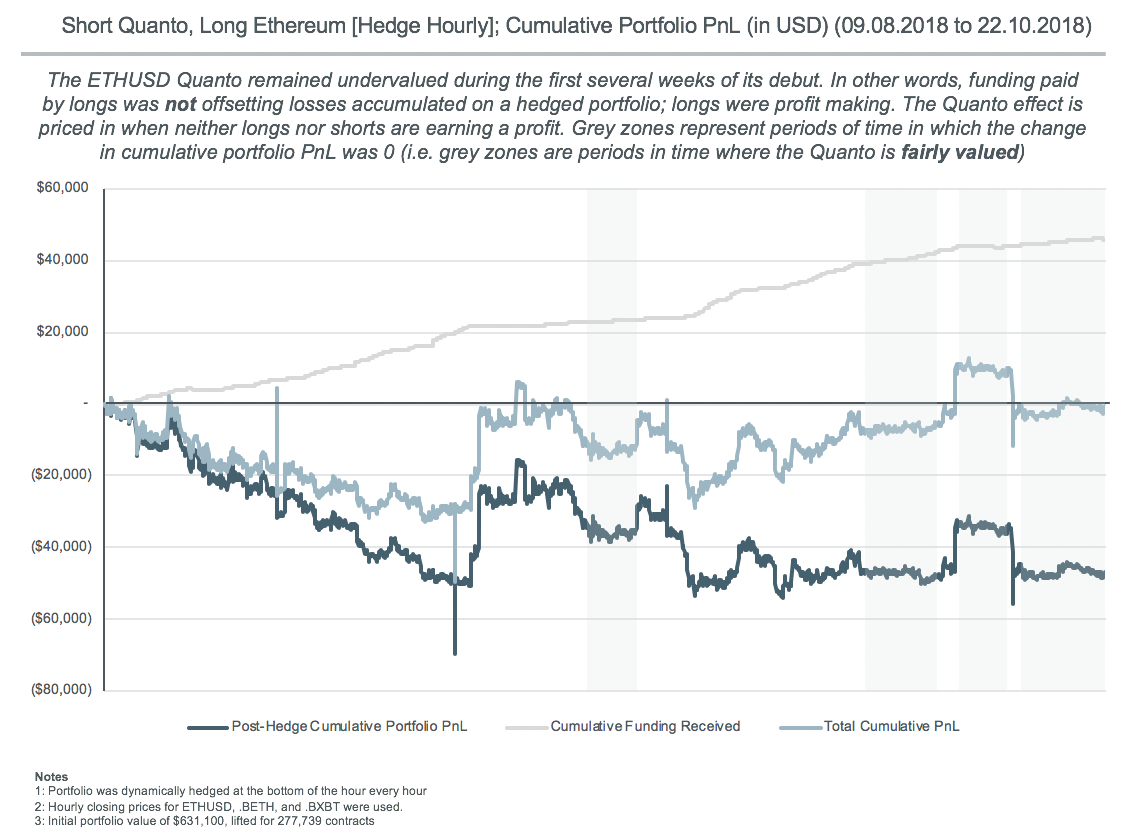

Absent the positive funding, you would have lost $46,779.73 hedging your Bitcoin PnL. This is expected because you are short correlation. Over the past few months, the XBTUSD and ETHUSD correlation has risen.

When the net funding payments received, $46,010.85, are added, your trade essentially breaks even. Along the way you bought 31.94 ETH to delta hedge and accumulated a 43.83 XBT short position to PnL hedge. The conclusion is that even though the funding rate has stayed positive, this funding compensates for the quanto risk premium.

Correlation is rising, therefore traders will bid up the ETHUSD swap over the spot price to profit from the quanto PnL. A positive funding rate results, and brings the market into equilibrium.

This is true over a long holding period. There were times where your net PnL was positive or negative. The chart above provides a time series of the cumulative PnL from this trade. As we can see, the market does misprice this swap occasionally.

It is quite amazing that in under six months, the ETHUSD swap has been priced to perfection. However, the volatility of both Bitcoin and Ether has fallen. When we return to a normal level of volatility, I expect fearful and greedy traders to push the ETHUSD swap away from the quanto adjusted fair price.