Abstract: In this piece, we explore why the BitMEX insurance fund is needed and how it operates. We compare the BitMEX insurance fund model, to the systems utilized by other more traditional leveraged market places (e.g. CME). We conclude that crypto-currency trading platforms which offer leverage and a capped downside face some unique challenges, when compared to traditional institutional trading platforms. However, the growth of BitMEX’s insurance fund provides a reasonable level of assurance to winning traders that they will be able to attain their expected profits.

(BitMEX Co-founder & CEO Arthur Hayes (left) and CME Chairman & CEO Terrence Duffy (right))

Leveraged Trading Platforms

When one trades on a derivatives trading platform such as BitMEX, one does not trade against the platform. BitMEX is merely a facilitator for the exchange of derivatives contracts between third parties. A key feature of the BitMEX platform is its leverage, where traders can deposit Bitcoin, then leverage it up, (in theory up to 100x) and purchase contracts with a notional position size far higher than the value of the Bitcoin they deposited.

The combination of offering both leverage and the ability for traders to trade against each other implies winners are not always guaranteed to get back all the profits they expect. Due to the leverage involved, the losers may not have enough margin in their positions to pay the winners.

Consider the following simplified example, where the platform consists of two customers trading against each other:

| Trader A | Trader B | |

| Direction of trade | Long | Short |

| Margin | 1 BTC | 1 BTC |

| Trade execution price | $3,500 |

|

| Leverage | 10x | 10x |

| Notional position size | 10 BTC | 10 BTC |

| Current BTC price | $4,000 |

|

| Expected Profit | $5,000 | ($5,000) |

In the above example, the winning trader A expects to make a profit of $5,000, which is greater than the amount of capital the loser, trader B, put up as collateral for the trade (one Bitcoin is worth $4,000). As such, trader A can only make 1 BTC ($4,000) in profits, perhaps making him/her feel slightly disappointed.

Traditional Exchanges

Traditional exchanges like the Chicago Mercantile Exchange (CME) do not share this problem to the same extent as crypto-platforms such as BitMEX. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits:

- In the event an individual trader makes a loss greater than the collateral they have in their account, such that their account balance is negative, they are required to finance this position by injecting more funds into their account. If they are unable or unwilling to do so, their broker may initiate legal proceedings against the trader, forcing the trader to provide the funds or file for bankruptcy. Each trader must use a broker, who may evaluate the balance sheet and capital of each of their clients, providing each client a custom amount of leverage depending on the assessment of their particular risk.

- In traditional derivative markets, traders are not typically given direct access to trading platforms. Instead, clients access the market through their brokers (clearing members), for instance investment banks such as JP Morgan or Goldman Sachs. In the event a trader endures losses and the debt cannot be recovered, the broker is required to pay the exchange and make the counterparties whole. From the perspective of the exchange, these brokers are sometimes referred to as clearing members.

- In the event of a clearing member default, the centralised clearing entity itself is often required to make the counterparties whole. In many circumstances clearing and settlement is conducted by a separate entity to the one operating the exchange. The clearing house often has various insurance funds or insurance products in order to finance clearing member defaults.

- In the event of a clearing member failing and the centralized clearing entity also having insufficient funds, in some circumstances the other solvent clearing members are expected to provide capital.

- Many of the larger clearing houses (and perhaps even the larger brokers) are often considered systemically important for the global financial system by financial regulators. Therefore in a doomsday scenario where it looks likely that a major clearing house could fail, it is possible the government may step in and bail out traders, to protect the integrity of the financial system. Traders and institutions often have massive notional positions (multi-trillions of USD) hedged against other positions or instruments, typically in the interest rate swap market. Therefore it is crucial that the main clearing houses remain solvent or the entire financial system could collapse.

CME

CME is the world’s largest derivatives exchange, with an annual notional trading volume of over one quadrillion USD; it is over 1,000x as large as BitMEX. CME has several buckets of safeguards and insurance to provide protection in the event that a clearing member defaults. The funds are financed in various ways:

- Contributions from CME

- Contributions from clearing members

- Bonds placed by clearing members, redeemable by the clearing funds in the event of member default

CME Clearing’s Various Safeguards and Insurance Funds (2018)

| Base Financial Safeguards Package | |

| Guaranty Fund Contributions | $4.6 billion |

| Designated Corporate Contributions | $100 million |

| Assessment Powers | $12.7 billion |

| IRS Financial Safeguards Package | |

| Guaranty Fund Contributions | $2.9 billion |

| Designated Corporate Contributions | $150 million |

| Assessment Powers | $1.3 billion |

(Source: CME)

In exceptional circumstances, CME also has the power to apply “assessment powers” against non-defaulting clearing members to help finance the cost of defaulting members when all the other insurance funds have been drained. The value of the assessment powers is capped at 2.75x for each clearing member guarantee fund per member default.

