Abstract: In contrast to the apparent management difficulties at Bitmain, in a shrewd piece of corporate finance, cryptocurrency ASIC manufacturer Canaan Creative successfully raised $90m in an IPO in November 2019, at a very attractive valuation from the company’s perspective. From Canaan’s point of view, the timing appears impeccable, right before the release of a set of financial results likely to show a loss in 2019, a Bitcoin price decline and the 2020 halvening which should reduce mining revenue. Quarterly disclosures in the prospectus illustrate extreme volatility in sales, which appear more volatile than both cryptocurrency prices and mining farm operation financials. The shares are down 43% since the listing, moving towards what we would consider a more attractive valuation for investors.

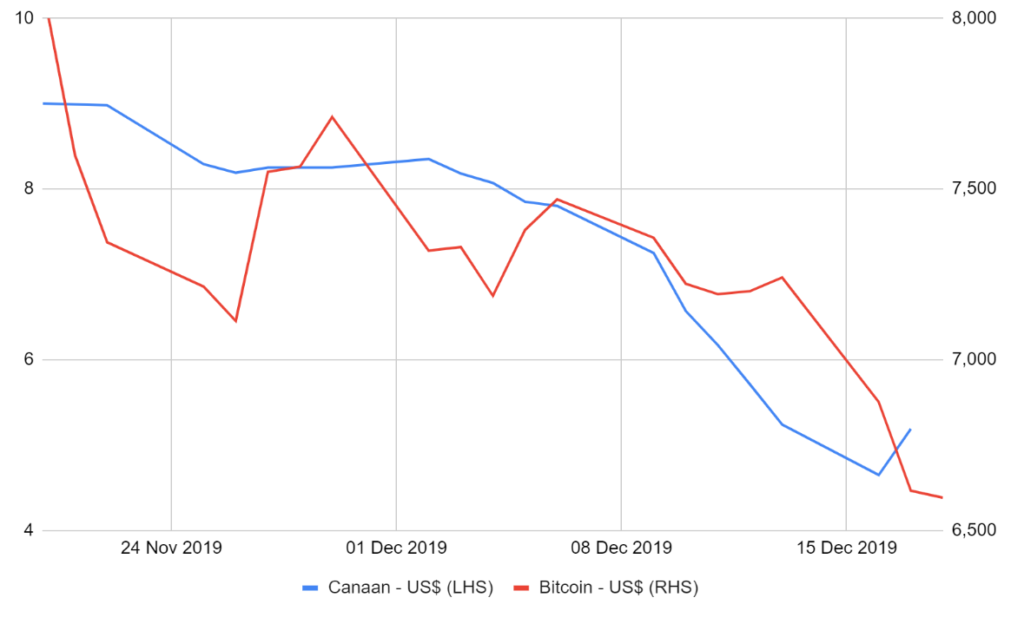

Canaan’s sharp share price decline since the IPO vs Bitcoin

(Source: Bloomberg)

Overview

Chinese cryptocurrency mining ASIC manufacturer Canaan Inc [CAN US] conducted an IPO in November 2019, raising US$90m. Behind Bitmain, Canaan is one of the largest players in the space, with a market share of around 22%. The shares were listed on the Nasdaq on 20th November 2019. Citigroup was the lead underwriter, with a share of around 55% and is estimated to have eared US$3.9m of the US$7.2m paid in fees. The US$9 IPO price (which was at the lower end of the range) values the company at US$1.35 billion, making Canaan by far the largest listed pure play cryptocurrency company. With mining ASIC industry behemoth Bitmain failing to list last year, Canaan is the only significant listed entity in the space. At the time of writing, the shares are trading at $5.19, down 43% since the listing, while in the same period the Bitcoin price is down 8.3%.

Canaan was founded in 2013, by the current chairman and CEO Dr Nangeng Zhang, along with current co-chairman, Jianping Kong. The company took over the Avalon mining brand in 2014, while Avalon itself launched in 2012. This is the company’s 2nd attempt at an IPO, after previously trying to list in Hong Kong in 2018.

