(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Stick a fork in it, ‘cause we’re done with inflation in Pax Americana. Hip hip hooray! /s

US CPI YoY Index

As you can see from the chart above, the inflation measured by the (flawed and misleading) Consumer Price Index (CPI) series published by the US Bureau of Labor Statistics peaked around 9% in mid-2022 and is now hurtling down towards the all-important 2% level.

There are many who think that the CPI’s recent steady downtrend can mean only one thing – Sir Powell is getting primed to turn back on the free monaaay taps and make it rain like it’s March 2020. With America – and possibly the world – on the verge of a recession, those prognosticators would argue that our esteemed Lord Powell is looking for every opportunity to pivot away from his current Quantitative Tightening (QT) policies, which would shoulder a good chunk of the blame if we were to enter into an economic downturn. And with the CPI moving lower, he can now point to the dip and say that his righteous campaign to slay the beast of inflation has succeeded – making it safe to turn the taps back on.

I’m not so sure these forecasters are right, but more on that in a bit. For now, let’s assume that the market believes this is the likeliest path forward – begging the question, how can we expect Bitcoin to react? To accurately model that out, we must remember two important things about Bitcoin.

The first is that Bitcoin and the broader crypto capital markets are the only markets that are truly free from manipulation by central bankers and large global financial institutions. “But what about all that alleged shady behaviour at failed companies like Three Arrows Capital, FTX, Genesis, Celsius, etc?” you might ask. And it’s a fair question – but my response would be that these firms failed as crypto market prices corrected, and the market quickly found a much lower clearing price at which leverage was washed out of the system. If the same reckless behaviour had occurred in the parasitic TradFi system, the authorities would have attempted to delay the reckoning of the market by propping up the failing entities – as they always do – and in the process undermined the very economies they are supposed to be protecting (thanks for nothing!). But the crypto space faced its reckoning head-on and quickly purged itself of poorly run businesses with flawed business models, laying the groundwork for a swift and healthy rebound.

The second thing to remember about Bitcoin is that, because it is a reaction against the profligacy of the world’s global fiat monetary system, its price is heavily dependent on the future path of USD global liquidity (due to USD’s role as the global reserve currency). I spoke at length about this concept and my USD Liquidity Index in my recent essay “Teach Me Daddy”. To that end, over the last two months, Bitcoin has outperformed thea flatlined USD Liquidity Index value. This indicates to me that the market believes the Fed pivot is upon us.

Gold (yellow), Bitcoin (green), USD Liquidity Index (white), Indexed at 100

Looking at the price action of Bitcoin, it is currently pumping off of a low base. From here, we can identify a few different potential paths forward depending on what is actually driving the rally:

Looking at the price action of Bitcoin, it is currently pumping off of a low base. From here, we can identify a few different potential paths forward depending on what is actually driving the rally:

Rally Catalyst Scenario 1: Bitcoin is simply experiencing a natural bounce off the local lows of sub $16k.

- If this rally is really just a natural rebound off of local lows, I expect that Bitcoin will subsequently find a new plateau and move sideways until USD liquidity conditions improve.

Rally Catalyst Scenario 2: Bitcoin is rallying because the market is frontrunning a resumption of Fed USD money printing. If this is the case, I see two possible scenarios playing out:

- Scenario 2A: If the Fed does not follow through with a pivot, or multiple Fed governors talk down any expectation of a pivot even after “good” CPI prints, Bitcoin will likely crash back down towards previous lows.

- Scenario 2B: If the Fed does follow through with a pivot, Bitcoin continues its strong performance, and this rally becomes the start of a secular bull market.

Obviously, we all want to believe that we are headed toward Scenario 2B. That said, I think we are actually going to be facing some combination of Scenarios 1 and 2A – which is causing my itchy “Buy” trigger finger to hesitate a bit.

