Abstract: We look at the price correlation between Bitcoin and some traditional financial assets since 2012 and notice that the correlation with stocks in the last few months has reached record high levels, although it remains reasonably low in absolute terms. We conclude that a crypto-coin investment thesis of a “new non-correlated asset class” may therefore have some merit, although correlations may increase if the ecosystem expands. Due to the current correlation with stocks, Bitcoin may no longer offer downside protection in the event of a financial crisis, which some people may expect.

Overview

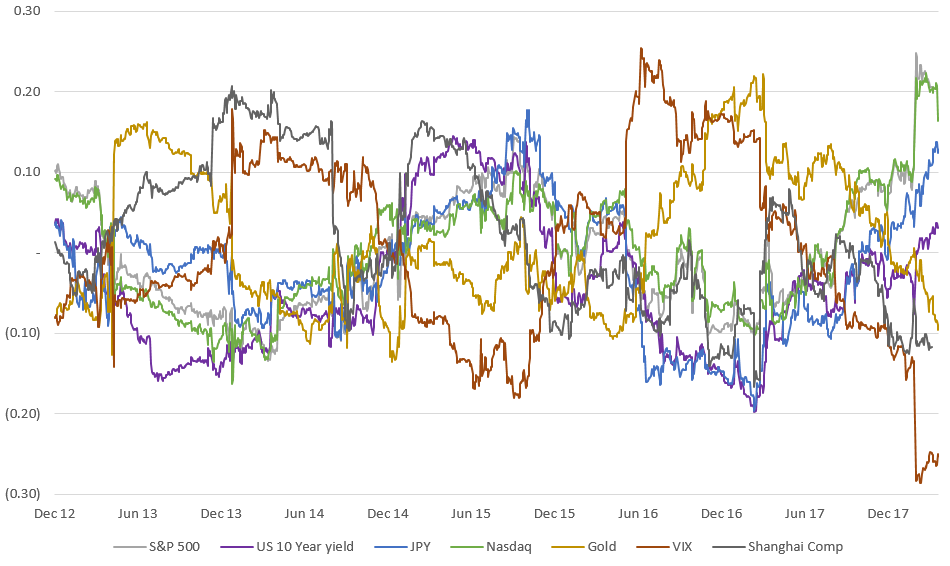

We calculated the 180-day rolling daily percentage price-change correlation between Bitcoin and a variety of traditional financial assets since 2012. As the chart below demonstrates, the correlation never really significantly escaped the -0.2 to +0.2 range, which is a reasonably low level.

Bitcoin price correlation versus various traditional assets – daily price percentage change over a rolling 180-day period. (Source: BitMEX Research, Bloomberg, Bitstamp)

Bitcoin vs. the S&P 500 and gold

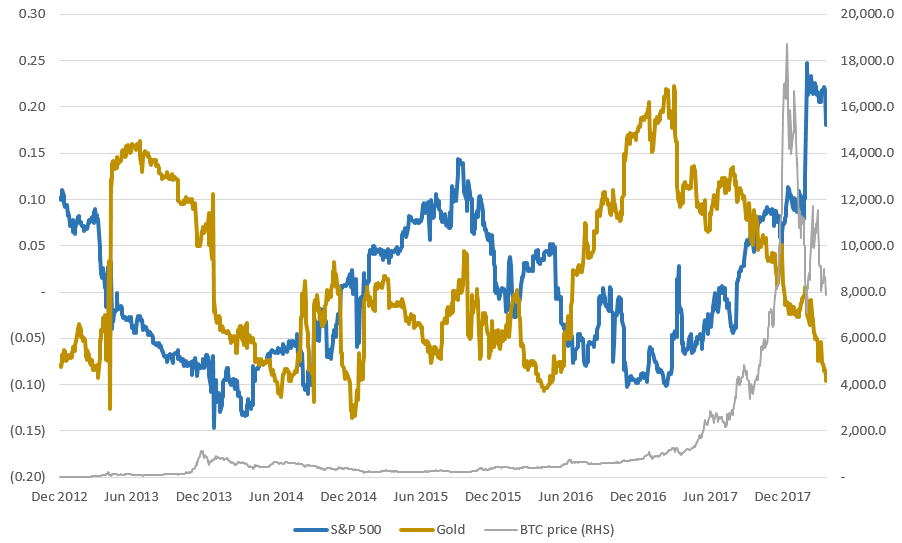

Focusing on just the S&P 500 index and gold, it appears as if Bitcoin has experienced several periods of correlation.

- During the Bitcoin price rally in March 2013, which commentators at the time suggested was partially caused by the Cypriot financial crisis, the Bitcoin price correlation with gold increased and remained somewhat elevated until the January 2014 Bitcoin price crash.

