Key Highlights

Crypto Spot Volumes Soar, with Top Tier Exchanges Dominating

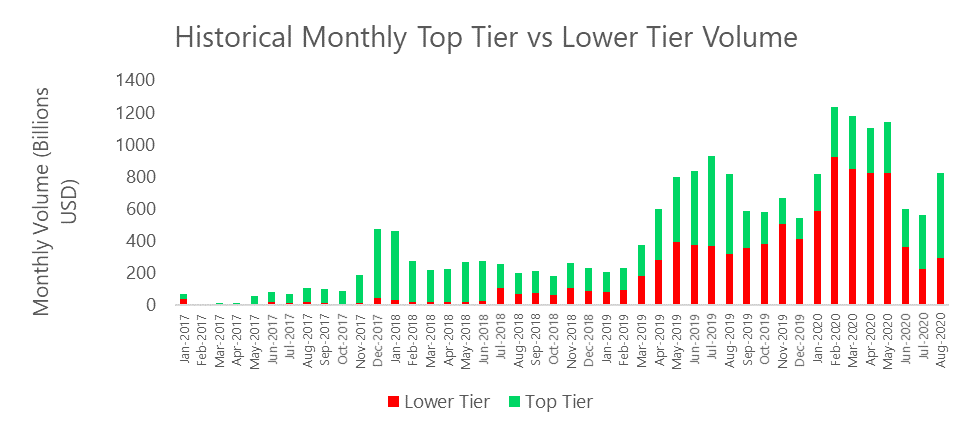

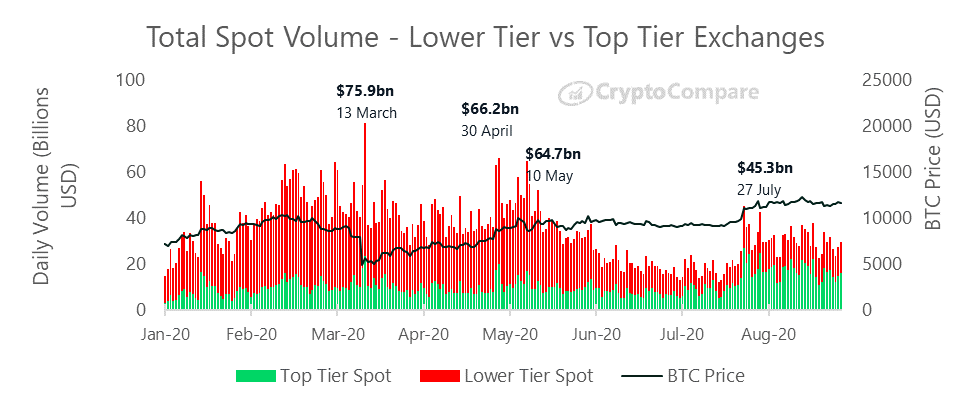

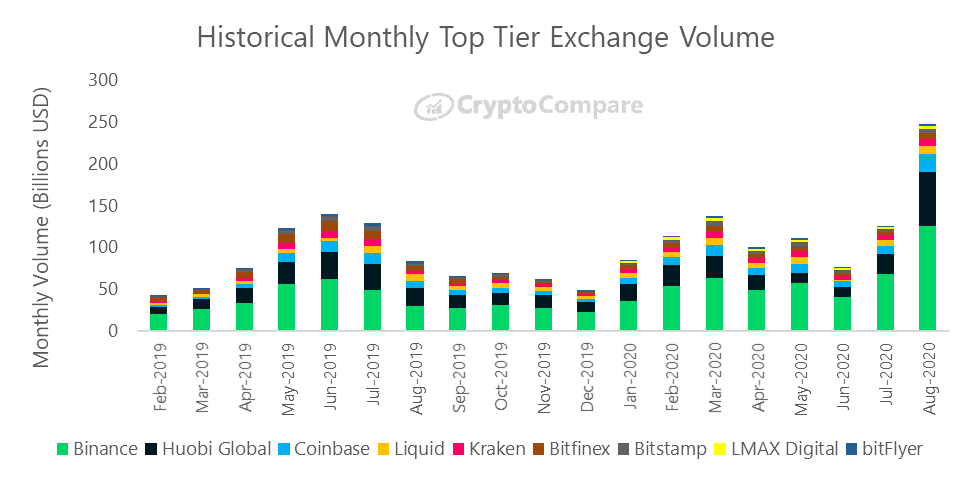

In August, Top-Tier volumes increased 58.3% to $529bn while Lower-Tier volumes increased 30.2% to $291bn. Top-Tier exchanges now represent 64% of total volume (vs 60% in July).

