(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The price of anything is the most powerful signal of the collective will of humanity. As a society we utilise forms of money as an abstraction of the energy it costs to produce the things that sustain us. The price tells us what amount of energy balances supply and demand for a given good or service. When society distorts pricing signals, supply and demand becomes imbalanced, resulting in wasted energy. Waste enough energy, and civilisation falls; hopefully to be replaced with a new social structure that is properly organised to conserve energy in a better way. With all of the exciting current and future developments of crypto, we must not lose sight of the most important ingredient to the current excitement … The BOOLMARKET.

Yes, the technology has to work and does … sometimes. But if we are moving towards a tokenised world, the price of the token that represents a particular piece of crypto technology or community is the easiest way for a layperson to understand whether it is successful or not. However, the PRICE = SUCCESS identity is easily perverted if the unit of account is attached to a money printing central bank / government.

How are we to tell the real energy value of a thing if the quantum of the yardstick increases every year? Or worse, if the yardstick is just a piece of political theater based on the whims of fallible humans who care only for their survival in office. While many crypto natives benchmark their wealth in Bitcoin (and increasingly, Ether) terms, the vast majority of humanity values their net worth on some derivative fiat currency linked to the US dollar.

The spectacular rise of all things crypto since the washout in March 2020 will make some think that superior technology is winning. The tech is so amazing and transformative that the gains in adoption will not only increase but accelerate. Along with this success, the prices of many assets will continue to rise exponentially. You think to yourself, “this shit is so LIT, I only look at charts on a log scale.”

But the easiest way to generate buzz and click-baity news articles and draw eyeballs to a particular project is the token price. The purchase of an NFT piece of artwork for $69 million at a Christie’s auction earlier this year set the stage for the explosion of interest in the technology-enabled art form. The talent and technology were ever present, but it took a splashy purchase to train the world’s attention upon all things NFTs.

Any token price is a combination of technology and monetary conditions. The difficult part is determining the percentage weighting of each factor. As we close out 2021, the two major economies of the world, America and China, stand at the precipice of a market maelstrom. In America, the Federal Reserve is feeling intense political pressure to deal with inflation now. In China, Beijing must decide whether it actually wants to reform its economy, or continue printing money to support the current growth model. The decisions these two economies make in the next quarter will determine the extent to which the monetary landscape supports the further price appreciation of the crypto complex.

The technological improvements offered by crypto have become irrelevant at this point because current expectations are so high. Many TradFi research analysts previously pooh-poohed various aspects of the crypto market, but now gush with praise for crypto and laud it as a transformative advancement. Many politicians around the world are recognising the inevitable coming shift in how corporate, government, and individual actors interact due to crypto. The bright future is baked in, only disappointment awaits. That does not mean I’m bearish on the good crypto will accomplish in short order, but it does mean adding users at the anticipated rate will not generate outsized returns.

There are three types of crypto allocators, and each one will alter their portfolio according to their Q1 2022 outlook.

1.

There are those who must decide whether to allocate more fiat into crypto. They are chiefly concerned with the amount of monetary debasement that will or will not occur. “Do I sell USD to buy Bitcoin or Ether?” Their benchmark is outperforming the growth in fiat money supply.

2.

There are those who must decide whether to allocate more Bitcoin or Ether into other types of tokens. They are chiefly concerned with finding projects whose technological impact or user adoption will grow quickly, such that the price outperforms Bitcoin / Ether. “Do I sell Bitcoin / Ether to buy Solana, Cosmos, Terra etc.?”

3.

Finally, there are those who must decide if it is time to liquidate their crypto holdings and return to fiat / government bonds. They must determine whether this is the part of the cycle where the crypto complex drops 75% – 90%. They want to protect the value of their wealth in terms of units of commonly used hydrocarbons such as oil and natural gas.

The monetary policy decisions of the US and China affect cohorts 1 and 3. The second cohort could create independent value to nullify a poor monetary environment, but that will occur only once there are larger self-contained economies such as open Metaverses and a plethora of DAOs. These forms of crypto organisations are in their infancy, and so cannot completely steralise conditions that favour cash and bonds over financial assets.

This may sound repetitive, but this iterative process of advancement and decline all fits within the circular nature of human society. Our collective actions follow a predictable wave-like progression. It’s as if human society exists purely inside a rave. A known set of baselines are augmented with melodic progressions that lead us from the intro, into the breakdown, followed by the drop, which causes nirvana, and then death and rebirth into a new track. After completing this circo loco millions of times, we hope the general trajectory is progress, but stagnation and decay cannot be dismissed as impossibilities.

