Slow Motion Banking Collapse

The banks are open today. Capital controls are still in place. What the world is witnessing is a slow motion bank run. The ECB will not continue to fund the banks indefinitely. At some point they will tire of increasing their Greek liabilities and cut the banks off once and for all. Greek depositors know their banks are living on borrowed time. They will rush to withdraw in cash and send abroad any amount that is permitted. Images of long bank withdrawal lines, and empty store shelves will continue to frame the collective world image of Greece. We like to pretend that our 21st century society is more civilised and advanced than the late 19th and early 20th century. Our Just-In-Time highly advanced production economy depends on the free flow of capital between suppliers of raw materials and producers of finished goods. Remove that even for a short while, and the human condition will regress to levels of our great grandparents.

The European diplomats are all comfortably back at their favorite summer holiday destinations. Beneath the surface, the markets are setting up for an explosion of volatility this fall. Spaniards have watched the complete German subjugation of a vassal state without one bullet fired. They take to the polls later this year. Prime Minister Rajoy’s People’s Party is in trouble. They have towed the austerity line, and there are rumblings of dissent amongst the plebes. If Greece succeeds in getting a debt haircut, which the IMF (aka US) is advocating, the Spaniards will demand one too. To get one, the government will have to take the currency union to the brink of breakup like the Greeks.

Global macro volatility and instability has proven supportive of Bitcoin. Bitcoin was the only asset outperforming during the midst of the latest Grexit crisis. Once Grexit was off the table, the price fell almost 15%. 7 years after the onset of the GFC, it appears that another unlikely event could plunge the world financial markets into turmoil once more. December Bitcoin futures contracts expire just before the end of 2015. If you believe the world is going to get more uncertain, consider buying XBTZ15 and use Bitcoin to reduce the overall volatility in your portfolio.

Liftoff

During Empress Yellen’s testimony in front of the US Congress and Senate, she stated that a hike in interest rates is very likely to happen by the end of 2015. A 0.25% increase in the Federal Funds rate may happen at the September or October FOMC. After over 6 years of 0% interest rates, the onset of positive short term rates will significantly impact financial markets globally.

There are two camps with regards to how markets will react to a Fed in a tightening cycle. The first camp believes that the hike in interest rates confirms that the US economy is strong. The financial markets will welcome confirmation that the largest economy in the world is on sure footing. The second camp believes that the world has become addicted to 0% interest rates, and the onset of more expensive money will destroy asset markets globally.

I agree with the second camp’s doom and gloom position. With regards to the Bitcoin price, it is unclear as to the initial price reaction. During margin calls, investors will dump everything they can to raise cash. Bitcoin could become a casualty as well. Or it could rally substantially as global financial market instability rises.

The one thing I am certain about is that unsecured USD interest rates will rise faster than those for Bitcoin. The basis between forward and spot prices for Bitcoin will increase. I would rather benefit from a general rising interest rate environment, and not be subject to whether I can call the price direction correctly. There are several strategies to profit from this view.

Strategy 1:

If you are a long holder of Bitcoin and don’t intend to sell regardless of the short term price, consider replacing your long physical Bitcoin with leveraged futures contracts. As the USD rates rise, your futures contract will become more valuable. With the Bitcoin not utilised as margin, you can sell them for USD and lend on a margin trading platform to earn extra income.

Trade Recommendation:

Buy XBUZ15 (25 December 2015) futures contracts.

Strategy 2:

To go long solely the futures’ basis, buy a leveraged futures contract and short sell spot Bitcoin. You have removed the price risk from the trade, and will benefit if the futures’ basis increases. You can short sell spot Bitcoin on a variety of margin trading platforms.

Trade Recommendation:

Buy XBUZ15 futures contracts. Short sell spot Bitcoin.

Strategy 3:

To go long solely the futures’ basis, construct a calendar spread between two different maturity futures contracts. Buy a December expiring futures contract, and sell a September expiring futures contract. As rates rise, the calendar spread will increase because the longer dated futures contract has more time value.

Trade Recommendation:

Buy XBUZ15 futures vs. sell XBUU15 (25 September 2015) futures contracts.

Weekly Review: Bitcoin Investment Products

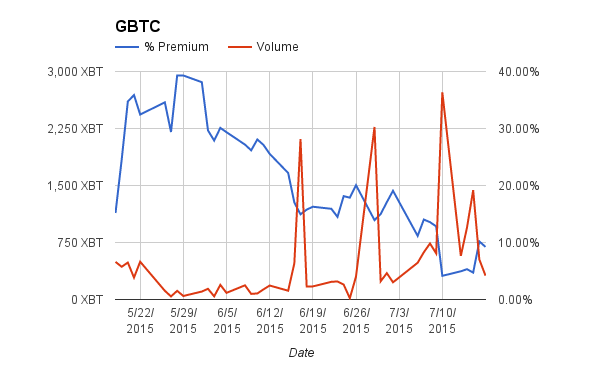

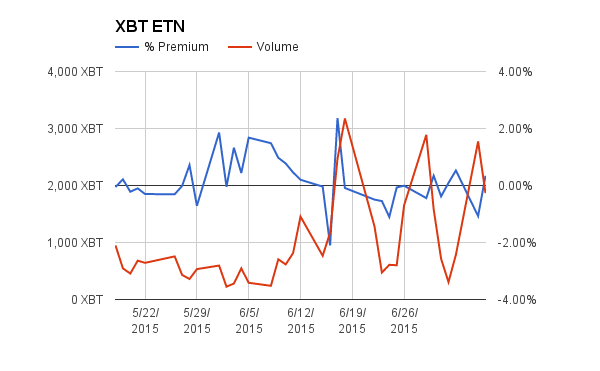

| Week Ending | GBTC Avg Volume | WoW % Chg | % Premium | XBT Avg Volume | WoW % Chg | % Premium |

| 7/10/2015 | 1,035 XBT | 8.35% | 2,673 XBT | 0.00% | ||

| 7/17/2015 | 760 XBT | -26.56% | 6.03% | 1,441 XBT | -46.09% | -0.17% |

The end of the current chapter in the Greek melodrama caused volumes to slide on both GBTC and XBT. As we enter the final weeks of summer, expect a general decline in volumes traded.

XBT Spot

The Grexit premium is slowly leaking from Bitcoin. The Greeks were betrayed by their leaders and continue to suffer in the Euro straightjacket. As the price hovers in the $270’s, it will take renewed cash buying pressure to lift Bitcoin back above $300.

Unless PM Tsipras is ejected by his party and fresh elections are called in Greece, the end of summer will end quietly for Europe. Bitcoin volatility will follow as well. Traders can return to their Mediterranean holidays, and stop babysitting their Bitcoin.

To maintain the bullish momentum, Bitcoin needs to hold $260. $300 was held for one 1D candle. That in itself is positive, but bulls will have to remain resilient as they are tested at lower levels. The level of XBT swaps outstanding on Bitfinex has fallen by almost half. The XBT swap rate stands at only 0.0058% per day; it is practically free to short Bitcoin. If the bears want to test $260 with vigor, it will not cost them much to do so.

Trade Recommendation:

Sell XBTN15 while spot is below $280. The downside target price is $260. If spot manages to rally above $280, cover the short XBTN15 position.