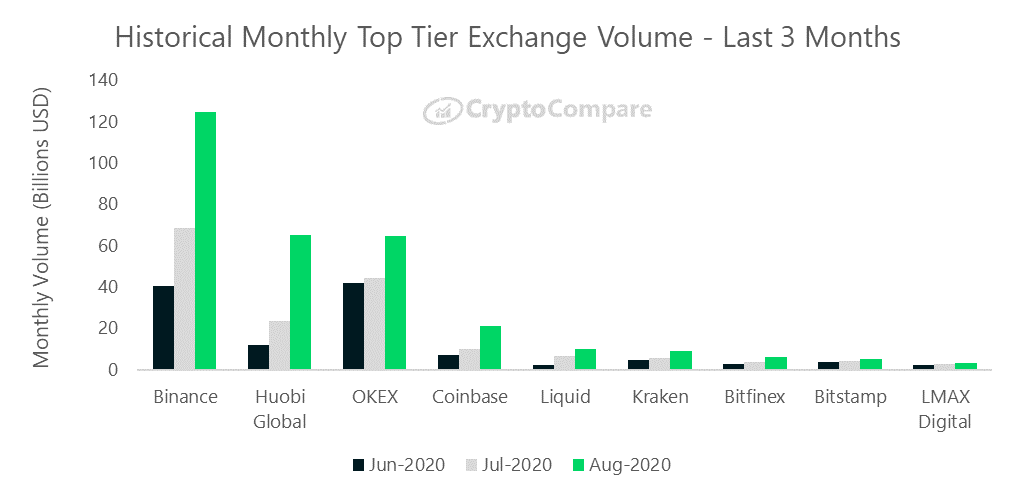

Binance (Grade A) was the largest Top-Tier exchange by volume in August, trading $124.9bn (up 83%). This was followed by Huobi Global (Grade BB) trading $65.0bn (up 176%), and OKEx (Grade BB) trading $64.7bn (up 47%).

