Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

For better or for worse, one of the interesting upshots of the pandemic and the ensuing outpour of pseudoscience on social media is that we are all now steeped in epidemiology. Remember flattening the curve, social distancing, lockdowns, etc.? I bet some of you can even recall R0 (R naught), or the number of healthy humans the average COVID-infected human infects. The comrades in Greater China are still living this nightmare, but thankfully, the rest of the world has largely moved on. Politicians have refocused their talent for misdirection on getting their constituents invested in the war for “Russian Reunification” – or of “Russian Aggression”, depending on which side of the iron curtain you reside.

Humanity now fights a two-front war. A war against an invisible virus (I know your Commander in Chief might have told you COVID is over, but viruses don’t adhere to election cycles and their economic impacts linger long after the last rapid-test clinic has shuttered); and an undeclared World War between US / NATO and Eurasia / Russia / China. The current policies of the fiscal and monetary authorities are driven by their attempts to mitigate the economic effects of these two conflicts.

Given that all politicians – elected or not – are focused on short-term myopic policies, they typically default to printing money to solve nearly all issues. There are very few problems that an infusion of cash can’t fix, which often makes printing money the easiest and quickest solution; it can be done immediately, without much discussion or deliberation. The alternative – the long-term restructuring of our global economy – would entail immense pain for certain stakeholders, and would necessitate having an honest conversation about the true state of our civilisation. Both of those requirements are non-starters for our short-sighted political friends, so regardless of whether your government practises capitalism, communism, socialism, or fascism, they all inevitably turn to “printing money-ism” to paper over any and all problems.

As we know, when you stimulate demand with free money, people buy shit. When people buy too much shit, the price goes up. That’s called inflation. Every country in the world is experiencing some sort of goods, food, and/or energy inflation. When the latter two subsets of inflation increase rapidly, the once docile plebes wake up and demand action. They will express it either at the ballot box or in the streets, but regardless, they will be heard. What would you be willing to do in order to feed your crying hungry child?

The world’s major central banks – The Federal Reserve (Fed), The People’s Bank of China (PBOC), The Bank of Japan (BOJ), The European Central Bank (ECB), and The Bank of England (BOE) – all assisted their governments by printing money in some way, shape, or form during the pandemic. They all worried about the ensuing inflation, and have since pledged with words (and, occasionally, followed up with actions) to remove fiat liquidity and tighten monetary conditions.

Imagine taking a round-house kick to the face courtesy of Nate Diaz. That’s probably about how the financial markets felt when the US’s and a select handful of others’ fiat wampum was withdrawn. The worst hit markets were sovereign debt markets, with a bond market rout that has been nearly the worst in recorded human financial history.

At the same time, the undeclared WW3 is intensifying, headlined by recent attacks on critical gas pipelines (see Nordstream I and II). The situation is putting a strain on the global economy as it is, and the compounding financial effects of a withdrawal of credit from the system are evident. The major central banks have begun to backslide on their promises to fight inflation, and the next pandemic – the Yield Curve Control (YCC) virus – is quickly spreading. Over a long enough time horizon, all central banks will succumb. Here is a quick scorecard of where each one is at currently.

BOE – Recently reverted to Quantitative Easing (QE) in order to save its financial system, which will soon morph into YCC – more on this later.

BOJ – Continuing their policy of YCC in order to save their banking system and allow the government to borrow at affordable rates.

ECB – Continuing to print money to purchase the bonds of weak members of the EU, but has pledged to begin Quantitative Tightening (QT) soon – more on this later, too.

PBOC – Restarting the money printer in order to provide liquidity to the banking system to prop up the falling residential property market.

Fed – Continuing to raise interest rates and is shrinking its balance sheet via QT.

80% of the most globally important central banks have relapsed and are engaged in some form of money printing. Only the Fed has stood resolute in the face of a financial market bloodbath, determined to see through its hopeless quest to quell the inflation for which it is at least partially responsible – a culmination of decades worth of terrible economic policies with a world war cherry on top.

Of all the types of money printing, the most disastrous for the value of fiat currency – and by extension, society – is YCC. That is because it inherently requires central banks to attempt to fix the price of a multi-trillion-dollar bond market. Central banks that engage in YCC are essentially pledging to infinitely expand their balance sheets such that a particular interest rate metric does not rise above an unnatural ceiling set by the central bank. The market ALWAYS wins, and the market wins by inflicting crushing inflation on the entirety of human civilisation.

The BOJ’s YCC policy is the longest standing. The BOE effectively just joined them, and the thesis of my essay this week is that the ECB is not far behind. A move by the ECB towards YCC would mean that the majority (60%) of the major central banks would be engaged in this terrible policy. I could even argue the number would actually be 80%, since the PBOC works within the Chinese financial system. The Chinese regularly target a certain amount of economic activity and will supply any amount of credit necessary to hit the number.

Side note: technically speaking, the BOE committed to a time-bounded, GBP 65bn bond price-fixing operation that they have said will only span the next 13 weeks. But, I suspect that won’t be the last we see of BOE’s YCC. Once you admit defeat in the face of the market, you are on the hook indefinitely. Now that the BOE has broadcasted that it will be required to buy your Gilt at inflated prices, why the fuck would you not sell them every single Gilt you have? Market participants taking advantage of this policy will only push the bank further into the hole it dug itself – so I think it’s safe to assume the BOE will be re-upping this program, and as such I will count them as being in the YCC camp.

The BOE’s sudden reversal – going from a bank determined to slay inflation via raising interest rates and QT to buying an unlimited amount of UK Gilts in just a few trading days – serves as a good blueprint for how I expect the ECB will be dragged kicking and screaming into implementing a similar policy. Spoiler alert: this is all building to big daddy Fed eventually succumbing to the YCC virus and joining its compatriots in the land of the living dead.

Threadneedle St, London EC2R 8AH, UK

A quick aside, before we jump into the BOE’s recent foibles: someone in a chatroom I was in recently referred to the British royal family as “the Kardashians with Crowns,” and it made me chuckle. The amount of attention the royal family garners is sad to me. Maybe UK politicians wouldn’t have been able to get away with energy and economic fairy tales if their populace was as engaged with their policies as they are with how poorly or not the late Queen treated Meghan, Duchess of Sussex.