- During the 2016 Bitcoin price rally, a moderately strong gold-price correlation returned again and gold and Bitcoin both had a strong year. This indicates that the same underlying economic factors and political uncertainty (the economic slowdown in China, Brexit, and the election of President Trump) may have contributed to price movements of both assets during this period.

- During the recent Bitcoin price rally, things appeared somewhat different, with the price correlation between Bitcoin and stocks reaching record levels (almost 0.25). In our view, Bitcoin appears to have obtained some “risk-on” characteristics in this rally. Increased levels of liquidity available to investors and the amount of enthusiasm for new technology, may be driving price movements in both stocks and Bitcoin, to some extent. Therefore Bitcoin may be less likely to provide protection in the event of a financial collapse or fall in equity markets, something traditionally considered one of Bitcoin’s potential strengths. In addition to this, the price correlation with gold recently became slightly negative.

Bitcoin price correlation between the S&P 500 index and gold – daily price percentage change over a rolling 180-day period. (Source: BitMEX Research, Bloomberg, Bitstamp)

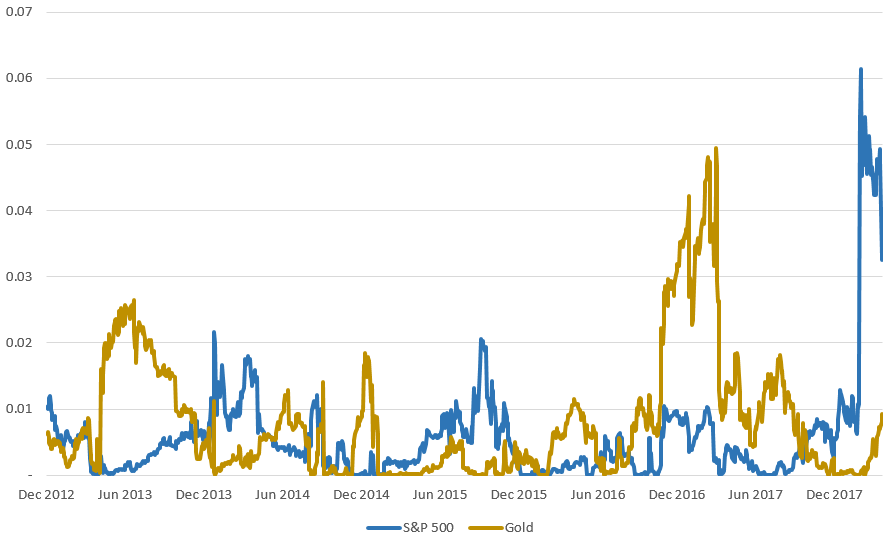

Statistical significance

The R-squared between Bitcoin and other assets in the chart below is low, peaking at only 6.1% with the S&P 500 during the recent price rally. In addition to this, we have not been able to prove the statistical significance of any daily price-change correlation between Bitcoin and any traditional asset using any robust methodology. Scientifically speaking therefore, this article is speculative.

Bitcoin price R-Squared between the S&P 500 index and gold – daily price percentage change over a rolling 180-day period. (Source: BitMEX Research, Bloomberg, Bitstamp)

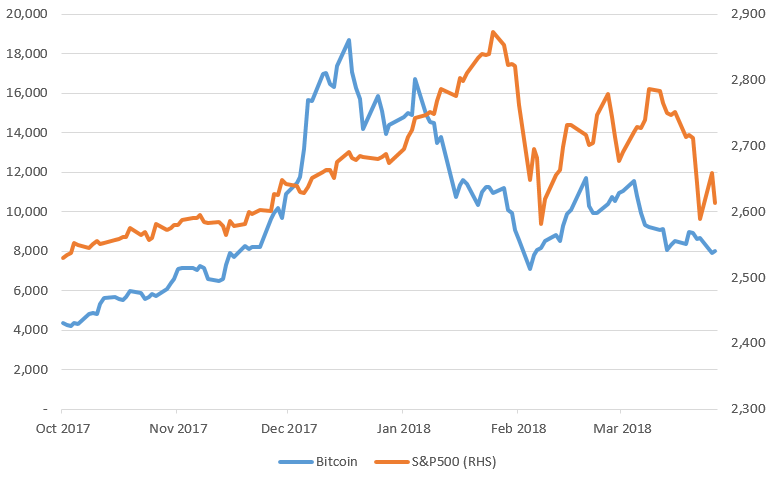

Recent price movements

Although it’s difficult to make any conclusions based on robust statistical methodology, due in part to the limited number of data points, a chart of the Bitcoin price versus the S&P 500 in the last few months shows a strong positive relationship, which is difficult to totally ignore.

