BTFD was the rallying cry of crypto traders throughout 2017. The beginning of 2018 will test even the most stalwart HODLers. When is the right time to back up the truck? It surely wasn’t at $15,000, $10,000, or $8,000.

One of my best friends, once a top-ranked bond salesman, describes himself as a first-rate method actor. When he showed up to work, he had the perfect coif, wrist watch, and tailored suit. Seeing him after he left all that behind, you would think he was a wannabe K-Pop star. When the play was over, he became himself again.

The actors in the financial-services theatre don their costumes to drape themselves in an air of respectability. The right accent, pedigree, and clothing allow them to convince the unwashed heathens that the financial products and advice they peddle is not snake oil.

I wore my costume too, although my performance was not as convincing. Every Friday at Deutsche Bank, we were allowed wear casual clothing. One Friday, while I was a first-year analyst, I decided to wear a pink polo shirt, acid-washed jeans, and yellow sneakers.

Later that afternoon, the head of Equities walked past my desk and saw me. He asked my boss, “Who the fuck is that?”, referring to me and my baller outfit. The next week, I learned that casual Fridays were cancelled for the whole office. Thank you, Arthur Hayes!

The firms employing these troops of actors still have an aversion to Bitcoin. They are hypocrites, and the latest volatility gyrations that REKT thousands of retail punters invested in products they sold is case in point.

A primer on leveraged and inverse ETFs

A traditional ETF is a product used to go long on a particular basket of assets. An example is SPY, the SPDR S&P 500 ETF. It gives holders exposure to the S&P 500 index by holding a basket of stocks.

One of the biggest reasons why ETFs are so successful in the US: investors can purchase them in their retirement accounts. Retirement accounts have various restrictions on the type of assets that may be purchased. Usually, these accounts do not allow investors to hold futures contracts or trade on margin.

Investors crave leverage and the ability to go short. Futures contracts are the most cost-effective way to gain this type of exposure. However, the minimum size of many contracts prohibits small investors from using them. Also, small investors cannot use them in their retirement portfolios.

To satiate this demand, ETF issuers began launching leveraged and inverse ETFs.

Let’s assume we launch an inverse ETF on the S&P 500 index (SPX). The purchaser of this ETF will profit if the index declines.

daily ETF performance = -1 * daily return SPX

Say that on day 1:

SPX Close0 = $1,000

SPX Close1 = $500

Return = -50%

ETF performance = -1 * -50% = +50%

And on day 2:

SPX Close1 = $500

SPX Close2 = $1,000

Return = 100%

ETF performance = -1 * +100% = -100% (Bankrupt!)

This simple example illustrates that inverse ETFs are path dependent. In other words, holders take on convexity while holding this ETF. Unfortunately, they are short, not long.

Leveraged and inverse ETFs are ticking time bombs. If held long enough during a period of suitable volatility, there is a significant likelihood that holders will severely underperform their intended strategy.

In addition, the fund manager must constantly rehedge his portfolio at the end of each trading day. The more a manager trades, the more fees must be paid to investment banks and the exchange. These fees are passed on to the client.

The client is short gamma, underperforms the benchmark, and pays more in fees. Can you spot the sucker?

The Volocaust

Selling volatility has been the sure bet to riches for retail and institutional investors alike since 2009. The CBOE VIX futures market took off after the crisis, and enterprising ETF issuers began listing products to allow retail punters to participate in this esoteric corner of the financial markets.

Retail punters took to VIX ETFs like a Donald Trump to Propecia.

As volatility continued to collapse, exchange-traded notes (ETNs) and exchange-traded products (ETPs) that allowed retail investors to short VIX futures proliferated. Retail punters got a double whammy of goodness.

The first whammy: VIX futures contango. Because investors feared another 2008 market crash, they bid up call and put prices. This led to enhanced implied volatility, which meant VIX futures traded at a premium to spot. Because volatility continued to realise lower and lower, VIX futures sellers picked up that premium.

The second whammy: central banks, crushing all market volatility. At any hint of crisis, the printing press went spastic and punished shorts.