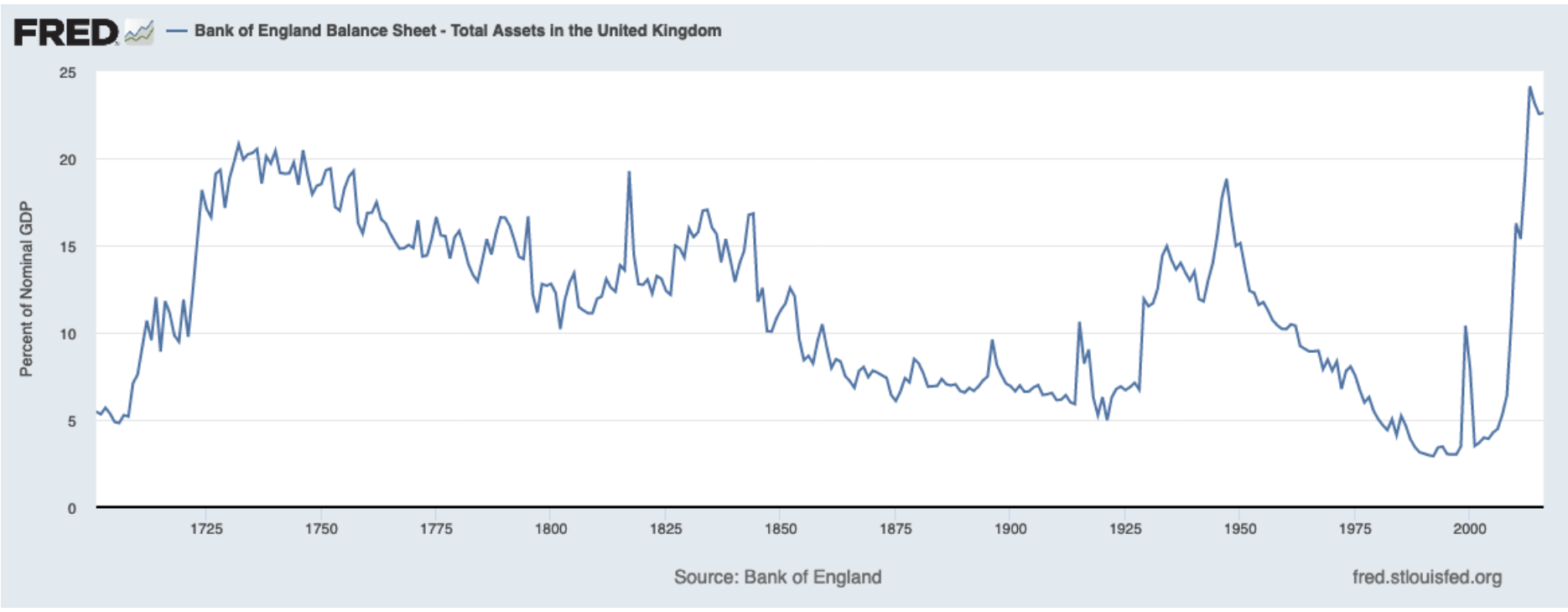

Getting back on track – in response to COVID, the BOE did what all good central banks do when presented with a crisis: they printed dat monay. To give you a bit of historical perspective, here is a chart showing the BOE’s total assets as a percentage of GDP since its founding in the 18th century.

The UK has been through some shit over the last three centuries. Pandemics, wars of empire, civil wars, world wars, etc. But even taking all that into account, you can see that the BOE’s recent bout of money printing was its most aggressive EVER!

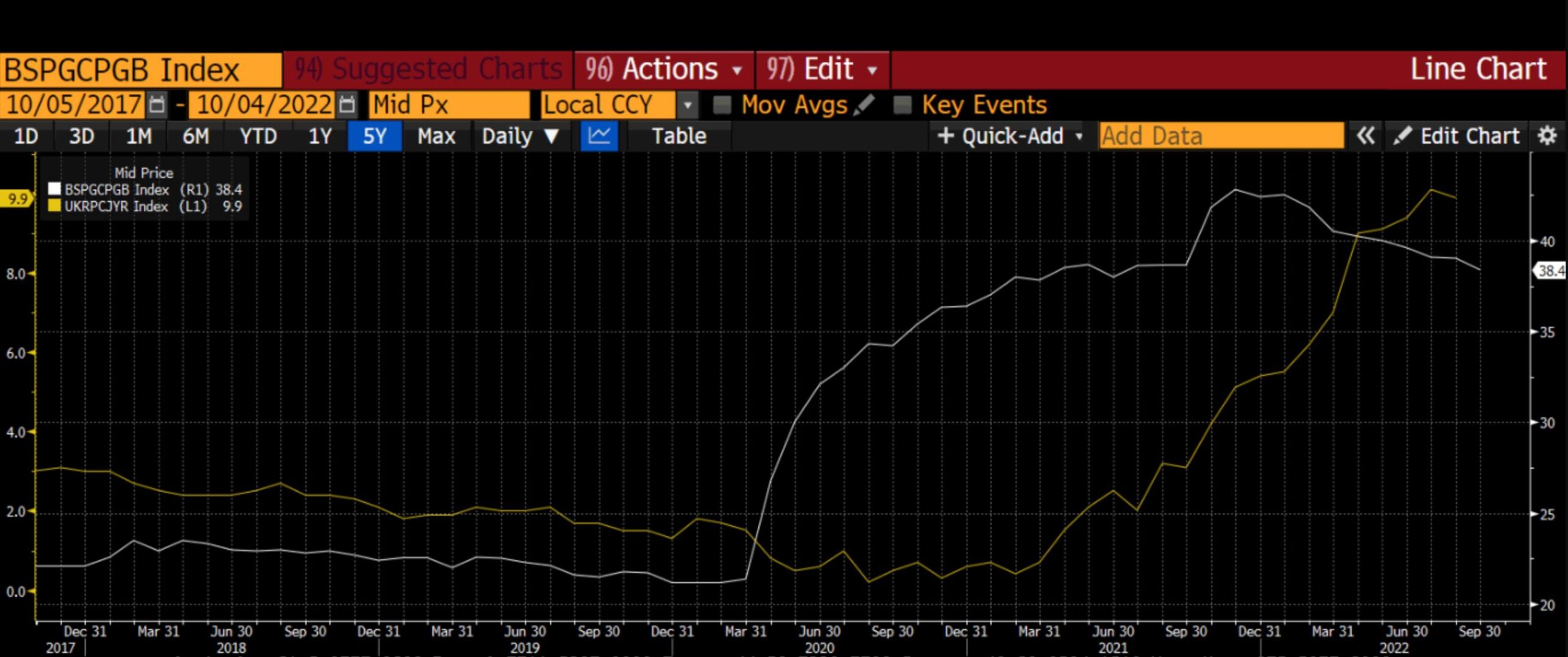

BOE Total Assets as % of GDP (white) vs. UK Consumer Price Index (yellow)

Back to the now, here is how inflation responded – with a bit of a lag – to what has been the most aggressive monetary loosening in the bank’s history. King Charles wishes that the gold line above was charting his popularity over time, but no – it’s just a representation of the suffering of his subjects.