I Can Handle It

The Evergrande saga and the ongoing decline of the Chinese property market in general is completely self-inflicted. Starting with the market reforms of Deng Xiaoping in the late 1970’s and early 1980’s, Beijing decided it would urbanise quickly. That drive to move hundreds of millions of poor peasants from their rural homelands to soon-to-be prosperous megalopolises, such as Beijing, Shanghai, Shenzhen, and Guangzhou ( the four wealthiest, Tier 1 cities), went into overdrive once America dropped its opposition to China joining the World Trade Organisation (WTO) in 2001.

The major private property developers purchased land from local governments, and built the housing necessary for this massive human migration from farm to city. At a certain point, instead of providing much needed new shelter for the people, property development became a tool of rampant speculation. Because the capital account was (and still is) closed in China (i.e., comrades can’t invest their savings abroad) and the domestic stock market was underdeveloped, people gravitated towards protecting their wealth via property ownership.

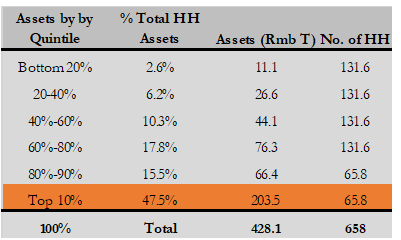

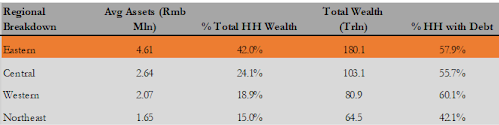

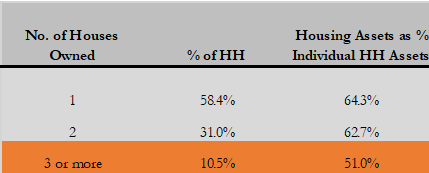

Andrew Collier produces excellent bottoms-up data on the economy in China. The below charts illustrate the degree to which the wealthy in China account for the majority of financial assets and, importantly, are heavily invested in property.

The top 10% of households own almost half the wealth in China.

The Eastern provinces, which encompass the wealthy coastal cities of Shanghai, Shenzhen, and Guangzhou, are the richest in China by a large margin.

Over 40% of households own two or more properties.

The central government supported developers and speculators with cheap loans. The large state-owned banks (commonly referred to as state-owned enterprises, or SOE) were happy to lend to developers and homebuyers to develop projects, acquire land and purchase physical units. Borrowing money to pursue activities that are not state-approved is difficult and extremely expensive. As a result, China consumed more raw materials in a shorter pace of time than any country in human history. A lot of that cement, steel, and other industrial commodities made their way into the construction of new flats and skyscrapers.

While the rapid urbanisation of China benefited many Chinese comrades and global businesses, at a certain point, building more apartment complexes did not return value greater than the cost of debt. Starting last year, Beijing decided enough was enough and began to implement policies to restrict credit to only the most profligate borrowers, the worst being Evergrande.

Predictably, after less than one year of the so-called “three red lines” policy, Evergrande faces imminent default on domestic and foreign bonds. It appears that Evergrande will enter “restructuring” on the totality of its foreign USD debt obligations. Default is here. Evergrande is just the worst of a bunch of companies that gorged on cheap credit for too long, and after a certain point failed to add real economic value to China.

However, the entire development model of rapid urbanisation will be called into question should Beijing allow Evergrande and companies like it to fail. Xi Jinping, via his proclamation of “common prosperity” and “socialism with Chinese characteristics”, signaled to the world that Beijing believed China’s economy could handle its first real credit cycle since the 1990’s (when its banking system essentially collapsed under the weight of massive non-performing loans and inflation).

If Xi and the party are serious, then the PBOC cannot rescue the Chinese capital markets by lowering the price of credit and/or allowing banks to lend freely again for property-related activities. It seems likely that the government will come to that conclusion, meaning that China will not provide more fiat-printed liquidity to the global markets. That essentially leaves the task of keeping global risk asset markets elevated to the Fed. The Fed, via its $120 billion per month of bond buying, seems willing to provide the wampum the global financial asset markets needed to continue their upward ascent.

It is undeniable that the brisk pace of economic growth experienced by most developed countries in 1H 2021 slowed considerably in the third and fourth quarters. China continues to ship record amounts of stuff to the world, but even with this export strength, something must be amiss– because over the weekend, the PBOC lowered the reserve ratio requirement by 0.50%.

CSI 300 Real Estate Index (SH000952 INDEX) is down 20% YTD.

