Bye Bye, New York State

I am sad to announce that due to Bitlicense, BitMEX will cease to service New York State residents. Residents of New York State will be barred from accessing BitMEX as of August 16 12:00 GMT. Affected users must close all positions and withdraw any Bitcoins held with BitMEX. Users who are unable to access their accounts after August 16th, can email support@bitmex.com to request their positions be closed at prevailing market prices, and their remaining Bitcoin balance withdrawn to a Bitcoin address of their choice.

BitMEX Launches World’s First Ethereum Derivative

Last Friday, Ether (the token powering Ethereum smart contracts) began trading on selected exchanges. Traders smart enough to buy at the IPO price were immediately up 20x on their investment. As expected, many attempted to rush for the exit and crystalise a profit. The problem was that exchanges were not crediting Ether balances and allowing traders to sell.

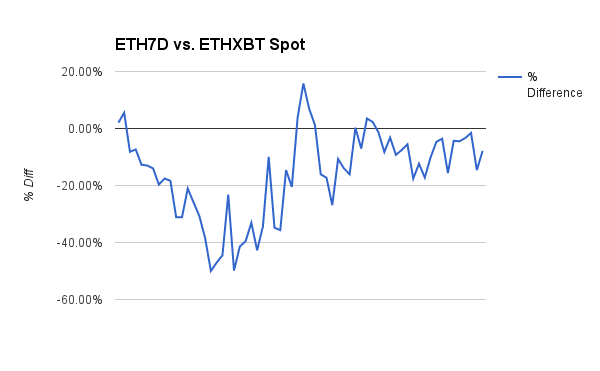

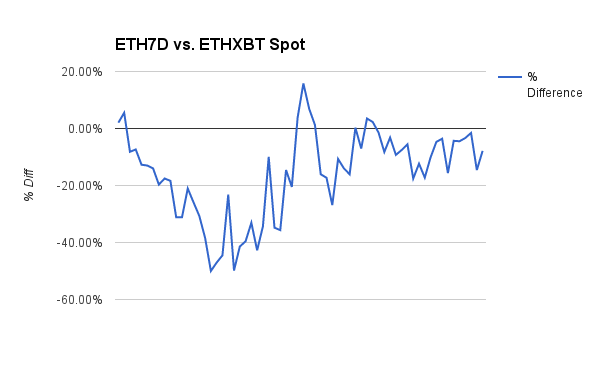

The launch of the BitMEX Ether / Bitcoin Weekly Futures Contract (ETH7D) coincided with spot trading launch. Because Bitcoin is used as margin, traders can short Ether and lock in their profit without depositing Ether with BitMEX. ETH7D immediately began trading at a substantial discount to spot. ETH7D represented the only mechanism for true price discovery of Ether’s value. The chart above illustrates this point. As each successive wave of Ether deposits were allowed to be sold, spot gapped down attempting to reach the level of ETH7D.

Holders of Ether from the IPO who have not liquidated yet are still in the money. Given the technical problems associated with the launch of new cryptocurrencies, it is likely that transfers and the sale of Ether for Bitcoin or USD could be halted again. ETH7D represents the only way for holders of Ether to lock in a Bitcoin profit.

Here is how to execute the hedge:

- Each ETH7D contract represents 1 Ether (ETH). The contract references the Kraken ETHXBT exchange rate and profit and loss are denominated in Bitcoin.

- If you bought 10,000 ETH at a price of 0.0005 ETHXBT at the IPO, you must sell 10,000 ETH7D contracts to lock in your profit.

- If ETH7D trades at 0.0025, you have locked in a profit of (0.0025 – 0.0005) * 10,000 = 20 XBT.

- BitMEX allows 5x leverage for ETH7D. You must deposit 20% * 10,000 * 0.0025 = 5 XBT as margin to place the sell order.

BitMEX ETH7D futures are not purely a speculative product, but have uses for ETH holders who wish to hedge their holdings. If you have any questions about how to hedge your ETH IPO allocation, please contact us.

Global Macro Musings

Germany, Japan, South Korea, and Taiwan, listed in order of importance, are four of China’s largest export competitors. The commonality amongst these countries is the race to the bottom in terms of currency debasement. While the Greek drama has torpedoed the Euro, the German export juggernaut is humming along as EURUSD has fallen from 1.5 to under 1.1. Kuroda-san and his BOJ have trashed the Yen from 80 to 120 in the last two years.

Xi Jinping and the politburo recognising the challenges facing the Chinese economy, are attempting to engineer a transfer of wealth from heavy investment industries into the hands of households. The chief conduit of change is removing the implicit subsidy of an undervalued Yuan. The Yuan is on a tear vs. the global major trading currencies, the USD, EUR, and JPY.

Unfortunately, the world economy isn’t cooperating with China’s rebalancing strategy. World trade is faltering and the commodity complex is imploding along with it. People don’t want more stuff, and China’s growth rate by some estimates has fallen to sub 5% (the official GDP is 7%, but no one believes those numbers). NPLs are rising and deteriorating local government finances have forced the PBOC to warehouse more and more toxic paper. At some point China will have to respond tit for tat vs. its major trade partners to recover some competitiveness and provide succor to its economy by devaluing the Yuan.

