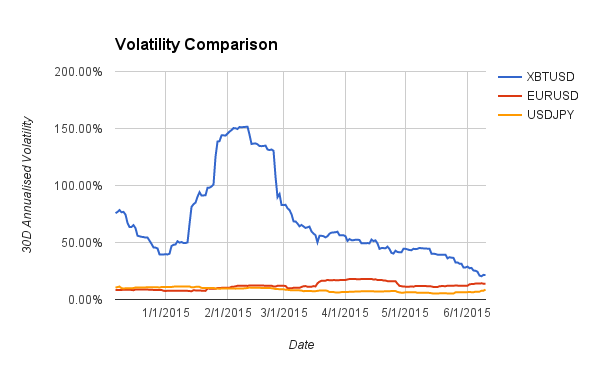

The last few months have been very frustrating for traders. The relentless decline in price volatility has almost transformed Bitcoin into a regular currency. The charts above show the realised 30 day volatility for XBTUSD (Bitcoin), EURUSD, and USDJPY. EURUSD and USDJPY are two of the most traded currencies globally. They are the most “mature” currency pairs one can trade.

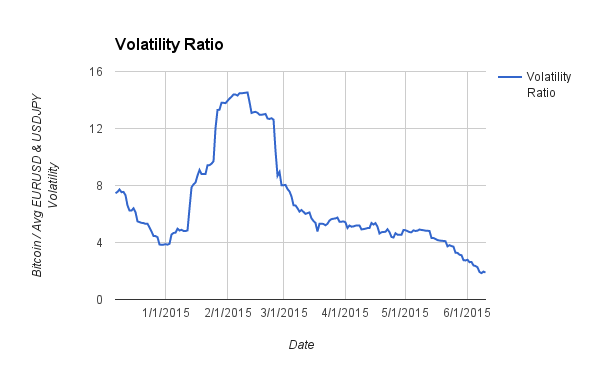

The Volatility Ratio is constructed by dividing the 30d realised volatility of Bitcoin by the average of the EURUSD and USDJPY 30d realised volatilities. During the price collapse at the beginning of the year, the ratio reached its highest value of 14.53x. Currently Bitcoin volatility has compressed significantly and the ratio now stands at 1.89x.

Has Bitcoin crossed the chasm from a pure speculative magic internet currency to a “stable” currency? No. Bitcoin still lacks many of the facets of global major currency. Local currency debt market? No. Liquid spot and derivatives market? No. Used in every day transactions? No. Volatility will return in a large way, because Bitcoin is still a very speculative currency, commodity, or store of value (take your pick). This lull in trading activity and volatility presents an great opportunity for traders establishing long positions.

Bitcoin is a long dated call option. It will either by worth nothing, or a lot. An option is most valuable when the volatility of the underlying asset is the highest. Bitcoin volatility has taken a nose dive, and so has the price. For long term terms (5 year trade horizon, and can stomach a >50% mark to market loss), the current price to volatility situation presents an optimal buying opportunity. Timing the bottom is a fools errand, if you have a long term vision whether you buy and the price drops 20% or more is irrelevant. You are gunning for a 5x, 10x, or beyond return. With that in mind, accumulating long dated futures contracts is a prudent strategy.

As Bitcoin volatility normalises, USD swap rates will begin rising. With higher volatility, speculators will re-enter the market and push USD swap rates higher. The risk / reward for leveraged longs is always better than leveraged shorts. USD to Bitcoin rate differential will widen, and longer dated futures contracts will become more expensive. The BitMEX 25 December 2015 Bitcoin / USD futures contract, XBUZ15, trades at a minimum premium to spot. Long term traders who want to take advantage of the low volatility and price should buy this futures contract.