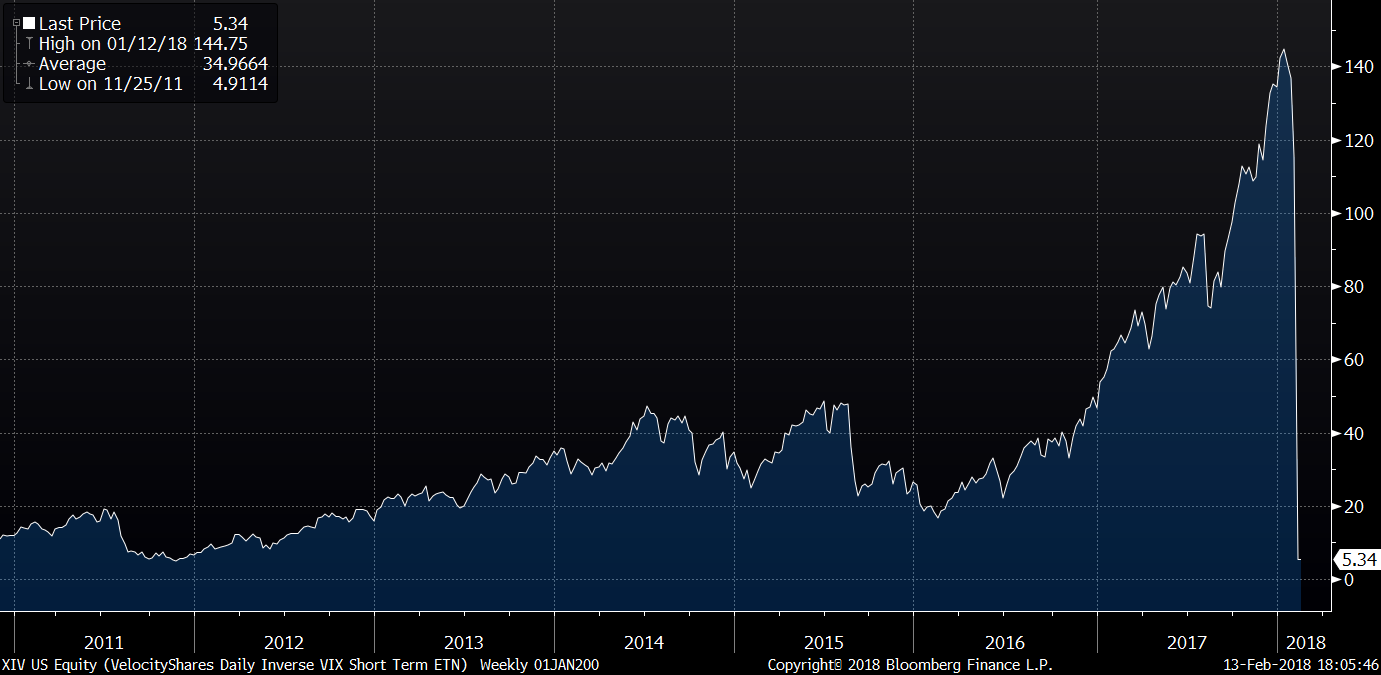

One of the most popular products was the VelocityShares Daily Inverse VIX Short-Term ETN (XIV, get it?) that Credit Suisse issued. XIV invests in the VIX short-term futures contracts, not the index itself. This is awesome when the market doesn’t move and the futures basis tends to zero, but if the term structure shifts dramatically higher, it will exacerbate the losses.

Things were going swell until the market dropped last week, and the VIX and its associated futures spiked. It went up so much that the net asset value (NAV) of the ETN declined by over 80% in one day. Remember, the ETN decreases in price if the VIX rises. There is a clause in the prospectus that allows the issuer to redeem the ETNs if the NAV drops by more than 80% in one trading session. Investors at that point get back what they can get back. Given that the short-term VIX futures basis spiked as well, these investors are pretty much guaranteed to receive a bagel.

Entire fortunes and accounts were destroyed overnight. Traders who saw steady profits as volatility ground lower were wiped out.

Bitcoin ain’t so volatile anymore

After witnessing a retail product that went from hero to zero in one trading session, how can any banker say with a straight face that crypto coins are too risky for retail investors? These same investment banks gladly structured toxic ETFs, ETNs, and ETPs that gutted the portfolios of those investors they claimed to care so much about.

Going long on Bitcoin could result in an investment worth nothing in the near or long-term future. But at least that is an investment with positive convexity. The maximum you can lose is what you put in, but the upside is infinity. Contrast that to any number of inverse ETFs. The maximum unlevered return is 100% and the maximum loss is also 100%. However, as I have shown, the path dependency of these products assures that you will underperform your benchmark in the long run.

If the banks that issue these carpet bombs also pooh-pooh Bitcoin, ignore them. The only reason why they don’t like crypto coins is that they have no way to profit from them. They don’t own the exchanges nor can they facilitate agency trading of these assets. A dollar invested into Bitcoin is a dollar not invested in the casino that they operate.

That negative attitude is changing fast. The “vampire squid” Goldman Sachs invested money in Circle, who just acquired Poloniex. It seems that crypto money isn’t that bad after all.

As compliance departments are browbeaten into allowing banks to trade crypto coins, the banks’ tone will shift. Suddenly, an allocation of crypto coins will be investment canon. Jamie Dimon and his ilk will flip-flop into crypto enthusiasts. But don’t hate on Jamie for dogging Bitcoin — he is just playing his part in the financial-markets theatre.