While XBT soars to all-time highs and volumes spike, we’ve observed excellent trading performance from the BitMEX platform. A big part of the success so far is thanks to the hard work of our engineering team – they’ve pulled long days, nights, and weekends over the past months to ensure the platform runs smoothly when traders need it most.

Earlier this month, their latest focus was latency outliers on our market data feed through the websocket. The team saw room for improvement in the tail latency for our market data websocket feed and deployed an upgrade to our data distribution layer on 2 February 2021 at around 04:00 UTC. This had a measurable impact on trade and order book data.

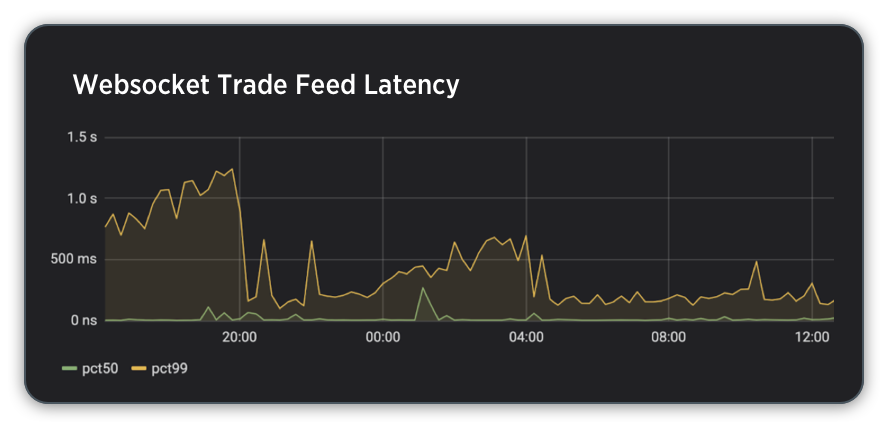

This graph shows the websocket API trade feed latency at the time of the change, with the x-axis as time and the y-axis latency of delivering an event after it occurs. The yellow line shows 99th percentile latency – in other words, the slowest 1 percent of data feed updates – while the green line shows median latency.

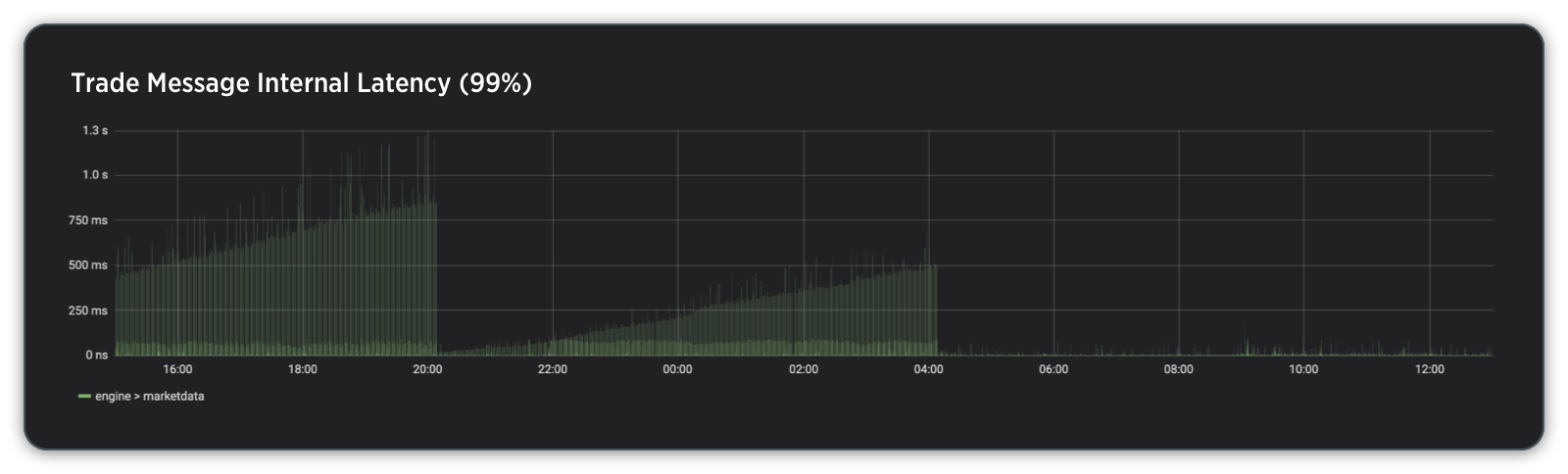

The graph below, which tracks rare occurrences (worst 1% of events) of elevated latency within our internal data distribution infrastructure, also shows a demonstrable improvement after the changes were made (same x and y axes).

The graph below, which tracks rare occurrences (worst 1% of events) of elevated latency within our internal data distribution infrastructure, also shows a demonstrable improvement after the changes were made (same x and y axes).

In practice, receiving market data updates sooner allows users to react to changes quickly and better manage risk on the platform, enhancing their overall trading experience.

In practice, receiving market data updates sooner allows users to react to changes quickly and better manage risk on the platform, enhancing their overall trading experience.

As interest in crypto trading continues to grow, especially in fevered trading conditions, we pledge to continuously enhance the trading experience on BitMEX. For us, this includes being responsive to user feedback but also making small but important proactive changes, such as ensuring even outlier high latency events aren’t tolerated.

For any questions or feedback, please contact Support.