Bitcoin price compared to the S&P 500 index. (Source: BitMEX Research, Bloomberg)

Bitcoin price compared to the S&P 500 index. (Source: BitMEX Research, Bloomberg)

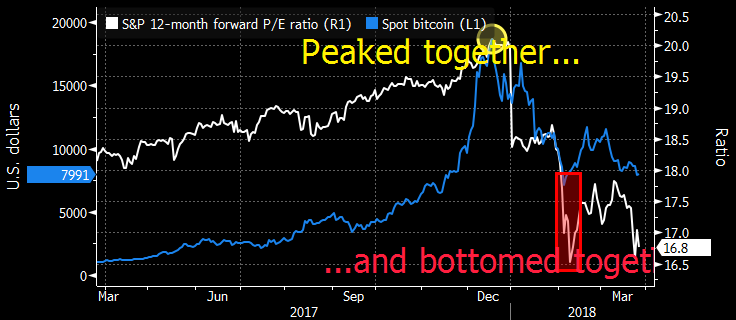

Indeed, as Bloomberg pointed out with the graph below, the peak of the Bitcoin price actually coincided with the peak forward earnings valuation ratio in the S&P 500. This comparison may be somewhat spurious, since the stock market actually peaked at the end of January (while Bitcoin peaked in December) and earnings estimates reset to higher levels for the year ending December 2018 at the end of 2017.

Bitcoin price compared to the S&P 500 index’s forward P/E ratio. (Source: Bloomberg)

Bitcoin price compared to the S&P 500 index’s forward P/E ratio. (Source: Bloomberg)

Ethereum and Litecoin

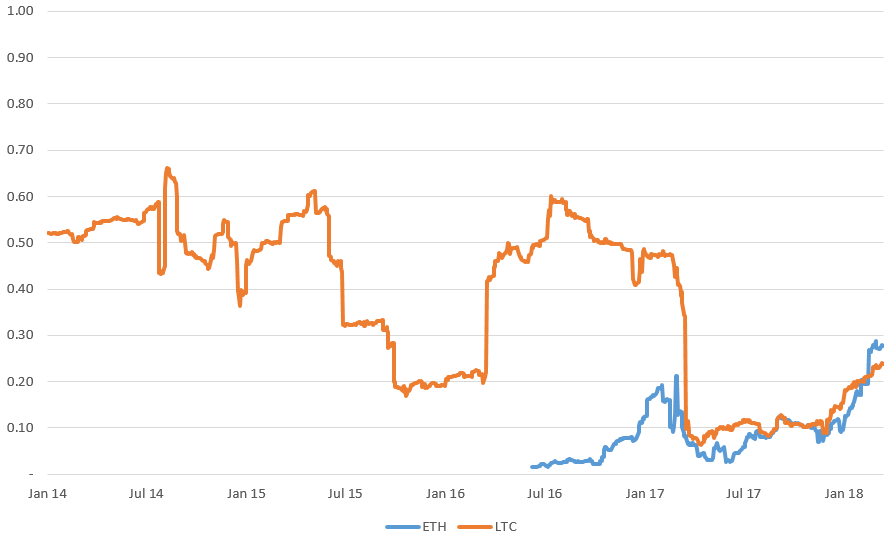

We also looked at the rolling Bitcoin daily price-change correlation between Ethereum and Litecoin. The price correlation between these coins and Bitcoin is obviously far higher than for traditional assets and it is statistically significant. During the massive crypto-coin rally in 2017, the price correlation to Bitcoin fell dramatically to the 0.1 level, as altcoins traded against Bitcoin and moved more independently. After the price correction started in 2018, price correlations have began to climb as the coins seem to move together again.

- Litecoin — The correlation normally tends to be high, at around the 0.5 level. The price correlation dipped to around 0.2 in 2015, when there was not much Litecoin price action.

- Ethereum — After Ethereum launched, the system was reasonably small and exposed to some unique risks, such as uncertainty surrounding its launch and the model of giving funds to the founding team. Therefore its price correlation with Bitcoin started low before eventually reaching levels similar to Litecoin.

Bitcoin price correlation between Ethereum and Litecoin – daily price percentage change over a rolling 180-day period. (Source: BitMEX Research, Bloomberg, Bitstamp)

Conclusion

Crypto-coin proponents sometimes mention that crypto coins are a “new non-correlated asset class” that can provide a hedge for traditional portfolio managers. These traditional portfolio managers are then expected to allocate a weighting in their portfolios for crypto-coins, which may cause further price appreciation.

It appears that Bitcoin has been a reasonably non-correlated asset class throughout its history. During the recent rally to a valuation of hundreds of billions of dollars, however, correlations — and, crucially, correlations to risk-on assets — started to increase.

Although there is some merit to the hypothesis of crypto-coins not correlating with traditional assets, if crypto-coin prices remain elevated or increase further and become a significant part of the global financial system, higher correlation with traditional assets may become inevitable.

Whether crypto coins are a “new” asset class and whether this matters is another topic. It’s not clear if there is significant merit merely to being new; more importantly, perhaps, is if crypto-coins offer anything unique.