Abstract: In this piece we look at the ten different chain split tokens that could exist on the Bitfinex platform in 2017 and some of the complexities and challenges involved. There are circumstances in which the policies Bitfinex has chosen are unfair and place a burden on customers, however perhaps this could not be avoided.

Chain split token overview

Bitfinex chain split tokens – 2017

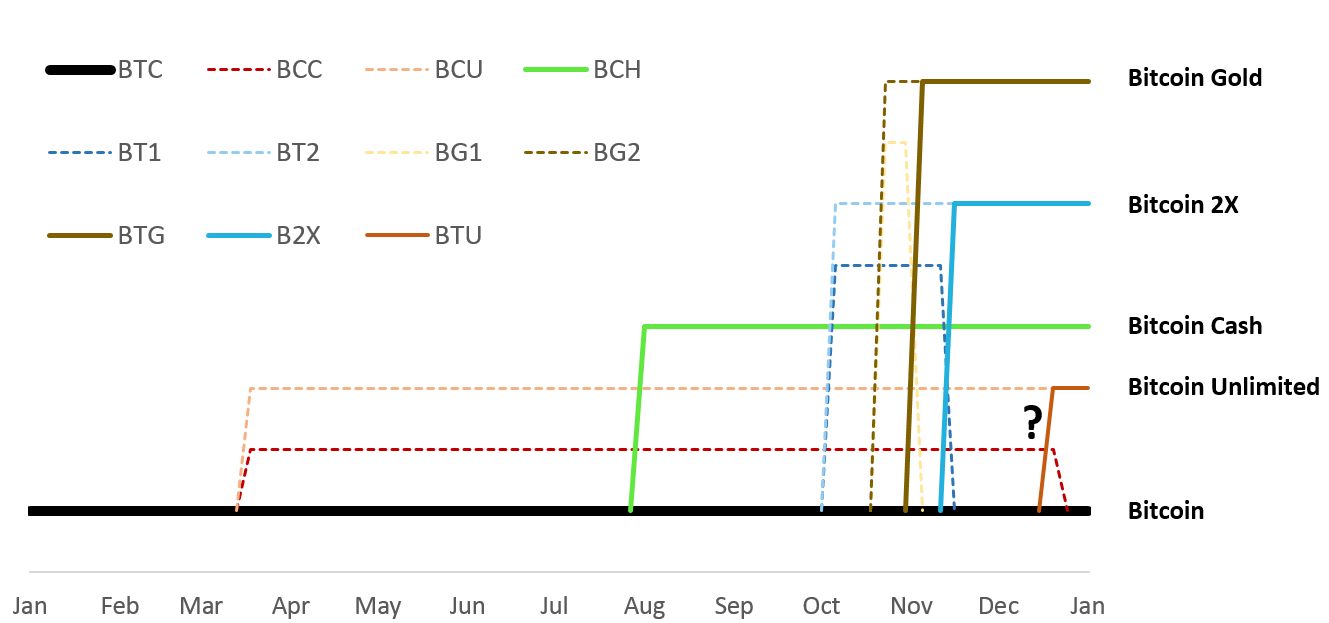

Source: Bitfinex, BitMEX Research

Notes: It is not known if the Bitcoin Unlimited chain will exist as a different coin to Bitcoin at the time the contract is due to settle in December 2017

The above diagram illustrates the 10 chain split tokens which could exist on the Bitfinex platform in 2017. During the year various groups created spin-off coins of Bitcoin and Bitfinex provided its customers the opportunity to trade these tokens. Typically each spin-off can result in three new tokens. For example SegWit2x resulted in:

- BT1 – The futures contract token redeemable for BTC after the fork

- BT2 – The futures contract token redeemable for B2X after the fork

- B2X – The SegWit2x token itself

As we explain below, allowing the trading of all these tokens results in operational problems for Bitfinex, places inconvenient burdens Bitfinex customers and results in various scenarios which are “unfair” for customers. However, avoiding any of these issues is difficult and perhaps potentially impossible, given the complexities involved. In many ways Bitfinex has done a service to the community by rising to the challenge and supporting these tokens.

A full timeline of the events related to the 10 chain split tokens is provided in the table below.