While I believe that a Fed pivot will occur, I do not think it will happen simply because CPI is trending lower. Sir Powell has proclaimed that, rather relying on CPI as his measure of inflation, he focuses on the interplay between wage growth (US hourly earnings) and core personal consumption expenditure (Core PCE). As an aside, I don’t think that either the CPI or Core CPE is a good measure for inflation. Core PCE is particularly disingenuous because it excludes food and energy. The plebes don’t riot when the hedonically-adjusted prices of flat screen TVs rise – they riot when the price of bread jumps 100%. But regardless of what I think, all that matters for our forecasting exercise is that Sir Powell has telegraphed that he intends to base any decisions regarding a potential policy pivot on not just the CPI, but US wage growth vs. Core PCE.

Link to a speech in November of 2022 where Powell discusses wage growth.

US Hourly Earnings % Change MINUS Core PCE % Change, Both YoY

As you can see from the above chart, wages in the US are on average rising at the same pace as inflation (as defined by Powell and the CPE). That means that, while goods are getting more expensive, people’s ability to buy those goods is actually increasing at a similar rate due to their increased wages. And as a result, there is a risk that people’s enhanced purchasing power could fuel further goods inflation. Put another way, goods producers may realise that their buyers are making more money now then they did previously, and raise their prices even further to capture more of their buyers’ recent wage gains – all without having to worry about killing demand for their products. So, Sir Powell actually has some justification to keep moving rates higher (i.e., to curb consumer demand and stop further goods inflation). And he’ll likely use it, because he has indicated that he is on a quest to ensure the entire US Treasury Curve yields greater than inflation (which it currently does not).

US Treasury Actives Curve

December 2022 Core PCE clocked in at 4.7% YoY. Looking at the above curve, only 6-month T-bills are currently yielding greater than 4.7%. So, Sir Powell has mucho wiggle room to continue raising rates – and more importantly, continue reducing the Fed balance sheet – to further tighten monetary conditions to where he’d like them to be.

December 2022 Core PCE clocked in at 4.7% YoY. Looking at the above curve, only 6-month T-bills are currently yielding greater than 4.7%. So, Sir Powell has mucho wiggle room to continue raising rates – and more importantly, continue reducing the Fed balance sheet – to further tighten monetary conditions to where he’d like them to be.

The point of these last few charts and bits of rhetoric is to simply show that the falling CPI number is meaningless, because it doesn’t align with the actual metrics we know Sir Powell is using to judge whether the Fed has succeeded in killing inflation. The fall in the CPI might point to something, but I don’t think it moves the needle in any meaningful way in terms of predicting the timing of the eventual Fed pivot.

That said, I do believe that if Powell ignores the CPI figure and continues shrinking the Fed balance sheet via QT, it will lead to a credit market disruption event so significant that it will create an “oh shit!” moment for the Fed and force them to aggressively reverse course.

Since reaching a high of $8.965 trillion on 13 April 2022, the Fed’s balance sheet has declined by $458 billion as of 4 January 2023. The Fed should have reduced the balance sheet by a total of $523 billion in 2022, so they have hit 88% of their goal. The current rate of QT suggests that the balance sheet is on pace to decline by another $100 billion each month, or another $1.2 trillion for FY 2023. If a removal of half a trillion dollars in 2022 created the worst bond and stock performance in a few hundred years, imagine what will happen if double that amount is removed in 2023.

The reaction of the markets when money is injected vs. withdrawn is not symmetrical – and as such, I expect that the law of unintended consequences will bite the Fed in the ass as it continues to withdraw liquidity. I also believe Sir Powell instinctively understands this, because as aggressive as his QT is, it would take many years at this pace to fully reverse the amount of money printed following the start of the COVID pandemic. From mid-March 2020 to mid-April 2022, the Fed printed $4.653 trillion. At a reduction of $100 billion per month, it would take roughly 4 years to completely return to the Fed balance sheet levels pre-pandemic.