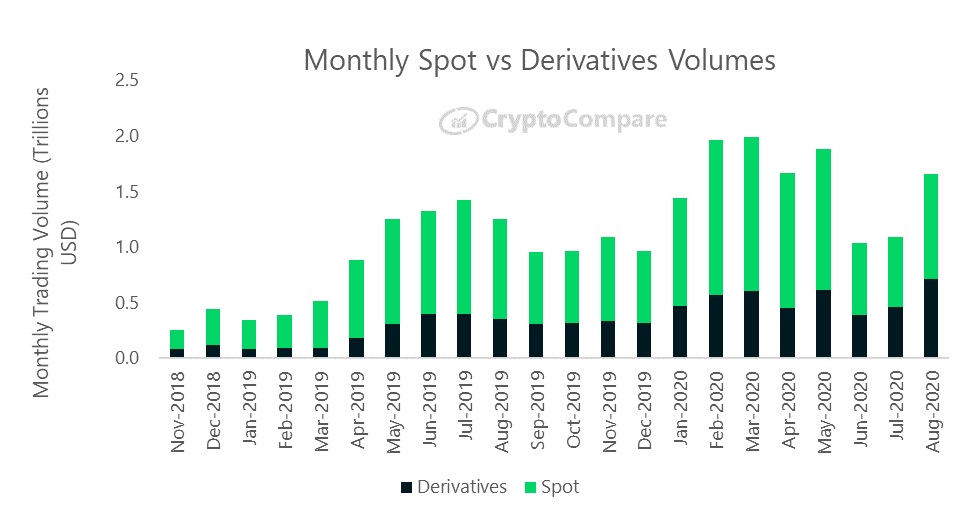

Derivatives Volumes Surge by 54%

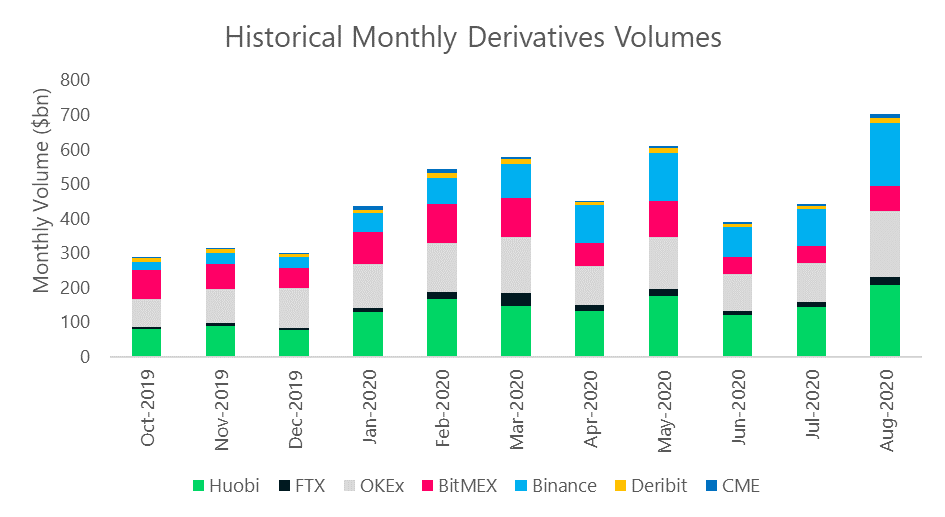

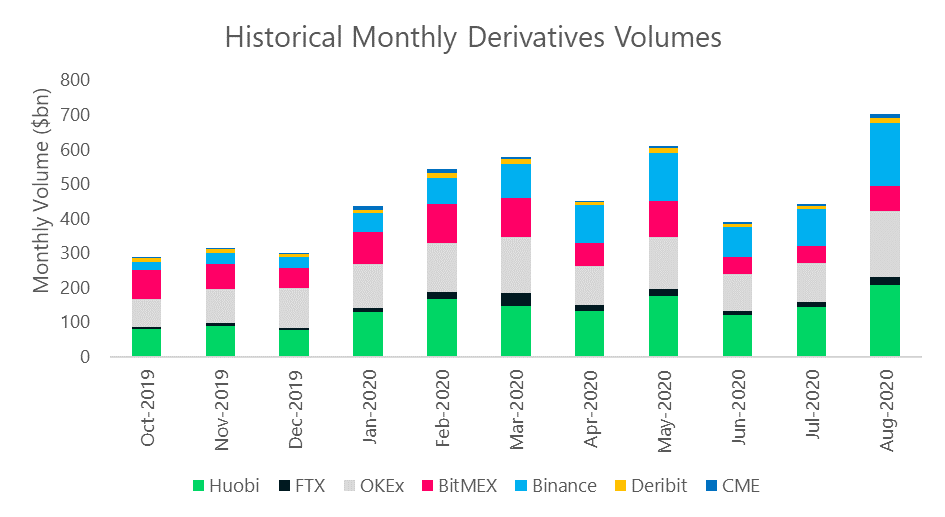

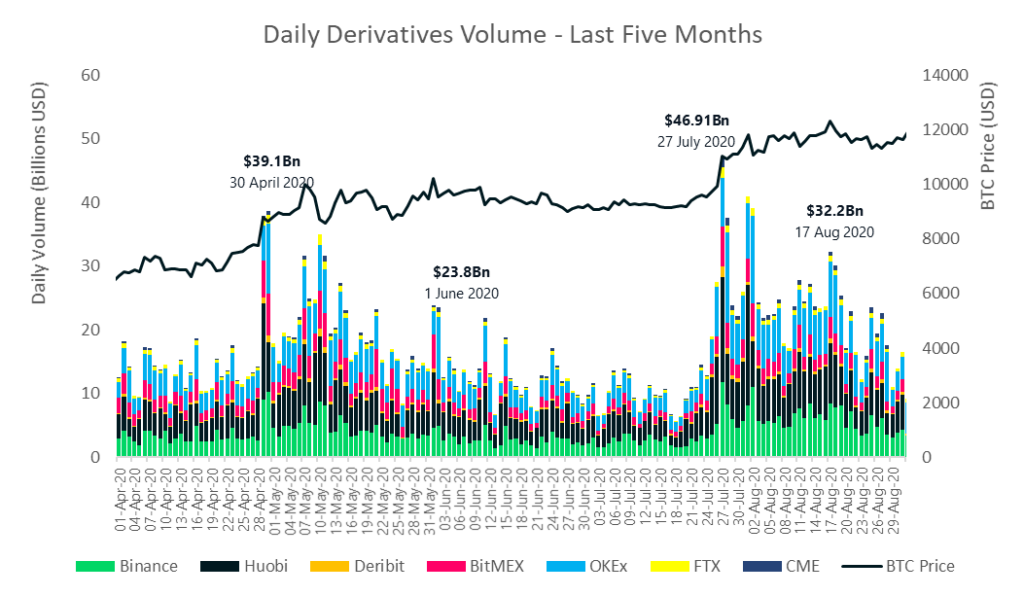

Derivatives volumes increased 53.6% in August to $711.7bn. Meanwhile, total spot volumes have increased by 49.6% to $944.9bn. Derivatives continue to represent just over 40% of total market share.

