BitMEX Happenings

Inside Bitcoins Hong Kong is this Thursday and Friday. I have a solo presentation on the Bitcoin derivatives market at 3:45pm on Thursday. Friday I am part of a panel about Bitcoin exchanges at 2:30pm. I hope to see many of you at the conference. If you would like to schedule a time to chat with me, please contact us.

How To Trade BVOL24H

BVOL24H is now live. BVOL24H is a futures contract that allows traders to speculate on the Bitcoin daily historical volatility. The Bitfinex last price is snapped every 5 minutes, and then the standard deviation of the logarithmic change between snaps is calculated. That number is multiplied by the square root of 288 to arrive at a daily volatility. The increased sensitivity to short term price movements makes BVOL24H a great tool in a trader’s arsenal in the quest for alpha in these choppy and sideways markets.

The above chart plots 289 price snaps taken every 5 minutes (the blue line), and the indicative fair price of a hypothetical BVOL24H contract (the red line). The first major takeaway is that as more snaps are known the settlement price converges around a value. The best way to play BVOL24H is using it to express a view on the degree to which the price will move in the next few minutes. The circled section displays how after a period of relative “calm” the price spiked down then up again. That price movement caused a noticeable jump in the fair price of BVOL24H. A trader bullish on near term volatility would have bought BVOL24H in anticipation of such an event. After the price moved, a trader bearish on near term volatility would be right to sell BVOL24H as the price gyrations subsided into settlement.

GBTC Week 1 Analysis

GBTC experienced its first trades this week, and the market took the trade data in a very positive light. Friday GBTC traded over 1,400 Bitcoin equivalent shares. If GBTC were an exchange, this volume would put it in the top 20 globally. The market reacted very positively and promptly spiked $10. I have been on record saying that GBTC represents a great stride forward, but has serious deficiencies as an investment product. The market thought otherwise, so let’s dig a little deeper into the first week of trading.

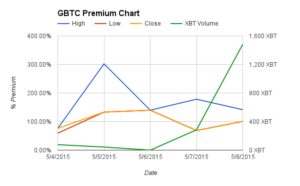

The above chart displays the premium and Bitcoin equivalent volume that traded each day. Each share of GBTC represents 0.1 Bitcoin. I retrieved the daily High, Low, Close, and Volume from OTC Markets, and then adjusted to create a Bitcoin equivalent number. The premium is on the left axis and the volume on the right. To compute a daily premium I used the opening print of the Tradeblock XBX Index (The Bitcoin Investment Trust uses this index to compute the daily Net Asset Value). The chart shows that the volume weighted average premium is approximately 100%, and Friday was the largest trading day with 1,400 Bitcoin equivalent shares traded.

Why would anyone pay double the fair value for Bitcoin? Anyone trading GBTC on the Pink Sheets is most likely a Bitcoin enthusiast. Therefore, they have experience buying Bitcoin on the spot market and know its real value in “physical” form. That leaves the only reason for such a high premium is the cash used to buy GBTC is not available to buy Bitcoin on a spot basis. Retirement savings schemes in the US that are tax advantaged are only able to buy certain types of investment products. You can’t withdraw cash early from your IRA without significant penalties and a loss of tax advantages. If you wanted to invest in Bitcoin with these funds, GBTC is your only avenue.

A 100% premium looks quite expensive, but after a sum of the parts reconstruction of GBTC 100% is not high at all. To arbitrage this premium, a trader would need to subscribe for BIT shares with USD, borrow GBTC, short sell GBTC, wait for 1 year then convert BIT shares into GBTC ones thus collapsing the trade. The one year value of USD for a similar risky investment is akin to lending on Bitfinex. At 0.1% per day interest, that is 36% lost income on the USD. We are down to a 64% premium. Traditional and Roth IRAs allow investors to avoid income taxes on the way in or out respectively. The funds inside the IRA grow tax free until withdrawn. Let’s call that a 20% pickup, as that is the highest capital gains tax rate in the US. The premium now stands at 44%. The only way to source borrow is from existing GBTC holders, at what rate would they lend their shares? They could earn 100% today by selling their GBTC shares, but then they give up on future appreciation of Bitcoin, and more importantly if they bought their initial BIT shares through an IRA they lose the tax benefits. The 44% represents the maximum borrow rate an arbitrageur would pay to borrow shares. Given GBTC is not held by just one entity, competition should drive the borrow rate below 44%. I believe the clearing rate will be 20%-30%. That leaves a 14%-24% premium over fair value. While this is high, it’s not the stuff of legends.