If the Fed were being super-duper serious about reversing monetary growth, it would outright sell MBS and Treasuries rather than just ceasing to reinvest maturing bonds. Powell could go faster but hasn’t, which indicates that he knows that the market wouldn’t be able to handle the Fed dumping its assets. But, I still think he’s overestimating the market’s ability to handle the Fed remaining a passive participant. The MBS and Treasury market needs the Fed liquidity, and those markets – and all the other fixed-income markets that derive valuation and pricing off of these benchmarks – are in for a world of pain very soon if QT keeps chugging along at the same clip.

Fed Pivot Scenario Analysis

In my view, there are two things that could drive the Fed to pivot:

- Powell reads the falling CPI metric as confirmation that the Fed has done enough and can pause rate hikes sometime soon, and possibly stop QT and cut rates if a mild recession appears in 2H23. Monetary policy typically operates with a 12-to-24-month lag, and therefore Powell – seeing that CPI is trending lower – can be confident inflation will continue to head back to the holy grail of 2% in the near future based on what happened over the past year. As I outlined above, I think this scenario is unlikely, given that I don’t think Powell is using the CPI as his measure of inflation – but it’s not out of the question.

- Some part of the US credit market breaks, which leads to a financial meltdown across a broad swath of financial assets. In a response similar to the action it took in March 2020, the Fed calls an emergency press conference and stops QT, cuts rates significantly and recommences Quantitative Easing (QE) by purchasing bonds once more.

In Scenario 1, I expect that risky asset prices would meander gently upwards. We wouldn’t revisit the lows of 2022, and it would be a pleasant environment for money managers. Just sit back and watch the base effects of CPI kick in and mechanically reduce the headline number. The American economy would find itself in a so-so position, but nothing drastically bad would happen. Even if there was a slight recession, it would be nothing like what we saw from March to April 2020 or during the 2008 Global Financial Crisis. Of the two scenarios, this is the preferred one because it means you can start buying now in advance of a goldilocks outcome.

In Scenario 2, risky asset prices crater. Bonds, equities, and every crypto under the sun all get smoked as the glue that holds together the global USD-based financial system dissolves. Imagine the US 10-year treasury yield quickly doubling from 3.5% to 7%, the S&P 500 punching below 3,000, the Nasdaq 100 breaking below 8,000, and Bitcoin trading with a 15k handle or lower. Like a deer caught in the headlights, I expect that Sir Powell would mount his horse and lead the money-printing calvary to the rescue. This scenario is less ideal because it would mean that everyone who is buying risky assets now would be in store for massive drawdowns in performance. 2023 could be just as bad as 2022 until the Fed pivots.

My base case is Scenario 2.

All That Glitters

Gold (yellow), Bitcoin (green), USD Liquidity Index (white), Indexed at 100

The most logical counterargument to my Scenario 2 base case is that gold has also rallied alongside Bitcoin. Gold is a more liquid and trusted antifragile asset, and it serves a similar purpose – i.e., it is also a hedge against the fiat monetary system. Therefore, at first glance, you might reasonably speculate that gold’s recent pump is further evidence of the market’s belief that the Fed will pivot in the near future. It’s a fair deduction, but I suspect that gold is rallying for a different reason altogether – and it is therefore important not to conflate gold and Bitcoin rallying together as co-confirmation of an impending Fed pivot. Let me explain.

Gold is the money of the sovereign, as at the end of the day, nation states can always settle trade in goods and energy using gold. That is why every single central bank has some amount of gold on its balance sheet.

And because every single central bank holds some amount of gold, when a national currency must be devalued to remain competitive globally, central banks always resort to devaluing against gold (either explicitly or implicitly). As a recent example, the US devalued the USD vs. gold in 1933 and 1971. This is why I have a large allocation of physical gold and gold miners in my portfolio. (If you own paper dog shit like gold ETFs, good luck – the only thing those are good for is wiping your ass.) It’s always better to invest alongside the central bank than against it.