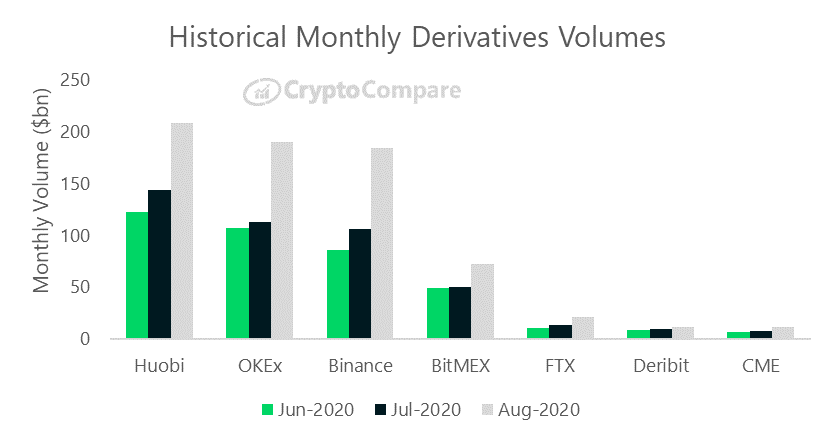

Derivatives exchanges saw significant increases in trading volume in August. Huobi (up 44.7%), OKEx (up 69.1%) and Binance (up 74.0%) led with $208.5bn, $190.8bn and $184.6bn traded respectively. BitMEX traded $72.5bn (up 43.6%) in August.

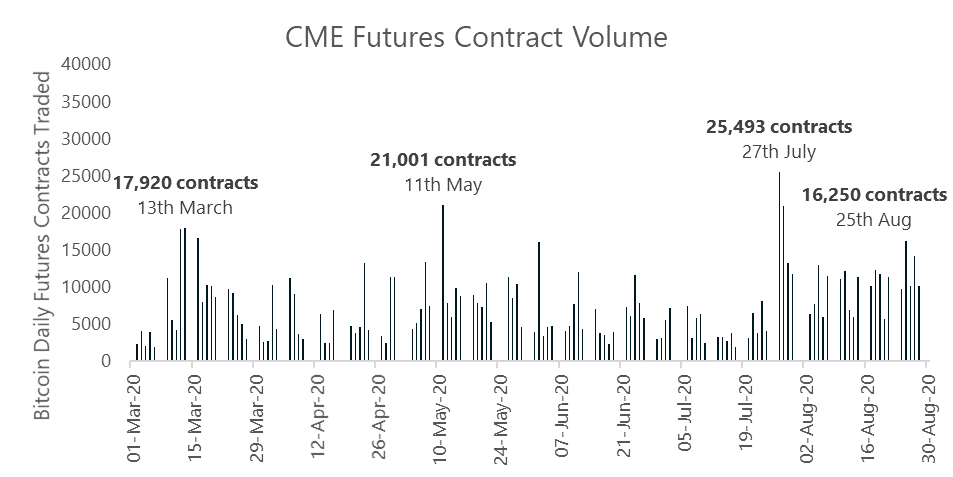

CME Derivatives Volumes Shoot Up

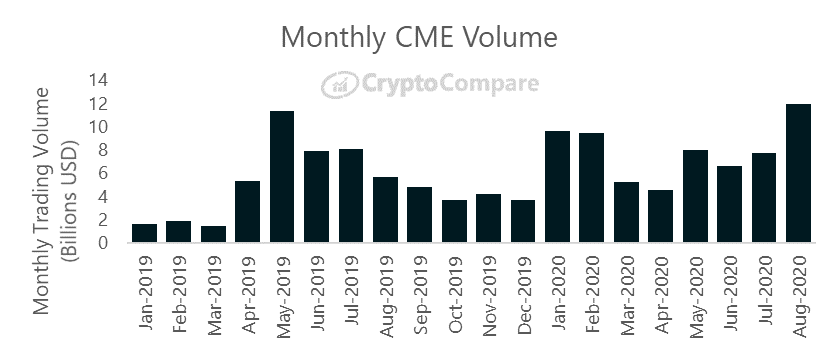

Monthly CME futures contract volumes have increased 36.3% since July to reach 203,867 contracts traded in August.