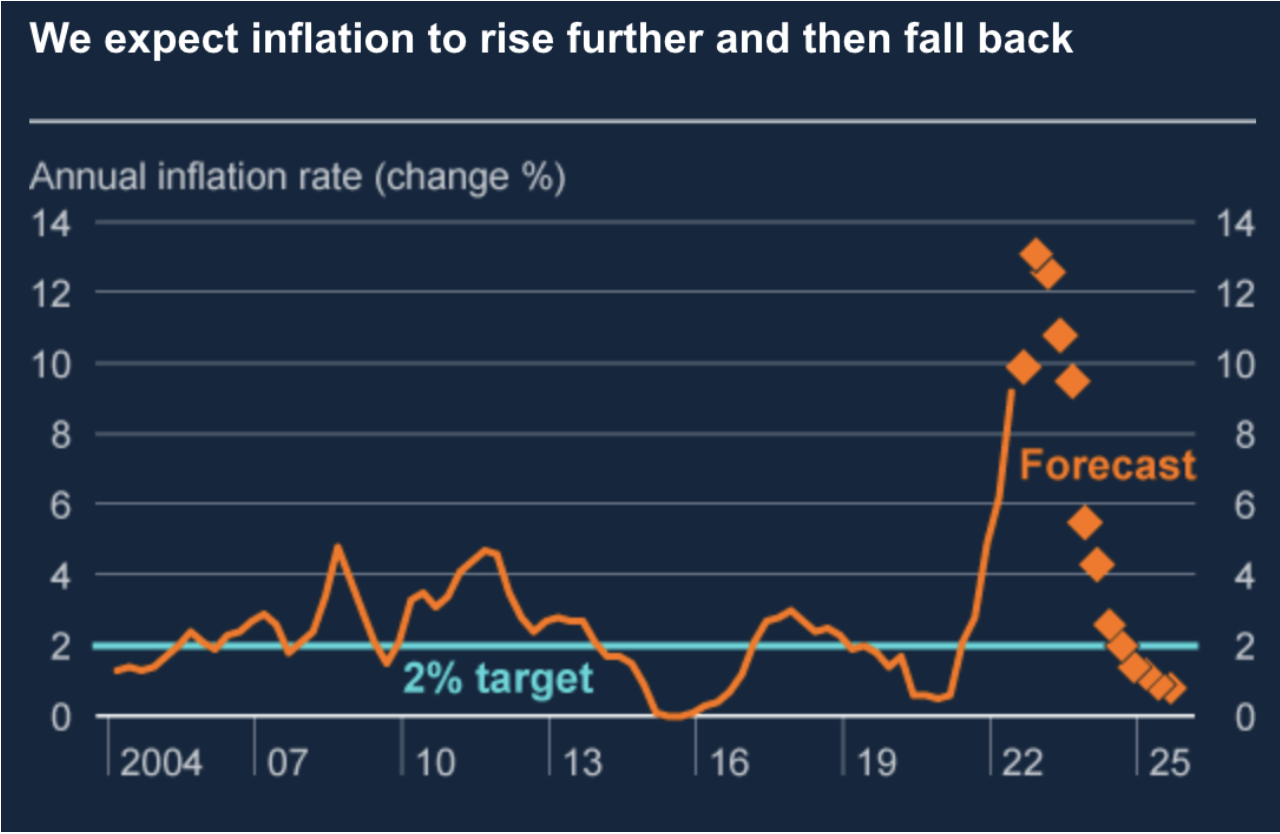

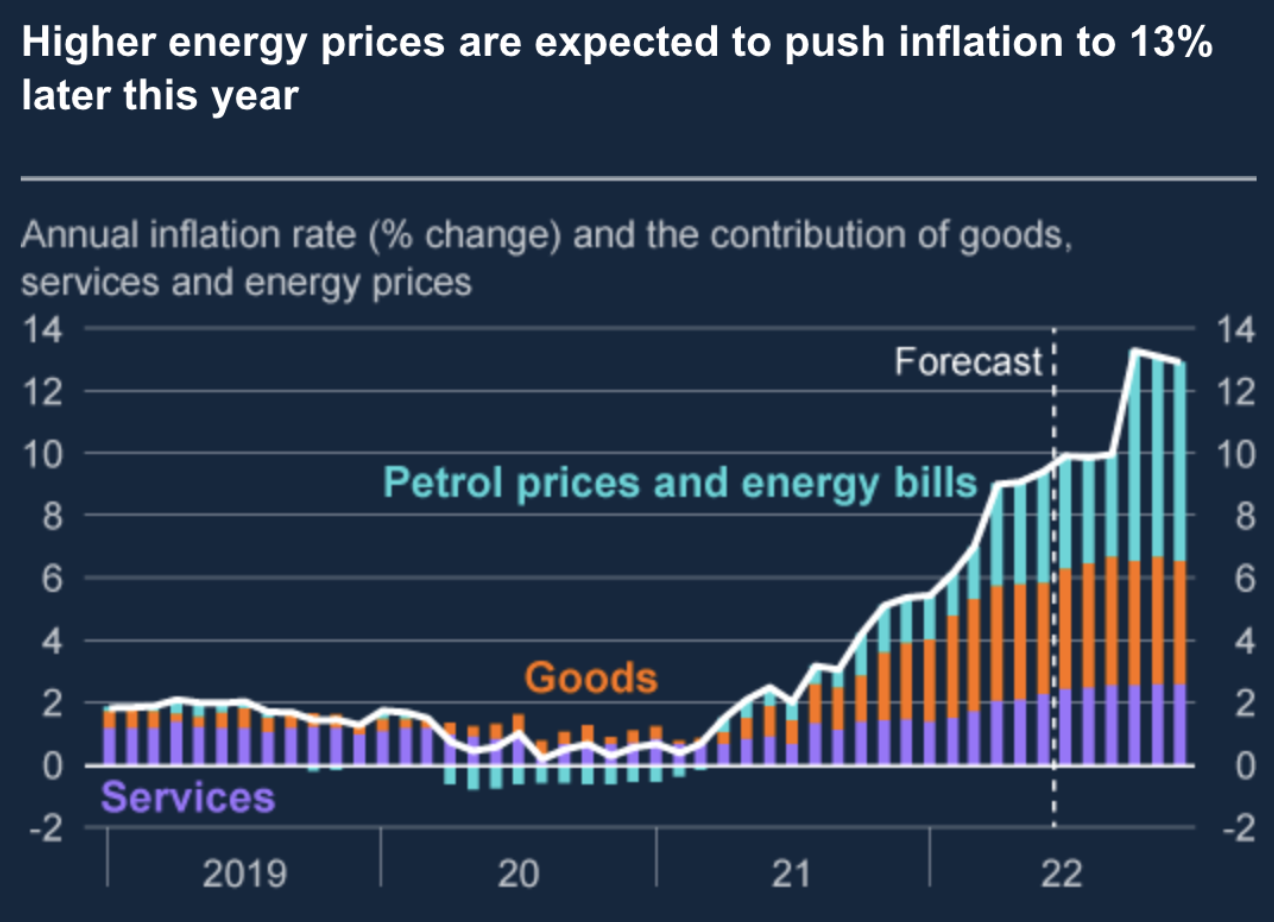

The BOE recognised earlier than its peers that something had to be done about the runaway inflation its money printing ignited. The bank even forecasted in its August 2022 report that inflation would rise to a high of over 13% by year end, before aggressively tapering in 2023 and 2024.

Monetary Policy Report Aug 2022, BOE

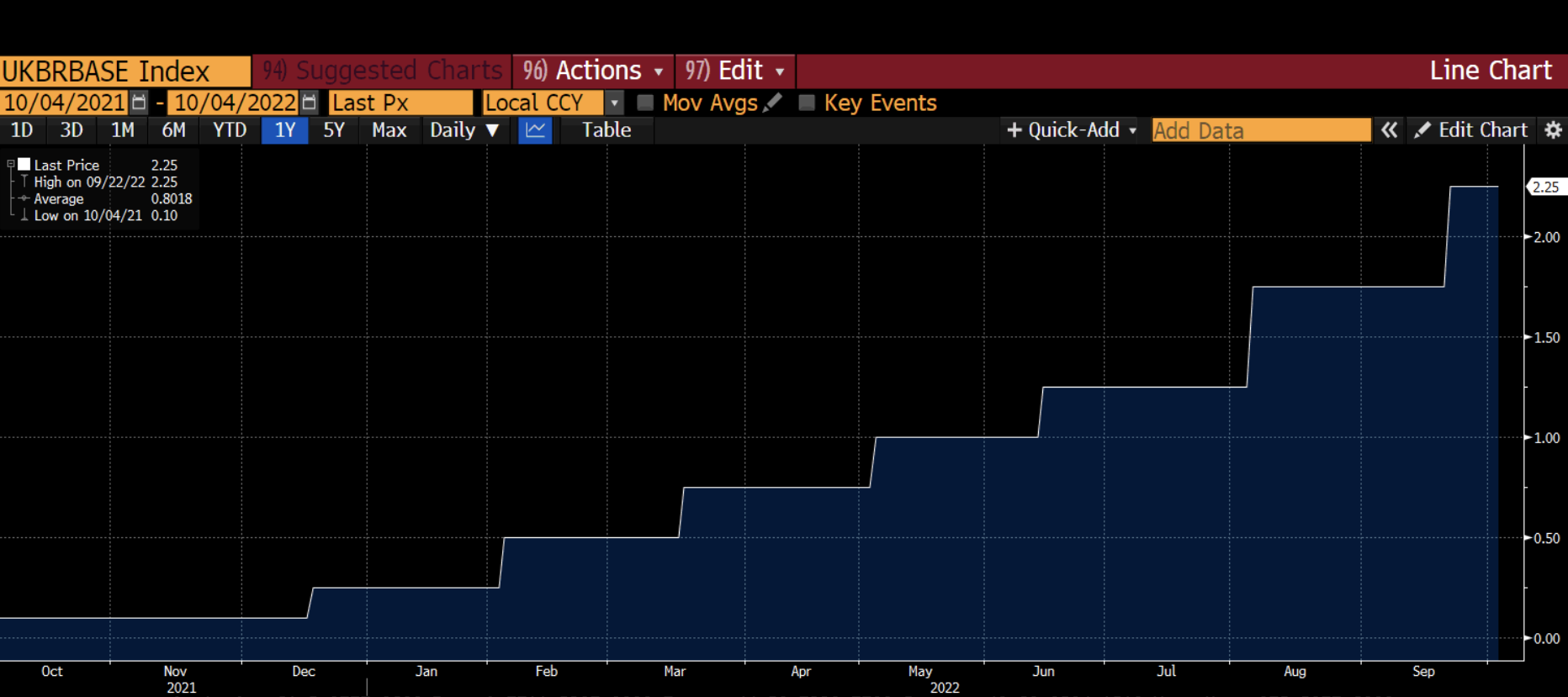

In an attempt to ameliorate the situation, the BOE was the first major central bank to begin reducing its balance sheet and raising its policy rate.

