(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

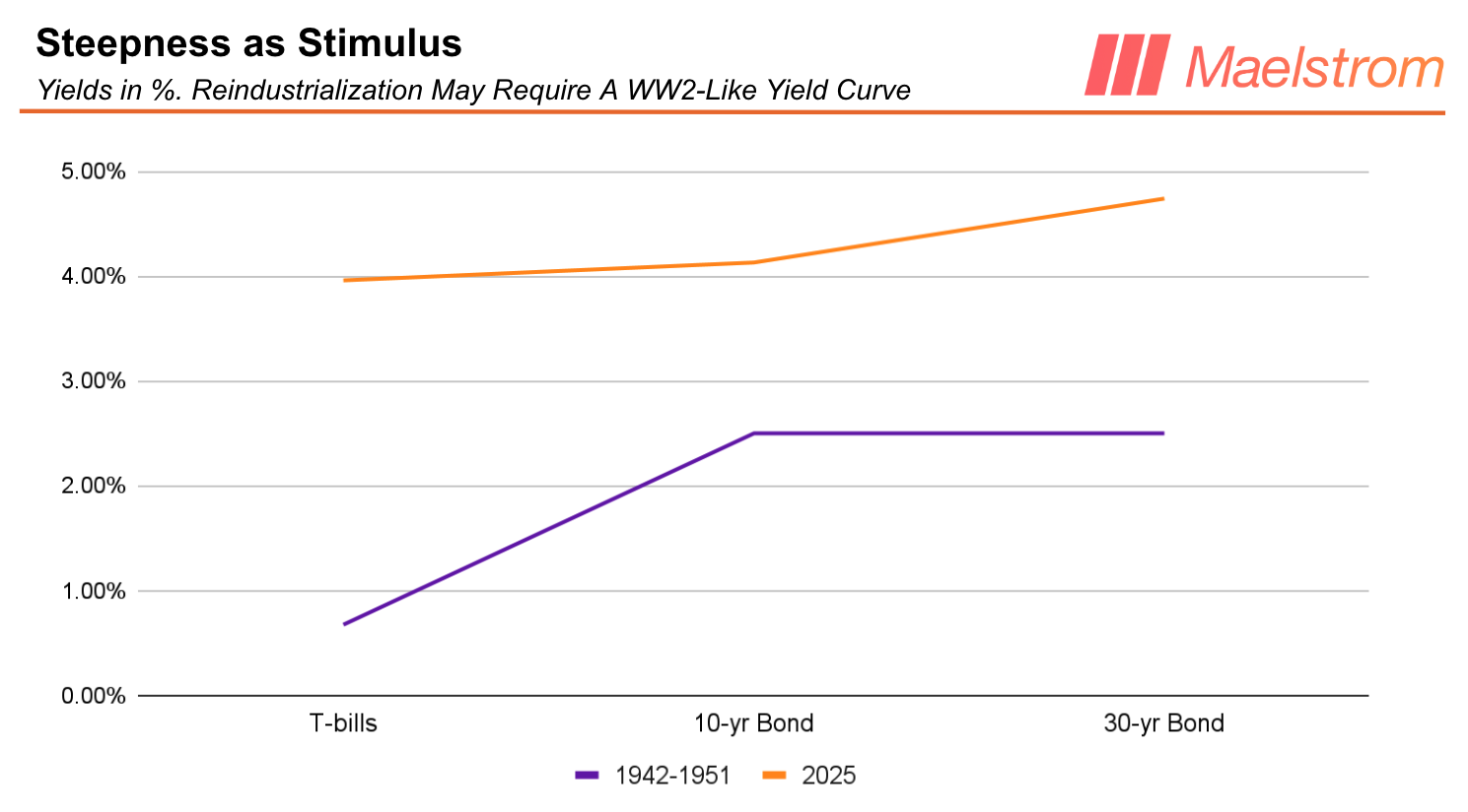

Buffalo Bill Bessent’s plan to re-industrialize America and attempt to forestall the inevitable decline of Pax Americana from a quasi-empire into purely a powerful nation state is nothing new. The exigent circumstances of WW2 allowed the Treasury to subsume the Fed from 1942 until 1951. Part of Bessent’s is reshaping the yield curve, aka yield curve control. What did the yield curve look like during that period versus today?