In terms of total trading volume in August, CME’s crypto derivatives volumes have increased 55.7% in line with many unregulated derivatives competitors to reach $12.02bn.

Exchange Benchmark Analysis

In August, Top-Tier volumes increased 58.3% to $529bn while Lower-Tier volumes increased 30.2% to $291bn. Top-Tier exchanges now represent 64% of total volume (vs 60% in July).

Trading activity across all spot markets throughout August was higher compared to July, as the price of BTC remained above the $11k mark. Following the July update to CryptoCompare’s Exchange Benchmark Ranking, the data shows that higher risk exchanges have generally lost market share, as users begin shifting to lower risk (Top-Tier) exchanges.

Top-Tier exchange volume, selected based on our rigorous Exchange Benchmark methodology, has increased 58.3% overall in August from July.

Macro Analysis and Market Segmentation

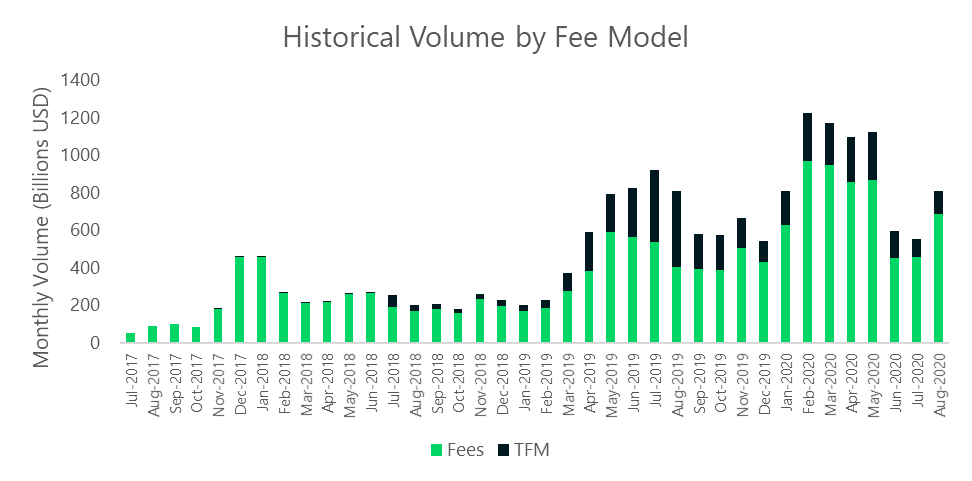

Exchanges that charge traditional taker fees represented 84% of total exchange volume in August (vs 82% in July), while those that implement Trans-Fee Mining (TFM) represented less than 16%.

Fee-charging exchanges traded a total of $685bn in August (up 50.13% since July), while those that implement TFM models traded $125bn (up 53.94% since July).

In August, volume from the 15 largest Top-Tier exchanges increased 58% on average (vs July).

Binance (Grade A) was the largest Top-Tier exchange by volume in August, trading $124.9bn (up 83%). This was followed by Huobi Global (Grade BB) trading $65.0bn (up 176%), and OKEx (Grade BB) trading $64.7bn (up 47%). Exchanges Coinbase (AA) and Liquid (A) followed with $21.3bn (up 101%) and $9.9bn (up 52%).

Binance (A), OKEx (BB) and Huobi Global (BB) remained the top players in terms of volume in August relative to other Top-Tier exchanges. Among the top 15 Top-Tier exchanges, they currently represent 74% of the volume in August (vs 63% in July).