Chinese households that experienced a rise in global purchasing power will not sit quietly during a devaluation. They will invest / speculate on goods they believe will protect their wealth. Bitcoin is one piece of the puzzle. While it is not an income bearing bond or asset, Bitcoin cannot be devalued by diktat. When RMB begins to flood the Middle Kingdom, it will find its ways into various non-standard assets and cryptocurrencies will benefit. The Litecoin ponzi scam will be the tip of the iceberg. A desperate population is prone to believe many tall tales, and promoters will capitalise on this desperation and greed.

Quantifying Quanto: XLT7D

BitMEX launched the world’s only Litecoin futures contract that uses Bitcoin as the margin, profit, and loss currency last Wednesday. Because traders are accustomed to trading the LTCUSD exchange rate, we decided to apply a Bitcoin multiplier to the LTCUSD exchange rate. As a result, XLT7D is classified as a quanto futures contract. Many users are still confused as to the implications of quanto vs. non-quanto futures contracts from a pricing perspective. I intend to walk readers through a simple example meant to illustrate how to properly price the quanto risk premium.

Assume that a trader has gone short XLT7D futures contracts. He is now short Litecoin, long USD, and his profit will be in Bitcoin. He decides to hedge his short LTC exposure by buying LTC on the spot market. His LTC and USD exposures as it relates to price movements are now hedged. However, his XLT7D pnl is denominated in Bitcoin while his LTCUSD pnl is denominated in USD. If LTCUSD rises he will be short XBTUSD from a pnl perspective, and if LTCUSD falls he will be long XBTUSD.

The question now becomes, what is the covariance between LTCUSD and XBTUSD. Covariance measures the degree to which two assets move together. I took daily log returns of XBTUSD and LTCUSD from Bitfinex and calculated the covariance over a 30 day period. The result was a positive covariance of 0.068% or 6.8 basis points. Therefore, XLT7D should be priced 6.8bps cheaper than LTCUSD. The adjustment is so small that it can be safely ignored. Traders can treat the quanto XLT7D future as they would a LTCUSD future. The upside is that XLT7D’s settlement currency is Bitcoin, which doesn’t necessitate the holding of Litecoin or USD.

XBT Futures Term Structure

When I used to be an ETF market maker, there was nothing more exhilarating than taking a large outright position in particular stock. I used to run overnight mean reversion strategies in certain ETFs between the NY and Asian time zones. I would wake up with substantial deltas and have to close out at market open. That only occupied me for a few hours each day. More fun and risk was to be had, playing basis curves between various equity index futures. Now that there is more volume going through BitMEX’s XBT series contracts, curve trades can be executed.

I will begin posting the WoW changes in the XBT futures term structure. The term structure illustrates the % basis per annum each maturity futures contract is trading at. I take a 24 hour average of the % annualised basis each Sunday. Traders who do not wish to predict the outright movement of Bitcoin, may instead trade the relative movement in the term structure.

The curve experienced a parallel shift downwards WoW. To sell basis or go short interest rates, traders would need to sell XBT futures contracts and buy spot. As the spread narrows, unwind the trade for at a profit.

XBT Spot

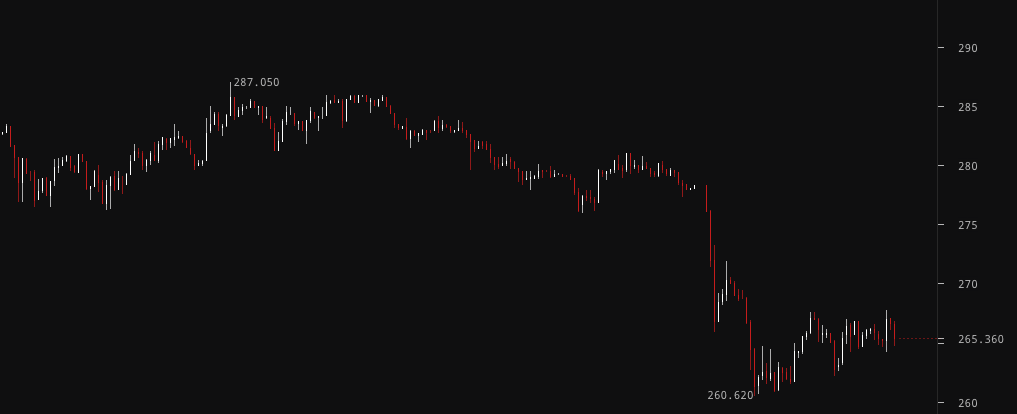

The downdraft I had called for finally occurred. A swift fall took the price to $260. The all-important support level held, and now the $260-$270 chop has begun. The Grexit premium has all but evaporated. The $300 bag holders can now hold a “cheap coins” symposium on an r/bitcoin thread.

$260 will be tested again. Failure to hold that level will most likely result in a retest of $220. If Bitcoin can hold firm during the final days of August, the return of traders from summer holiday should buoy the market.

Trade Recommendation:

Sell XBTQ15 while spot is above $265 with a near-term target price of $260. If that breaks, the next target is $240.