Bitfinex 2017 Chain Split Token Timeline

| Date | Event | From | To | Margin longs receive tokens | Margin shorts owe tokens | BTC lenders receive tokens* | BTC borrowers owe tokens* |

| 18/03/2017 | Optional Split | BTC | BCC + BCU | n/a | n/a | n/a | n/a |

| 01/08/2017* | Distribution | BTC | BCH | × | × | ✔ | × |

| 06/10/2017 | Optional Split | BTC | BT1 + BT2 | n/a | n/a | n/a | n/a |

| 23/10/2017 | Optional Split | BTC | BG1 + BG2 | n/a | n/a | n/a | n/a |

| 24/10/2017 | Conversion | BG1 | BTC | n/a | n/a | n/a | n/a |

| 24/10/2017 | Conversion | BG2 | BTG | n/a | n/a | n/a | n/a |

| 24/10/2017 | Distribution | BTC | BTG | ✔ | ✔ | ✔ | ✔ |

| 27/10/2017 | Buy back | BTG | BTC | n/a | n/a | n/a | n/a |

| 16/11/2017* | Conversion | BT1 | BTC | n/a | n/a | n/a | n/a |

| 16/11/2017* | Conversion | BT2 | B2X | n/a | n/a | n/a | n/a |

| 16/11/2017* | Distribution | BTC | B2X | ✔ | ✔ | ✔ | ✔ |

| XX/12/2017* | Distribution | BTC | BTU | ? | ? | ? | ? |

| 31/12/2017 | Conversion | BCC | BTC | n/a | n/a | n/a | n/a |

| 31/12/2017 | Conversion | BCU | BTU | n/a | n/a | n/a | n/a |

Source: Bitfinex, BitMEX Research

Notes:

- The BCH distribution had a coefficient of 0.85 for lenders

- 16/11/2017 is the expected date of the SegWit2x hardfork

- The date of the Bitcoin Unlimited hardfork is not known, its not easy to define if the fork occurs due to some of the nuances in Bitcoin Unlimited and it may not occur at all

- With respect to BTG and B2X distributions, lenders only receive the token when BTC is in “use as financing collateral”

- We apologies for any inaccuracies in the above table

Margin positions & lending

As we mentioned in our previous piece on the SegWit2x hardfork, the spin-off token distribution decision for financial platforms is not straight forward. There are essentially four options:

Potential financial platform policies regarding the distribution of spin-off tokens

| Policy A | Policy B | Policy C | Policy D | |

| Split user Bitcoin deposit balances into BTC & spin-off | × | ✔ | ✔ | ✔ |

| Split user Bitcoin margin long positions into BTC & spin-off long positions | × | × | ✔ | ✔ |

| Split user Bitcoin margin short positions into BTC & spin-off short positions | × | × | × | ✔ |

| Bitcoin lenders are due back BTC & spin-off | × | × | ✔ | ✔ |

| Bitcoin borrowers owe BTC & spin-off | × | × | × | ✔ |

Note: It is also possible to have a different policy with respect to Bitcoin lending and Bitcoin margin positions, which is not illustrated in the above chart.

BitMEX may choose policy A (or perhaps B in some circumstances), however Bitfinex typically chooses policies (or variant of the policies) C or D. While Bitfinex’s policies can be considered “fairer” in many respects, it can lead to some problems. Supporting additional tokens can not only put additional burdens on the exchange, but also on customers, as the situation with Bitcoin Gold below illustrates.

Bitcoin Gold (BTG) – The forced buyback

Bitfinex clients who were short BTC on margin at the time of the fork had a BTG liability added to their account when the fork occurred. This needed to be done to balance out the impact of users who were long BTC on margin at the time of the fork and benefited by receiving BTG.

This places a burden on customers who were short, as they now have to go into the market and buy BTG to cover their positions, despite potentially having no interest or knowledge in BTG. This may frustrate some customers as they were not given much notice in this particular case (perhaps under 24 hours). Since margin trading may not be enabled on BTG, customers have been given three days to cover their BTG shorts, or Bitfinex may buy back the BTG for them in the market with their BTC.

Anyone with a negative balance resulting from being a BTC borrower at the time of the fork will need to buy back into BTG within 3 days or risk having the system do it for them

Source: Bitfinex

The issue may be of particular concern to Bitfinex customers, since the BTG token does not exist yet, nor is the client ready to be released, as further development work may be required. The date Bitfinex enabled trading, 24th October, was only the date of the snapshot of Bitcoin balances, not when the token actually launched. Therefore Bitfinex customers who were short BTC at the time of the snapshot will not be able to deposit BTG to the platform to cover their short positions, as the token does not yet exist and instead they appear to be forced to buy it on the market at Bitfinex. There may be insufficient liquidity, which could cause problems.

Although this is “unfair” and likely to frustrate some customers, it is easy to criticize and there are no perfect policies.

The chain split tokens do not consider the impact of the other chain split tokens

The above contracts do not fairly reflect each other. For example there was a distribution of BCH tokens in August given to holders of BTC. However, holders of BCC never received any BCH. This problem is illustrated by the overlapping nature of the contracts in the chart above.

If Bitfinex wants to increase the complexity of the above even further, the following additional distributions could be conducted:

- When the SegWit2x hardfork occurs, distribute BTG to holders of BT1

- On 31 December 2017, the Bitcoin Unlimited contract settlement date, distribute BCH, BTG and B2X tokens to holders of BCC

Bitfinex may actually make adjustments for these events and even eluded to this possibility in a recent post. It would be interesting to see if any of their customers actually demand this.