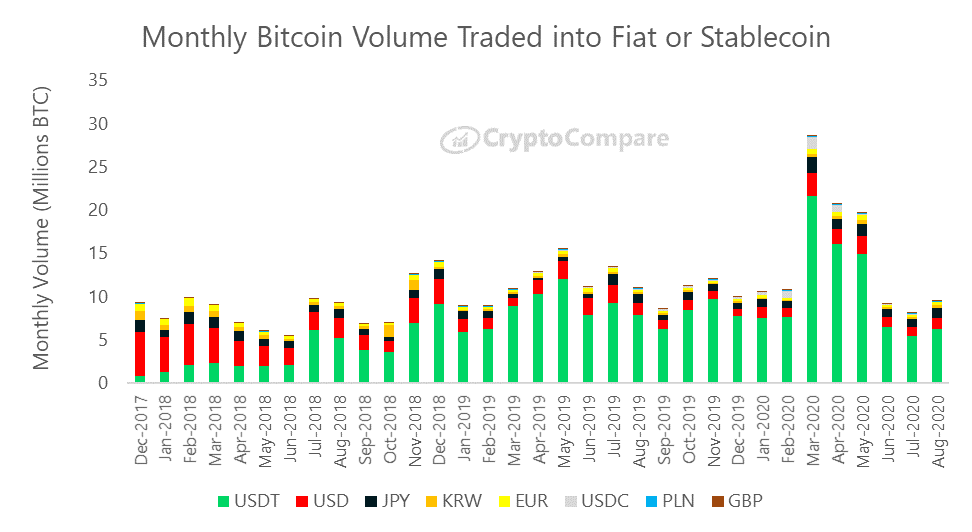

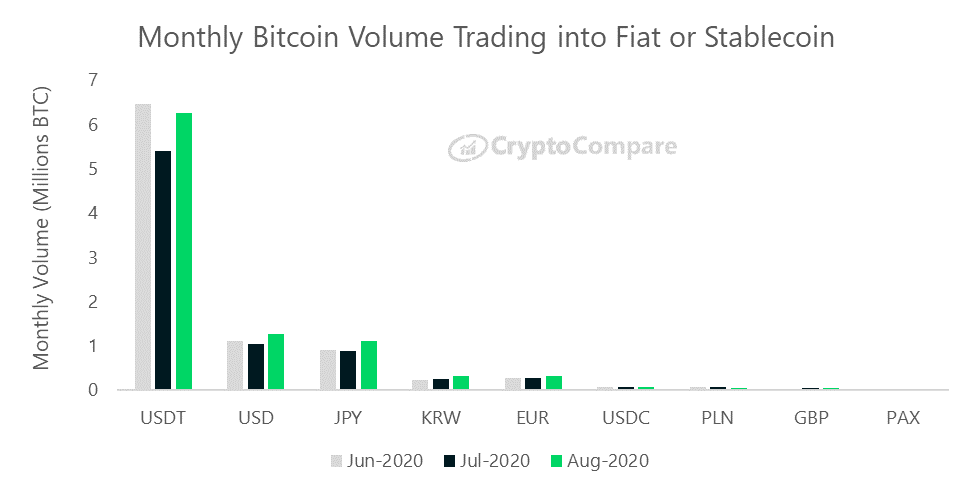

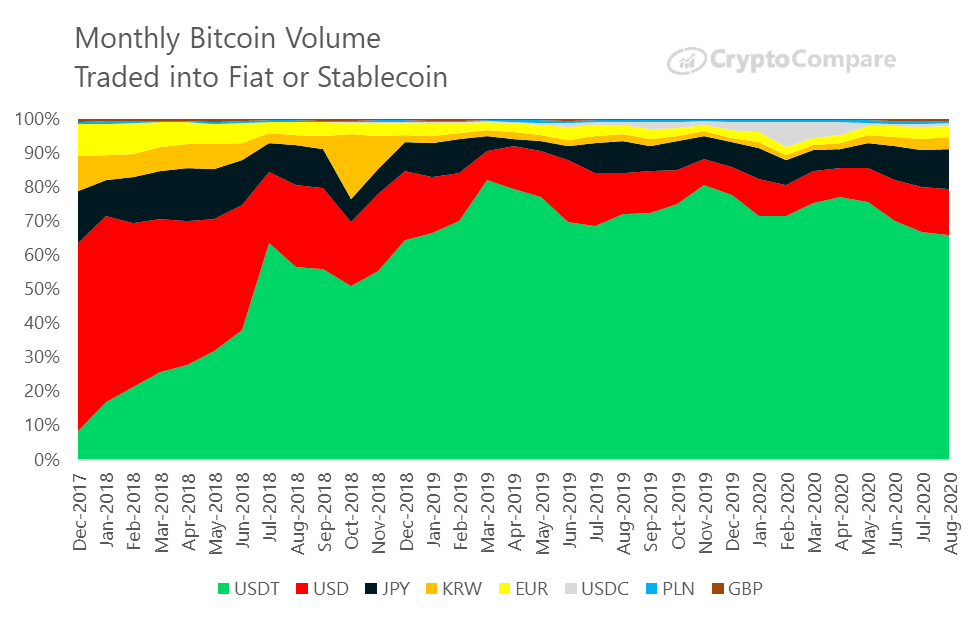

Bitcoin to Fiat Volumes

BTC trading into USDT increased 16% in August to 6.25mn BTC vs 5.41mn BTC in July. Trading into USD and JPY also increased to 1.28mn BTC (up 21%) and 1.12mn BTC (up 26%) respectively. EUR markets increased 10%, while BTC trading into KRW increased 23%.

