Did you take your losses like a champ, or bottom tick the market with your market close order? The first quarter of 2019 witnessed depressed volumes, volatility, and price. The local lows of late 2018 have not been retested; however the market chop makes me feel like I’m at the Saudi embassy.

The repair of crypto investors balance sheets is not done yet. Losses must be digested, and the unlucky masses must wage cuck a bit longer to get back in the game.

All is not lost; nothing goes up or down in a straight line. 2019 will be boring, but green shoots will appear towards year end. The mighty central bank printing presses paused for a while, but economic sophists could not resist the siren call of free money. They are busy inventing the academic crutches (here’s looking at your MMT), to justify the next global money printing orgy.

Do not despair. CRipple is still worth more than zero. And Justin Sun’s new age religion TRON, paired with the Pope CZ, tells us there are those still willing to eat shitcoins with a smile.

Electric Cars and Sand Schmucks

While Bitcoin is an innovative technology, the technical merits of the protocol do not exist in a vacuum. The world’s monetary situation is very important. It determines how willing investors are able to suspend disbelief and believe crypto fan boys and girls.

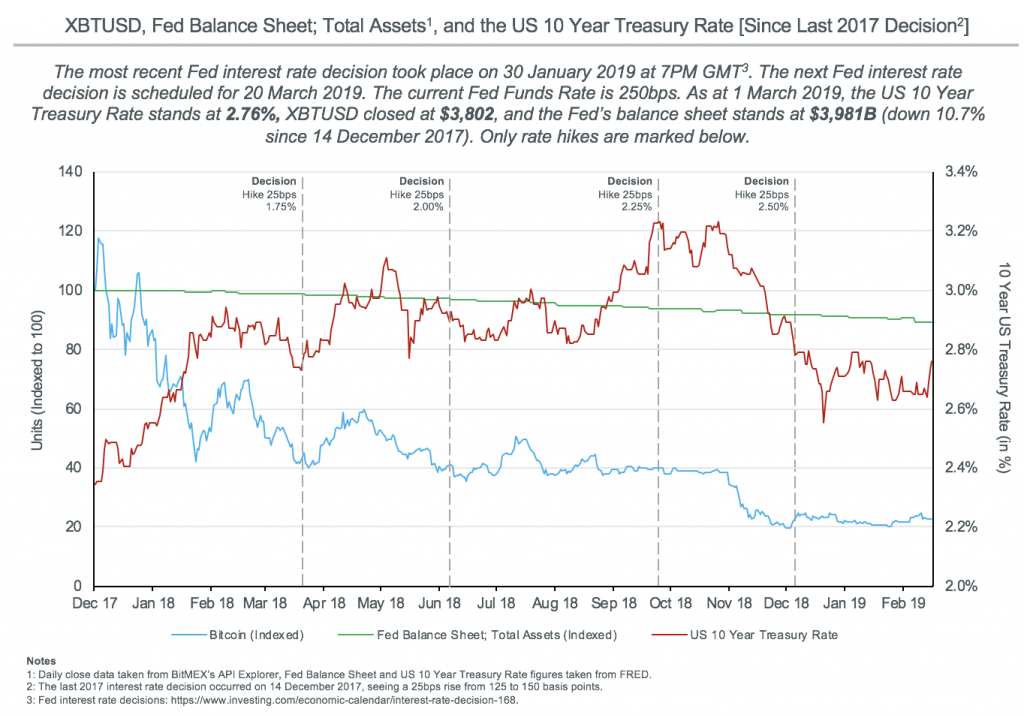

Throughout 2018 the omnipotent Fed began reducing the size of its balance sheet and raising short term interest rates. The world still beats to the tune of the USD. Financial institutions and governments require cheap dollars, and the Fed happily obliged since the 2008 GFC.

Tech VC funds won’t admit it, but cheap dollars are key to their business. How else can you convince LPs to continually fund negative gross margin businesses, until they “scale” and achieve profitability? Everyone wants to become the next Facebook.

When investing in government bonds yields zero or negative, desperate investors will do whatever it takes to obtain yield. Tesla is a perfect example. Lord Elon is a master at creating open-faced pits, and torching his investors’ money in them. Tesla does not belong on the Nasdaq, but rather as a speciality flavour at the New York Bagel Co.

The market disagrees with my Tesla melancholy, investors continue to line up to eat Elon’s sexy Tesla hot shit cakes. Can you blame them, after you are fully invested in the S&P500 where else will you be able to show alpha to your investors?

Another example of this free money folly is the Vision Fund.

- Top tick the “Value” your investments while still on the Softbank’s books.

- Find a group of schmucks from the sand (That’s where the former Deutsche credit boys come in, “Be Bold”)

- Sell your mark-to-fantasy private Unicorns into the vehicle populated by your sand schmucks

- Take your cash and payout to your Japanese investors as dividends.