The BOE’s first rate hike was in Dec 2021. Remember that back then, JayPow wasn’t even thinking about thinking about raising rates (he didn’t join his pals on Threadneedle Street at the party until March 2022).

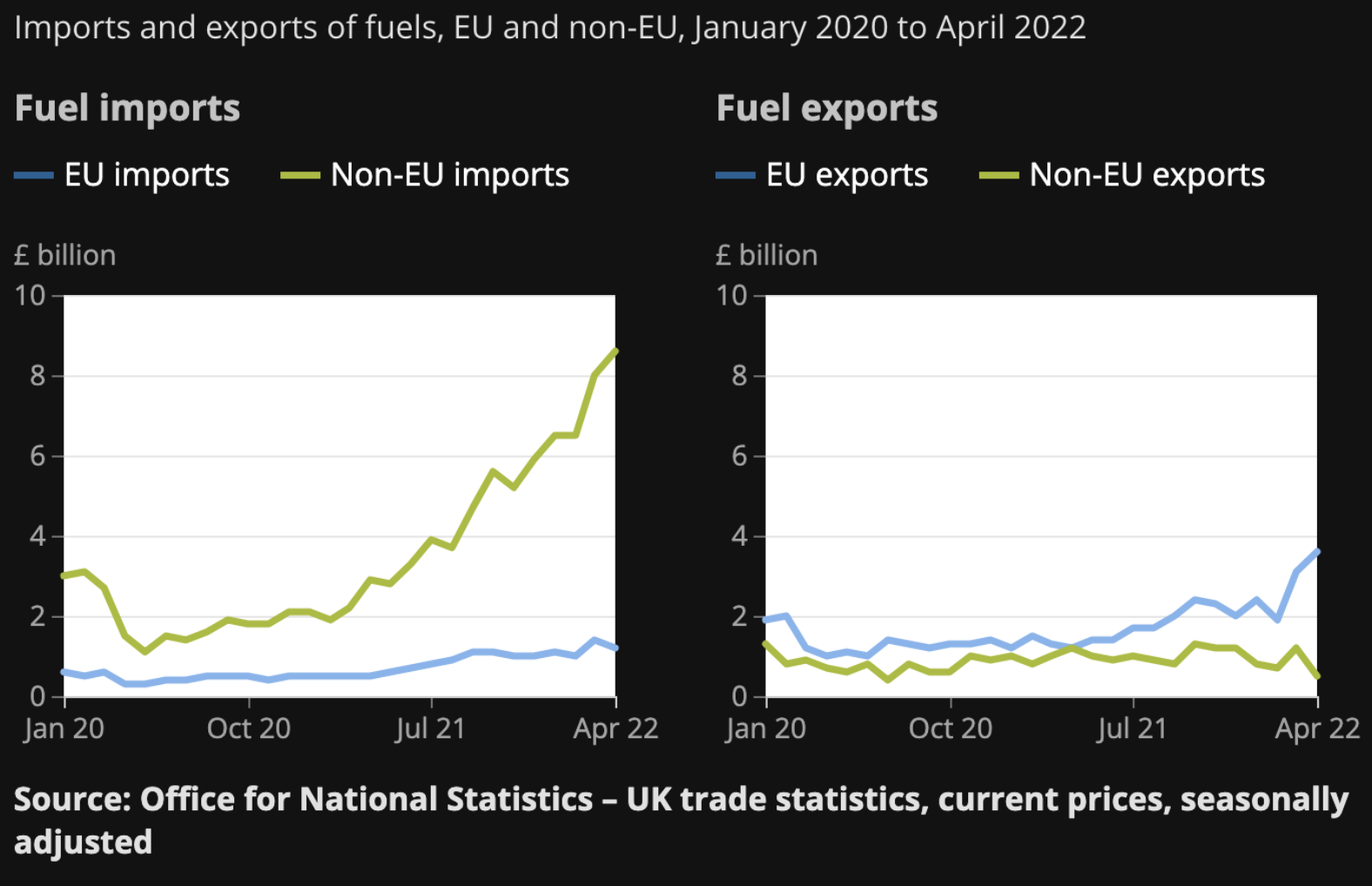

UK policy makers, like most of their brethren in the developed world, believe in energy fairy tales. Namely, that the developed world – which basically grew in lockstep with the use of hydrocarbons – could, by a year that ends in a 0 (2050), eschew those hydrocarbons completely for the less energy-dense wind and solar. The UK has coal, oil in the North Sea, and possibly trapped shale oil as well – but these sources of energy independence have been shunted aside, and the UK’s energy import bill has gotten larger and larger.

WW3 is currently an economic war that is causing the energy markets to balkanise, which has and will continue to be highly inflationary. A country that has both pursued the most aggressive money printing in its history and must import energy simply will not be able to escape the jaws of inflation.

The chart above clearly shows that energy inflation is a big contributor to the overall pain felt by the plebes.

The UK is being hit by a double whammy: not only must the BOE remove credit from the system to reduce demand, but energy prices must rise as well due to the inflationary aspects of WW3. That is not a recipe for economic growth.

Boris Johnson finally got his comeuppance, and it wasn’t due to his bumpin’ and grindin’ during lockdown at 10 Downing St. – he was ultimately KO’d by the poor economic performance of his country. In came Prime Minister Truss and her merry band of fools, ready to deploy the tried-and-true medicine of any government: goodies for everyone.

Last week, she unveiled a new budget replete with measures that will definitely stimulate the economy. For the rich, she reduced the corporate and individual tax rates. For the poor, she intends to hand out vouchers to pay for increased energy bills. Hip hip HOORAY! It’s Margret Thatcher with a new pants suit.

To paraphrase my homie Jim Bianco, “the problem with Truss’ budget is that it will work.” By work, he means that it will spur activity at a time when inflation is raging at greater than 10%. The bond market would have strongly preferred for Truss to have committed to raising taxes and cutting government spending (aka austerity), but both were absent from Truss’ budget. So, the bond market threw a fit.

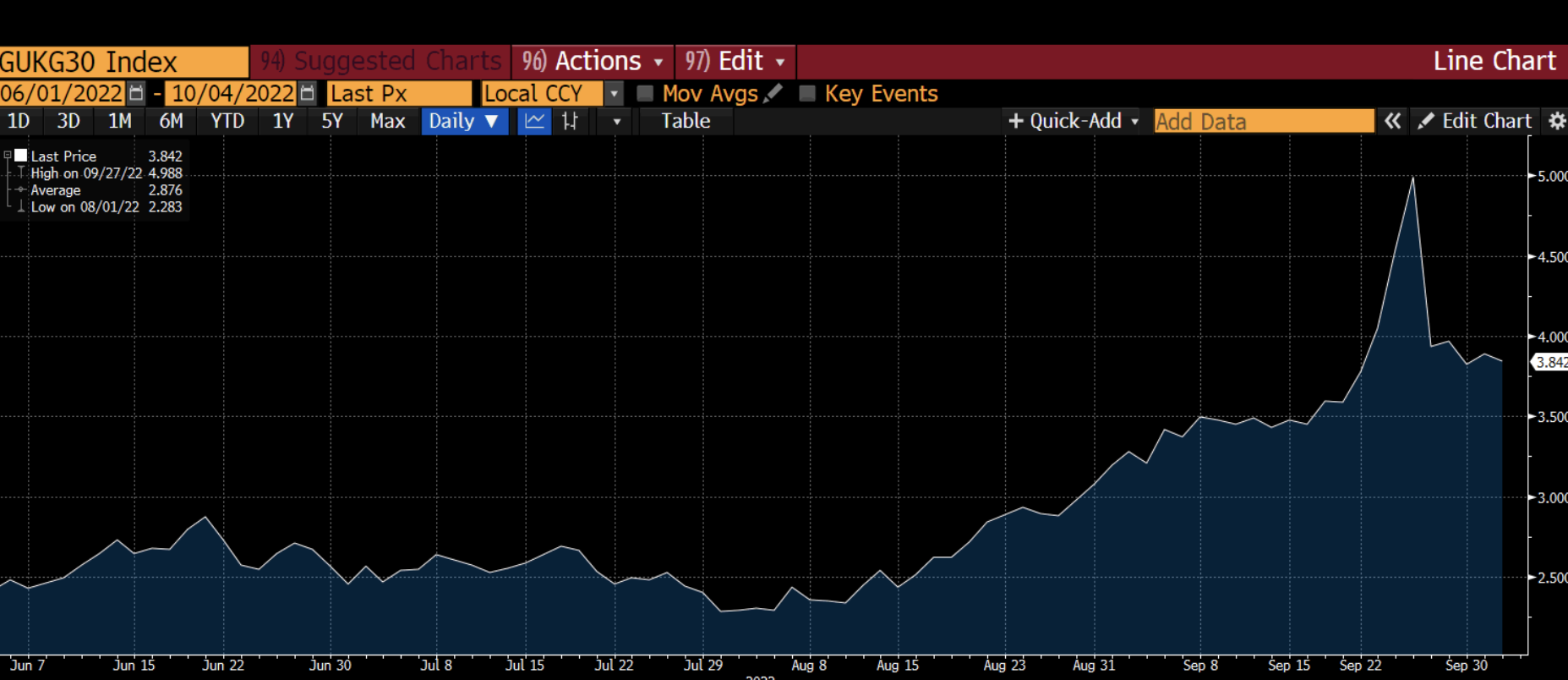

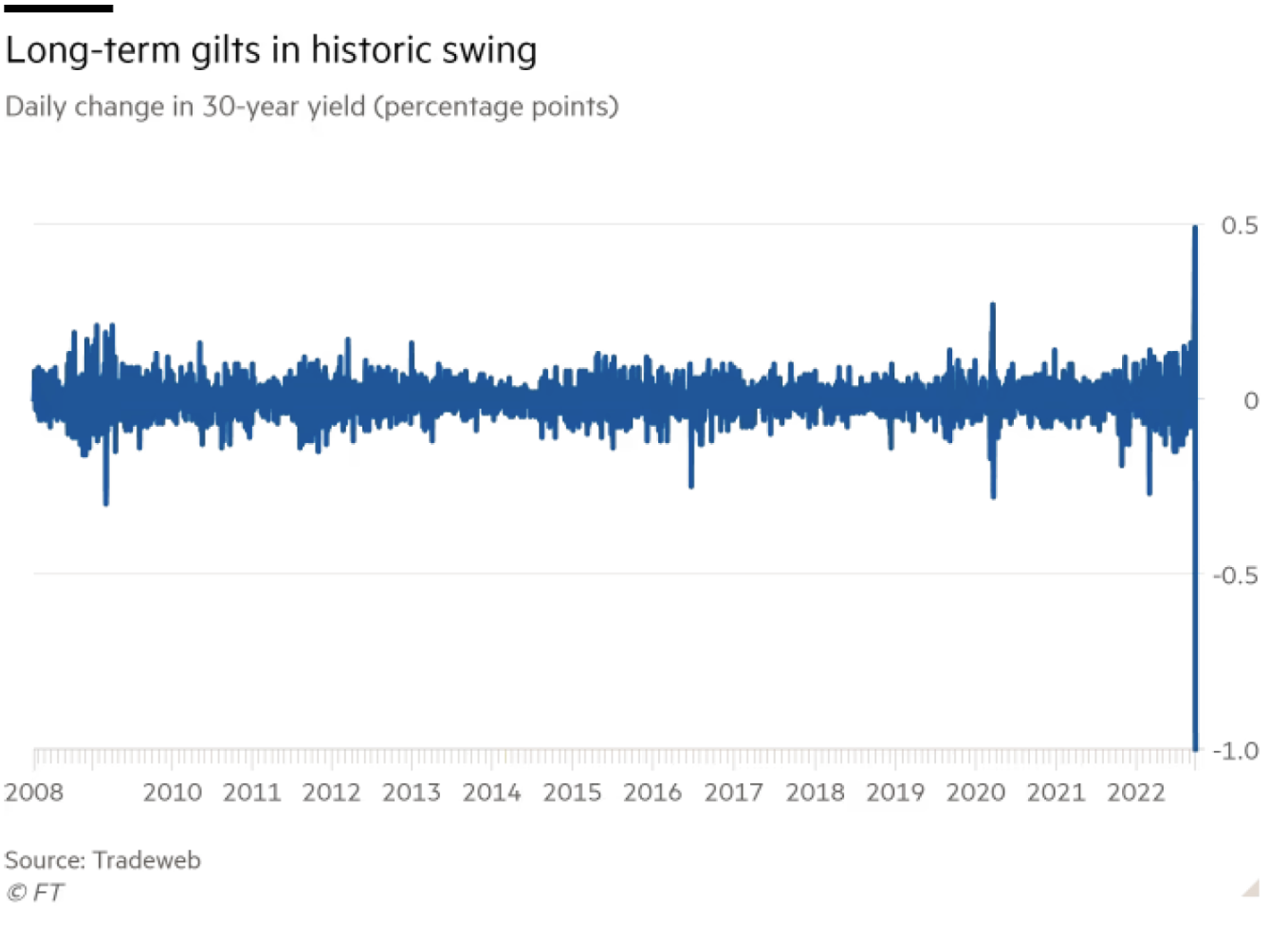

This is a chart of the 30-year Gilt yield. As you can see, in the days after Truss announced her budget, yields spiked the most they have in history. And remember – the Gilt market is the longest continuous bond market in the world, so we’re talking about a few hundred years of history.

Suffice to say, the Gilt market put on some Cardi B and showed the pole who’s boss.

Before this happened, the BOE was supposedly super-duper committed to fighting inflation. To their credit, they were actually raising short-term rates and reducing the size of their balance sheet. But, the rapid rise in yields threatened to destroy the ENTIRE highly-leveraged UK financial system overnight – forcing them to change course.

I won’t go into too much detail, but the systemic threat to the UK banking system stemmed from accounting gimmicks that the regulators allowed pension funds to participate in. Essentially, the UK pension funds were allowed to use levered derivatives in the interest rate markets to match their liabilities. Derivatives require margin, and when you are short rates and rates rise, then you must post more margin. The pension funds didn’t have the money (they spent it all trying to pick stonks and whatever else their sell side banker could stuff them with), and the historic rate spike would have caused them to go bankrupt overnight. The FT has an excellent description of the chicanery that occurred under the watchful eye of the BOE.

So, to avoid a financial apocalypse, the BOE in a single morning abandoned all their hard work and moved immediately to unlimited purchases of long-dated Gilts in order to jam prices lower.

