BitMEX Happenings

The Inside Bitcoins Hong Kong conference had a good turnout. We were pleased to meet many new Bitcoiners in the Asia Pacific region.

BitMEX has been hard at work on improvements to our product suite. We are pleased to announce that as of Wednesday May 20th at 12:00 GMT leverage will be increased and fees will be decreased on the XBT series. Leverage will be increased to a maximum of 20x, and fees will be reduced to Maker 0% / Taker 0.1% for the series. BitMEX has pioneered a new way to deal with highly leveraged and speculative Bitcoin derivatives. Our new Capped Price system is an alternative to the controversial socialised loss system. I will describe the our new system in greater detail further down.

Capped Price Logic Explained

With highly leveraged contracts, it is possible for traders to reach negative equity during fast market movements. This causes a systemic loss on the exchange.

Most exchanges offering highly leveraged speculative Bitcoin derivatives use a socialised loss system. In this system, the exchange spreads this loss amongst the profitable traders. This system has proven opaque and unpopular. Traders do not know how much they will lose until settlement. Additionally, profits cannot be withdrawn until settlement so that they can be taxed. This can tie up funds for months.

BitMEX has a new approach. The “capped price” system is a transparent and fair method to deal with highly leveraged speculative Bitcoin derivatives.

The “capped price” system is simple: the price of a contract is not allowed to reach a price that would cause a trader bankruptcy. Instead, contract limits are placed at the highest and lowest safe price. These limits are recalculated continuously. In the case of fast market movement, traders must be liquidated before the price is allowed to move further.

Traders placing orders above or below these limits are notified upon attempting an order. They can then make the decision whether they wish to trade the contract or not with full knowledge of the maximum gain available. Traders who hold existing positions may exit at the limit price if they wish and close any hedges.

Traders are in full control. They can withdraw realised PNL immediately, and are not surprised at settlement by uncontrollable socialised loss. Please read Capped Price Logic Explained for a more in depth explanation of how BitMEX will implement this new system.

BitMEX will be implementing the Capped Price Logic on the BVOL and XBT series. The XBU series which is used as a hedging product will continue to enjoy the BitMEX settlement guarantee.

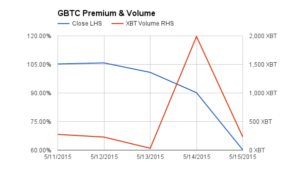

GBTC Weekly Analysis

GBTC volumes continued their climb higher last week. A total of 2,800 Bitcoin equivalent shares were traded, which was a 46% increase WoW. The weighted average closing premium was 90%, a 6% decrease WoW. The most interesting fact about last week’s trading is that the premium nose dived into the weekend. By Friday, the premium declined to “only” 60% over spot. Long holders of BIT shares are being given a golden opportunity to recover some of their losses on their Bitcoin investment. As more holders realise they can sell their shares at a substantial premium, they will rush to market and in the process the premium should narrow considerably.

The euphoria over the commencement of GBTC trading has faded. The spot price gave back all it’s gains of last week during the $10 drop to $235. GBTC provided a short pop in the price, but the bearish trend could not be overcome with misplaced enthusiasm. Even the much celebrated premium is in sharp decline as long holders rush for the exit. If you are considering buying GBTC, be patient the premium will decline to more reasonable levels in short order.

BVOL24H And Volatility Seasonality

BVOL24H concluded its first week of trading. The reaction from traders was overwhelmingly positive. The contract already features some market makers posting automated two-way prices. Many more traders are building volatility prediction models to assist them in the trading of this contract.

The above is a chart depicting a 5 day time series of the BVOL24H price. What should interest volatility hungry traders is that the contract features wild swings. It can double or halve in a few minutes. In sideways and choppy markets, traders looking for something with enough juice to keep them interested should gravitate towards BVOL24H. To further assist traders with pricing of the contract, I will be constructing an Excel sheet to better visualise how BVOL24H is tracking the indicative daily volatility.