The Loss-Making Technology IPO Bonanza

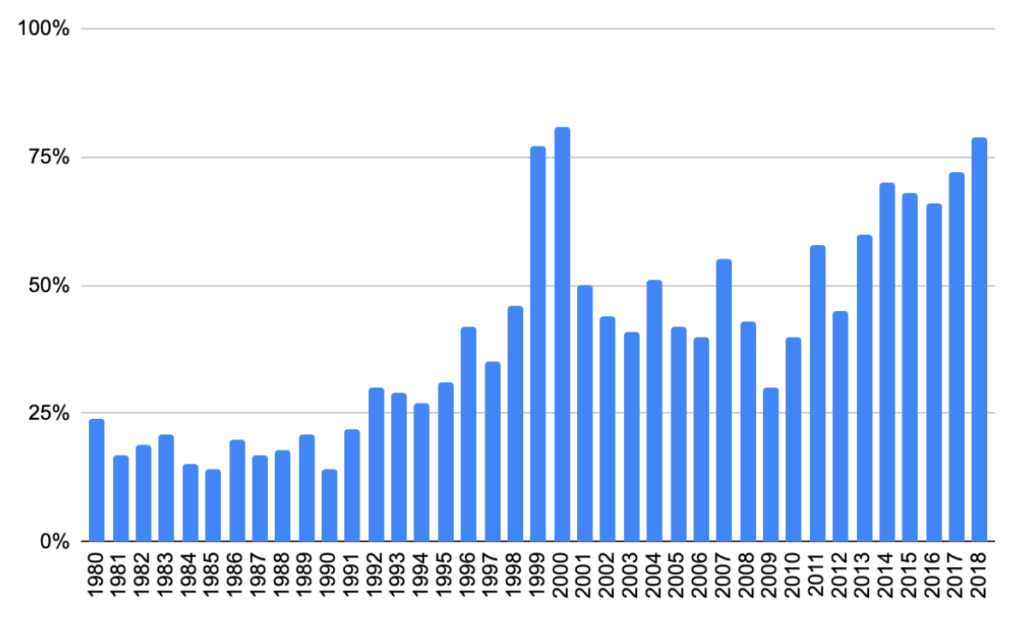

There has been a litany of loss-making technology related IPOs in the last two years in the US: Uber, Lyft, Beyond Meat, Pinterest, Slack, Spotify, Hello Fresh and Snapchat, to name a few. In fact, as Figure 1 below indicates, the proportion of loss-making IPOs is reaching an all-time record high, approaching the 82% peak achieved in the 2000 technology bubble. Canaan appears to have capitalized on this attractive IPO market in the US.

Figure 1 – Percentage of loss-making IPOs in the United States

(Source: Jay Ritter, Warrington College of Business, University of Florida)

Canaan Financials

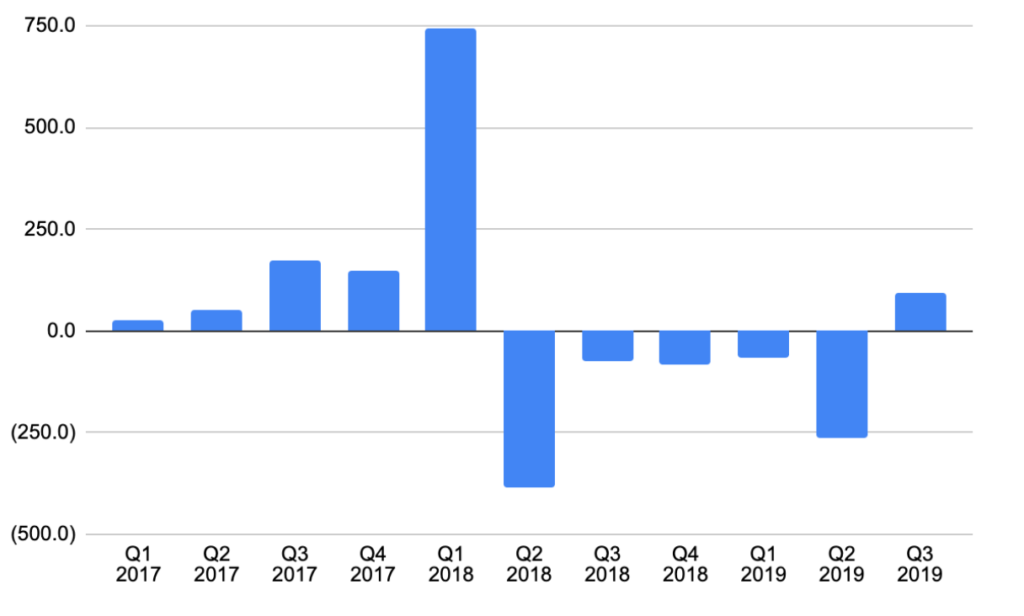

According to our projections, the company should generate a significant loss in 2019. In some ways, Canaan is an exception to this loss making rule mentioned above, with the company generating positive earnings in the financial years ending 2017 and 2018. On the other hand, this doesn’t reveal the full picture. The quarterly disclosures show that the group generated significant earnings in the bull market from 2017 to Q1 2018, before experiencing five quarters of consecutive losses from Q2 2018 to Q3 2019.