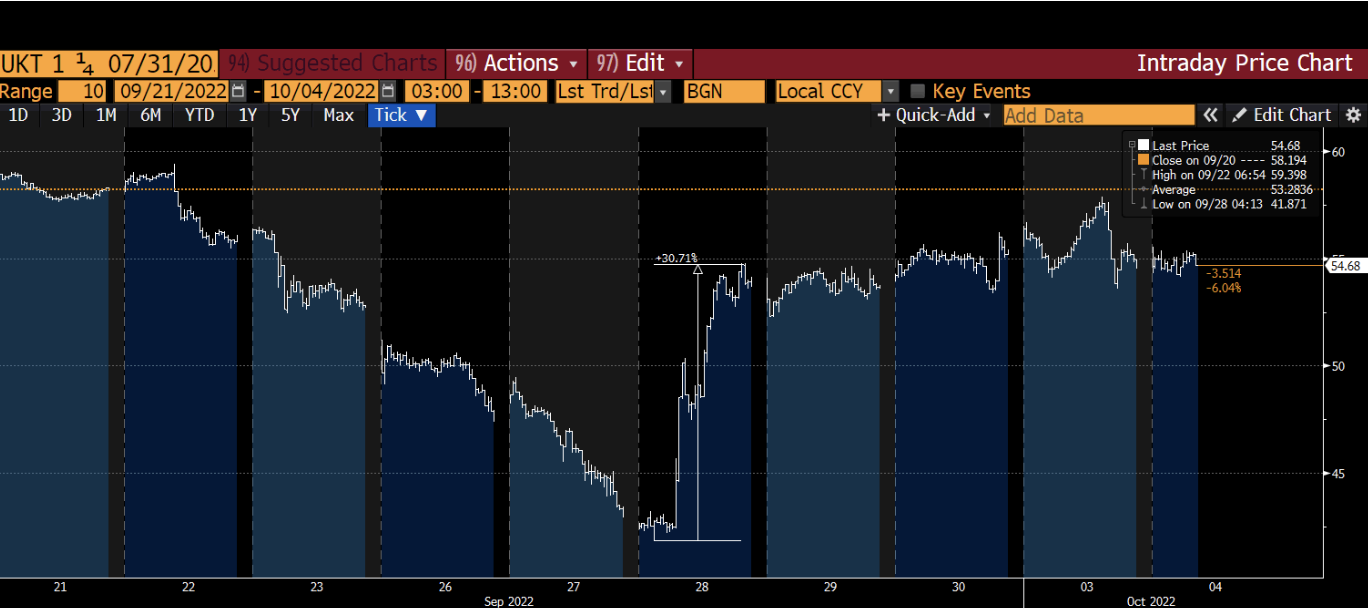

This is another lesson in “never shall I ever fight a central bank.” The above chart is of the current on-the-run 30-year Gilt. On September 28th, after the BOE turned the money printer back on, this bond moved 30%. Thirty fucking percent! That is an unheard-of daily move for a developed market sovereign bond. You might think you were invested in an offshore USD bond of a Chinese property developer – but nope, it’s just His Majesty’s government obligations.

The political need to hand out goodies to the population to help them fight the terrible current economic situation ran headfirst into financial reality. Given that – like all modern economies – the UK financial system is debt-based and highly levered, the central bank did what it is supposed to do: protect the financial system from asset-price deflation. Remember this: as bad as it is right now, inflation is not their number one priority. The BOE example couldn’t have made that clearer. In a few hours, they threw almost a year of prudent monetary policy out the window to save the financial system. And in the process, they ushered in the end game (YCC).

Before we move onto the continent (and pardon me if you live on a continent other than the European one, but let’s be honest – you just are not culturally relevant) let’s play “Central Bankers Say the Darndest Things.”

This is what the BOE was spittin’ pre-meltdown:

Financial Times, October 17th, 2021 “The governor of the Bank of England warned on Sunday that it ‘will have to act’ to curb inflationary pressure, making no attempt to contradict financial market moves that have priced in the first interest rate increase before the end of the year.”

Speech from Gov Andrew Bailey on July 19th 2022, “Let me be quite clear, there are no ifs or buts in our commitment to the 2% inflation target. That’s our job, and that’s what we will do.”

The official monetary policy announcement of the MPC, August 4th 2022, “The MPC will take the actions necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

September speech from Catherine Mann, member of the MPC, Sept 5, 2022 “a fast and forceful monetary tightening, potentially followed by a hold or reversal, is superior to the gradualist approach because doing so is more likely to promote the role that inflation expectations can play in bringing inflation back sustainably to 2% over the medium term.”

And this is what they said when their financial system almost blew up in on trading session:

On 28 September, the Bank of England’s Financial Policy Committee noted the risks to UK financial stability from dysfunction in the gilt market. It recommended that action be taken, and welcomed the Bank’s plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace.

Hmm… apparently it’s dysfunctional when the price goes down, but functional when the price goes up. In that case, can I call my crypto portfolio dysfunctional and get a BOE bailout?

Let’s now move on to the EU and the ECB. The ECB is trying to fight the good fight against inflation, but it too will soon succumb to the YCC virus for many of the same reasons as the BOE.

ECB Tower, Sonnemannstraße 20, 60314 Frankfurt am Main, Germany

Economically speaking, the only two countries that matter in the EU are France and Germany. The entire goal of modern European history has been preventing Germany and Russia from joining forces. The manufacturing prowess of the Germans combined with cheap Russian commodities could be a game-changing force from a geopolitical point of view.

The EU is an artifice – a political ploy of France to keep Germany down, which the Germans only went along with due to their guilt over WWII. The US shares France’s interests, and it too lurks in the shadows, standing ready to prevent any real alliance between Germany and Russia. A weak EU serves the political interests of America quite well. The Eurasian landmass must be prevented from unifying at all costs. (I’m paraphrasing daddy Felix quite a bit here, as I felt a direct quote of a substantial chunk of his most recent missive would probably garner me a spanking.)

As with everything in life, unpacking the energy policy of Germany is the best means through which to understand why the German economy is fundamentally fucked, as well as why that spells doom for the broader EU. Germany – the EU’s only real economic engine – is being rendered impotent due to a lack of affordable energy, and as a result, a depression looms for the EU. Amidst this economic malaise, the “union” is at serious risk of splintering. In order for the ECB to keep the EU intact, it will likely have to ditch any plans to shrink its balance sheet and quickly move to outright YCC in order to save the unholy political union that is the EU.

France, to its credit – and I find very few geopolitical things to give France credit for – actually did the intelligent thing and went all in on nuclear energy. Roughly 70% of electricity generation is nuclear powered (Source: IAEA). Therefore, their manufacturing base can withstand the cessation of Russian gas flows. Germany, on the other hand, cannot.

