BitMEX Happenings

On July 10th, Sam Reed (BitMEX CTO) will be speaking at the upcoming Inside Bitcoins Chicago conference. He is on a panel speaking about Bitcoin exchanges at 2:45pm. Anyone attending the conference who is interested in speaking with Sam, please contact us.

After No, What’s Next For Bitcoin And Europe

The Greeks rejected the EU bailout program. Unfortunately the banks are still closed, capital controls remain, and depositor haircuts are likely coming. After 5 years of pretending, Greeks have woken up to their reality and it won’t be pretty in the near term. I must repeat it is almost impossible for Greeks to acquire Bitcoin so using it is out of the question. The rest of the European plebes watching these events should take notice.

Traders bid up Bitcoin to $275 on improved sentiment and a hope the Spanish, Portuguese, Italian, and even French citizens realise the precarious nature of their country’s financial position and read the writing on the wall. A war on cash and capital controls are coming to a European nation near you. The biggest boogieman looming is re-denomination of domestic bank accounts. A Euro balance might become Liras or Francs once more at a devalued exchange rate. As depositors realise that the Euro can die after all, they will rush to transfer Euro deposits to a safe haven country’s banking system while capital still flows freely.

Peeling back the veneer, no country’s banking system is safe. While one might escape a Spanish bank, it is a big gamble that contagion wouldn’t spread to the UK or Switzerland as well. Storing a portion of your savings in Bitcoin is not a bad option when faced with re-denomination at home and possible theft abroad. Bitcoin might be volatile, but at least you are in full control of your assets. Bitcoin can be exchanged 24/7 into just about any fiat currency. Domestic devaluation and capital controls are happening before your eyes; Bitcoin is a solution that cannot be ignored.

QE Arrives In The Middle Kingdom

The PBOC had to do something over the weekend in an attempt to support the crashing Chinese equity market. On Sunday, the major Chinese brokers pledged to buy 120 billion RMB worth of equities and the IPO market was shuttered. Chinese brokers don’t like to catch falling knives. The cash is coming from the PBOC. The PBOC is now directly monetising the stock market, which is the definition of quantitative easing. The equity market capitalisation is down over 2 trillion RMB, 120 billion is a drop in the bucket. However, the signal is clear. BTFD because the PBOC has got your back.

Today investors took the opportunity to sell into strength. The market opened up 8%, but the SHCOMP closed up “only” 2%. The margin calls will continue and analysts expect traders to sell into the PBOC’s market operations. If the market can’t close up on the week, expect more firepower from the PBOC.

Just like the Fed, ECB, and BOJ, the PBOC is committed to propping up the equity market. PBOC has the most fire power out of any major central bank because their policy rates are over 4%. Free money will leak from the equity market and find its way into other assets. Bitcoin will be supported by the tidal wave of RMB liquidity. If the threat of capital controls and wealth confiscation wasn’t enough, the tidal wave of RMB liquidity will light a fire under the Bitcoin price.

Futures Premium Behaviour

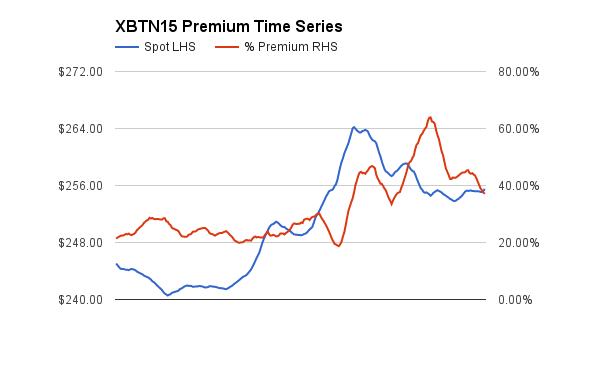

Volatility for both spot and the futures premium is on the rise. The above chart is a time series of the annualised percentage premium of XBTN15 (July 2015 Bitcoin / USD futures contract) over spot vs. the spot price. I used the hourly mid price of XBTN15 vs. the hourly price of Bitcoin on Bitfinex.

During the recent $240 to $270 rally, the premium doubled as traders rushed to accumulate long exposure. For traders who like arbitrage, this is the perfect opportunity to sell futures and buy spot to earn the carry.