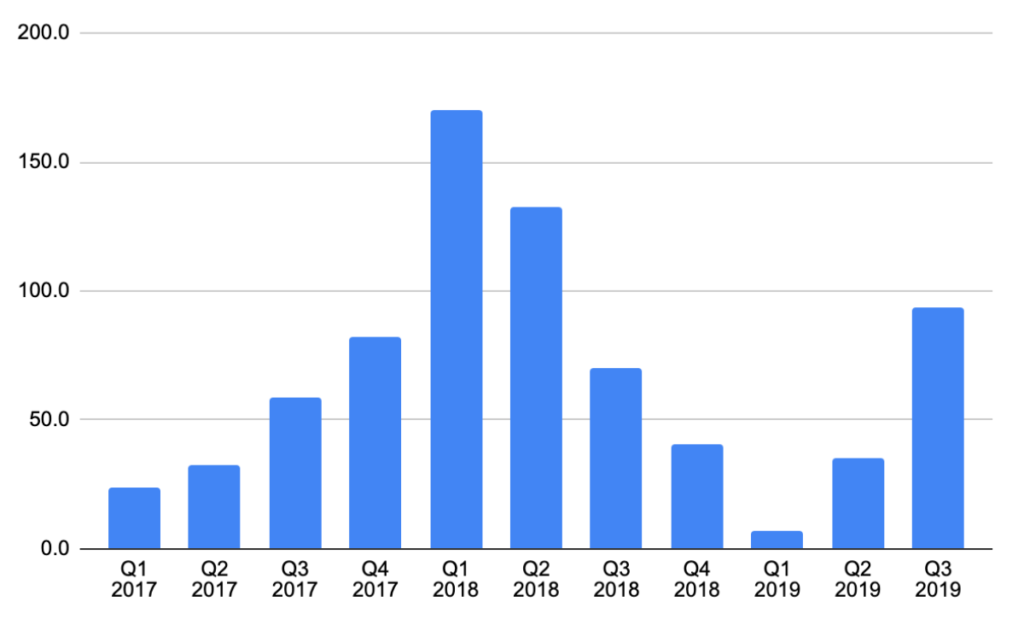

Figure 2 – Canaan Quarterly Revenue (US$m)

(Source: Canaan IPO prospectus)

Figure 3 – Canaan Quarterly Profit before tax (US$m)

(Source: Canaan IPO prospectus)

The Mining Cycle

As it turns out, mining ASIC sales appear to be extremely volatile, more so than both the Bitcoin price and mining farm-operating entities’ revenue and earnings. This is illustrated by Figure 2 above. By Q1 2019 sales had dropped to a mere $7m, down 96% YoY, a far more substantial decline than the Bitcoin price. Unsurprisingly, mining farm operators’ willingness to engage in capital expenditure is highly impacted by changes in the price of the underlying cryptocurrency. Many mining farms are dependent on external investors to finance the purchase of new equipment and these investors may be highly sentiment-driven and focused on short term profitability.

