BitMEX Happenings

For those in Hong Kong, Happy Buddha’s Birthday.

It’s that time of the month: expiry for XBTK15 and XBUK15 is Friday at 12:00 UTC. We are listing two new long-term contracts, XBTU15 (25 September 2015) and XBUZ15 (25 December 2015), on Friday as well.

BVOL7D: New Weekly Volatility Futures Contract

Two weeks ago we launched the popular BVOL24H. BVOL24H allows traders to speculate on the daily realised volatility of Bitcoin. Many traders have asked for a weekly version as well because they have a weekly time horizon for their trading strategies. We have listened: BVOL7D will expire every Friday at 12:00 GMT. With a new contract comes a new index: the underlying index .BVOL7D measures weekly volatility of Bitcoin using Bitfinex Bitcoin / USD prices snapped every 5 minutes. For each 1% point move in the volatility, the contract pays out 0.01 Bitcoin.

Armed with daily and weekly expiring volatility futures contracts, traders can construct very sophisticated strategies. Imagine you are long XBTK15 which expires this Friday, and the market is trading sideways. Buying volatility is a good form of insurance. If price action intensifies, you will make money regardless of the outright direction. If the market moved lower, some of the loss on your long XBTK15 contracts is offset from profit on your long BVOL7D contracts.

What Real Market Manipulation Looks Like

Bitcoiners love to take to Reddit regaling stories of how the “Whales” control everything related to the Bitcoin price. Unlike the rest of the financial system, Bitcoin is the only fair and free market there is.

From Reuters:

Four major banks pleaded guilty on Wednesday to trying to manipulate foreign exchange rates and, with two others, were fined nearly $6 billion in another settlement in a global probe into the $5 trillion-a-day market.

Citigroup Inc (C.N), JPMorgan Chase & Co (JPM.N), Barclays Plc (BARC.L), UBS AG (UBSG.VX)(UBS.N) and Royal Bank of Scotland Plc (RBS.L) were accused by U.S. and UK officials of brazenly cheating clients to boost their own profits using invitation-only chat rooms and coded language to coordinate their trades.

All but UBS pleaded guilty to conspiring to manipulate the price of U.S. dollars and euros exchanged in the FX spot market. UBS pleaded guilty to a different charge. Bank of America Corp (BAC.N) was fined but avoided a guilty plea over the actions of its traders in chatrooms.

First it was LIBOR (London Interbank Offered Rate), now it’s FX as well. Cases against the same cast of characters are pending in the Gold and Silver markets as well. From Michael Lewis we already know that the equities markets are rigged to high heaven. Where is left to trade in a market where all participants share the same information? Bitcoin is all there is. Every trader large and small has DMA (direct market access) connections to the exchange. The order book is published live for all to see. The lack of regulation strips away the false sense of security and forces traders to act like adults and make informed and intelligent decisions with their money.

While there are various allegations of Bitcoin exchanges front running their customers, wash trading, and other unscrupulous practices, traders can easily take their business elsewhere. There are hundreds of exchanges serving various locations, with various products, and different operating models. Bitcoin is a true free market at work.

How To Trade Grexit

The Greek tragedy is coming to a close. Both sides have dug in their heels, and the month of June will be make or break for Europe’s favourite whipping boy. Many Bitcoiners have been salivating over a European banking crisis as they believe it will show to the world the superiority of non governmentally aligned currencies.

Cyprus’ depositor bail-in in April 2013 ignited the first bubble of that year. Cyprus was a warm up for the main event of Greece. The Troika believes that Grexit will be contained and the Eurozone will be minimally impacted. That is pure poppycock and everyone knows it. Just because the Cyprus bail-in cased a spike in the price, doesn’t mean a similar event in Greece will have the same effect. In Bitcoin’s case, will Grexit ignite the rocket ship to the Moon, or send Bitcoin careening towards sub $100 prices. What we can be certain of is that if Grexit occurs or capital controls are introduced in Greece this June, there will be a return of volatility to the Bitcoin market.