The Fed capped treasury bill (T-bills) yields at 0.675% and 10-year to 25-year bonds at 2.5%. As you can see, the current yield curve features both higher short-term and long-term rates. However, the key difference is that the yield curve back in the day was much steeper than the current one. Before I discuss the benefits to various sectors of the American economy of a 1951-shaped yield curve, let’s understand how the Fed, using its current tools, could engage in this type of yield curve control (YCC).

The Fed capped treasury bill (T-bills) yields at 0.675% and 10-year to 25-year bonds at 2.5%. As you can see, the current yield curve features both higher short-term and long-term rates. However, the key difference is that the yield curve back in the day was much steeper than the current one. Before I discuss the benefits to various sectors of the American economy of a 1951-shaped yield curve, let’s understand how the Fed, using its current tools, could engage in this type of yield curve control (YCC).

Manipulating the yield on T-bills by lowering the interest on banking reserves (IORB) and the rate at which banks borrow from the discount window (DW) allows the Fed to pin short-term yields where it desires. Using the System Open Market Account (SOMA) to print money (e.g. create banking reserves) and purchase bonds from banks, the Fed ensures yields do not exceed the agreed upon cap. This action expands the Fed’s balance sheet. The current Fed toolkit can perfectly achieve a 1951-shaped yield curve. The question this essay will ponder is how politically Trump and Buffalo Bill Bessent will achieve this level of market manipulation.

Before we get into the politics and bureaucratic rules that govern the Fed, I want to touch on the benefits for various sectors of the economy of a 1951-shaped yield curve.

The essence of Buffalo Bill’s plan is to move credit creation and by extension economic growth out of the hands of the Fed and various non-bank financial institutions like private equity firms into the hands of small and medium-sized bank loan officers (I will call these regional banks). In his recent Wall Street Journal op-ed where he lambasted the Fed, he described it in populist terms of elevating Main St. over Wall St. Don’t get too hung up on the fact that entrance into his economic Valhalla requires the use of the undemocratic tools of Fed money printing. Bessent is a two-faced Treasury Secrecy as evidenced by his critique of Bad Gurl Yellen’s policies prior to his ascension and dutiful implementation of the same said policies post-coronation.

For regional banks to create credit profitably, they require a steep yield curve. The chart below shows that while the overall rate of interest was lower during the 1942-1951 period, the yield curve was much steeper and thus it was safer and more profitable to lend to SMEs. SMEs are the lifeblood of the American economy. Firms with fewer than 500 FTEs account for roughly 46% of employment. However, these SMEs cannot get loans when the Fed is the primary issuer of credit, as this printed money flows to large corporations who can access institutional debt capital markets. Also, the yield curve is too flat if not inverted; therefore, it is too risky for regional banks to lend to these types of businesses. My essay “Black or White” talked about this. I called Bessent’s monetary policy QE 4 Poor People.

The banks will now lend to the real industry that can produce the weapons needed for another glorious century of Bombs of Baghdad / Tehran / Gaza / Caracas (yes, an attempt at Venezuelan regime change is going to happen by 2028) etc. fill in your brown or Muslim population center and now the American military can bring forth DemocracyTM … assuming the denizens are still breathing :(.

That fixes the industrial side of the equation. In order to placate the American plebes, who require the ever-expanding welfare state to purchase their allegiance, the government must finance itself more affordably. By fixing the yield on long-term bonds, Bessent can issue infinite amounts of dogshit treasuries that the Fed dutifully buys with printed dollars. The interest expense collapses, as does the federal deficit.

Finally, the value of the dollar relative to other filthy fiat currencies and gold collapses. This allows American industry to export competitively priced goods to Europe first and then the global south in competition with China, Japan, and Germany.