Mining Equipment Performance

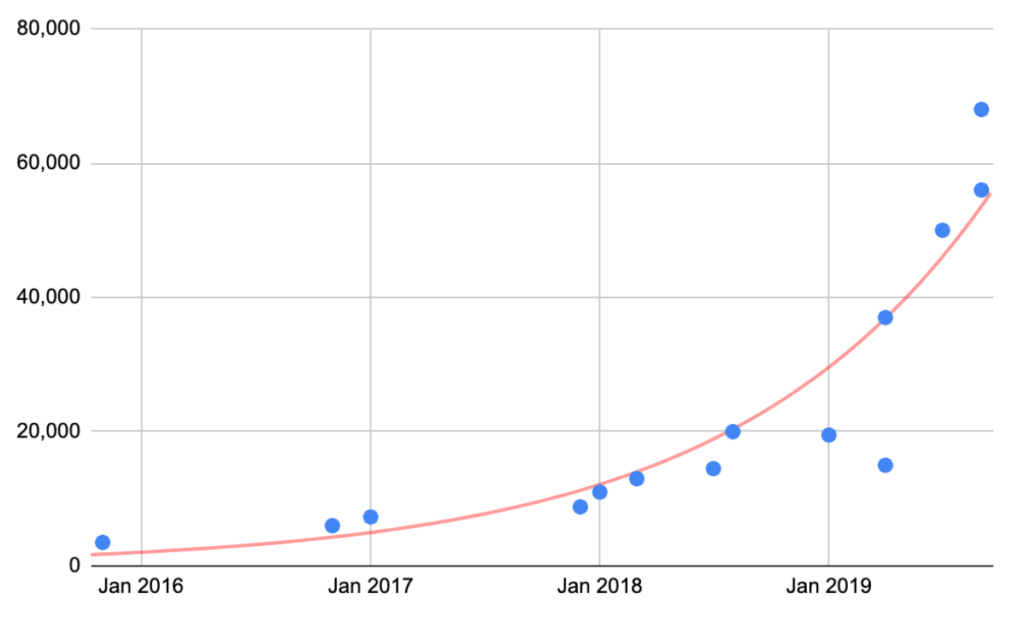

In the IPO prospectus, Canaan disclosed its full product history, a total of 14 different products since 2015, ranging from 28 nanometer to 8 nanometer. Figure 4 below shows the exponential increase in the power of the machines, driven by both an increase in efficiency, but also a trend towards larger more power-hungry machines.

Figure 4 – Canaan ASIC Power vs Product Release Date (GH/s)

(Source: Canaan IPO prospectus)

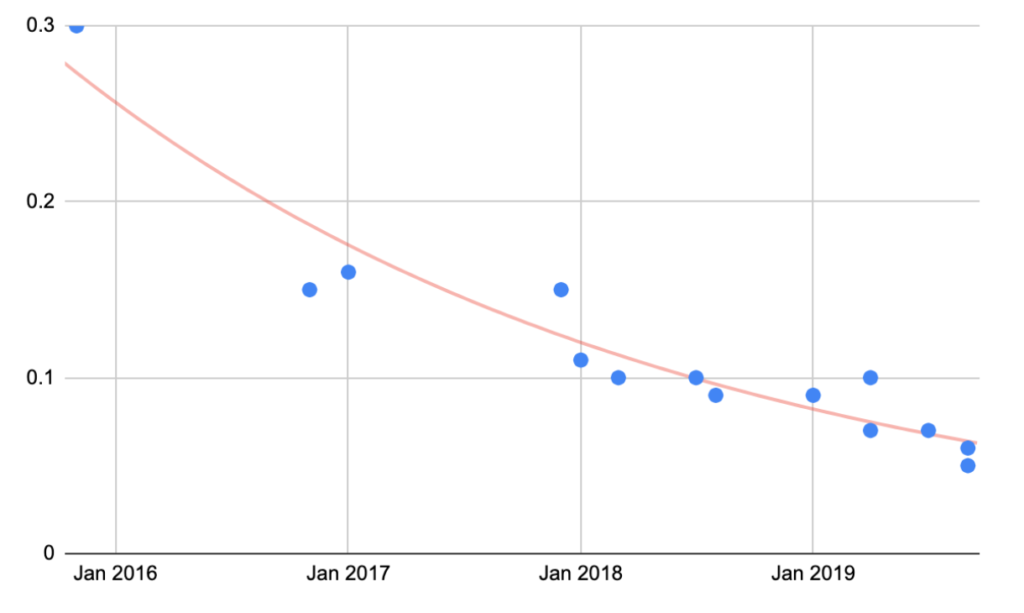

Although it is hard to clearly distinguish, Figure 5 below may illustrate a decline in the rate of efficiency improvement in the last five years. This has coincided with a slowdown in the rate of improvements in computer chip technology as we reach physical chip constraints.

Figure 5 – Canaan ASIC Efficiency vs Product Release Date (W/GHs)

(Source: Canaan IPO prospectus)

Balance Sheet & Cash Flow

Although Canaan was profitable in 2017 and 2018, the company did not have too much success with respect to operating cash flow generation. In 2017 the group only generated operating cash flow of around US$14m, only around 7.1% of its US$200m sales in the period. In contrast, in 2017 Bitmain generated operating cash flow of over $1.2 billion, almost 48% of its total sales of $2.5 billion. Being able to generate and retain cash when times are good is crucial in this highly volatile industry. This may reflect the fact that Bitmain was more mature than Canaan in 2017, and that Canaan may have had even less favourable payment terms with its suppliers than Bitmain, which may be supported by the numbers in Figure 6 below.