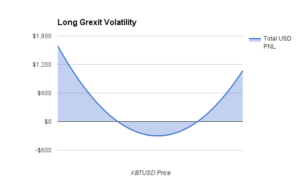

How can traders position their portfolio to profit from a surge in volatility due to Grexit? The goal is to buy June 2015 volatility. On BitMEX we offer two types of XBTUSD futures contracts, the XBT and XBU series. The XBT series applies a Bitcoin multiplier to the XBTUSD price. Each XBU contract worth a fixed amount of USD in Bitcoin. By combining a long position in XBT and a short position in XBU, one can buy June 2015 volatility as both expire on 26 June 2015. XBTM15 trades at a premium to XBUM15. In USD terms it is better to be long XBTM15, because as the market rises the contract is worth more in Bitcoin and USD terms at the same time, making the USD return squared. The premium of XBTM15 over XBUM15 represents the premium paid to go long volatility. For a more in-depth explanation of the differences between the two series, please read XBT vs XBU Chain.

The above chart shows the return profile of going long XBTM15 ($244) and short XBUM15 ($241) in equal Bitcoin nationals. The parabolic nature of the return profile indicates that profit is earned if Bitcoin trades outside a specified range. To profit, Bitcoin needs to be above $269 or below $215. The larger the range the more premium you have paid for your volatility. If Grexit does occur in June, volatility across all asset classes will jump significantly. Bitcoin is the world’s most volatile asset, and the sleepy sideways trading days we are having now will be fond memories.

Weekly Review: Bitcoin Investment Products

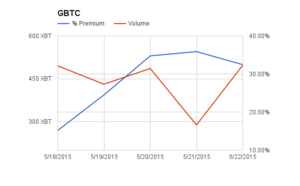

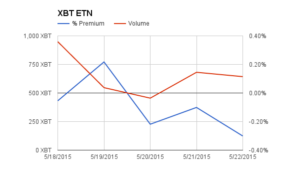

The products covered are GBTC and XBT (the Swedish ETN).

GBTC capped off its third week of trading with a freefall in the premium. The volume weighted premium was 27.95% down 62.62% points from last week. Total volume for the week was 2,197 XBT down 20% WoW. A 90% premium over intrinsic value brought out the sellers in droves. He who sells first, sells best.

XBT logged its first week of trading. For the new kid on the block lacking the PR push that GBTC has, XBT traded more volume and at a more affordable price (i.e. the ETN traded at a discount). Weekly volume was 3,275 XBT. The volume weighted discount was 0.08%.

The reason that XBT trades at discount while GBTC trades at a premium comes down to the structure of the respective investment products. The market maker for XBT can create and redeem shares at will. This allows them to keep the price inline with fair value. If it gets too expensive, they sell shares and create at fair. If it gets too cheap, they buy shares and redeem at fair. Market makers of GBTC cannot easily create new shares. To acquire inventory, long holders must sell to them. Understandably GBTC long holders expect a high premium given they are the only source of supply for the product.

XBT Spot

Range bound trading ruled last week. The $230-$240 range proved formidable and there was no sustained breakout. Trading volumes were subdued worldwide. Last week was extremely boring for many traders. Daily volatility closed below 1% on Thursday, which was the lowest reading in the past 6 months. The flow of news has also been very light.

Consider playing the $230-$240 range. Use the daily expiring futures contract XBU24H to place short term trades. Until volume and volatility returns to the market, discerning a direction will be very tough. The chop can eviscerate precious capital, so rather than placing direction trades, trade volatility instead. BVOL24H allows traders to speculate on the daily volatility, and BVOL7D the weekly volatility. Timing the bursts of trading activity and volatility can be very profitable.

Trade Recommendations:

Play the $230-$240 range with XBU24H. Instead of placing directional trades, trade volatility using BVOL24H and BVOL7D.