I (and many others) have written extensively about how the de-dollarisation of the world will accelerate in the coming years following a few key recent geopolitical events, such as the U.S.’s freezing of the “assets” that Russia held in the Western financial system. Sooner or later, I expect the producers of cheap human labour and natural resources of the world will realise that it doesn’t make sense to store their wealth in US Treasury bonds when they could possibly face the same fate Russia did if they piss off the patricians in Pax Americana. That leaves gold as the most obvious and attractive place to park their capital.

The data supports the idea that governments are shifting towards storing wealth in the time-honoured reserve currency of the sovereign, gold. The below chart goes back a decade and depicts net central bank purchases of gold. As you can see, we hit an all-time high in Q3 2022.

Central Bank Net Purchases of Gold in Metric Tonnes

Peak cheap energy is upon us, and the heads of many nation states recognise this. They instinctively know, as most humans do, that gold keeps purchasing power in energy terms (crude oil) better than fugazi fiat currencies like the USD.

Peak cheap energy is upon us, and the heads of many nation states recognise this. They instinctively know, as most humans do, that gold keeps purchasing power in energy terms (crude oil) better than fugazi fiat currencies like the USD.

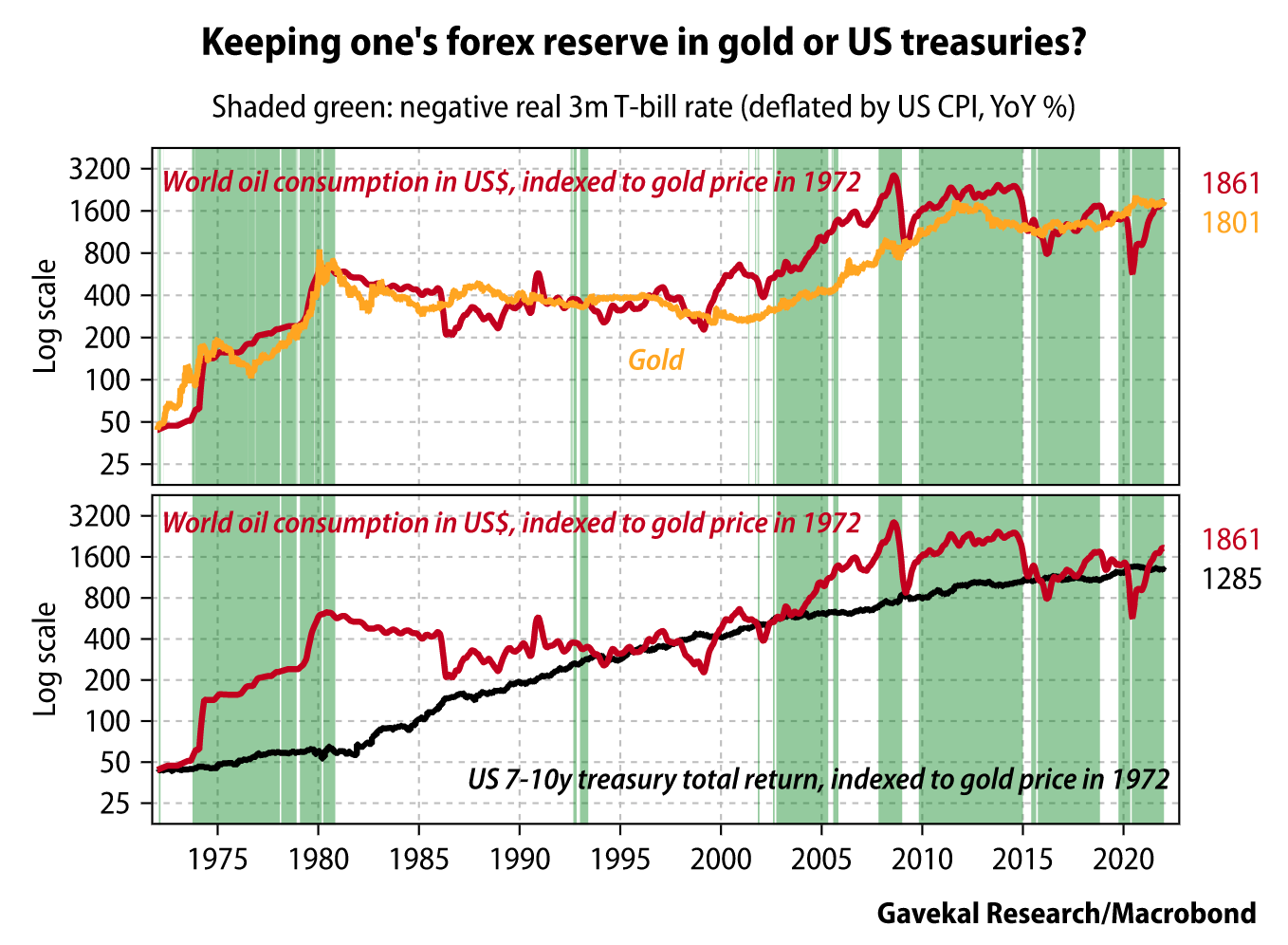

This excellent chart from Gavekal Research plainly shows that gold is a better store of energy than US Treasuries.

This excellent chart from Gavekal Research plainly shows that gold is a better store of energy than US Treasuries.

These data points suggest to me that gold is rising more because of real physical demand than because the world’s central banks think a Fed pivot is upon us. Of course, at least some part of the move is due to expectations that the Fed’s monetary policy may loosen in the near future, but I do not believe those expectations are the driving force behind it.

Trade Setup

What if I’m wrong, and the goldilocks Scenario 1 comes to pass?

That means I have already missed the move off of the bottom, and Bitcoin is unlikely to look back as it marches inexorably towards a new all-time high. If that is true, the move will probably come in two stages. In the first stage, savvy speculators will frontrun the actual shift in Fed policy. Bitcoin could easily trade to $30,000 to $40,000 during this stage, as the price is currently massively depressed by bearish post-FTX sentiment. The next stage would take us to $69,000 and beyond but could only commence once a significant amount of USD has been injected into the crypto capital markets. Such an injection would require – at a minimum – that both rate hikes and QT be paused.