Stablecoin markets BTC/USDC and BTC/PAX traded 72.0k BTC (up 8%) and 24.1k BTC (up 29%) respectively in August.

The BTC/USDT pair still represents the majority of BTC traded into fiat or stablecoin in August at 65%. Its proportion of total volume in July was 66%.

Derivatives

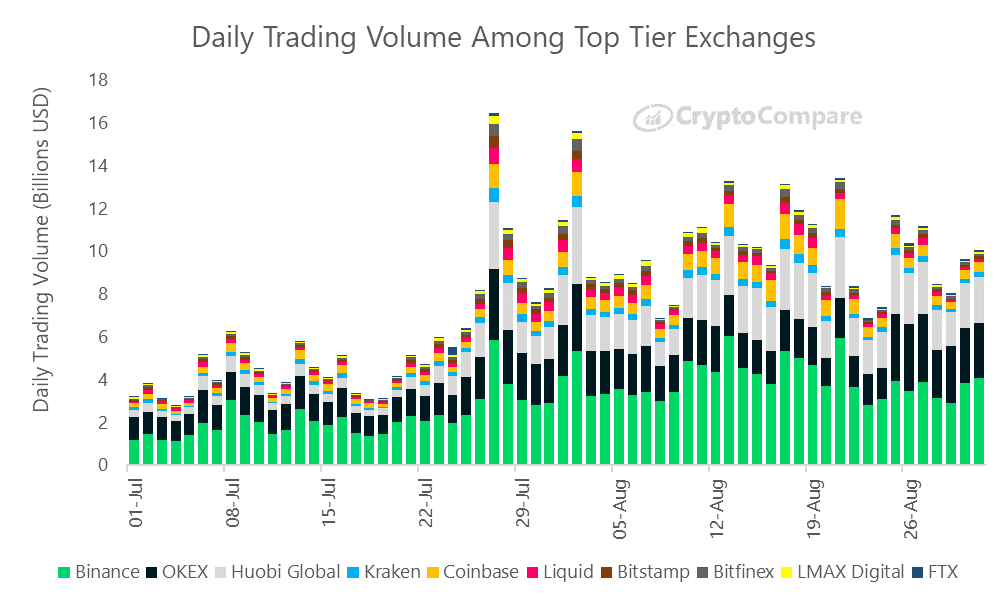

Derivatives volumes increased 53.6% in August to $711.7bn. Meanwhile, total spot volumes have increased by 49.6% to $944.9bn. Derivatives continue to represent just over 40% of total market share.

Derivatives exchanges saw significant increases in trading volume in August. Huobi (up 44.7%), OKEx (up 69.1%) and Binance (up 74.0%) led with $208.5bn, $190.8bn and $184.6bn traded respectively. BitMEX traded $72.5bn (up 43.6%) in August.

Trading activity remained high in August compared to July. The top 4 exchanges Huobi, OKEx, Binance and BitMEX generally represented 90% of the volume traded throughout the month.