Conceptually, it’s very easy to understand why Bessent wants to take control of the Fed and enact YCC, but the current Fed is not playing along. Therefore, Trump must pack the Fed with his loyalists who will submit to the will of Buffalo Bill lest they get the hose again. Fed Governor Lisa Cook is about to experience the 2025 version of the firehose treatment. If you don’t know what that is, take a gander at the tactics used by the establishment during the civil rights protests in the 1960s.

The Fed has two boards that control the various policies needed for Bessent’s plan to succeed. The Federal Reserve Board of Governors (FBOG) controls the IORB and, by extension, the rate on DW loans. The Federal Reserve Open Market Committee (FOMC) controls the SOMA. How do voting members of each board interact with each other? How are these voting board members chosen? How can Trump legally gain control of both boards quickly? Speed is of the essence because the 2026 midterm elections are a little over one year away, and Trump’s Team Red Republicans will face stiff competition at the ballot box. If Team Red Republicans lose control of the Senate and Trump hasn’t got a voting majority on both boards by November 2026, the Team Blue Democrats will confirm none of his future appointments. These are the questions that this essay shall answer. I must caution that when delving into the purely political sphere, there is a heightened risk of error. Humans do weird and unpredictable things. My goal is to point out a very probable path forward, and highly probable is all that my portfolio requires to remain long as fuck Bitcoin, shitcoins, physical gold bullion, and gold miners.

Fed Board Primer

Understanding the bureaucratic decision-making process of the organization in charge of printing money is integral to my investment framework. Along my educational journey into the mechanics of the global filthy fiat monetary system, I learned many things about how various finance ministries and central banks operate. As complex adaptive systems filled with nodes of human decision makers, these bureaucratic organisms must abide by “rules” to achieve anything. Certain rules govern the unelected bureaucracy (the Fed) responsible for the US monetary policy. Therefore, I must answer a few questions to forecast how said policy will bend to the will of Trump and Buffalo Bill Bessent.

- Who, and specifically which boards, votes on which parts of monetary policy?

- How many aye votes are required to carry a motion?

- Who chooses the people who sit on these various boards?

- When are board members replaced?

First, Trump must gain four seats for a majority on the seven-member FBOG. Then he can use his FBOG majority to get seven voting seats for a majority on the twelve-member Fed Open Market Committee (FOMC). I will explain the monetary policies each body can enact, member selection, and how Trump can get control by the end of the first half of 2026.

Let’s dive into the composition of the FBOG.

FBOG Explained

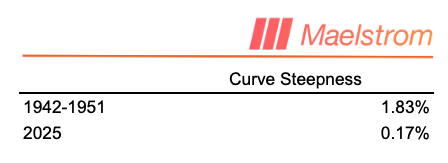

There are seven members appointed by the president, confirmed by the Senate, who sit on the FBOG. Below is the current list of governors:

The FBOG has power over two very important things. One, the board sets the IORB. Two, the board votes to approve nominated Federal Reserve District Bank presidents who rotate into voting positions on the FOMC.

In order for the Fed to manipulate short-term rates effectively, it must set the IORB within the upper and lower bound of the Fed Funds rate determined by the FOMC. Therefore, when things are harmonious within the organization, the FBOG and FOMC work together and the IORB is within that range. But what if the FBOG is pro-Trump and believes monetary policy set by the FOMC is too restrictive? Is there anything the FBOG can do to force the FOMC to lower the Fed Funds rate?

The FBOG could set the IORB much lower than Fed Funds. This opens up an arbitrage opportunity for the banks that are members of the Fed. The banks can post collateral at the DW, whose rate will follow the IORB lower, borrow at the lower DW rate and lend at SOFR. The loser is the Fed, as it essentially prints money and hands it to the banks doing the arbitrage. In order to stop getting cucked by Jamie Dimon et al., the FOMC must lower the Fed Funds rate to match the IORB, even if they would rather not because a majority of voting board members suffer from TDS.

If Trump had a four-seat majority on the FBOG, he could force the FOMC to lower rates to the level he desires quickly. How many governors are loyal to Trump at this current moment?