itBit Kissed The Ring

This week itBit became the first Bitcoin exchange to obtain a Trust license which enables them to accept deposits in all 50 states, and offer FDIC insurance of up to $250,000 on deposits. They also revealed three new high profile additions to their board, notably Sheila Bair the former head of the FDIC. A Bitcoin startup has basically become a US regulated bank. The market digested the news and promptly spiked higher.

American banking is one of the most regulated industries globally. Most regulations are meant to extract rent from certain industries and create barriers to entry. It is no surprise that the Sunlight Foundation’s recent study found that for each $1 spent on lobbying, corporations received $760 back. Many Bitcoin startups are queuing up to Kiss the Ring of Ben Lawsky in hopes he will bestow his blessing and protection. itBit was the first lucky princess.

King Lawsky of the East might have blessed itBit, but some aren’t so sure all the Kings of other US states will recognize his blessing. Some questions whether itBit’s charter allows it to offer its services in California (see this Wired article). You can be sure many states will be looking for their piece of the itBit regulatory cash stash. What at first blush looked like a slam dunk blanket authorisation to operate freely across America, now appears like another power grab from King Lawsky. Would you carry an edict from Westeros beyond the Wall? Maybe, but you better have a big army behind you. itBit and Coinbase are now competing bedfellows in the quagmire of US state and federal banking regulations. VC firms should just open a law firm because that’s where all their cash is going.

Ripple Gets Rekt, R.I.P. XRP

Last week was the tale of two Crypto startups. On the “right” side of the tracks was itBit, they Kissed the Ring and can sort of offer their services throughout the US. On the “wrong” side of the tracks was Ripple Labs, they tried to be like Bitcoin but centralised and now owe FinCEN $700 thousand. Ripple failed to adhere to the Bank Secrecy Act and submit Suspicious Activity Reports in a timely fashion on users of their platform. Many have speculated that any Ripple gateway operator who touches US persons or entities must register as an MSB. Welcome to the US red tape orgy. Does that mean anyone operating a Ripple gateway needs to have an MSB for each of the 50 states in America, or Ripple as the parent needs to have those licenses as well? Either way, it sounds like a fee bonanza for the Ripple Labs’ legal team.

Ripple’s biggest sin was being a centralised way of transferring value in an innovative way. I’m not an expert on the ins and outs of Ripple, but when you upset the wrong apple cart someone is coming after you. With Bitcoin, governments can only go after specific businesses and individuals not the protocol itself.

The moniker “The Paypal of Crypto” is apt to describe how Ripple Labs will need to operate so as not to get fined again. Chargebacks, blocked transactions, and the necessity to know relevant data about their users will become de rigeur. The cost associated with operating a gateway will also increase exponentially as well. Retail traders will shun ripple for other crypto currencies without these obstacles. In the end this may hasten the transformation of Ripple into what it’s best suited for, a value transfer mechanism used in a closed loop by certain industries. For the retail traders, R.I.P. XRP.

XBT Spot

GBTC and itBit ignited the rally this week. While impressive, if it is to continue $260 needs to be retested and broken. The rally stalled at $250 / 1,550 CNY and is now $10 / 60 CNY lower. Those fortunate enough to have caught the move early in the low to mid $230s hang tight. If you are waiting on the sidelines looking for your entry point, consider waiting until $250 is breached before joining the party. A failure to breach $260 will be an excellent opportunity to short the market for bears.

The market has spoken, and GBTC is not to be ignored. Traders will be watching the trading volumes very closely. If GBTC’s momentum flags, a quick return to the bear trend is in order. As I have repeatedly said, GBTC structural properties preclude an addition of new cash into the system through arbitrage. GBTC to many is the marker of the beginning of the next bull run for Bitcoin. Greed is a powerful force, and shorts should pay heed.

Trade Recommendation:

Buy XBUK15 if $250 is breached with a $260 target price. If $260 fails to be taken out on the upside, consider taking your portfolio short for a retest of $214.