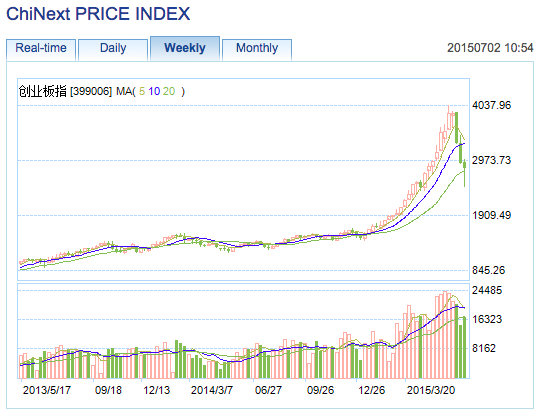

The desperate attempts by the PBOC to stem an equity market collapse have failed initially. After the weekend interest rate and RRR cuts, the main equity indices (ChiNext, CSI300, SHCOMP) opened down 5% only to rally intraday 11% and close up 4%-5%. The exuberance was short-lived as the market continued lower Tuesday and today markets are flat. Traders and analysts not satisfied with the current spate of monetary easing measures and are calling for the big daddy, Quantitative Easing (QE).

QE is the fancy economists’ term for printing money. Analysts believe the PBOC should begin to buy government debt, in particular the debt of local governments. The PBOC could also allow banks to swap NPLs for fresh RMB. The dash for trash will spur more financial institutions away from high yielding government debt and into risky equities. This will lend a healthy bid to the market. The newly minted retail traders will be saved from their FOMO buying madness, and China will be a happy and harmonious society where everyone gets rich buying equities.

The stimulus addicted market needs more rate cuts and QE at a constant pace or the market will continue falling. Goading the retail trading herd and more importantly leveraged structured product buyers back into the market will take a serious demonstration of commitment to money printing. QE is a foregone conclusion, the only question is when.

Faced with an abundance of money, equities will not be the only asset class that benefits. Speculative assets across the spectrum will be bid up by traders. Traders will look to the next market that could deliver 2x and beyond returns. Bitcoin’s fall from grace with Chinese speculators will end with an onslaught of central bank RMB liquidity. Now is the time to pre-position one’s portfolio for another manic Chinese Bitcoin trading episode. Instead of solely focusing on Greece and Europe, traders should listen carefully to PBOC communications to get a jump on when QE will finally be introduced into the Middle Kingdom.