Because beta cuck towel bitch boy Jerome Powell’s term as Fed chairperson finishes in May 2026, certain board members are angling to replace him. To show their fealty to Trump, they speak publicly about what the Fed policy should be, and in certain circumstances dissent from the majority decision at FOMC meetings. The two board members who dissented at the July 2025 meeting were Bowman and Waller. Trump is halfway there.

Surprisingly, Adriana Kugler abruptly resigned from the board this summer, and the Senate has confirmed Trump’s nominee Stephen Miran. The rumor on the street is that Kugler’s hubby was trading securities during Fed blackout periods; for those readers who are not politically connected, that behavior might be called insider trading and comes with a one-way ticket to JAIL if the DOJ ever comes knocking. Kugler resigned before being tarred and feathered by the Trump administration. With Kugler gone and Miran in, that’s three in Trump’s camp, just one more to go.

Like all humans, Fed governors abuse their power. They insider trade (see the previous paragraph), and in board member Cook’s case, allegedly lie on mortgage applications. Bill Pulte, the head of the Federal Housing Finance Agency, accused Cook of mortgage fraud and called for her resignation. She stood her ground and refused to go. Pulte referred her case to the Department of Justice (DOJ) and its head, Pam Bondi, is currently reviewing whether to seek a grand jury indictment for bank fraud. Grand juries almost always agree to indict. It is trivial for the DOJ to get the green light to indict Cook, and therefore I can only imagine the hesitation on the DOJ’s part is to use the threat of a formal indictment as leverage to force Cook to resign. I don’t know if she is guilty or innocent; depending on which mainstream media outlet you follow will determine whether you believe in her guilt or innocence. Supposedly, Buffalo Bill Bessent had irregularities on some of his financial applications with banks. Everyone is a criminal in America, doncha know! Regardless of her ultimate guilt or innocence, the DOJ has close to a 100% conviction rate, and Cook will be cooked if she doesn’t resign. I imagine her obstinacy is purely a negotiation tactic for a soft, cushy landing at some well-paid academic post in government or academia provided by the Trump administration. In any case, she will not be on the FBOG by early 2026. Snake eyes, mothafucka!

With four votes in his pocket, Trump can cap the yields on T-bills quickly as he instructs the FBOG to drop the IORB. Next up, the FBOG can unshackle the regional banks from nonsensical regulations and allow them to lend to Main St. small businesses as Bessent desires. The FBOG can do this as it handles the regulation or lack thereof of commercial banks. The last piece of the puzzle is gaining control of the quantity of money, which allows him to fix long-term yields much lower via the SOMA. To accomplish this, Trump needs control of the FOMC.

How then can control of the FBOG lead to getting a seven-vote majority on the FOMC?