Figure 6 – Canaan cashflow analysis – US$m

| Cashflow | 2017 | 2018 | 2019 Estimates |

| Net Income | 57.8 | 17.8 | (28.9) |

| Change in inventories | (19.1) | (47.4) | 27.0 |

| Change in payables | (90.4) | 65.4 | 59.4 |

| Contract liabilities | 30.9 | (28.4) | (37.7) |

| Other | 34.7 | (9.2) | (20.3) |

| Operating cash flow | 14.0 | (1.9) | (0.5) |

| Capex | (1.9) | (3.6) | (3.0) |

| Disposals | 2.1 | ||

| FCF | 14.2 | (5.4) | (3.0) |

| Other Financing | (1.0) | 2.3 | |

| Issuance of shares | 23.1 | 183.7 | |

| Distribution to shareholder(s) |

(100.6) | ||

| Change in net debt | 36.3 | (103.8) | 180.7 |

(Source: Canaan IPO prospectus, BitMEX Research)

Despite the group struggling to generate cash from operating activities, the company has not squandered much cash either, unlike Bitmain, which may have spent almost a billion dollars on Bitcoin Cash. As a result of this, combined with significant equity offerings this year ($93m earlier in the year followed by the recent IPO), Canaan should end the year with a strong balance sheet and healthy net cash position. In our view, although Canaan has not been able to generate significant cash flow, if there is another cryptocurrency bull market, the company should be able to capitalize on it more effectively, based on the group’s larger market share and longer experience.

Valuation

Figure 7 – Canaan valuation metrics

| Canaan Valuation | 2017 | 2018 | 2019E | |

| Share price | 5.19 | |||

| Market Cap (US$m) | 779 | |||

| Net Cash/(Debt) (US$m) | 101.7 | |||

| EV (US$m) | 677 | |||

| PE | 13.7 | 45.5 | (27.0) | |

| P/B | 5.9 | 23.1 | 5.9 | |

| FCF/EV | 2.1% | (0.8%) | (0.4%) | |

| EV/Sales | 3.4 | 1.8 | 3.3 |

(Source: Canaan IPO prospectus, BitMEX Research)

The IPO was conducted at a valuation of around $1.35 billion, around 24x 2017 earnings and a FCF/EV of only 1.1% on 2017 peak free cash flow. We considered the IPO price expensive, certainly for any value investors. As Figure 7 above illustrates, we project that the company will make a loss in 2019 and generate negative FCF. However, the stock trades on a PE of 13.7x and FCF/EV of 2.1% based on peak 2017 results. We think the current valuation is more reasonable, at least relative to the current elevated valuations in broader equity markets.

The above being said, the Bitcoin price has been weak recently and the halvening is due around May 2020. In order for this investment to make sense, one is reliant on sharp increases in the Bitcoin price at some point. As the data shows, while the Bitcoin price declines, miners barely make any new orders at all. Therefore the investment case is not compelling, however we do not consider Canaan to be among the least attractive investment propositions in the space.