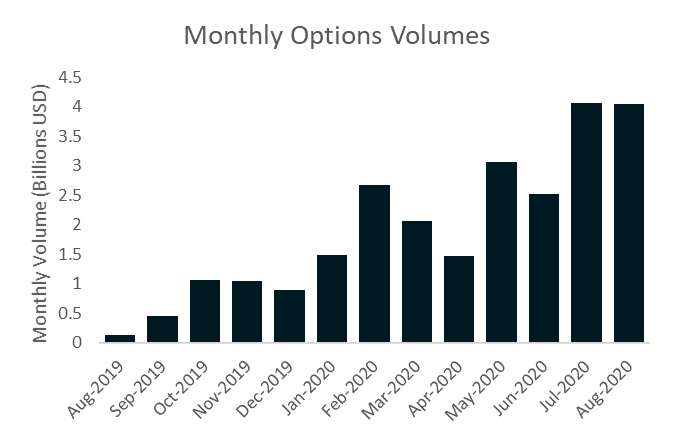

Options

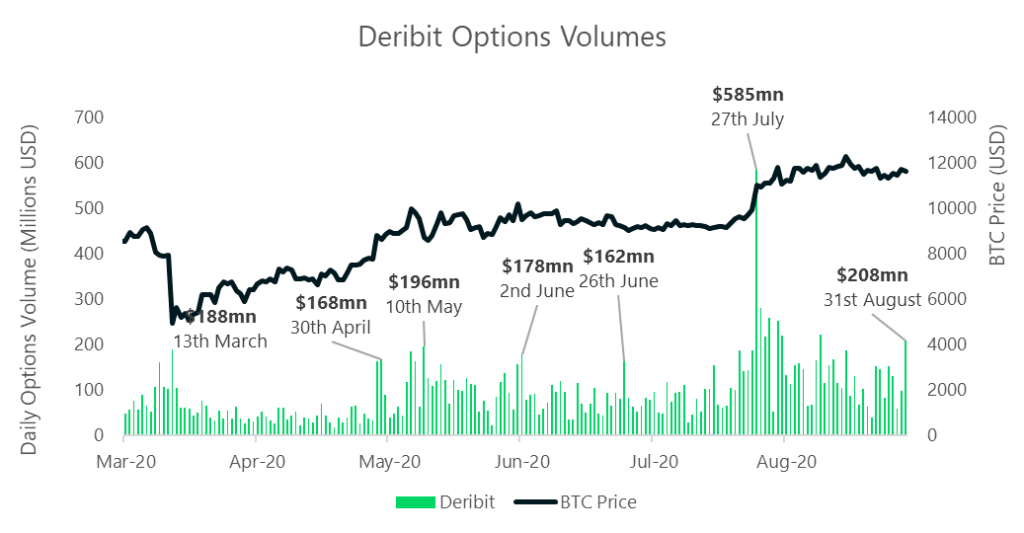

Deribit’s options volumes remained steady compared to the previous month, with $4.05bn traded throughout August (down 0.6% since July).

CME Institutional Volume

Monthly CME futures contract volumes have increased 36.3% since July to reach 203,867 contracts traded in August.

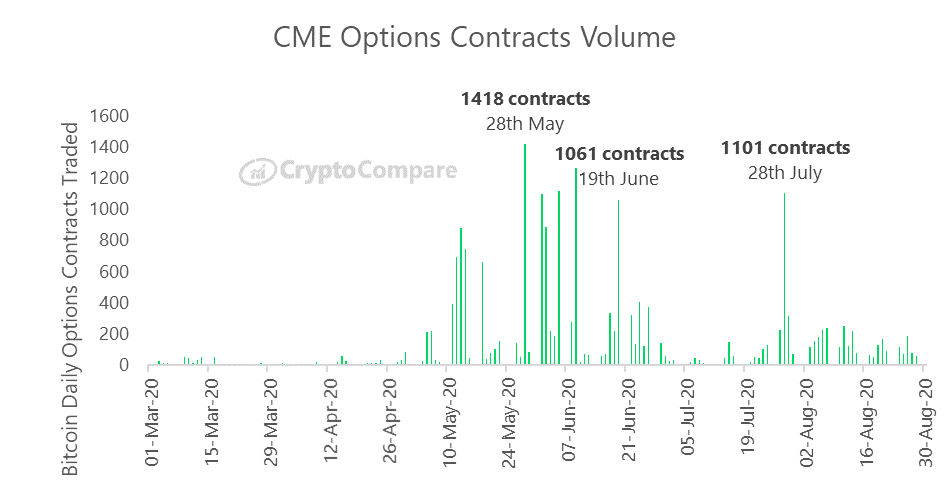

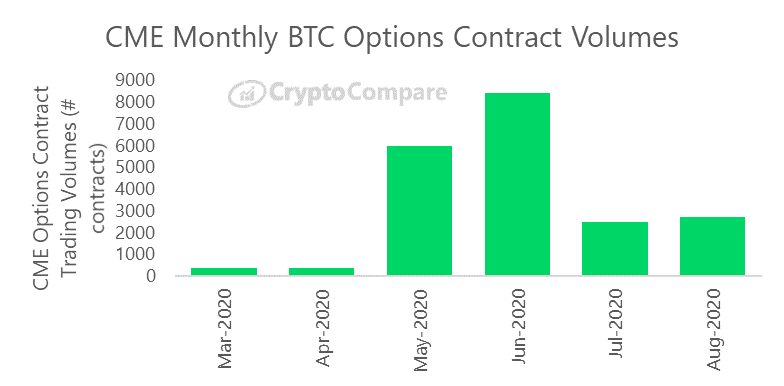

CME options contract volumes also increased 8.4% in August to 2,715 contracts traded. In July, this figure was 2,504 contracts.

In terms of total trading volume in August, CME’s crypto derivatives volumes have increased 55.7% in line with many unregulated derivatives competitors to reach $12.02bn.