HSCEI, Hang Seng China Enterprise Index (HSCEI INDEX) is down 20% YTD. There are Chinese companies listed in Hong Kong, which are much easier for foreigners to trade given Hong Kong’s open capital account. This index contains Evergrande and many other property and technology names.

The weakness in Chinese equities and spike in low-quality Chinese bond yields indicate that Beijing accepts the consequences of their policy choices to reign in big tech and crush domestic property developers. I don’t know what on the ground has changed, but the PBOC lowering the RRR requirement and decreasing the cost of credit– which should be increased to wean the country off its easy money addiction– indicates the calculus has changed somehow for Beijing.

It will be telling how large of a haircut Evergrande USD offshore bond holders are stuffed with. Will Beijing swoop in and provide a lifeline for overseas bondholders, dampening their losses, in order to stave off the impacts of a negative credit cycle a bit longer? If they backtrack on their claimed willingness to allow a painful contraction in their economy, then we can interpret that as a signal that the flow of cheap credit into China (and subsequently the world) will buoy all manner of risk asset prices.

Beijing cannot maintain a strong Yuan, pursue aggressive domestic monetary stimulus, and maintain a closed capital account. I will be keeping a close eye on the USD/CNY exchange rate, if Beijing is serious about printing money in gargantuan quantities again, the currency must weaken. Given that the PBOC maintained a strong Yuan policy post COVID, observing what facet of the holy trinity is allowed to falter will tell us politically what direction China wishes to take its economy.

If China straps up and joins the monetary easing orgy once more, it is a positive development for the Fed. Because as I will explain in the next section, the political heat felt by the Fed on the need to contain inflation may force the high priests to raise interest rates in Q1 of next year. If China is still aggressively easing to preserve their economic growth model, the Fed can tighten its monetary policies without negatively impacting US and global risk asset prices. It can start working more aggressively to tame inflation and address related concerns from certain of its constituents without hurting the pocket books of the wealthy.

I Got 99 Problems and Deflation Ain’t One

You know it’s bad when you have to completely change your “inflation is transitory” narrative on a dime – because the government realised it can’t Jedi mind trick the plebes into believing the highest inflation readings in almost 40 years are benign and temporary.

Jerome Powell suggests it’s time to stop describing inflation as ‘transitory’

As I mentioned in Chain Reaction, I believe Democrats are two-stepping into a shellacking in the 2022 midterm elections, courtesy of fiscal and monetary enabled inflation. Like a good government employee, the Fed Chair always does what the big man requires, regardless of his political party. The President needs to Whip Inflation Now, and he has called upon the esteemed Federal Reserve board of governors to change their tune.

Now, the Fed chair has frighteningly declared that the pace of the “Taper” will increase.

Powell Vows to Speed-Up Taper, Market Falls

Many market participants naively believe that the fundamentals of the stock market – and risk assets in general – are buoyed by actual economic strength, rather than wanton money printing. Every time the Fed signals that it will reduce the pace at which it indiscriminately purchases bonds, the market reacts negatively over time.

One can argue that the crypto puke-out that saw Bitcoin and Ether lose over 20% of their value on December 4th was the crypto market signaling a severe reduction in risk asset prices. Given the crypto capital markets are the only free markets left globally, they act as the only functioning smoke alarm. The S&P 500 declined as well, but over a five day period from close of trading on 29 November to 6 December, it was down approximately 1.55% (versus a 16% decline in Bitcoin).

To put these returns in context, I calculated the number of times the 5-day return (assuming it was negative) was greater than the 5-day negative return, starting November 29th and using 2021 data. For the S&P 500, 31% of negative 5-day returns were greater, while for Bitcoin, only 5% were greater.

I believe that Bitcoin has a larger predictive value of future monetary conditions vs. any other asset. That is because Bitcoin is not directly manipulated by global central bank purchases like stonks and government / corporate bonds. Any financial asset that resides on a central bank’s balance sheet is ripe for politically motivated price targeting. Given the Fed is still buying over $100 billion per month in bonds, the negative effects to stonk prices of a cessation in bond purchases, and a possible rate hike will only be felt months into the future.

One could argue– and many already have– that a flushing of crypto leverage positions contributed to the weekend rout. That was undeniably a contributing factor, but you cannot ignore the forward-looking value of how Bitcoin anticipates changes in the global fiat liquidity regime. The fact that both retail and institutional market participants globally can congregate in one free market, Bitcoin, and express their belief on whether fiat money will become more or less expensive, indicates the Bitcoin offers a great signal as to how the market interprets the change in Fed rhetoric and its forward-looking monetary policy.