Arbitrage Process:

- Borrow USD from your bank and buy Bitcoin. Do your best to match the Bitfinex price.

- Deposit initial Bitcoin margin on BitMEX. For XBTN15, to open a position worth 100 Bitcoin, you must deposit 15 Bitcoin as initial margin.

- Sell XBTN15 contracts to match the amount of Bitcoin you bought.

- Wait until XBTN15 expires, then sell your Bitcoin for USD.

Traders should watch the fluctuation of futures premium closely. Sometimes the premium will increase or decrease in advance of a large spot movement.

Don’t Forget About Litecoin

Litecoin is the hottest altcoin at the moment. From $1.50 to $5 in under a month, some traders have made a bundle. Our friends at Shitco.in wrote an interesting peace about manipulation of LTC swaps on Bitfinex and how that is partially to blame for the rapid ascent. Please read Underlying FOMO + Creative Thinking = LTC Pump.

Weekly Review: Bitcoin Investment Products

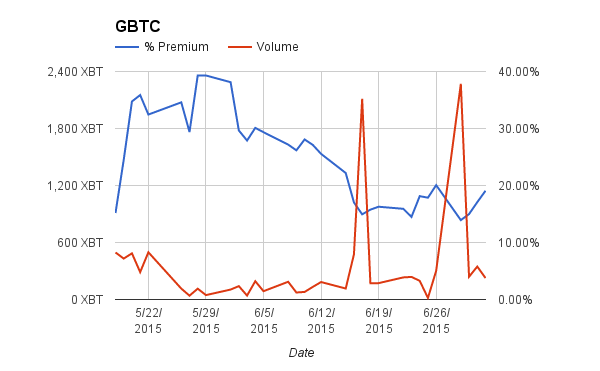

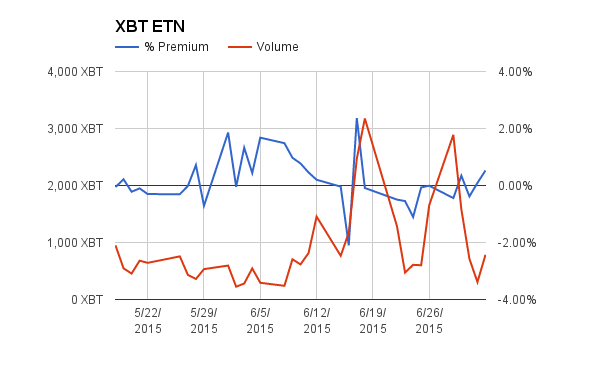

| Week Ending | GBTC Avg Volume | WoW % Chg | % Premium | XBT Avg Volume | WoW % Chg | % Premium |

| 6/26/2015 | 197 XBT | 15.66% | 923 XBT | -0.35% | ||

| 7/3/2015 | 771 XBT | 291.15% | 17.32% | 1,255 XBT | 35.91% | -0.09% |

As expected, the Monday after the announcement of the Greek referendum featured heavy volume. GBTC and XBT both traded over 2,000 XBT. Volume for the rest week was subdued. Expect volumes to grow after the historic No vote in Greece.

XBT Spot

After the referendum was announced, trading ground to a halt. Bitcoin retreated towards $250 and starting on Saturday the price began to climb. The slow and stead ascent continued until the polls closed in Greece. As soon as data began trickling out about the No vote landslide, the price spiked through $270 to $275.

The events over the weekend should make shorts quiver. The first European nation openly rebuked the Troika via a public vote, and the world’s largest economy’s central bank is now printing money to support financial assets. Bitcoin will began another ascent towards $300, but this time there is a solid global macro narrative to help it punch through and unleash a true bull market.

Begin establishing long positions with an eye towards $300. The $300 level will be hard fought, and it is likely that the first attempt will be rejected. Take profit at $300 and reload for a stronger and more consolidated push through $300. Depending on the European chaos, and the Chinese equity market gyrations the first attempt at $300 could happen this week.

Trade Recommendation:

Buy XBTN15 (31 July 2015 Bitcoin / USD futures contract) while spot is below $275. The upside price target is $300.