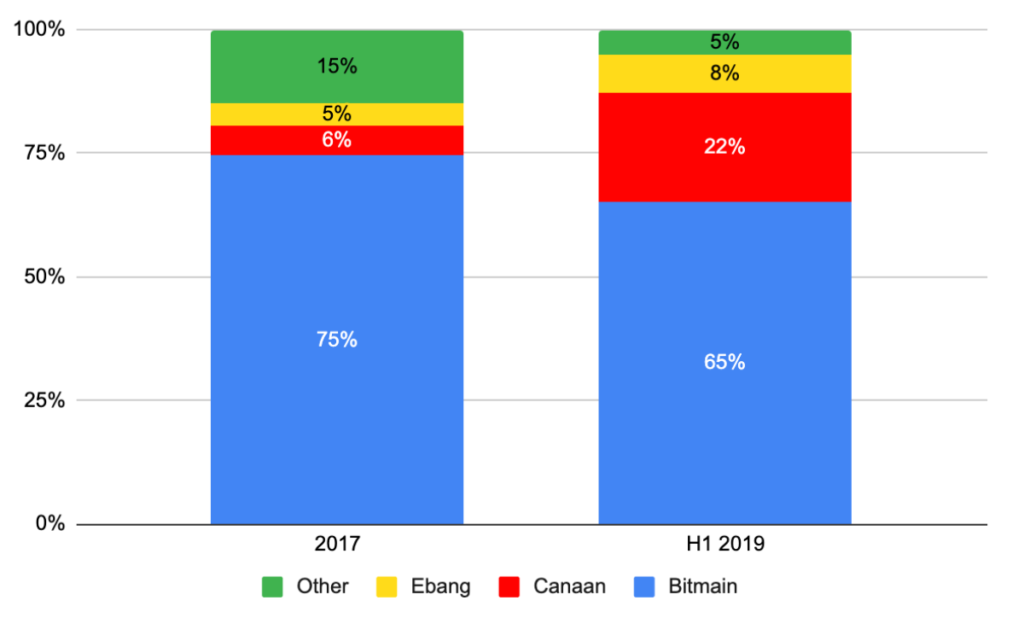

Canaan’s Growing Market Share

As we mentioned above, in the last couple of years Canaan has gained market share from Bitmain, as Figure 8 below shows. That data is based on the two companies respective IPO prospectus documents.

Figure 8 – Mining ASIC Market Share by Manufacturer (TH/s sold)

(Source: 2017 figures from Bitmain IPO prospectus. H1 2019 figures from Canaan IPO prospectus)

In a positive sign, from the perspective of Bitcoin decentralisation, Bitmain has lost considerable market share to Canaan and Ebang in the period. However, the top three players now control 92% of the market, as smaller players have existed or shrunk in size, a negative for decentralisation. Although, as we have mentioned in previous reports, mining decentralisation should be measured by considering four key parts of the mining supply chain, mining farms, mining pools, ASIC manufacturers and the foundries.

Bitmain Difficulties

There have also been rumours circulating that Bitmain may be planning another IPO attempt, after the failure last year. This move by Canaan will certainly make Bitmain even more keen to list and boost its cash reserves, to be able to compete with Canaan and maintain its strong lead.

However, Bitmain’s IPO attempt may have been delayed or prevented again, this time by management difficulties. According to Coindesk, Bitmain co-founder and former CEO Jihan Wu, dismissed his fellow co-founder and largest shareholder Micree Zhan, following a supposed “ugly power struggle”. Zhan is then said to have begun legal proceedings to get reinstated in the company. In addition to this, according to Bloomberg, former Bitmain director of design Dr Yang Zuoxing is said to be under arrest, the charges supposedly relate to a dispute with Bitmain and an allegation of embezzlement. One may remember that Dr Zuoxing was sued by Bitmain in 2017, according to Coindesk, in an issue related to patents, a case which Bitmain may have eventually lost. It is possible that this recent arrest is a continuation of that dispute. The litigious Bitmain is also said to be suing what is now Bitcoin’s largest mining pool, Poolin, over a non-compete agreement with former employees. These management difficulties may make an IPO difficult to conduct, until the issues are resolved. At least for now, Canaan may be the beneficiary of this to some extent, as the largest and most liquid listed pure-play Bitcoin stock.

Share Price Volatility

In this report we discussed how Canaan’s sales are more volatile than cryptocurrency, understanding how this may impact the share price may be interesting to investors in the space. In the gold space, miners tend to offer a leveraged play on gold, as the high cost of extracting the metal ensures margins can be significantly impacted by relatively small changes in the price of gold. Whether this is set to be the case with Bitcoin remains to be seen.

In Bitcoin, there is the issue of the difficulty adjustment, which can dampen the impact of Bitcoin price moves on some mining farm earnings. Listed miners like Hut 8 are likely to be well down on the mining cost curve and therefore their earnings could prove more resilient that many expect. Mining pools may have high margins and therefore resilient business models and foundries are diversified away from cryptocurrency. As of now, our theory is unproven, but it could be the case that the pure play cryptocurrency ASIC manufacturers like Canaan, eventually end up being the most volatile cryptocurrency related asset of them all.

Conclusion

The success of this IPO was a major victory for Canaan and its bankers. Canaan managed to raise $90m at what we consider an extremely expensive valuation, right before a decline in the Bitcoin price and with the Bitcoin halvening coming up in around 6 months time. This should provide the company a significant cash buffer if the bear market continues. As for whether one should invest in Canaan, we do not think the valuation is compelling. However, it is certainly a stock to watch closely and the current price is not unreasonably high, in our view.

While Canaan managed to pull off this clever piece of corporate finance, when they otherwise may have been facing cash difficulties, management troubles at Bitmain seem to have held them back. At least for now: