(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Being right is great, but the true trading legends are right and then continue holding their positions until they are RICH. A lot of people lament that, had they bought Bitcoin back some years ago, if they held until today, they would be in a different wealth category. But how many shoulda, woulda, coulda investors could have bought Bitcoin at $1 and not sold when it doubled to $2, or how about 10x’d to $10.

Being right is great, but the true trading legends are right and then continue holding their positions until they are RICH. A lot of people lament that, had they bought Bitcoin back some years ago, if they held until today, they would be in a different wealth category. But how many shoulda, woulda, coulda investors could have bought Bitcoin at $1 and not sold when it doubled to $2, or how about 10x’d to $10.

The difference between a trader and a truly prescient investor is having the courage to let your winners run until you reach the logical conclusion of the investing thesis that prompted the initial investment. That requires not just tactical trading acumen, but a macro belief in a theme or regime that powers the asset’s long-term returns.

I laid out in “Pumping Iron” my macro view on inflation and why I believe the crypto complex will feature the best returns in the financial asset firmament over the near to medium-term. The crypto complex market cap has grown markedly since then, now flirting with $2 trillion in total capitalisation. We are riding a bull market wave at the moment, and the question on many people’s minds is – “when should I step off the ride?”

If we can predict the turning point where Bitcoin and cryptos cease to outperform the expansion of the reserve currency’s central bank balance sheet (The U.S. Federal Reserve), then the exit point is clear.

To help identify that turning point, let’s go back in time and empirically evaluate how the major asset classes have or have not outperformed the Fed’s balance sheet expansion. (Note: I am choosing to focus on the Fed because of the USD’s status as the world’s reserve currency. Most of this analysis will still apply to other currencies, but as we live in a USD world, let’s analyse assets priced in USD).

And of course, before I get into it, I want to thank Raoul Pal of Global Macro Investor and Luke Gromen of The Forest for the Trees for the analytical frameworks I will use below to support my thesis.

The 2008 Global Financial Crisis

The beginning of the end started when the world’s central banks decided that they learned their lesson from the 1930’s Great Depression. That is, when deflation takes hold due to a banking crisis, money printer go BRRR. Ben Bernanke was named Time’s Person of the Year in 2009 for “saving” the world from the spectre of deflation.

Below are historical performance charts of oil, copper, The Case-Shiller U.S. Home Price Index, Taiwan Semiconductor (TSMC), The S&P 500, Nasdaq 100, gold, and Bitcoin deflated by the Fed’s balance sheet. If the ratio is rising, that means the asset is outperforming. If it is falling, the asset is underperforming. Since everything costs fiat money, and as a worker bee you can’t print USD, the growth of your financial savings must at least equal the debasement of money so that your quality of life is constant.

WTI Spot Oil

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -95%

2008 Low to Present: -61%

This chart above shows WTI spot oil. We are still a hydrocarbon-powered civilisation. As you can see (and will see in every subsequent chart), there was a sharp fall from 2008 highs to 2009 as the Fed enacted quantitative easing. This marked the Fed balance sheet’s first big growth spurt since immediately after WWII.

Investing in spot oil underperformed monetary debasement. That is a good thing for plebeian consumers, as the cost of energy actually declined.

Copper

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: -88%

2008 Low to Present: -11%

The above chart shows the performance of copper, one of the most important industrial commodities. When copper is ripping, many downstream goods that we consume will become more expensive. Again, the underperformance is a net positive from a commodities point of view as consumers’ cost of living isn’t skyrocketing alongside the Fed’s balance sheet.

