BitMEX Happenings

Summer is here and whether you are in the Hampton’s, St. Tropez, or Marbella global macro events aren’t stopping while you bronze. The BitMEX team is hard at work on many improvements to the platform. 20x leverage for our XBT quanto futures contracts is in the works. Our exchange Exchange Default Swap will not be far behind, and the recent events demonstrate the need for price discovery of exchange default risk even more.

Asia Risk recently profiled BitMEX, you can read the article here.

This past Saturday the BitMEX team was on Whaleclub discussing the BitMEX platform and fielding questions. Soundcloud Recording

Bitcoin Implied Volatility Surface

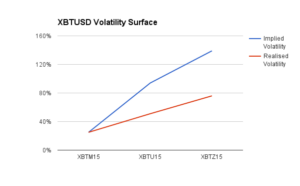

This past Friday we listed XBTU15 (25 September 2015) and XBTZ15 (25 December 2015). As I have often pointed out, it is possible to glean the implied volatility of Bitcoin from the premium over spot that the XBT quanto futures contract trade. Please read XBT vs. XBU Chain for a more in depth explanation of the return profile. Now that there are three quarterly maturities, a curve of implied volatility can be constructed from actual market prices.

The above chart shows the implied and realised annualised volatility. The implied volatility comes from the premium over spot of the respective XBT futures contract. The realised volatility takes the .XBT2H value (the daily 10:00 – 12:00 GMT Bitfinex 1-minute TWAP), and looks at the realised volatility based on how many days until expiry of the contract. The longer dated the contract, the bigger premium of implied over realised volatility. There is substantial time value premium or theta in these contracts. Traders wishing to collect theta, and go short gamma and volatility should short XBTU15 and XBTZ15. To isolate theta, gamma, and volatility, use the XBU series to hedge spot Bitcoin price movements. Because XBU contracts are worth $100 of Bitcoin, the USD payoff is linear with respect to spot movements, and you can isolate the relevant trading variables. If volatility continues to be subdued, this will be a very profitable trade. Those bidding these contracts believe that volatility will rise in the future, and want to enjoy an asymmetric upside payoff.

Trade Recommendation:

To earn time value and gamma premium, sell XBTU15 or XBTZ15 and buy XBUU15 or XBUZ15. To go long future volatility and gamma, buy XBTU15 or XBTZ15 and sell XBUU15 or XBUZ15.

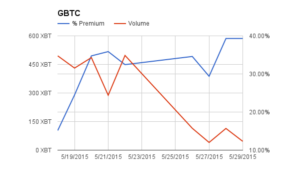

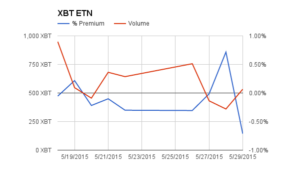

Weekly Review: Bitcoin Investment Products

Volumes across the board were lower for both GBTC and XBT. GBTC volume experienced a 82% decline WoW, and XBT a 21% decline WoW. The GBTC premium rose 8% points WoW, and XBT’s discount widened by 0.08% points. XBT is definitely the more popular investment product, I assume that is because it trades close to fair value while GBTC trades at a hefty premium.

XBT Spot

There were rumours last week about an European interest with a large bid in the OTC market at $235. That level was well defended until the OKCoin fiasco went nuclear on Saturday. The bearish sentiment was unleashed and the price now stands below $230. The kill spot is $213-$225. If the price falls within that range, it is likely that cascading margin calls of leveraged longs on Bitfinex will be unleashed and a run at $200 will commence. The bears have been waiting for a retest of the $150-$170 levels seen in January. It has eluded them for six months. The current price action is a perfect setup for another attempt. $200 won’t come easy, but if it does the suicide hotline will be inundated.

Trade Recommendation:

Short XBUU15 (25 September 2015) futures contracts at current levels. A sustained break back above $235 and consider covering the short. The near term price target is $220-$225.