Over a month ago, BitMEX launched the world’s first daily Bitcoin volatility futures contract BVOL24H. BVOL24H allows speculation on the daily historical volatility by observing the log price move between prices at 5 minute intervals on Bitfinex. Trading this contract allows traders to profit on their view on the intensity of price movements in a 24 hour period.

The daily volatility is very volatile itself. A sudden flurry of trading activity causes the price of BVOL24H to spike. Because upside gains can be enormous, buying volatility is a popular strategy with speculators. However, for a trade to happen someone needs to sell that volatility. Faced with unlimited downside and limited upside, sellers of BVOL24H will demand a time value premium over the expected future volatility. Each 5 minutes, more observations are known and there is less uncertainty about where BVOL24H will settle. As a result, BVOL24H sellers get bolder as the day progresses.

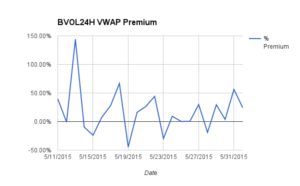

The graph above shows the premium of the daily BVOL24H VWAP (volume weighted average price) over the settlement value. Here are the relevant statistics:

Mean: 18.13%

Median: 12.72%

Standard Deviation: 39.55%

Max: 144.18%

Min: -44.52%

Observations: 22

To purchase their volatility lottery ticket, buyers are paying 18.13% on average. Sellers are doing a good job as their max drawdown or loss was “only” 44.52% vs. a max gain of 144.18%. Looking at the data so far, traders should feel more comfortable selling BVOL24H as buyers are willing to pay a high price for long volatility.