The Fed’s not-so-secret mandate is to keep global investors feeling rich by supporting the S&P 500. But they can only do that up to a point – the politics of inflation dictate that something must be done. That something is changing the narrative to admit that inflation will not quickly dissipate and will instead be with us for some time, and to signal to the market that the Fed is serious about changing tactics to bring inflation back under control in the medium-term. Hopefully for the Democrats, the medium-term is some time before they lose seats in Congress and the Senate in November 2022.

If the Fed follows up on their rhetoric at their December meeting and doubles the pace of the taper from $15 billion per month to $30 billion, then the March 2022 meeting is suddenly in play for a potential hike in interest rates. And while a small hike may not seem like it could do that much damage, when you lift off from zero-percent interest rates, bond prices react violently in a way that is very bad for long holders. That’s just the depressing nature of bond math at the zero bound. Again, why anyone would continue to hold negative real-yielding government bonds is beyond me. It must be because most asset managers are good at possessing the requisite pedigree and deference for orthodoxy, which is more conducive to success than protecting the capital of their investors.

For stonks, it’s just as bad. Again, plug a 0% or very low discount rate into any terminal value calculation in a discounted cash flow model and your shitty, no-profit company looks like it should be owned by Berkshire Hathaway. But even a small shift higher in rates decimates (on a percentage change basis) the “fair value” of your vapourware company.

We all think that the meme stonk crowd can’t do math, but they respond just as dutifully to negative real rates as any trained market professional. They buy, they buy, and they buy some more. Diamond hands, bitches!

Moving on to crypto, it’s the same story. The easy monetary conditions acted as an accelerant to the already amazing increase in adoption of various facets of the ecosystem post-March 2020. The tech won’t change dramatically by March 2022, but the monetary conditions and the general disposition of the market to hold any risk asset– lest they get stuck with rapidly depreciating fiat– will quickly worsen.

Politically, the US cannot continue to juice its economy with free money. The high gas prices and bare shelves provide concrete proof to the voters that the stimmie checks and Fed money printer go brrr… policies are directly harmful to their wallets. Most of them don’t own enough stonks to benefit from the cheap money flowing into the markets. Their wages are stagnant, and costs are rising; a toxic mix that leads to anger at the ballot box. So the Fed got a new hymn book, and they sang the spirituals like Mahalia Jackson.

In the upper room with [POTUS]

Sitting at His blessed feet

Daily there my sin confessing

Begging for His mercy sweet

Squid Game

On one side there is China, who– in order to cushion the blow of the intentional destruction of their property market– began easing monetary conditions. On the other side is the US, who due to 2022 electoral politics, needs to appear to fight inflation so the ruling party has a chance to remain in power.

Chi-Merica is the Janus of the world economy. Each side’s economic model is codependent on the other. China needs the American consumer market to sell its exports into. America needs cheap Chinese labour so that its corporates and ruling class can continue to earn above average returns, keep labour’s share of income low, and keep its asset markets buoyant.

The Fed will continue tightening monetary conditions up until the point where stonks decline (I think the Fed put is 20% below the S&P 500 all-time-high), or some part of the US Treasury market stops functioning normally. While the PBOC is concurrently easing, it allows the Fed to reverse the effects of the largest expansion of the money supply and fiscal deficit since WWII.

As we move into year end and 1Q 2022, I don’t see how we can take out Bitcoin at $69,000 or Ether at $5,000. I can imagine, though, a muddle-through, sideways, boring market with small bouts of downside volatility followed by a tepid recovery. Therefore, as I return to the three types of crypto investors out there, here is how I feel.

- For those who are deciding whether to allocate more fiat into crypto, it pays to wait. I don’t see money getting any free-er or easier. Therefore, it pays to sit on the sidelines until the dust settles after a March 2022 or June 2022 Fed rate hike. Watch out for a puke fest in risk asset prices should the Fed hike, followed by a quick resumption of zero interest rate policy and aggressive bond purchases. When the Fed signals a return to business as usual, then it’s time to back up the truck.

- For those who will maintain their macro crypto exposure, but must allocate amongst various coins, the coins that outperform will probably be Metaverse, Play-2-Earn, or NFT-related. The success of these themes do not hinge on global monetary conditions, but an actual change in behavior of actors whose lives can be dramatically improved by adopting new forms of technology.

- For those who like to trade around their crypto vs. fiat positions, I would err on the side of USD strength and the long bond performing well in the medium-term. Again, monetary conditions in the best case will be at a standstill, and in the worst case will become tighter.

It’s a draw, but don’t get too cocky or you may end up under a fire, encased in a box wrapped in a large pink bow.