These entities thrived while the Fed held rates at 0% and reinvested their treasury and MBS roll off. TSLA hit its all-time high in mid-2017. Since then Elon has struggled to generate enough buzz to keep his stock elevated. I’m sure he isn’t thrilled that bondholders are due close to $1 billion in cash because the stock price failed to scale $360.

The Vision Fund’s sand schmucks also got cold feet. They baulked when the fund proposed to invest an additional $20 billion into the We-Broke company. The check size got sliced down to $2 billion.

When dollars get scarce suddenly investors discover value investing all over again.

The height of crypto silliness in December 2017 occurred just before the Fed embarked on its quantitative tightening. The 2018 pain train spared no crypto asset or shitcoin.

But things are a changin’. The Fed couldn’t stomach a 20% correction in the SPX. In the recent Fed minutes, the dot plot now shows no rate increases for the rest of 2019. The Fed will start reinvesting its runoff in the third quarter. We are only a hop, skip, and a jump away from an expanding Fed balance sheet.

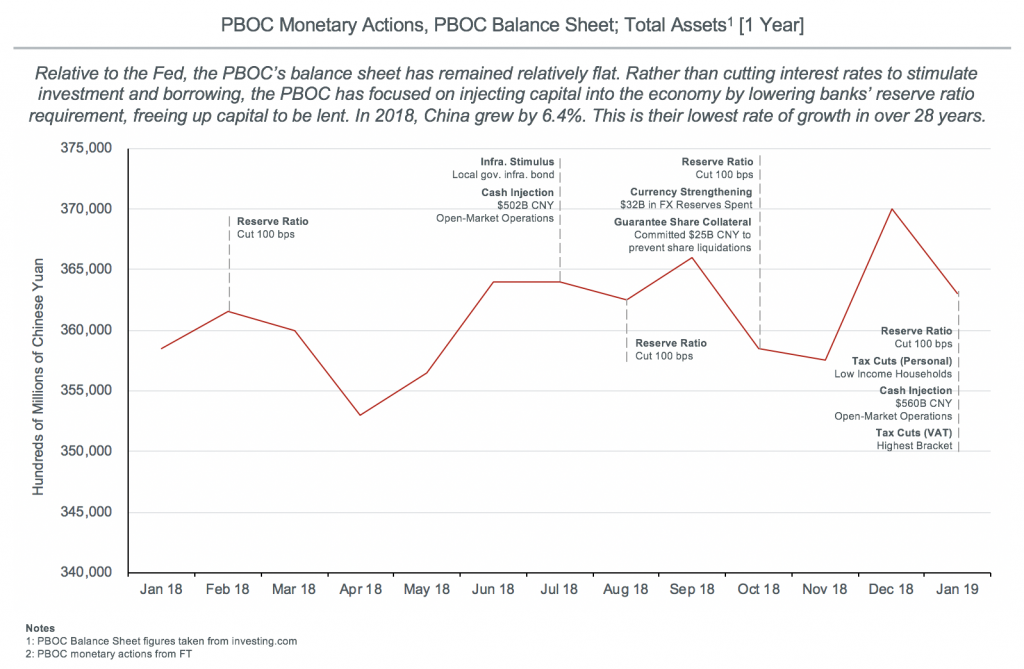

Beijing knows China must rebalance its economy away from credit-fueled fixed asset investment. However, Xi must not have the political cojones to push this sort of painful change through. Therefore, the PBOC said “fuck it” to any attempt to reign in credit growth. The two most important central banks are creepin’ back into a super easy credit regime.

Easy money will manifest itself in other higher profile and more liquid dogshit before crypto. 2019 will feature an IPO beauty pageant of some of the best cash destroying businesses. Uber, Lyft, AirBnB, and possibly the We company all are rumoured to IPO this year.

Lyft is apparently oversubscribed for its upcoming IPO. Oh baby, this is going to be a fun year.

If these beauties can price at the top of the range, and trade above the IPO price, we know that party time is back. Crypto will be the last asset class to feel the love. Too many people lost too much money, in too short a time period, to immediately Fomo back into the markets.

Get Excited

Green shoots will begin to appear in early Q4. Free money and collective amnesia are powerful drugs. Also after two years of wage cucking, punters should have a few sheckles to rub together.

The 2019 chop will be intense, but the markets will claw back to $10,000. That is a very significant psychological barrier. It’s a nice round sexy number. $20,000 is the ultimate recovery. However, it took 11 months from $1,000 to $10,000, but less than one month from $10,000 to $20,000 back to $10,000.

Melissa Lee peep this. $10,000 is my number, and I’m stickin’ to it.