Based on the size of the insurance funds in the above table, CME has around US$22 billion in various insurance funds. This represents around 0.002% of CME’s annual notional value of trading.

BitMEX and other crypto-currency trading platforms that offer leverage cannot currently offer the same protections to winning traders as traditional exchanges like CME. Crypto-currency is a retail-driven market and customers expect direct access to the platform. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. Leveraged crypto-currency platforms like BitMEX offer an attractive proposition to clients: a capped downside and unlimited upside on a highly volatile underlying asset. But traders pay a price for this, as in some circumstances there may not be enough funds in the system to pay winners what they expect.

BitMEX Insurance Fund

In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders.

When a trader has an open leveraged position, if their maintenance margin is too low, their position is closed forcefully (i.e. liquidated). Unlike in traditional markets, the trader’s profit and loss does not reflect the actual price their position was closed on the market. On BitMEX if a trader is liquidated, their equity associated with the position always goes down to zero.

| Example trading position | |

| Direction of trade | Long |

| Margin | 1 BTC |

| Bitcoin price (at opening) | $4,000 |

| Leverage | 100x |

| Notional position size | 100 BTC = $400,000 |

| Maintenance margin as percentage of notional position | 0.5% |

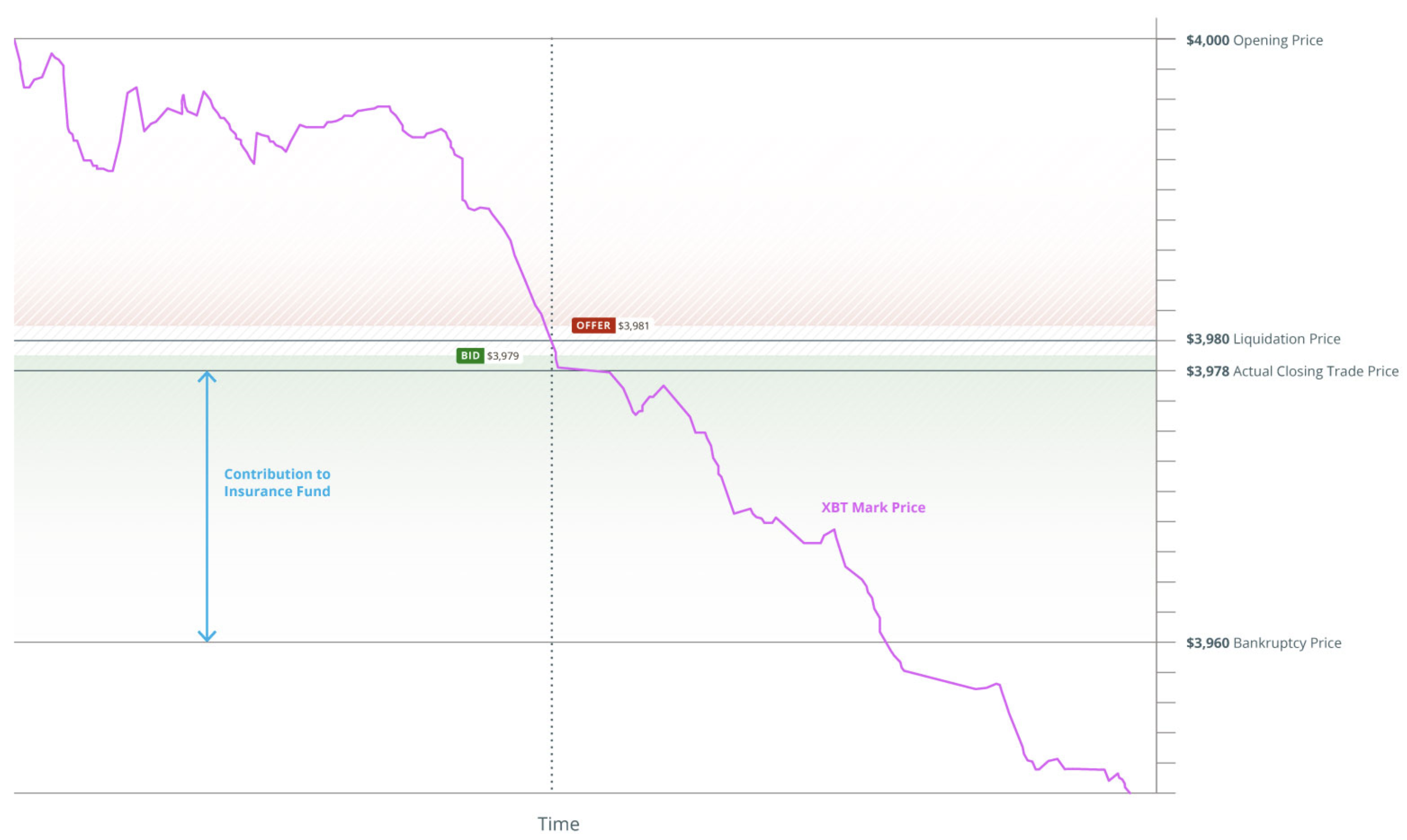

In the above example, the trader has a 100x long position. If the mark price of Bitcoin falls 0.5% (to $3,980) the position is liquidated and the 100 Bitcoin position needs to be sold on the market. From the perspective of the liquidated trader, it does not matter what price this trade executes at, whether its $3,995 or $3,000, either way they lose all the equity they had in their position, they lose the entire one Bitcoin.