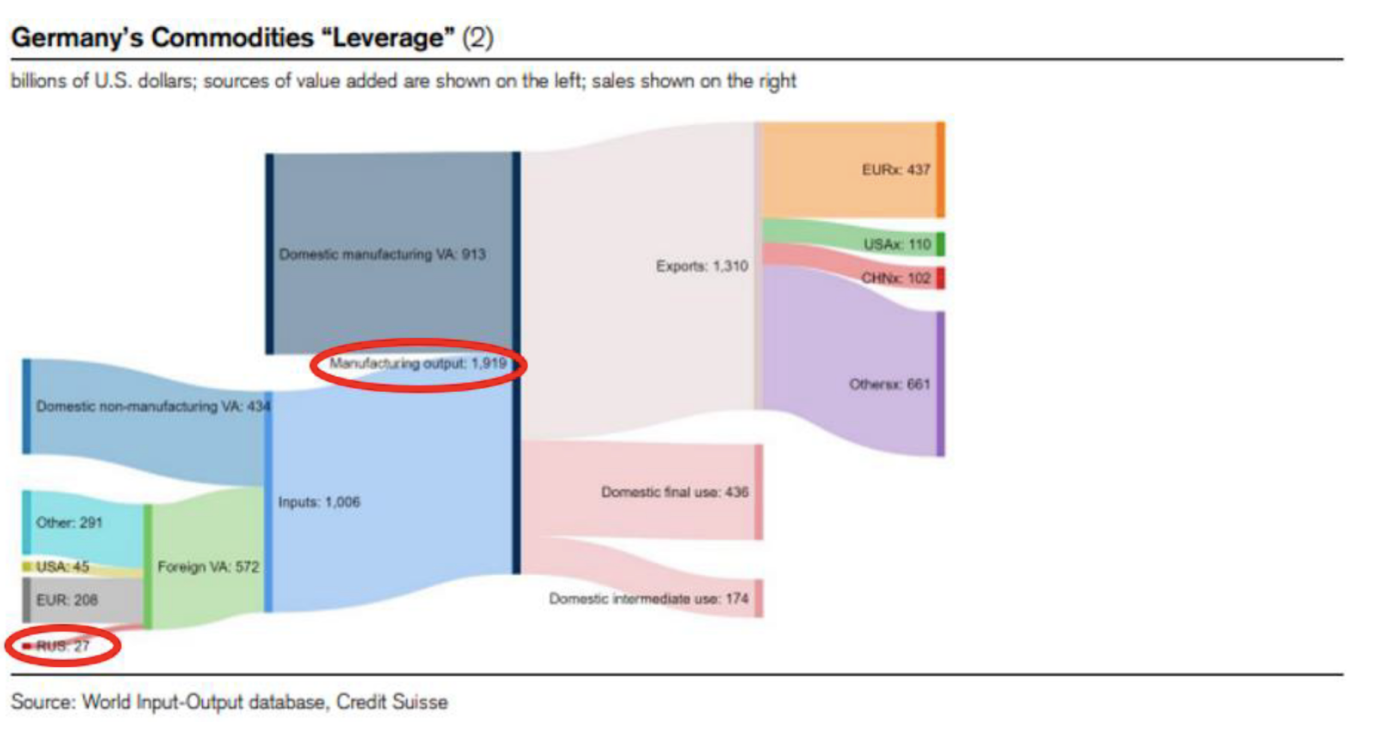

My boy Zoltan produced this excellent graphic which details just how fucked Germany is as cheap Russian gas is removed from the industrial economy.

$27 billion worth of Russian gas powers almost $2 trillion worth of German economic output – an effective energy leverage of almost 75x. The German public were hoodwinked into believing the same energy fairy tales their politicians bought into, and as a result, they overwhelmingly allowed the Green party to dismantle any efforts to build a functioning nuclear energy ecosystem over the past several decades. So, unlike France, the sabotage of the Nordstream I and II pipelines have left Germany with quite literally no option but to import expensive American and Qatari liquid natural gas (LNG) via supertankers.

The mainstream media touts the limitless ability of the Americans to send cheap gas to Europe. But, the gas is only cheap because America is not the swing producer for the Western world. Should that come to be – which would cause gas prices to rise domestically in America – the plebes would agitate for the cessation of imports so that they wouldn’t pay more to heat their homes.

In this scenario, German goods would carry a significantly higher price (if they could be produced at all). We can already see the impact of rising producer prices in Germany, which have surged 46% YoY according to the August reading. As a result, the German current account is quickly hurtling towards zero, and will enter negative territory shortly thereafter.

German Producer Price Index % YoY Change

German Current Account

The reason this matters is a curious construction called TARGET2. Let’s hear from the horse’s mouth what exactly this beat is:

The reason this matters is a curious construction called TARGET2. Let’s hear from the horse’s mouth what exactly this beat is:

TARGET2 is the real-time gross settlement (RTGS) system owned and operated by the Eurosystem. Central banks and commercial banks can submit payment orders in euro to TARGET2, where they are processed and settled in central bank money, i.e. money held in an account with a central bank.

Source: ECB

In case you are not steeped in economic dogma, let me attempt to explain this in my vernacular.

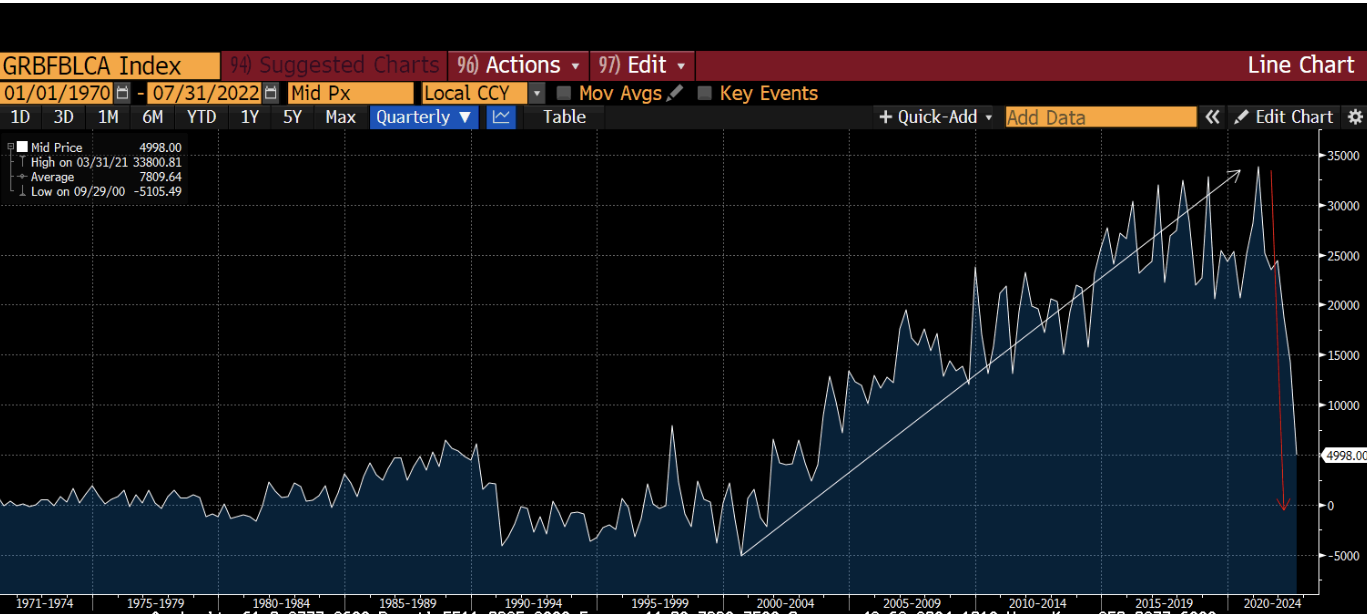

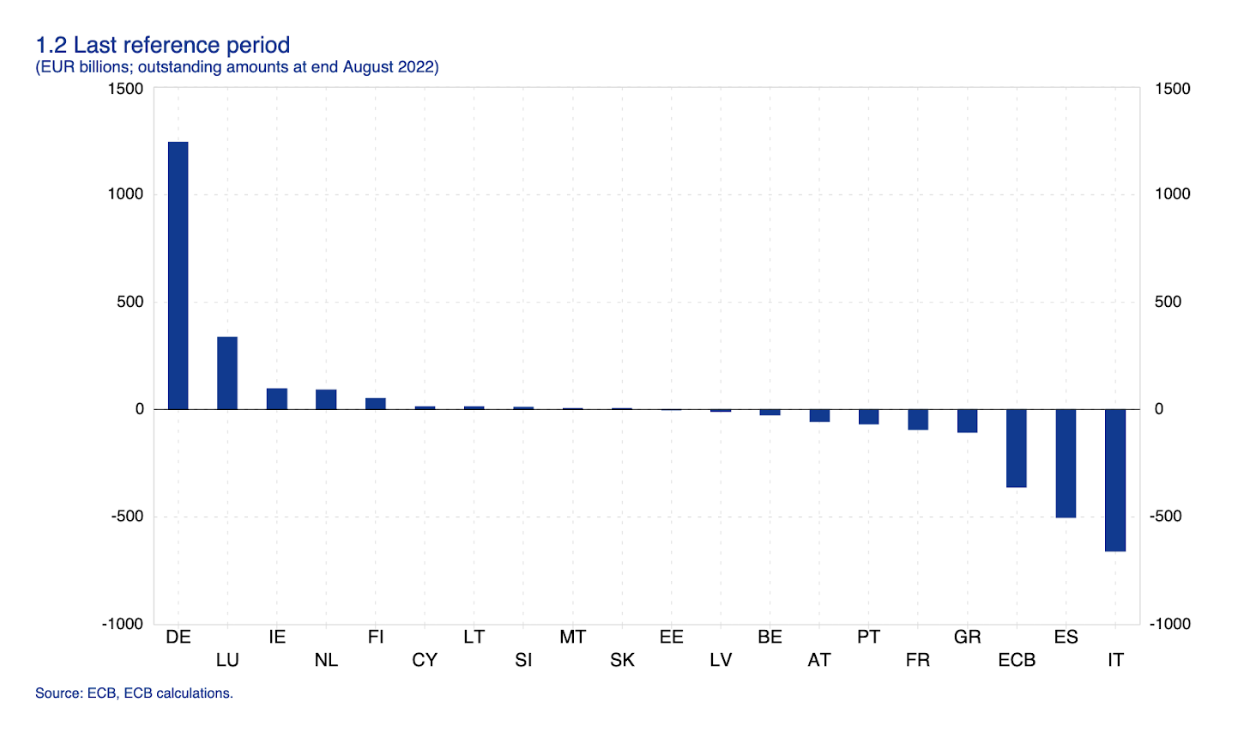

The above is a chart of the intra-EU credits and debits between members. This is TARGET2. Because Germany is the powerhouse of Europe and runs trade surpluses with the rest of the members, it is “owed” money. Think of Greeks buying G-wagons with IOUs. (As an aside, I recently saw the G-wagon pickup truck IRL – it’s fucking badass).