Federal Reserve District Bank Presidents

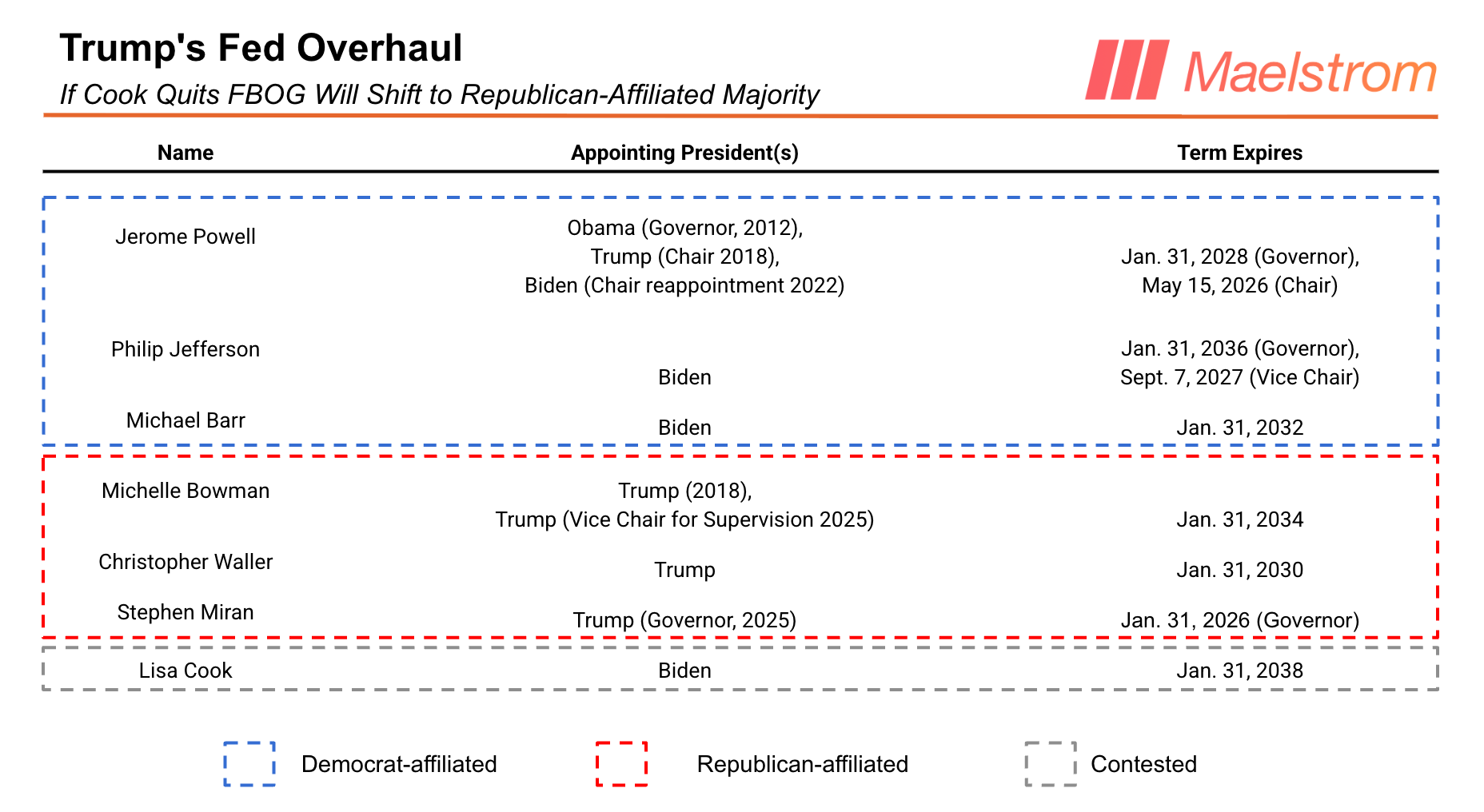

There are twelve Fed district banks. Back in America’s more agrarian past, different districts needed different interest rates depending on the type of goods and services provided to the national economy throughout the year — hence the need for twelve district banks. Each district bank nominates a president who must receive at least four aye votes from the FBOG to sit on the FOMC. There are only five voting members out of the twelve district presidents on the FOMC, with the New York Federal Reserve Bank president holding a permanent voting seat. Therefore, each year, four different district bank presidents vote on the FOMC. Every year ending in a 1 or a 5, the district presidents face re-election by each Fed district’s board. A simple majority of the Class B and C board members (four out of six) on each district board votes to select a bank president. In February of next year, all presidents are up for reelection. The relevant voting districts alongside New York are:

- Cleveland

- Minneapolis

- Dallas

- Philadelphia

What do you notice about the professional backgrounds of most of these board members? They are financiers or industrialists. Their personal net worth would increase dramatically if money were more plentiful and cheaper. These folks are also all human, and humans usually when left to their own devices, always act in their own self-interests. I do not know their political affiliations, but I am confident that even if they suffer from TDS, the antidote of higher asset prices that enrich themselves and their cronies will cure this affliction. That being said, if it’s known that the FBOG will only approve a president who would vote in favor of easier monetary policy on the FOMC, the boards of each district bank will do what’s in Trump and their best interests.

If the district boards don’t put through dovish candidates for the FOMC seat, the FBOG will reject them. Remember, Trump now has the controlling four votes out of seven.