Now, assuming there is a liquid market, the bid/ask spread should be tighter than the maintenance margin. In this scenario, the liquidations result in contributions to the insurance fund (e.g. if the maintenance margin is 50bps, but the market is 1bp wide), then the insurance fund will rise by almost as much as the maintenance margin when a position is liquidated. Therefore, as long as healthy liquid markets persist, the insurance fund should continue to grow at a steady pace.

The two graphics below attempt to illustrate the above example. In the first chart, at the time of liquidation, market conditions are healthy and the bid/ask spread is narrow, at just $2. As such, the closing trade occurs at a price higher than the bankruptcy price (the price where the margin balance is zero) and the insurance fund benefits. In the second chart, at the time of liquidation the bid/ask spread is wide. The closing trade occurs at a price lower than the bankruptcy price, therefore the insurance fund is used to ensure the winning traders receive their expected profits. This may seem like it would be a rare occurrence, but there is no guarantee such healthy market conditions will continue, especially in times of heightened price volatility. In these times, the insurance fund can drain much faster than it builds up.

Illustrative example of an insurance contribution – Long 100x with 1 BTC collateral

(Note: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments. The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,978, representing $1 of slippage compared to the $3,979 bid price at the time of liquidation.)

Illustrative example of an insurance depletion – Long 100x with 1 BTC collateral

(Notes: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments. The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,800, representing $20 of slippage compared to the $3,820 bid price at the time of liquidation.)