If each country in the EU had their own fiat currencies, then the above chart would tell you that the Deutsche Mark should be stronger than the Italian Lira. It also tells you that if the rest of Europe had to buy goods from countries outside the EU, the Euro would be a much weaker currency. In other Federal vs. Provincial / State political setups, the imbalances are smoothed out by credits and debits between the smaller political units. This is possible because those systems are typically both a financial and fiscal union. But the EU is purely financial, and thus the centre cannot force the periphery to settle the imbalances between themselves.

To-date, the Greeks have never needed to buy Ford’s or Kia’s instead of BMW’s – but what if Germany had to shut down its auto manufacturing plants due to a lack of energy?

Italians have gotten along just fine buying ammonia from Germany, rather than China – but what if BASF had to shut down its Ludwigshafen facility due to a lack of affordable natural gas?

I suspect you’re starting to see the problem here…

All those debts that EU countries typically owe to Germany would suddenly be owed to foreign producers like America, China, South Korea, Japan etc. instead. And since these countries aren’t tied into an uneconomic union for the sake of politics, they will demand “hard” fiat currency, like USD, rather than the toilet paper (or I guess toilet plastic) that Euros have become.

For a politician schooled in Keynesian economics, when you can’t afford the market price of a good, there is a very simple solution. As the government, you can issue debt and force production to continue. The debt is used to cover the cost differential between what a business can afford and the international market price of energy.

Germans, due to their institutional memory of the Weimar Republic’s hyperinflation, are very conservative when it comes to monetary policy. The only thing holding back even more profligacy at the ECB is the Bundesbank. But without cheap energy, Germany will have to attempt to print their way out of their problems. And just like every other nation, they will issue more bonds to cover fiscal transfers.

With a greater supply of Bunds, the price will decline. That’s a problem for the entire EU, because without German monetary discipline, the Euro would long ago have become a trash currency akin to any other emerging market that imports energy and food and whose labour is uncompetitive in the global market.

All other EU country bonds are priced relative to Bunds. In fact, the ECB’s money printing operation is specifically geared towards keeping the spread of the weak EU members’ bonds vs. Bunds at reasonable levels. If Bunds go down, everyone goes down.

Similar to the UK, it will likely be the German politicians seeking re-election who precipitate a selloff in Bunds. They will promise goodies for industry and individuals in order to alleviate the economic impact of the lack of cheap Russian gas, and bond investors will (understandably) have none of that. Just like in the UK long-term Gilts market, the long-dated Bunds will get smoked. As Bund yields skyrocket, the ECB will face a raft of uber-levered financial players who will instantly go insolvent should they mark to market their fixed income derivatives books at the higher Bund yields.

An example of some goodies 4 da people: Germany has pledged to spend €200B to help consumers and businesses cope with energy prices, including promoting renewable energy production.

And that, ladies and germs, is how and why the ECB will immediately abandon QT, move to a stop-gap QE program to normalise the Bund and every other EU bond market, and eventually graduate to YCC as the market pukes bonds of all stripes into the loving hands of Christine Lagarde. I bet she has soft hands, too.

As the German economy self-implodes, the 30-year Bund market has already begun to take notice. Look at the meteoric rise in yields that started in 2021.

Current 30-year Bund Yield

Let’s play “The ECB Says the Darndest Thangs”:

“We took today’s decision, and expect to raise interest rates further, because inflation remains far too high and is likely to stay above our target for an extended period.”- Christine Lagarde, ECB Press Conference, Sept 8

“The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target over the medium term.”- ECB Monetary Decision, July 21

“High inflation is a major challenge for all of us. The Governing Council will make sure that inflation returns to our two per cent target over the medium term.” ECB Press Conference, June 9th

That’s the before, and I can’t wait to read about the after. I imagine that, similar to the BOE, the ECB will cite market dysfunction in the debt markets as their reason for ditching their plans to shrink their balance sheet so quickly and resuming QE once more.

Eighty Percent

I like my YCC just like I like my dark chocolate – 80% and above. Once you go black, you never go back ;).

With 80% of the world’s major central banks either conducting QE and/or on their way to outright YCC, is it enough to overcome the toughness of Sir Powell with respect to the price of fungible risky assets?

Gold and crypto are fungible global risky assets. A bar of gold is a bar of gold whether you are in New York, London, Frankfurt, Tokyo, or Shanghai, and the same goes for a Satoshi.

As more Euros, Yen, Renminbi, and Pounds are printed, at some point people will start moving their savings from these currencies into either Dollars or other stores of value. That means that the USD will continue to strengthen as long as the Fed continues raising rates and shrinking its balance sheet. But, Gold/EUR and BTC/JPY could also catch a strong bid.

Given the gold and crypto markets are much smaller in size than the trillions in fiat money that will be printed, in non-USD currency terms these assets will appreciate. Now, because we care about the global price, or the USD price, from a trading perspective, these flows only matter in one specific instance. If the BTC/EUR price appreciates faster than the EUR/USD declines, then an arbitrage exists. Here is how it works:

- A USD-based investor notices the high price of BTC in EUR terms.

- This investor borrows USD, then sells it vs. buying BTC.

- Then they sell BTC vs. buy EUR.

- Then they sell EUR vs. buy USD.

- The investor pays back the USD loan, and the remainder is their profit.

This triangular FX arbitrate will push the global / USD price of BTC in line with the elevated price of BTC in EUR, JPY, CNY, and GBP.

As the non-Fed central banks get real serious about the task of printing money, even if the Fed continues QT – which I don’t believe they will be able to do for much longer than early 2023 – small sized stores of value like gold and Bitcoin could still rise.

“Arthur, this is just more copium,” you might retort.

And to that, I say: patience. This process will not be immediate. The economic and political forcing functions I discussed won’t happen overnight. But, it’s clear from the BOE example that once the politicians set in motion the policies necessary to placate their electorate, the bond markets will have none of it. There is no immediate solution to decades worth of poor energy policy decisions. Therefore, money printing will be the only politically expedient option. Once bond markets see what is coming, with more and more stimulative budgets, yield will rise, and the over-leveraged fiat debt-based financial system will quickly buckle – followed by the equally rapid appearance of a monetary bailout.

America is self-sufficient in food, fuel, and people. China, Europe, Japan, and the UK are not so blessed. America can be an autarky if it pleases. As a result, the Fed has the luxury of being able to prioritise domestic political concerns regarding inflation over and above supplying the world (and most of its allies) with a constant flow of dollars. A constant flow of dollars allows the rest of the world to print their currencies and still afford to buy energy in USD terms. It’s a relative game, and if the strongest player goes their own way, everyone else is left to suffer.

I am working on creating a GDP weighted index that charts the amount of money printed by these five central banks. I will share it, and its rate of change, when it is ready. This will give us a way to visually track the point at which the money printing of the 80% eclipses the tightening of the Fed.