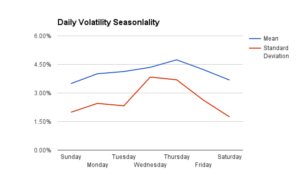

A very important question is how does daily volatility differ depending on the day of the week. I looked at the .BVOL24H index data since the beginning of November 2014. The mean and standard deviation of each weekday were computed. The table above lists the results. A full day is 12:00 UTC to 11:59 UTC. Wednesday and Thursday exhibited the highest daily volatility and the highest standard deviation. Saturday and Sunday had the lowest. Bitcoin traders are human after all. And being human, we also like to enjoy other activities besides staring at computer screens. Another factor is that banks are closed so the moving fiat in and out of exchanges ceases for two days which dampens trading volumes and volatility.

Why Bitcoin ATM Operators Need Derivatives

Bitcoin ATM machines represent one of the most crucial onramps into the Bitcoin ecosystem. They present an easy and understandable way for the general public to obtain their first Bitcoins. ATM operators that do not utilise Bitcoin derivatives in their process flow are exposing their business to unnecessary risks. The use of Bitcoin derivatives can help lower spreads and increase profitability.

The vast majority of ATMs are cash in, Bitcoin out. Two way ATMs are slowly gaining ground, but most customers want to exchange fiat cash for Bitcoin. The goal of an ATM operator is to maximise the return on equity denominated in a fiat currency. They do this by selling Bitcoin at a premium to the market price. In a perfect world, the operator would hold a balance of cash on their preferred exchange, then when the customer sent them cash they would buy Bitcoin and immediately send to the customer’s wallet. Sending Bitcoin from the exchange to the customer’s wallet at the minimum would take 10 minutes (the time for 1 confirmation). In addition, many exchanges do not allow Bitcoin withdrawals through their API. Customers want their coins now, and aren’t going to patronise an ATM where the buying experience takes that long.

To satisfy customers in a timely fashion, the operator must divide their working capital into fiat cash on an exchange, and Bitcoin on an ATM hot wallet. The Bitcoin held is now exposed to price risk. Absent a price hedge, operators must charge a higher spread to compensate for the price volatility to which they are exposed. BitMEX offers futures contracts that allow operators to lock in the USD value of Bitcoin. With the use of BitMEX XBU futures contracts, operators can hedge their Bitcoin working capital.

The ATM operator has $20,000 total of working capital. They split that into $10,000 of cash on an exchange, and $10,000 of Bitcoin. Assume the spot price is $100, therefore they hold 100 Bitcoin. Each BitMEX XBUM15 (June 2015 expiry) futures contract is worth $100 of Bitcoin, and currently trades at $100. The operator sells 100 contracts, this locks in $10,000 of Bitcoin. BitMEX requires the operator to post 30 Bitcoin as margin for the trade. Now the operator has 70 Bitcoin left to place on the ATM hot wallet. A customer deposits $110 for 1 Bitcoin. The operator will instantly buy 1 Bitcoin for $100 on the spot exchange, and send 1 Bitcoin to the customer from the ATM’s hot wallet. The operator has made $10 or 10%, and their Bitcoin working capital was not exposed to any price risk during the transaction. As the spot price of Bitcoin changes, the XBUM15 contracts will gain or lose Bitcoin to keep a constant value of $10,000.

When the XBUM15 futures contract expires, the operator just needs to roll into the next month’s expiry and the hedge will still be in place. Now that the process flow is free of price risk, the operator can consider lowering their spread to gain market share and increase volume.

If you are an ATM operator and would like to discuss your hedging options in more detail, please contact us and a member of staff will help create a hedging program suited to your needs.

XBT Spot

Last week featured about one hour of interesting price action. The price exited the $240-$245 range and remerged $10 lower. It is quite telling that the market couldn’t hold $240 after the itBit and GBTC positive developments. Another cathartic event is needed for the return to a healthy bull market. The price pop from each successive “game changing” event diminishes. The bulls are getting fatigued and soon the cracks will widen just enough for a push below $200.

If you are finding it hard to discern a market direction during these choppy and sideways times, consider trading BVOL24H. BVOL24H allows the speculation on the daily realised volatility. Traders need only predict the extent of price action not the outright direction, which for some might be a more fruitful endeavour

Trade Recommendation:

Go short XBUM15 above $235 with a $220 target price. Cover the short if the price rises above $245.