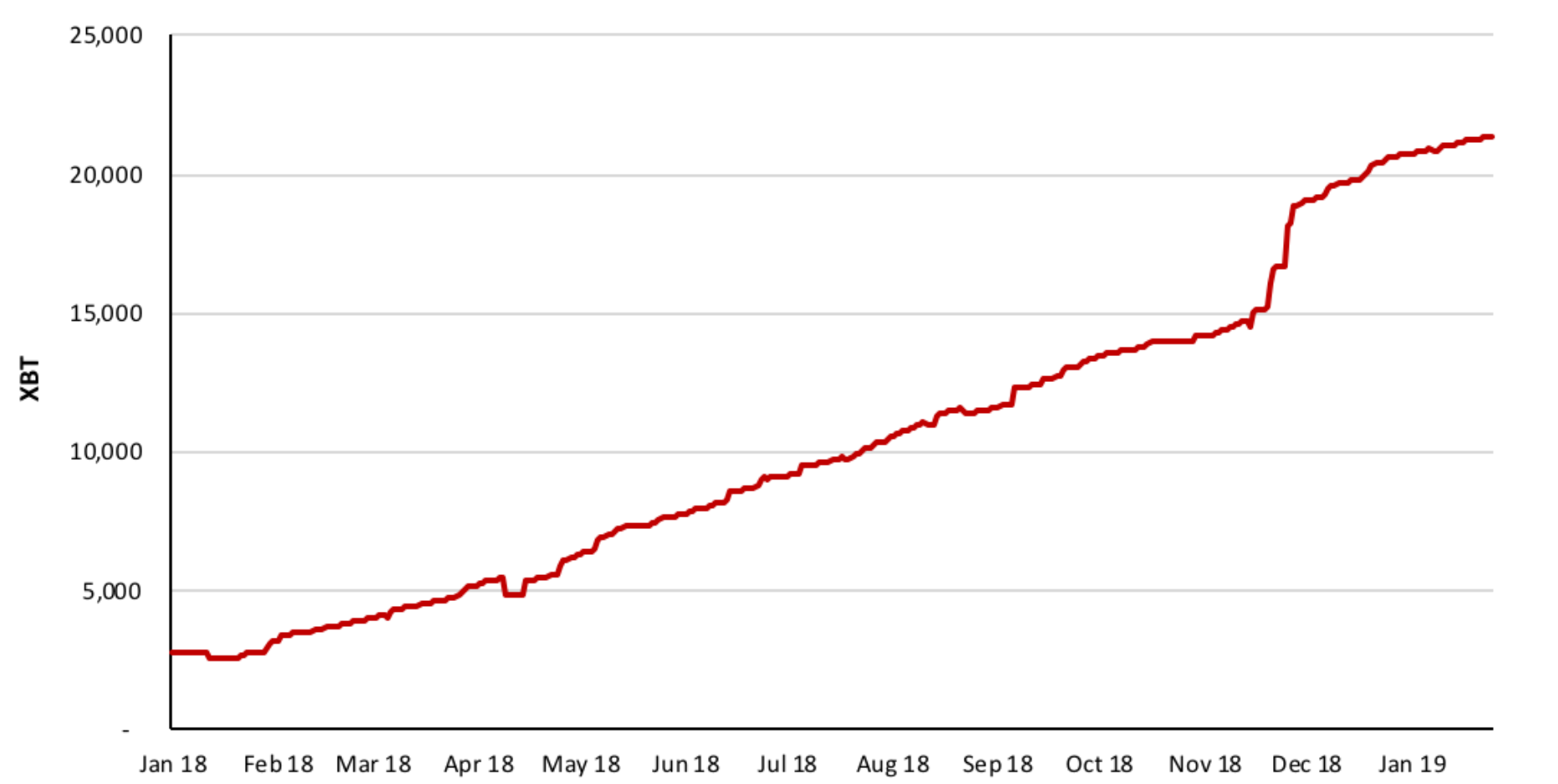

The BitMEX insurance fund currently sits at around 21,000 Bitcoin or around US$70 million based on current Bitcoin spot prices. This represents only 0.007% of BitMEX’s notional annual trading volume, of around one trillion USD. Although this is slightly higher than CME’s insurance funds as a proportion of trading volume, winning traders on BitMEX are exposed to much larger risks than CME traders through the following:

- BitMEX does not have clearing members with large balance sheets and traders are directly exposed to each other.

- BitMEX does not demand payments from traders with negative account balances.

- The underlying instruments on BitMEX are more volatile than the more traditional instruments available on CME.

Auto-deleveraging

In the event that the insurance fund becomes depleted, winners cannot be confident of taking home as much profit as they are entitled to. Instead, as we described above, winners need to make a contribution to cover the losses of the losers. This process on BitMEX is called auto-deleveraging.

Auto-deleveraging has not occurred on the BitMEX Bitcoin perpetual swap contract since March 2017. In early March 2017, the SEC disapproved the Winklevoss’ application for the COIN Bitcoin ETF. On that day, the market dropped 30% in five minutes. The sharp price drop depleted the insurance fund entirely. Many XBTUSD shorts were ADL’d (Automatic Deleveraging) and their profits were capped.

Although the BitMEX insurance fund has grown considerably since then, crypto-currency trading is a volatile and uncertain industry. Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view. One cannot be certain that ADL’s won’t occur again, even on the BitMEX Bitcoin perpetual swap contract.

Insurance Fund Data

Although the absolute value of the insurance fund has grown, as the charts below show as a proportion of other metrics from the BitMEX trading platform, such as open interest, the growth is less pronounced.

BitMEX Insurance Fund – Daily data since January 2018

(Source: BitMEX)

BitMEX Insurance Fund as a proportion of the BitMEX Bitcoin perpetual swap open interest – Daily data since January 2018

(Source: BitMEX)

Incentives

Assuming the insurance fund remains capitalized, the system operates under a principle where those who get liquidated pay for liquidations, a losers pay for losers model. While this approach may be considered somewhat novel, in a way there is a degree of fairness to it, that isn’t present in some alternative models mentioned above. It begs the question, why should traders who do not engage in risky leveraged bets have to pay for those that do?

Conclusion

Although 21,000 Bitcoin inside an insurance fund, worth around 0.1% of the total Bitcoin supply may seem large, BitMEX cannot offer the same robust guarantees to winning traders, compared to those provided by traditional leveraged trading platforms. While the insurance fund has achieved a healthy size, it may not be large enough to give winning traders the confidence they need in the volatile and unpredictable bumpy road ahead in the crypto-currency space. Given such volatility, it’s not impossible that the fund is drained down to zero again.