Trump needs only three out of four new voting governors to be loyalists. That gets him to seven votes on the FOMC, and most importantly, control of the SOMA, which is the Fed’s money printer. Then Trump’s peeps on the FOMC will print the money to buy the shitload of dogshit debt which Buffalo Bill Bessent cannot find a buyer. And there you have it, ladies and germs, the Treasury Fed Accord of 2026. Complete with money printing and YCC. Just remember that in the filthy fiat financial system, a pre-flop hand of Four, Seven off-suit is more powerful than pocket rockets.

But I know y’all are jonesin’ for a bull post on my future price of Bitcoin assuming my money printing prediction comes true. Here you go.

Bull Market Math

For those who doubt Trump is serious about printing money to “revitalize” the dream of Pax Americana, here is a brief history lesson on what animates elite politicians to push for radical change. American elite politicians have always done whatever it takes, even if it is very unpopular, to preserve the fruits of the supposed empire for the ruling class. The relationship between the descendants of former African slaves and the European immigrants is a great example and one that continuously dominates the political and social discourse of the country. It was the Civil War, the bloodiest war in American history, that saw President Lincoln kneecap the Confederate economy by emancipating slaves. After the Union triumphed, they abandoned the newly freed humans to Jim Crow segregation in the former Confederate states, and the ruling elite didn’t reconsider formally extending suffrage and other civil rights to the former slaves until 1965. The rise in literacy amongst former slaves and the #Marketing of communism that espoused economic and civil equality of all humans enthralled the black underclass. The problem was that the elite needed those poor black bodies on the front line in Indochina fighting communist “Charlie”, in the northern factories producing exportable goods, in the wealthy households doing domestic work, and on the southern farm but definitely marching on televised Washington D.C. asking for the same rights as everyone else. American #Marketing also needed to sell an image to the non-aligned world that American capitalism was better than Soviet communism. And it’s not a good look when the nation’s Declaration of Independence says “all men are created equal” but police dogs are snarling at little girls on their way to newly desegregated schools. Therefore, a Southern Democrat, resident Lyndon B. Johnson, became a champion for civil rights for a bunch of niggers who were only a few generations removed from picking cotton, much to the chagrin of many members of his class. Today, another war against a more united, prosperous, and militarily strong Eurasia (Russia, China, India, and Iran) requires a drastic change in credit allocation. And therefore, I proclaim with extreme confidence regarding money printing, these crackers ain’t playin’.

Trump and Buffalo Bill Bessent believe it is their mission to restore the global primacy of America. That requires rebuilding a solid manufacturing base to produce real goods, not “services”. President of China, Xi Jinping, came to a similar conclusion when faced with the 2018 US-China Trade War started by Trump. Xi crushed the animal spirits of the financiers and big tech CEOs to change the economic direction of China. Who would have thought Alibaba CEO Jack Ma would be called to Zhongnanhai to drink tea and serve a stint in tycoon jail. Instead of building shitty apartments and bike-sharing apps, the best and brightest in Xi’s China would conquer the green economy, rare earths, military drones, ballistic missiles, AI etc. And after almost a decade, China can endogenously produce all the real goods a nation state needs to preserve its sovereignty in the 21st century without the help of America.

The point is, do not doubt that team Trump will use all the tricks in the book to print the money this transformation of America requires. With that said, indulge me in a bit of mental masturbation as to the amount of credit the Fed and the commercial banking system will create by 2028.