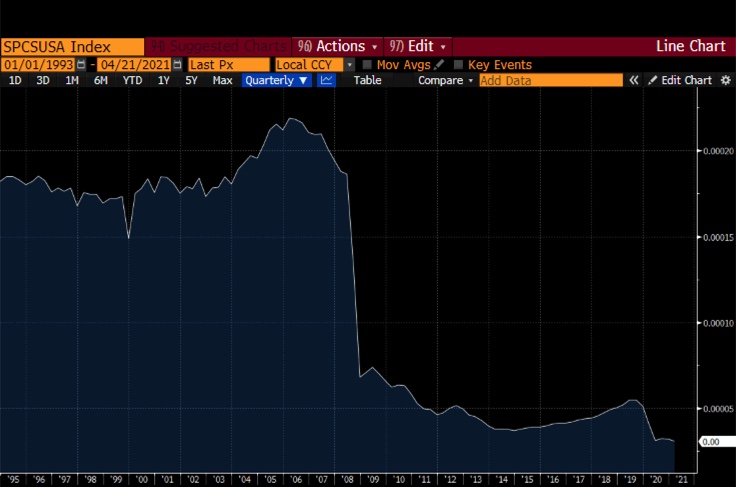

Case-Shiller U.S. National Home Price Index

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2006 High to Present: -86%

2008 Low to Present: -55%

The above chart is of the Case-Shiller U.S. National Home Price Index. Property is commonly thought of as a suitable inflation hedge. However even with the nominal price bouncing off the lows of the 2008 GFC, prices when deflated by the Fed balance sheet got REKT!

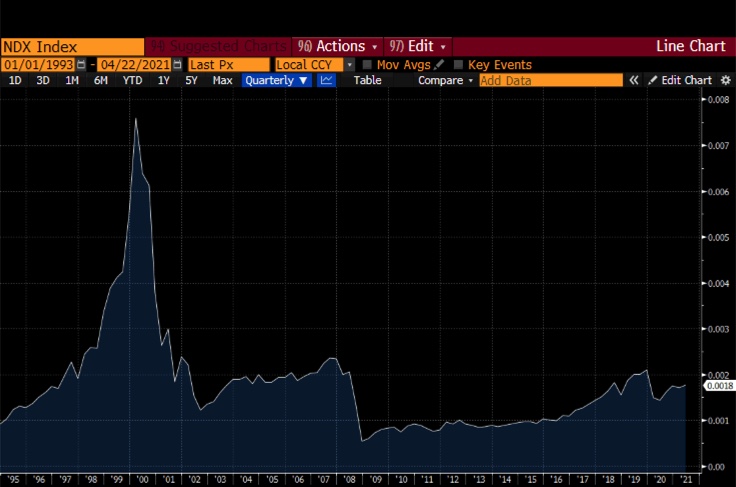

Moving on to the stock market, the computer and internet have fundamentally changed human civilisation and created enormous wealth across equity capital markets. The following two charts show the performance of the Nasdaq 100 Index, which I use as a proxy for tech as a whole, and of Taiwan Semiconductor (TSMC), which I view as the most important company in the world.

Nasdaq

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -25%

2008 Low to Present: +225%

The body bags of analogue businesses continue to pile up in the wake of the Big Tech takeover. The monumental rise in tech and digital businesses has propped up the Nasdaq, enabling it to continue performing well even after the crisis. However, it has still not regained its 2007 local high and we are nowhere close to its real peak vs. the Fed’s balance sheet, which occurred in 2000. For those who think Tech is overvalued, it actually isn’t when viewed against the monetary base. It hurts me to say this, but in the age of central bank inspired monetary chicanery, earnings mean nothing. The flow of liquidity to and from is what determines “value”.

TSMC

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: +16%

2008 Low to Present: +320%

TSMC is a pure-play foundry that is at the forefront in the development of chips that power integrated circuits. TSMC is to the computer and internet as hydrocarbons (oil) are to transportation. No TSMC, no cars, no smartphones, no personal computers, and most importantly no Bitcoin mining.

TSMC is just a monster. It outperformed its 2007 high by 16%. Similar to the Nasdaq, even buying into its parabolic nominal price chart at these levels is not paying too much. It still has significant room to go and match its 2000 valuations.

S&P 500

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -70%

2008 Low to Present: +37%

The S&P 500 represents broad-based equities. So many hedge fund masters of the universe wish their returns could beat the SPX BEFORE fees … on second thought, their clients probably want that even more. (Remember, it’s all about the 2, not the 20) SPX is a straight dog. It is still 70% below its 2007 highs, and don’t even look yonder to 2000 lest you die of fright.

Broadly speaking, equities are not undervalued when deflated by the expansion of the domestic currency monetary base. If anything, they have proved that on a macro level, they are poor inflation hedges.

Now, let’s get into the realm of alternative stores of value. Because the oracles of the Marriner Eccles building cannot print gold or Bitcoin, these so called “zero-income producing pieces of fiction” can act as a neutral monetary asset.

Gold

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: -78%

2008 Low to Present: -42%

As you can see above, gold has not done its job. After performing well up until its nominal all-time high (reached in 2011), it shit the bed and all-in-all has underperformed by 78% since its highs in 2008. Many gold bugs will cite the chicanery surrounding unallocated gold and paper derivatives as supposed levers they “used” to keep the gold price down and avoid signaling the return of rampant inflation. If you believe that, then absolutely buy physical gold using no leverage, and hopefully in the near future the market comes to its senses.

Bitcoin

(Under) Over Performance vs. Fed Balance Sheet

(Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: 24,280,396%

+24,280,396% up top, HOLLA AT THAT! The caveat here is that up until recently, Bitcoin’s nominal USD market cap was supremely insignificant. Only now that it has crossed the $1 trillion milestone can we truly evaluate whether it can continue to outperform Fed sponsored monetary debasement.

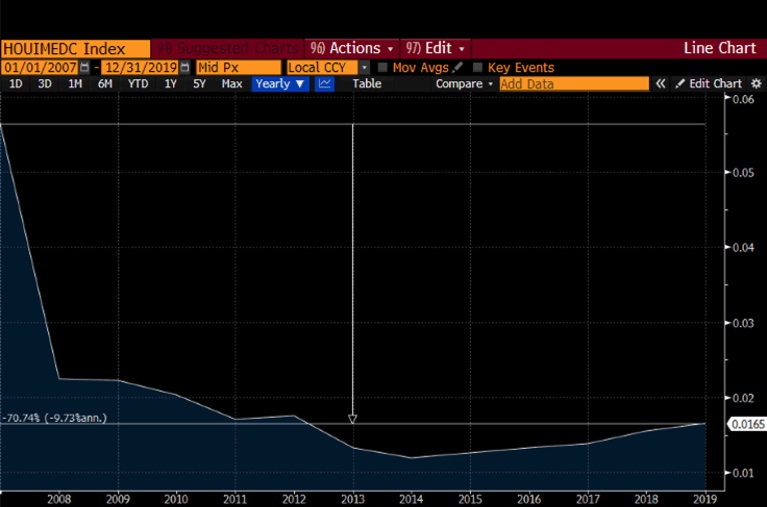

Personal Savings Rate

Evidentially, only TSMC and Bitcoin outperformed the Fed’s balance sheet expansion from 2008 until the present. That alone should illustrate the carnage inflicted on the global markets as a result of efforts to defeat the horrors of deflation. As bad as the performance was, that analysis assumed that you saved 100% of your income and then invested it in financial assets or hard money equivalents.

The aggregate personal savings rate for the U.S. as of February 2021 is 13.6%. Let’s make a big assumption that 86.4% of total income spent in the U.S. is spent on goods whose prices in USD terms increase at the same rate as the Fed balance sheet. That means to just stand still, you must not only invest 100% of the total 13.6% savings, but also lever it up 7.35x (1 / 13.6%). Leverage is necessary because your 13.6% of equity must generate a return such that 100% of your earnings grow at the same pace as the Fed’s balance sheet.

The other way to keep up with the Kardashians is to get paid more. While that’s a nice theory, take a look at this grotesque chart below of how labour wages performed vs. capital from the highs of 2007 until the latest data point in 2019.

Wage growth underperformed by 70%. Ouchie!

Wage growth underperformed by 70%. Ouchie!

Inflation makes everyone a market speculator because they must invest in financial assets and take larger risks to keep pace with monetary debasement. The poorer you are, the less you save, and therefore the more leverage or market volatility is required in order for you to break even amid increasing inflation. The least fortunate among us are often the most susceptible to dubious “get-rich-quick” schemes, as it is imperative that they swing for the fences given their limited ability to save and subsequent difficulties purchasing financial assets with a long-term investment orientation.

Whatever It Takes

COVID first infected China’s financial markets in January 2020. When the rest of the world got the message that a pandemic was upon us, the Fed governors earned their stripes and proceeded to print like no administration has printed before. On March 23rd, the endgame began when the Fed backstopped just about all institutionally-traded USD denominated credit instruments in order to avert a collapse in the financial markets.

The Fed’s balance sheet increased by 25% in 2020. While the percent increase is large in and of itself, the fact that 25% equates to over $2 trillion is absolutely mindboggling. Spurred on by the Fed, both Republicans and Democrats championed spending bills that were in the trillions. Overnight, the reticence for fiscal spending in all OECD countries vanished. Fuck austerity, QE 4 DA PEOPLE!

Given the gargantuan amount of fiat printed since March 2020, how has our universe of assets performed? The following chart is from 20 March 2020 until the present, normalised at 100.

As you’ll see above, Bitcoin entered beast mode in 2020 and beyond. Every asset profiled in this space outperformed except for our dear friend gold.

As you’ll see above, Bitcoin entered beast mode in 2020 and beyond. Every asset profiled in this space outperformed except for our dear friend gold.

Bitcoin’s PAST performance is amazing; however, what must happen for it to continue going forward? What must be true, is that the Fed’s balance sheet must continue to grow, forcing financial players and everyday people alike to look for a safe haven that protects them against inflation. That is the common denominator from 2008 until the present. Let’s now take a look at three important American bureaucracies that play an important role in shaping financial markets: The Federal Reserve, The Department of Treasury, and The White House.

Listen Up

Those of us who love financial markets, trading, and investing all try to think differently than the herd. But what if listening to our policymakers generates better returns with less risk, and less time wasted pontificating?

Their message is simple: money will be provided in any amount necessary and for as long as it takes such that labour does better than capital in the aftermath of COVID.

This two-step is simple, the bureaucrats been watching TikTok and ‘bout to teach y’all how to dougie:

- The Treasury borrows money from the bond market to spend on bills that the White House passes.

- In order to keep interest rates down and prevent the government from crowding out all other borrowers, the Fed expands its balance sheet.

Point 1 is not controversial. Point 2 is. The conventional playbook is that if inflation is actually rising, then the Fed will raise rates to fight it. However, I believe that all branches of the US monetary establishment are telling the market very clearly that the Fed will stand ready to buy all bonds issued so that societal goals are met.

If I’m right, then the balance sheet will continue to grow as the government spends. Bitcoin number go up. If I’m wrong, the Fed’s balance sheet will stop growing and maybe outright decline as it battles inflation. Bad news Bitcoin bears.

Let’s listen to the actors:

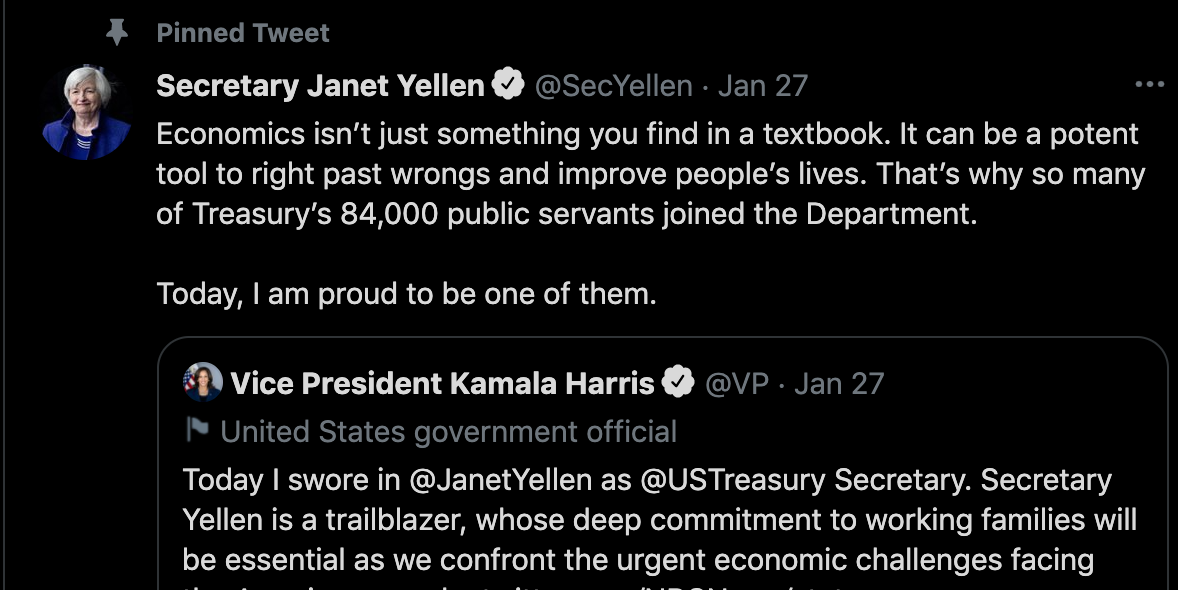

The US government has discovered WOKE.

Translation: QE 4 DA PEOPLE!

Translation: QE 4 DA PEOPLE!

Biden Administration Weighs Forgiving Student Debt by Executive Action – Wall Street Journal, 4 February 2021

The Biden administration is considering using executive action to forgive Americans’ federal student debt, the White House’s chief spokeswoman said Thursday, responding to pressure from Democratic lawmakers and progressive groups.

President Biden has previously questioned his ability to use executive action to forgive some or all of Americans’ federal student debt. He has instead urged Congress to pass legislation to write off $10,000 in student debt for every borrower.

The White House shifted Thursday, saying it was open to forgiving debt without a move by Congress. “Our team is reviewing whether there are any steps he can take through executive action and he would welcome the opportunity to sign a bill sent to him by Congress,” Jen Psaki, the White House press secretary, wrote on Twitter.

Translation: Millennials’ balance sheets must be de-levered in order to prostrate them over the altar of Consumerism just like their boomer parents. Let no household be without a McMansion or gas guzzling pick-up truck / SUV.

Democrats hit back at Summers after criticism of stimulus bill – Financial Times, 9 February 2021

Lawrence Summers, who served as Bill Clinton’s treasury secretary and Barack Obama’s top economic adviser, warned that Biden’s plan was excessive and that it might trigger “inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability”.

Summers’ scepticism, delivered in a Washington Post op-ed on Thursday, clashed with the nearly universal backing among left-leaning economists for Biden’s argument that the U.S. needed to “go big” with massive government support to tackle the still-raging pandemic.

Translation: The Fed is committed to printing money, regardless of the potential impact on the USD.

Dethrone ‘King Dollar’, bring back US jobs: VP Joe Biden’s chief economist Jared Bernstein – New York Times, 28 August 2014

WASHINGTON — THERE are few truisms about the world economy, but for decades, one has been the role of the United States dollar as the world’s reserve currency. It’s a core principle of American economic policy. After all, who wouldn’t want their currency to be the one that foreign banks and governments want to hold in reserve?

But new research reveals that what was once a privilege is now a burden, undermining job growth, pumping up budget and trade deficits and inflating financial bubbles. To get the American economy on track, the government needs to drop its commitment to maintaining the dollar’s reserve-currency status.

Others worry that higher import prices would increase inflation. But consider the results when we “pay” to keep price growth so low through artificially cheap exports and large trade deficits: weakened manufacturing, wage stagnation (even with low inflation) and deficits and bubbles to offset the imbalanced trade.

But while more balanced trade might raise prices, there’s no reason it should persistently increase the inflation rate. We might settle into a norm of 2 to 3 percent inflation, versus the current 1 to 2 percent. But that’s a price worth paying for more and higher-quality jobs, more stable recoveries and a revitalized manufacturing sector. The privilege of having the world’s reserve currency is one America can no longer afford.

Translation: Jared Bernstein is currently on Biden’s Council of Economic Advisors. Whoa, an establishment economist is advocating against the USD remaining the reserve currency. If the U.S. prints enough to fuel fiscal programs, maybe the rest of the world will get the message and adopt a neutral monetary asset like gold or Bitcoin as the global trade currency.

Biden and the Fed leave 1970s Inflation Fears Behind – New York Times, 15 February 2021

Now, as President Biden presses ahead with plans for a $1.9 trillion stimulus package, he and his top economic advisers are brushing those warnings aside, as is the Federal Reserve under Chair Jerome H. Powell.

After years of dire inflation predictions that failed to pan out, the people who run fiscal and monetary policy in Washington have decided the risk of “overheating” the economy is much lower than the risk of failing to heat it up enough.

Translation: QE 4 DA PEOPLE!

Powell says economy still needs Fed support, pushes back on inflation worries – Reuters, 23 February 2021

“Monetary policy is accommodative and it continues to need to be accommodative … Expect us to move carefully, patiently, and with a lot of advance warning,” before any changes, Powell said in response to questions from Republican lawmakers about whether a faster-than-expected recovery still required crisis-level assistance.

Powell, who was testifying before the U.S. Senate Banking Committee, acknowledged the potentially fast growth to come as the coronavirus crisis eases and vaccinations expand. Coming updates to the Fed’s outlook may show the economy expanding “in the range” of 6% this year, he said, and overall output conceivably returning in the next few weeks to the pre-pandemic level.

Such a rebound would have been unthinkable even a few weeks ago, but the rollout of COVID-19 vaccines coupled with federal fiscal support that has bolstered household income has boosted the economic outlook for the year.

When asked what his message was to financial markets, Powell did not talk about the risks of rising bond yields or a possible spike in inflation, but of the roughly 10 million jobs still missing compared to a year ago, and the need for the U.S. central bank’s policy to stay wide open until that is fixed.

Translation: Nominal GDP is going to be LIT! We are going to keep pushing until we get to full employment. What’s full employment? Well, we will know it when we see it. Inflation, nothing to see here. Money printer go BRRR.

27 January 2021 FOMC Statement

In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

Translation: The Fed would buy $120bn per month of bonds. As Janet Jackson said, “What Have You Done For Me Lately?”

|

2021 Month Ending |

USD Billions of Bonds Purchased |

Over or (Under) Monthly Target |

|

February |

179 |

59 |

|

March |

99 |

(21) |

|

April (monthly run rate) |

189 |

69 |

|

Total |

467 |

107 |

Per the above chart, the Fed is buying 30% more bonds than it should be. Could it be that the Fed is stealthily targeting bond yields? That is important because it means that the Fed is implicitly expanding their balance sheet to whatever level is needed to lower borrowing costs for the Treasury as it spends money to achieve the White House’s societal goals.

Biden’s stimulus plan will sharply cut poverty and hand out large amounts of cash to families – The Washington Post, 6 March 2021

President Biden’s stimulus package, which passed the Senate on Saturday, represents one of the most generous expansions of aid to the poor in recent history, while also showering thousands or, in some cases, tens of thousands of dollars on Americans families navigating the coronavirus pandemic.

The roughly $1.9 trillion American Rescue Plan, which only Democrats supported, spends most of the money on low-income and middle-class Americans and state and local governments, with very little funding going toward companies. The plan is one of the largest federal responses to a downturn Congress has enacted and economists estimate it will boost growth this year to the highest level in decades and reduce the number of Americans living in poverty by a third.

Translation: Who can politically oppose helping poor people AND jacking up financial asset prices? No one. Just like on Oprah, everybody gets goodies.

Biden’s New Deal: Re-engineering America, quickly – Axios, 3 March 2021

President Biden recently held an undisclosed East Room session with historians that included discussion of how big is too big — and how fast is too fast — to jam through once-in-a-lifetime historic changes to America.

Translation: YUGE fiscal stimulus is coming. Trillions upon trillions will be spent in order to right the past wrongs, prepare for climate change, and rebuild America’s decrepit public infrastructure. How will we pay for it? That’s the Treasury and Fed’s problem.

FED’S POWELL: LEVEL OF DEBT TODAY IS NOT UNSUSTAINABLE, NO QUESTION OF U.S. BEING ABLE TO SERVICE ITS DEBT RIGHT NOW – Bloomberg, 25 March 2021

… Oh, speak of the devil.

POWELL: DON’T THINK WE WOULD EVER SELL BONDS INTO THE MARKET – Bloomberg, 13 April 2021

A poker player who never folds must have the best cards or an inexhaustible supply of money. What do you think?

Translation: How does a government “invest” when it runs a deficit? It borrows more money in order to spend it.

Translation: How does a government “invest” when it runs a deficit? It borrows more money in order to spend it.

This is the last one.

Translation: It’s 2010 and you are a member of the great American middle class. Your home is now worth a fraction of what you paid for it— but you still you had to pay every cent on your mortgage, credit card bill, and/or student loan note. Meanwhile, the big banks get bailed out globally, senior management stays put and equity holders keep their shirts.

Translation: It’s 2010 and you are a member of the great American middle class. Your home is now worth a fraction of what you paid for it— but you still you had to pay every cent on your mortgage, credit card bill, and/or student loan note. Meanwhile, the big banks get bailed out globally, senior management stays put and equity holders keep their shirts.

Fast forward to 2020 and COVID hits. Asset holders are worried about what inflationary spending policies could do to their large bond portfolios and other assets. Do you care? Fuck that, give me my stimmie check, cancel my student loan, and make sure there are more good paying manufacturing jobs. If you don’t listen, I will find someone who will in 2022. Best believe, the White House knows what time it is. The money printer is going brrr for the great American middle class. If you hold financial assets, you better find the correct rock to hide under.

Print in All Circumstances

Economic canon holds that when inflation, as defined by the government, gets to an unacceptable level, the central bank will tighten money supply by raising rates. They can raise their short-maturity policy rate, and they can raise long-term rates by selling government bonds. As I argued in “Pumping Iron,” if real rates actually rise, Bitcoin / crypto and all other financial assets will plummet. Therefore, the risk to my long-term bullish outlook is that in response to inevitable inflation, the Fed and other central banks will reduce the size of their balance sheets.

Scenario 1: The U.S., which runs the world’s largest deficit in absolute terms, continues to fiscally stimulate the economy and there is no inflation.

The Fed continues to expand their balance sheet in their quixotic quest to achieve 2% core-PCE inflation. That’s their measurement, but don’t worry if your smashed avo toast costs 30% more YoY, as that’s not inflation.

“I consider it completely unimportant who in the party will vote, or how; but what is extraordinarily important is this—who will count the votes, and how.” – Joseph Stalin

There is no general disagreement with how the Fed would respond in this scenario.

Scenario 2: The U.S. achieves all of its policy goals and stops fiscally stimulating the economy even though there is no negative inflationary impact.

If I ate cake for every meal, get all my nutrients, and have a six-pack, would I stop eating cake for every meal? No. So why would you stop handing out goodies to your constituents if there are no consequences? If you don’t hand them out, they will elect someone who will.

There is no way any government will stop handing out free shit if there is no cost to it. It is therefore highly unlikely that the U.S. government will turn off the tap once the population receives consistent support. By the way, in the span of 12 months, the general U.S. population has received 3 stimulus checks per eligible person. There will be a 4th and a 5th ad infinitum.

Scenario 3: Inflation as defined by the Fed runs hot, what happens?

The market consensus is that the Fed will become less accommodative. I disagree – let’s see how the Fed’s central banking counterparts recently dealt with accelerating inflation in their respective economies. I often look at other central banks to predict the actions of the Fed because our high clergy all subscribe to the same economic dogma. They go to the same universities, publish papers on the same topics, and use the same frameworks and models to describe macro-economic behaviour.

Let’s first turn to the Reserve Bank of Australia. They are playing the Yield Curve Control (YCC) game. They set a target; in this case they want the 3-year government bond yield to be 0.10%. If the yield is too low, they sell bonds. If the yield is too high, they buy bonds.

Currently the 3-year yield is approximately 0.20% above their 0.10% target. To maintain their target, they must expand their balance sheet by purchasing more bonds. As you can see, this rate appears to be artificially low because when the market is left to itself at the longer end, yields are materially higher.

Currently the 3-year yield is approximately 0.20% above their 0.10% target. To maintain their target, they must expand their balance sheet by purchasing more bonds. As you can see, this rate appears to be artificially low because when the market is left to itself at the longer end, yields are materially higher.

Rising global yields may push RBA to defend 3y yield target – Bloomberg, 21 February 2021

Ten-year yields climbed the most since the height of the market dislocation in March 2020, while benchmark three-year yields inched further above the Reserve Bank of Australia’s 0.1% target. And this was after the RBA ended a two-month hiatus by stepping back into the market to purchase A$1 billion ($790 million) of the shorter-date debt.

The moves underscore the challenge to central banks as they strive to keep borrowing costs low for years to come while investors position for a more immediate return of inflation. Global vaccination programs and talk of another commodities supercycle have put Australia at the forefront of bets for rebounding growth and rising prices, making the RBA’s job particularly difficult. But it’s unlikely to be unique.

Translation: This shows the dilemma faced by all central banks. Do they serve bond holders by fighting inflation via reducing their balance sheet and raising rates, or do they serve the government by increasing their balance sheet and lowering rates? The RBA has obviously chosen to help lower the government’s financing costs.

The ECB has also chosen lowering government financing costs over fighting inflation.

ECB signals faster money-printing to combat rise in yields – Reuters, 11 March 2021

ECB signals faster money-printing to combat rise in yields – Reuters, 11 March 2021

The European Central Bank said on Thursday it would accelerate money-printing to keep a lid on euro zone borrowing costs, signalling to sceptical markets that it is determined to lay the foundation for a solid economic recovery.

Concerned that a rise in bond yields could derail a recovery across the 19 countries that share the euro, the ECB said it would use its 1.85 trillion Pandemic Emergency Purchase Programme (PEPP) more generously over the coming months to stop any unwarranted rise in debt financing costs.

(Side note: Professor Werner is a god. Please watch or read Princes of the Yen. He coined the term Quantitative Easing.)

Is the Fed going to write the New Testament in the central banking bible, or will they uphold the old-time religion?

All currencies float against each other with no hard money anchor. Consider the following:

- All advanced economies’ federal governments are committed to aggressive fiscal spending to re-energise their middle class after the ravages of COVID.

- The government will sell bonds to finance spending rather than raising taxes too aggressively. At a certain level, raising taxes acts as a drag on the economy and is very unpopular (take a look at the Laffer Curve). It is much easier politically to print money and spend it into the economy.

- The central bank will support the government by expanding their balance sheet to buy bonds in order to reduce borrowing costs.

- A weaker currency helps your export sector. Increasing the supply of a thing, reduces the price of a thing.

- In conclusion, if everyone else is debasing their currency to stimulate their domestic economy, you must do it too. If you don’t, your currency will appreciate in value and it hurts your export sector.

The Fed doesn’t have a choice. It must expand its balance sheet even if yields rise. More importantly the process is reflexive. The more the Fed prints, the more the private bondholders will sell into the Fed because of inflation fears, the more the Fed has to print to keep borrowing costs manageable for the government.

Separately, check out Lords of Finance for some additional context on historical central bank monetary policy. It describes how the Fed, Bank of England, Banque de France, and Reischebank’s governors interacted with each other between WWI to WW2.

Grow Up or Blow Up

I have no price target for Bitcoin. I only care about the size of the Fed’s balance sheet. The Fed must stand ready to buy what the Treasury is selling. Otherwise, the reorientation of the U.S. economy from capital to labour cannot happen.

That is the end state. Between now and then, there will be intense volatility as the market – for the first time in a generation – experiences real, persistent and government mandated inflation. Most market participants simply have no mental model for how to deal with this scenario. In addition, the exponential transformational network effects of technology intersect with the coming period of aggressive fiat monetary expansion. Humans are linear thinkers who extrapolate a known past into an unknown future at a constant rate.

Investors who possess an active imagination that depicts a future not seen before will be able to appreciate an inflationary period where Bitcoin / crypto is the release valve. The charts clearly show that Equities, Real Estate, and even Gold failed to protect the value of investors’ capital in the face of aggressive central bank balance sheet expansion. If they couldn’t do it in 2008, what hope is there for overall financial market outperformance in the new roaring ‘20s?

Do not be beguiled by the siren song of nominal price appreciation. At all times, you must deflate nominal returns by the amount of new money in the domestic system. Only then will winners and losers be as clear as a double-boiled abalone, fish maw, and chicken soup.