If I’m wrong, I am content to miss out on the initial rally off of the bottom. I’m already long, so I would benefit regardless. But, my USD held in short- term T-bills would suddenly be underperforming, and I would need to redeploy that capital to Bitcoin in order to maximise the return on my invested money. Before I ditched a bond I bought at 5% yield, though, I would want to be highly confident that the bull market is back. 5% is obviously below inflation, but it’s a better alternative than being down 20% because I mistimed the market and purchased risky assets too early in the next cycle.

When they do decide to pivot, the Fed will clearly communicate their move away from tight monetary policy ahead of time. The Fed told us in late 2021 they would switch to fighting inflation by restricting the money supply and raising rates. They followed through and started doing so in March 2022, and anyone who didn’t believe them got slaughtered. As such, the same thing is likely to happen in the other direction – i.e., the Fed will tell us when it’s over, and if you don’t believe them, you will miss out on the monster ensuing rally.

Since the Fed hasn’t signalled a pivot yet, I can afford to wait. I’m about capital preservation first and growth second. I would rather buy into a market already up 100%+ off the lows after the Fed communicates a pivot, than buy into a market up 100% off the lows in which the pivot doesn’t occur, and then suffer a 50%+ correction due to poor macro fundamentals.

If I’m right and the disastrous Scenario 2 occurs (i.e., a global financial meltdown), then I get another bite at the apple. I will know that the market has probably bottomed, because the crash that happens when the system temporarily breaks will either hold the previous $15,800 lows, or it won’t. It doesn’t really matter what level is ultimately reached on the down draft because I know the Fed will subsequently move to print money and avert another financial collapse, which will in turn mark the local bottom of all risky assets. And then I get another setup similar to March 2020, which requires me to back up the truck and purchase crypto with two hands and a shovel.