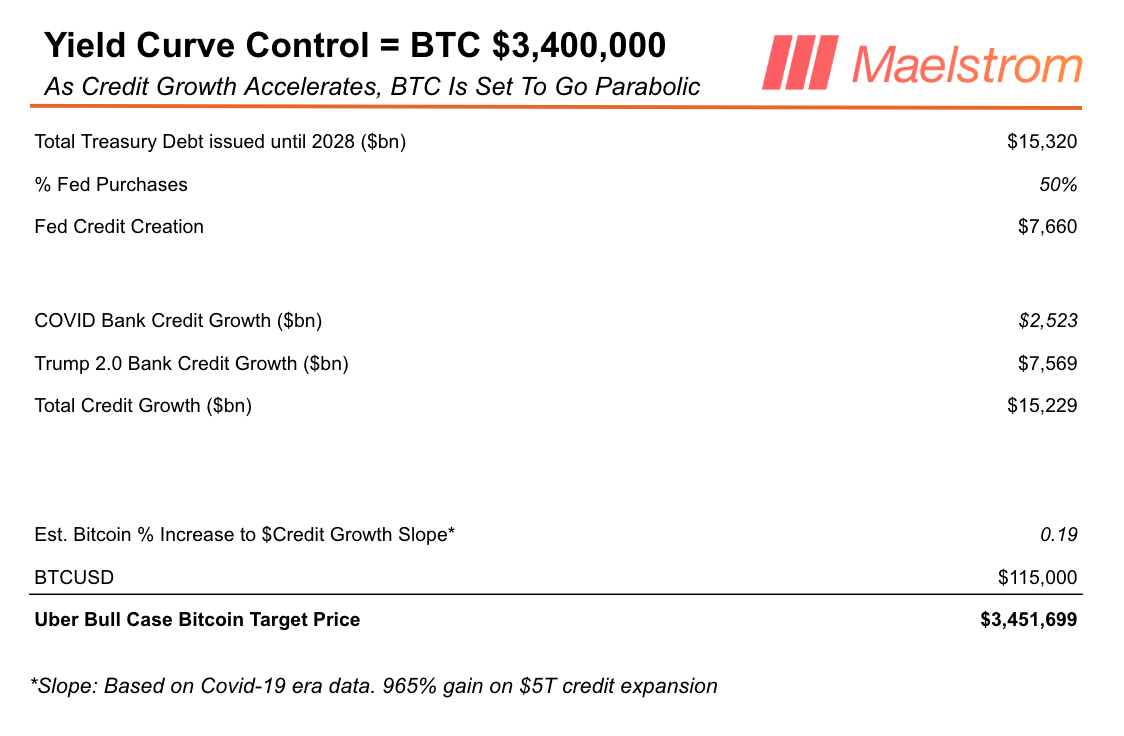

Between now and 2028, the Treasury must issue new debt to pay back old debt and to fund the government deficit. I used the <DDIS> function on Bloomberg to estimate the total amount of treasury debt maturing between now and 2028. Then I assumed the federal deficit would be $2 trillion per year until 2028. That brings my estimate of treasury debt issuance to $15.32 trillion.

Between now and 2028, the Treasury must issue new debt to pay back old debt and to fund the government deficit. I used the <DDIS> function on Bloomberg to estimate the total amount of treasury debt maturing between now and 2028. Then I assumed the federal deficit would be $2 trillion per year until 2028. That brings my estimate of treasury debt issuance to $15.32 trillion.

During COVID the Fed purchased approximately 40% of all treasury debt issued using the SOMA, which increased the size of the balance sheet. I believe the Fed will purchase 50% or more of debt issued, because today even fewer foreign central banks will buy treasury debt because they know Trump will issue a fuck ton of it.

Arriving at an estimation of bank credit growth is difficult. The most defendable estimate is to use the COVID period as guidance. During COVID, Trump ran QE 4 Poor People. Bank credit growth increased by $2.523 trillion over that period evidenced by the growth in banking other deposits and liabilities reported each week by the Fed. Trump has approximately three years left to juice the markets, which equates to $7.569 trillion of bank loans issued.

That brings the total Fed plus commercial banking credit growth to $15.229 trillion. The most finger in the air portion of this model is guessing how much Bitcoin will rise per dollar of credit created. Again, I referred to the COVID time period. The slope of the percentage increase in Bitcoin to a dollar of credit growth was ~0.19. Ladies and gentlemen, that results in a 2028 Bitcoin price prediction of $3.4 million!

Do I think Bitcoin will rise to $3.4 million by 2028? No, but I believe the number will be markedly higher than the ~$115,000 that it trades at today. My goal is to get the direction of travel correct and be confident that I’m betting on the fastest horse, assuming that Trump is serious about printing trillions of dollars to achieve his policy goals. This model does just that.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar